Net Asset Value (NAV) Analysis: Amundi MSCI World Catholic Principles UCITS ETF Acc

Table of Contents

Analyzing the Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV Trends

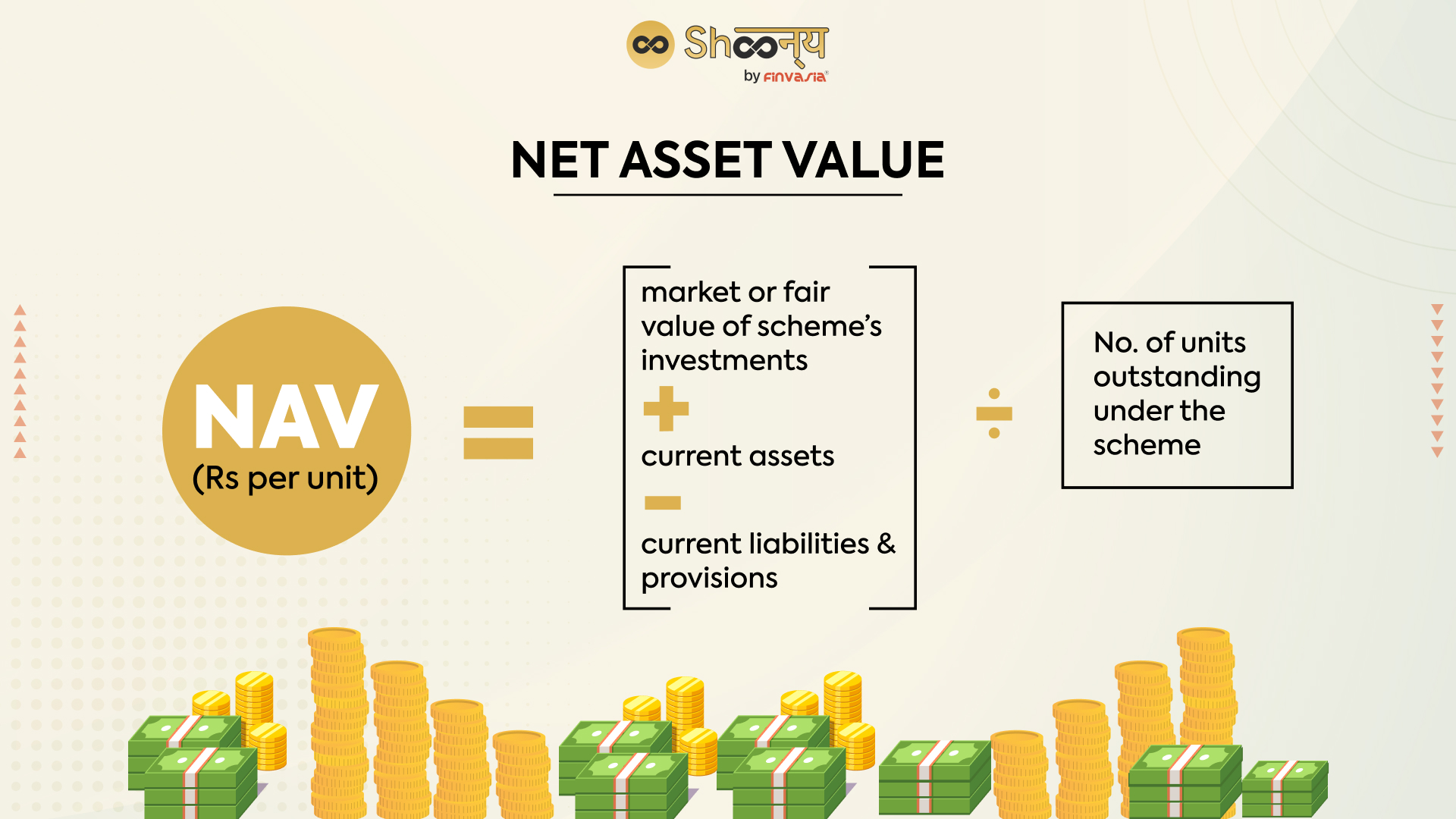

Analyzing the historical NAV performance of the Amundi MSCI World Catholic Principles UCITS ETF Acc provides valuable insights into its growth and stability. By examining past trends, investors can gain a better understanding of the ETF's potential for future returns and associated risks.

