Navigating The Housing Market: Finding Affordability Without A Price Crash

Table of Contents

Understanding Current Market Conditions

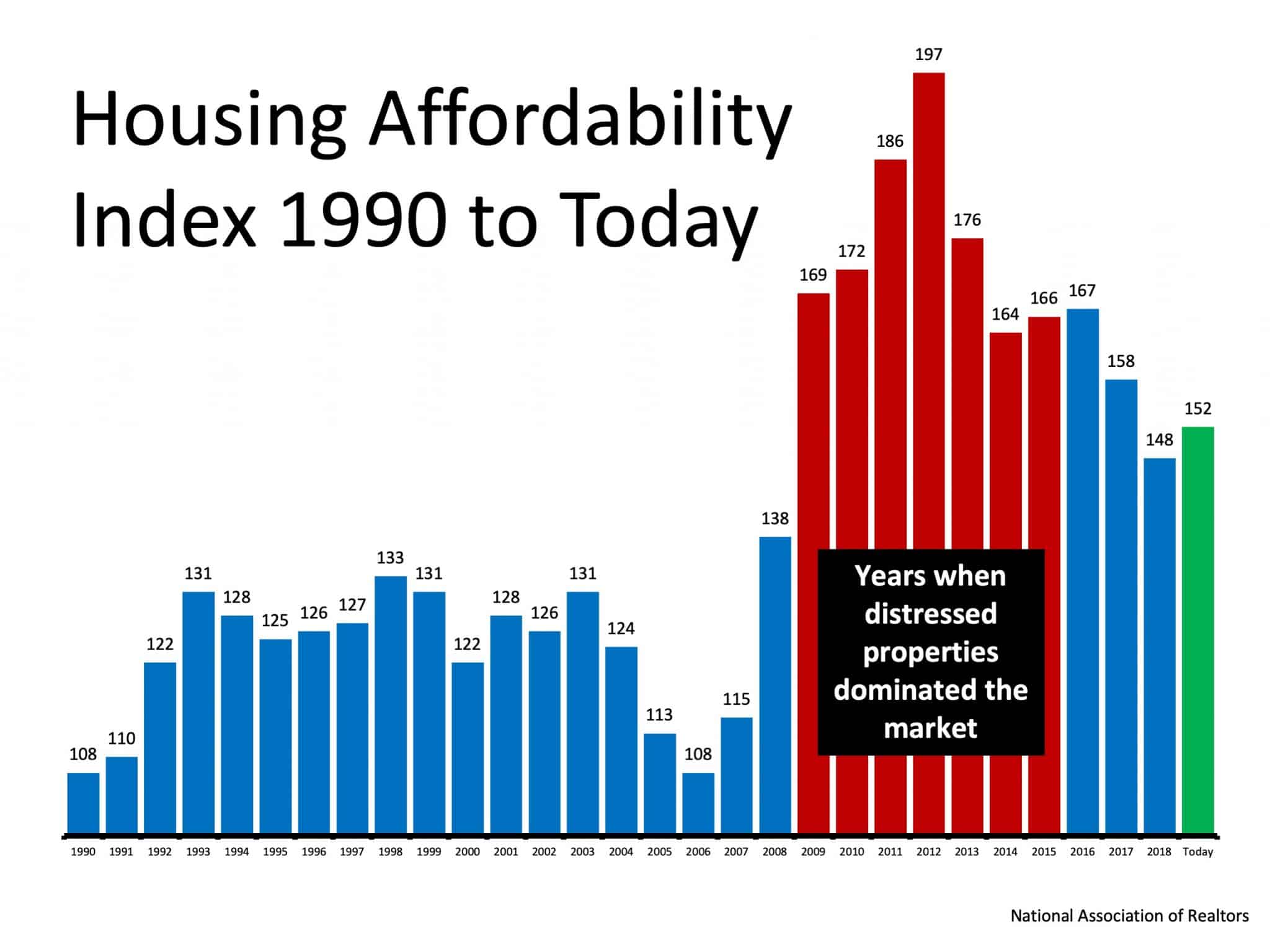

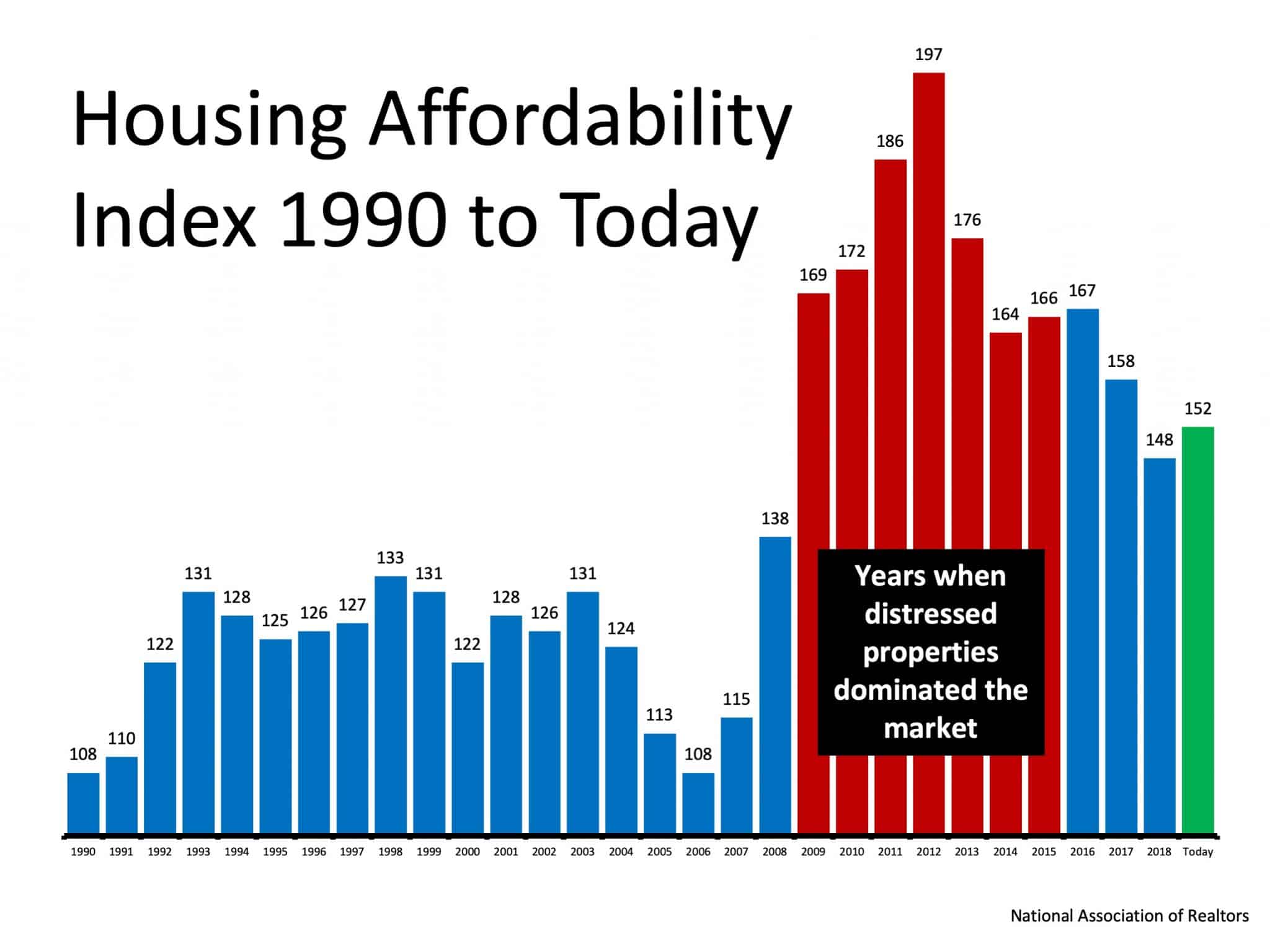

Before diving into strategies, it's crucial to understand the current landscape. Interest rates, inventory levels, and price trends significantly impact affordability. Inflation and the overall economic outlook also play a vital role. Analyzing these factors provides a realistic perspective on your home-buying journey.

- Analyze local market data: Websites like Zillow, Realtor.com, and your local Multiple Listing Service (MLS) offer valuable insights into median home prices, days on market, and price-per-square-foot in your target area. This helps identify neighborhoods with potentially more affordable options. Understanding the nuances of your local market is crucial for successful navigation.

- Median vs. Average: It’s vital to understand the difference. The median home price represents the middle value, offering a more accurate picture than the average, which can be skewed by high-priced outliers. Focusing on the median gives you a more realistic view of affordability.

- Interest rate impact: Even a slight change in interest rates can significantly affect your monthly mortgage payment. Use online mortgage calculators to see how different rates impact your budget. Understanding this allows you to adjust your search criteria accordingly and strategize your financing.

Exploring Different Housing Options

The type of housing you choose significantly influences affordability. Single-family homes, condos, and townhouses all have pros and cons regarding cost and lifestyle.

- Single-family homes: Offer privacy and space but are often the most expensive option. Consider areas slightly outside of the city center for potential savings.

- Condos and townhouses: Generally more affordable than single-family homes, offering a balance between affordability and community living. However, HOA fees need to be factored into your budget.

- Fixer-uppers: These properties often sell below market value, allowing for potential savings. However, factor in renovation costs and potential delays. A thorough inspection is essential.

- Multi-generational living: Sharing a home with family members can dramatically reduce housing costs, though it requires careful consideration of family dynamics.

- Rent-to-own: This option allows you to build equity while renting, eventually leading to homeownership. However, be cautious and thoroughly review the contract terms.

