May 16th Oil Market Report: Prices, Trends & Analysis

Table of Contents

Crude Oil Price Analysis for May 16th

Benchmark Prices (WTI, Brent):

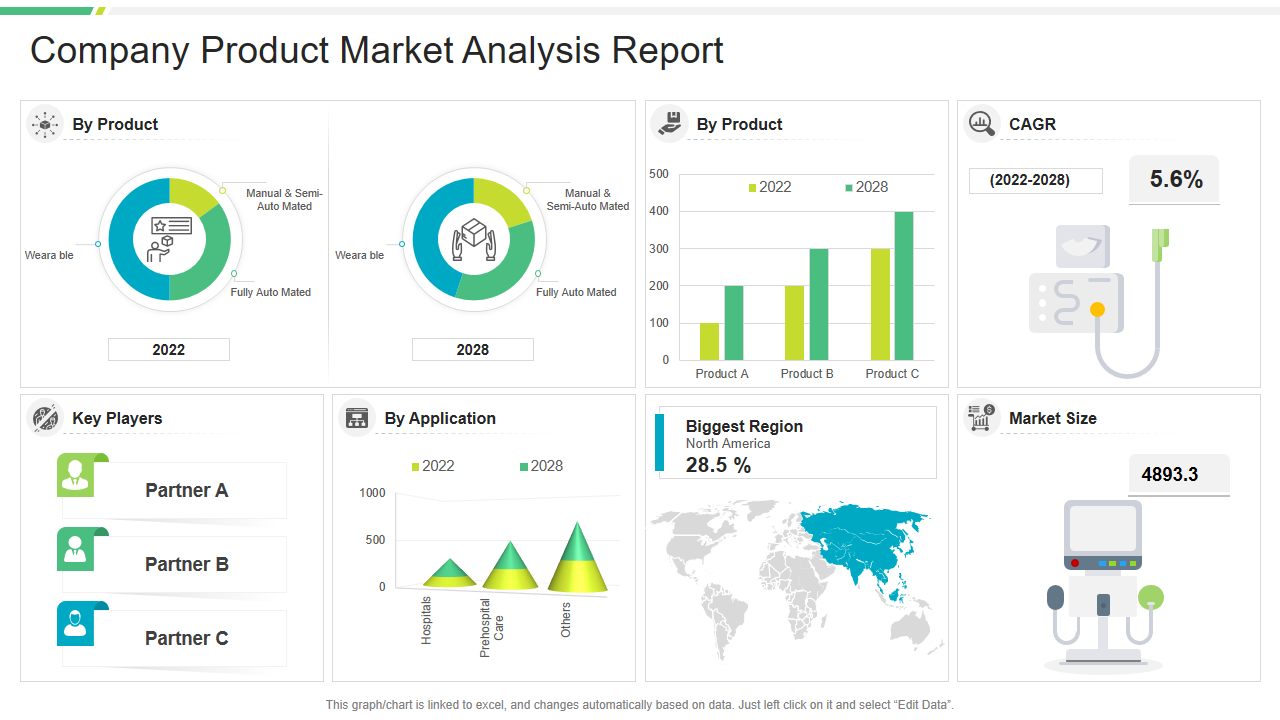

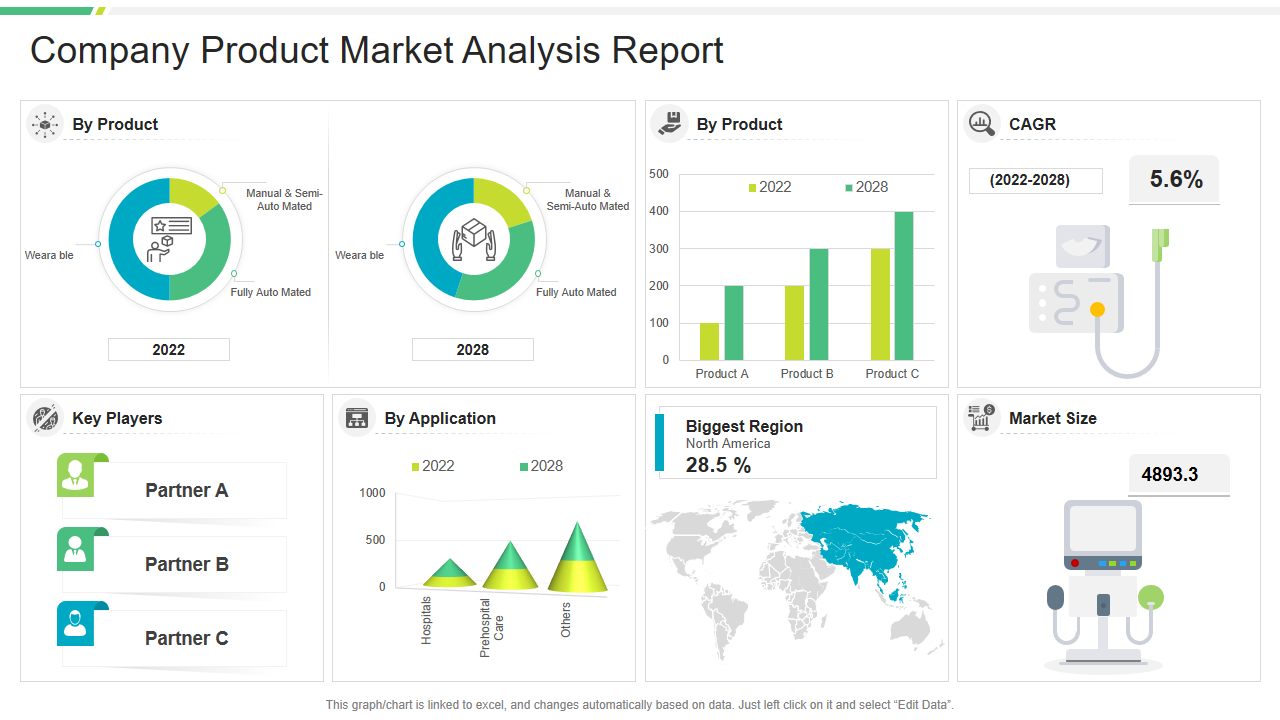

At market close on May 16th, West Texas Intermediate (WTI) crude oil settled at $X per barrel, while Brent crude oil closed at $Y per barrel. This represents a Z% increase/decrease compared to the previous day's closing price and a A% change year-over-year. (Replace X, Y, Z, and A with actual data). The following chart visually represents the price movements:

[Insert Chart/Graph showing WTI and Brent prices for May 16th, including previous day and year-ago data]

- Percentage Change: WTI: Z%; Brent: A%

- Trading Volume: [Insert Data]

- Volatility: [Describe the volatility of the day's trading, e.g., "relatively stable," "highly volatile," etc.]

- Significant Fluctuations: [Mention any significant price spikes or drops that occurred during the trading day and their potential causes.]

Factors Influencing Prices:

Several interconnected factors contributed to the price movements observed on May 16th. These include:

- Geopolitical Events: The ongoing conflict in Ukraine continues to disrupt global energy supplies and fuel price uncertainty. Tensions in the Middle East also remain a key factor influencing market sentiment.

- OPEC+ Production Decisions: The recent OPEC+ meeting and its decisions regarding production quotas significantly impacted market expectations. Any adjustments to output levels directly affect global supply and pricing.

- Global Economic Growth: Positive economic data releases (or conversely, negative indicators) from major economies can boost (or dampen) demand for oil, impacting prices. Manufacturing PMIs and GDP growth figures are closely monitored.

- US Dollar Strength: A stronger US dollar typically puts downward pressure on oil prices, as oil is priced in dollars. Fluctuations in the dollar's value have a noticeable impact on the oil market.

- Seasonal Demand: Seasonal changes in demand, particularly relating to increased travel during certain times of the year, can also affect oil prices.

- Inventory Levels: Crude oil and refined product inventory levels in major consuming regions provide insights into supply and demand dynamics, impacting price projections.

- Speculative Trading: Speculative trading activity can exacerbate price volatility, particularly in the short term.

Technical Analysis:

[Insert brief technical analysis, mentioning relevant indicators like moving averages, support and resistance levels, and their implications for short-term price direction. Keep it concise and avoid overly technical jargon for a broader audience.]

Key Trends in the Oil Market

Supply and Demand Dynamics:

The global oil market is currently characterized by [Describe the current state of the supply and demand balance – e.g., a tight market, an oversupplied market, etc.].

- OPEC+ Production: OPEC+ production quotas are currently set at [Insert Data], impacting overall global supply.