Historical NAV Performance: [Insert chart/graph showing historical NAV performance here]. This graph illustrates the ETF's NAV fluctuations over time. Note periods of significant growth, decline, and any notable volatility. For example, you may see periods of strong performance correlated with positive global market trends and periods of weaker performance during market corrections. Analyzing this historical data allows for a more informed prediction of future performance. (Remember to cite the source of your data).

Factors Influencing NAV: Several factors significantly impact the Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV. Understanding these factors is key to interpreting NAV movements accurately.

- Impact of global market trends on NAV: Broad market movements, such as bull and bear markets, directly influence the ETF's NAV. A rising global market generally leads to NAV increases, while a declining market results in NAV decreases.

- Influence of specific sectors within the ETF's portfolio on NAV: The ETF's investment strategy focuses on companies adhering to Catholic principles. The performance of specific sectors (e.g., technology, healthcare, consumer staples) within this filtered portfolio heavily influences the overall NAV. A strong performance in one sector can offset underperformance in another, resulting in varying NAV fluctuations.

- Effect of currency exchange rates on NAV: Since the ETF invests globally, currency fluctuations can impact the NAV. A strengthening of the Euro (assuming the ETF is denominated in Euros) against other currencies can positively affect the NAV, and vice versa.

Comparing NAV to Other Similar ETFs

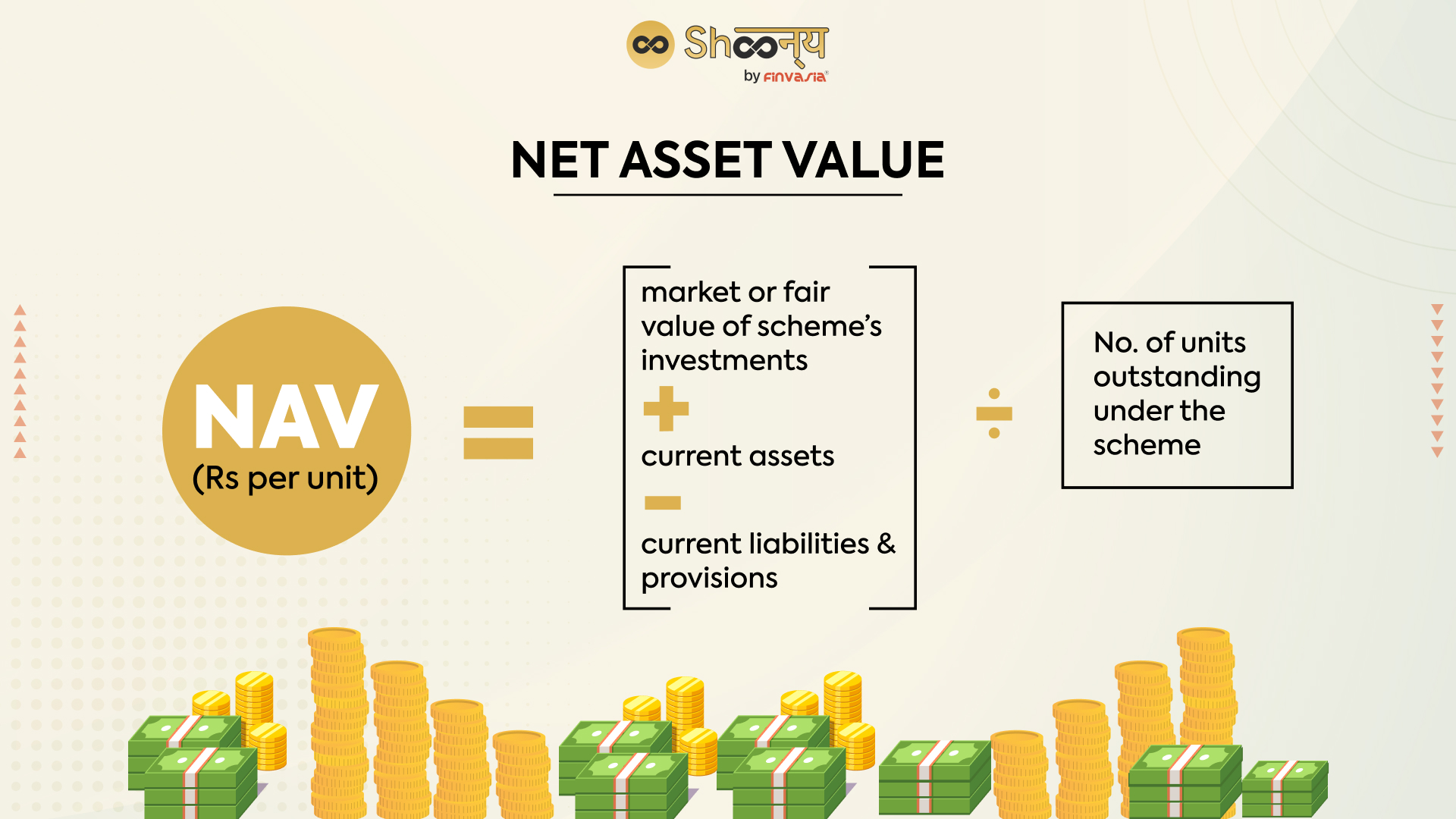

To gauge the Amundi MSCI World Catholic Principles UCITS ETF Acc's relative performance, comparing its NAV to similar ETFs is crucial. This benchmark analysis helps investors assess the ETF's risk-adjusted returns and identify its strengths and weaknesses.

Benchmarking: We'll compare the Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV performance against other ethically focused ETFs and broad global market ETFs. This comparison should include both similar ethically-screened funds and broader market indices to assess relative performance within the context of the overall market.

Performance Metrics: Using relevant performance metrics like the Sharpe ratio (measuring risk-adjusted return), alpha (measuring excess return compared to a benchmark), and beta (measuring volatility relative to a benchmark) will provide a more nuanced comparison.

- List of competitor ETFs for comparison: [List 3-5 comparable ETFs, including their tickers].

- Table summarizing key performance metrics for comparison: [Insert table summarizing NAV performance, Sharpe ratio, alpha, and beta for the Amundi MSCI World Catholic Principles UCITS ETF Acc and its competitors].

- Discussion of relative strengths and weaknesses based on NAV comparison: Analyze the table and discuss the relative strengths and weaknesses of the Amundi MSCI World Catholic Principles UCITS ETF Acc compared to its competitors based on NAV and the other metrics. Explain any significant differences in performance and potential reasons for these variations.