Strategies for Improving Your Affordability

Improving your financial standing is key to navigating the housing market effectively. This involves several crucial steps.

- Save for a down payment: A larger down payment typically translates to lower monthly payments and potentially better interest rates. Explore different savings strategies and set realistic goals.

- Improve your credit score: A higher credit score increases your chances of securing a favorable mortgage interest rate. Work on paying down debt and maintaining a good credit history.

- Get pre-approved: Pre-approval gives you a clear understanding of how much you can borrow, strengthening your offer when you find the right property. It also shows sellers you are a serious buyer.

- Down payment assistance programs: Many government agencies and nonprofits offer programs to help first-time homebuyers with down payments. Research programs available in your area.

- Mortgage options: Explore different mortgage types like FHA, VA, and conventional loans to find the best fit for your financial situation and needs.

- Budgeting: Create a detailed budget that accounts for mortgage payments, property taxes, homeowner's insurance, and other associated costs.

Negotiating and Making an Offer

Once you’ve found a suitable property, negotiating a fair price and securing favorable terms is crucial.

- Competitive offer: Research comparable properties (comps) to determine a fair market value and structure a competitive offer without overpaying.

- Strong real estate agent: A skilled agent can guide you through the negotiation process, ensuring you get the best possible deal.

- Contingencies: Understand the implications of contingencies in your offer, such as financing and inspection contingencies.

- Closing costs: Negotiate closing costs to minimize your upfront expenses.

Conclusion

Finding affordable housing in today's market requires careful planning, research, and a strategic approach. By understanding current market conditions, exploring different housing options, and improving your financial standing, you can increase your chances of achieving homeownership without having to wait for a market crash. Don't let the volatility discourage you; with the right strategy and persistence, navigating the housing market and finding affordability is achievable. Start your journey towards affordable housing today by researching local market trends and exploring the options outlined above. Remember, successfully navigating the housing market is possible — even without a price crash.

Featured Posts

-

Coheres Copyright Infringement Case A Legal Analysis

May 25, 2025

Coheres Copyright Infringement Case A Legal Analysis

May 25, 2025 -

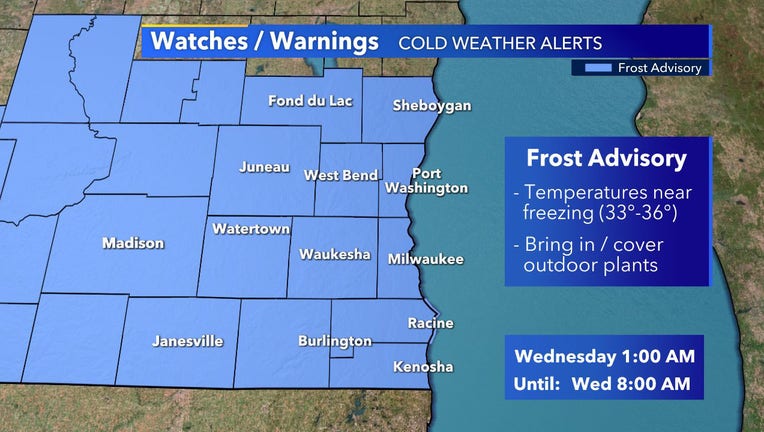

Coastal Flood Advisory Southeast Pa Wednesday Update

May 25, 2025

Coastal Flood Advisory Southeast Pa Wednesday Update

May 25, 2025 -

Mia Farrow And Christina Ricci At The Florida Film Festival

May 25, 2025

Mia Farrow And Christina Ricci At The Florida Film Festival

May 25, 2025 -

Housing Affordability Can We Achieve It Without Lowering Home Prices

May 25, 2025

Housing Affordability Can We Achieve It Without Lowering Home Prices

May 25, 2025 -

Jenson Button No Uk Return After 250k London Robbery

May 25, 2025

Jenson Button No Uk Return After 250k London Robbery

May 25, 2025

Latest Posts

-

Jenson And The Fw 22 Extended Everything You Need To Know

May 25, 2025

Jenson And The Fw 22 Extended Everything You Need To Know

May 25, 2025 -

Conquering Dr Terrors House Of Horrors Tips And Tricks

May 25, 2025

Conquering Dr Terrors House Of Horrors Tips And Tricks

May 25, 2025 -

Formula 1 Star Jenson Button Wont Return To Uk After 250k Theft

May 25, 2025

Formula 1 Star Jenson Button Wont Return To Uk After 250k Theft

May 25, 2025 -

Unveiling The Horrors A Look At Dr Terrors House Of Horrors

May 25, 2025

Unveiling The Horrors A Look At Dr Terrors House Of Horrors

May 25, 2025 -

Understanding Jensons Fw 22 Extended Release

May 25, 2025

Understanding Jensons Fw 22 Extended Release

May 25, 2025