- Non-OPEC Production: Non-OPEC production levels are [Describe current levels and trends]. This includes significant production from the US shale oil sector.

- Global Oil Consumption: Global oil consumption is projected to [Describe projected consumption trends, considering factors like economic growth and energy transition].

- Supply Disruptions: Any significant supply disruptions (e.g., pipeline outages, refinery closures, or extreme weather events) can trigger price volatility.

Inventory Levels:

Crude oil and refined product inventory levels in key regions offer insights into market dynamics:

- US Inventories: [Insert data and analysis of US inventory levels]

- European Inventories: [Insert data and analysis of European inventory levels]

- Asian Inventories: [Insert data and analysis of Asian inventory levels]

Geopolitical Risks and Their Impact:

Geopolitical risks continue to be a significant factor influencing the oil market's stability:

- [List specific geopolitical risks and their potential impacts on oil supply and prices, referencing specific conflicts or political situations.]

Analysis and Outlook for the Oil Market

Short-Term Outlook:

Based on current trends and analysis, the short-term outlook for oil prices suggests a range of [Insert price range] per barrel for the next few weeks/months. However, this forecast is subject to change based on unforeseen events, such as escalating geopolitical tensions or unexpected shifts in supply or demand.

- Potential Price Ranges: [Specify potential price ranges and the factors that could cause prices to move within those ranges.]

- Factors Influencing the Forecast: [Reiterate the main factors that will likely influence oil prices in the coming weeks and months.]

- Associated Risks: [Highlight potential risks that could impact the forecast's accuracy.]

Long-Term Outlook:

The long-term outlook for the oil market is more complex, considering the ongoing energy transition and technological advancements.

- Renewable Energy Sources: The growing adoption of renewable energy sources, such as solar and wind power, is expected to gradually reduce the demand for oil in the long run.

- Electric Vehicles: The increasing popularity of electric vehicles is another factor that will likely impact oil demand over the long term.

- Long-Term Implications for Oil Demand: The interplay of these factors will shape the long-term demand for oil and consequently, influence prices over the next few years.

Conclusion

This Oil Market Report highlighted the key price movements, trends, and influencing factors in the oil market on May 16th. WTI and Brent crude prices experienced [summarize price movements], influenced primarily by [mention the most important factors affecting prices]. The short-term outlook suggests prices may remain within the range of [repeat short-term price range], while the long-term outlook is subject to significant change based on the pace of energy transition. Staying informed about daily oil market fluctuations is crucial for informed decision-making. Check back regularly for the latest Oil Market Report updates and subscribe to receive future reports for comprehensive daily oil market updates and in-depth oil market analysis reports.

Featured Posts

-

Nba Addresses Crucial No Call That Affected Pistons In Game 4

May 17, 2025

Nba Addresses Crucial No Call That Affected Pistons In Game 4

May 17, 2025 -

Exclusive Interview Josh Alexander On Joining Aew And His Relationship With Don Callis

May 17, 2025

Exclusive Interview Josh Alexander On Joining Aew And His Relationship With Don Callis

May 17, 2025 -

Record Breaking Season Josh Harts Triple Double Dominance For The Knicks

May 17, 2025

Record Breaking Season Josh Harts Triple Double Dominance For The Knicks

May 17, 2025 -

Mariners Bryce Miller Elbow Injury And 15 Day Il Placement

May 17, 2025

Mariners Bryce Miller Elbow Injury And 15 Day Il Placement

May 17, 2025 -

New York Knicks The Landry Shamet Conundrum

May 17, 2025

New York Knicks The Landry Shamet Conundrum

May 17, 2025

Latest Posts

-

How Student Loan Debt Impacts Your Ability To Buy A House

May 17, 2025

How Student Loan Debt Impacts Your Ability To Buy A House

May 17, 2025 -

Buying A House How Student Loans Affect Your Mortgage

May 17, 2025

Buying A House How Student Loans Affect Your Mortgage

May 17, 2025 -

The Ultimate Guide To Refinancing Federal Student Loans

May 17, 2025

The Ultimate Guide To Refinancing Federal Student Loans

May 17, 2025 -

Federal Student Loan Refinancing Pros Cons And Considerations

May 17, 2025

Federal Student Loan Refinancing Pros Cons And Considerations

May 17, 2025 -

Homeownership With Student Loans Tips And Strategies

May 17, 2025

Homeownership With Student Loans Tips And Strategies

May 17, 2025