Interpreting NAV Data for Investment Decisions

Understanding how NAV data informs investment decisions is vital for maximizing returns and minimizing risk. NAV fluctuations provide insights into the ETF's performance and potential future movements.

NAV and Investment Timing: Investors can use NAV data to inform their investment timing. Strategies like dollar-cost averaging (investing a fixed amount regularly regardless of NAV) can mitigate the impact of NAV fluctuations. Analyzing trends and identifying potential dips can offer opportunities for strategic entry points.

NAV and Risk Assessment: Consistent, significant NAV fluctuations indicate a higher level of risk. Conversely, stable NAV suggests lower risk. Investors need to understand their risk tolerance before making investment decisions based on NAV analysis.

- Strategies for utilizing NAV data for buy/sell decisions: Discuss strategies such as buying low and selling high, using trailing stops to limit losses, and the benefits of dollar-cost averaging.

- Importance of considering longer-term NAV trends: Emphasize that short-term fluctuations are less important than long-term trends when evaluating the Amundi MSCI World Catholic Principles UCITS ETF Acc's performance and potential.

- The role of risk tolerance in interpreting NAV fluctuations: Stress that individual risk tolerance is a crucial factor when interpreting NAV movements and making buy/sell decisions.

Resources for Tracking NAV

Reliable access to accurate NAV data is crucial for informed investment decisions. Several reputable sources provide this information.

Official Sources: The official website of Amundi is the primary source for the most up-to-date NAV data for the Amundi MSCI World Catholic Principles UCITS ETF Acc. [Insert link to the official source].

Third-Party Providers: Many reputable financial websites and platforms (e.g., Bloomberg, Yahoo Finance, Google Finance) also provide NAV data. However, always verify the accuracy of this data against the official source.

- Links to official sources of NAV information: [Insert links to official sources].

- List of reliable third-party providers: [List 3-5 reliable third-party providers].

- Tips for verifying the accuracy of NAV data: Explain the importance of comparing data from multiple sources and always prioritizing data from the official source.

Conclusion: Making Informed Decisions with Amundi MSCI World Catholic Principles UCITS ETF Acc NAV Analysis

Regularly monitoring the Net Asset Value (NAV) of the Amundi MSCI World Catholic Principles UCITS ETF Acc is essential for making informed investment decisions. Understanding NAV trends, comparing performance against similar ETFs, and assessing the underlying factors influencing NAV fluctuations are all crucial aspects of effective investment management. By carefully analyzing the NAV and considering your individual risk tolerance, you can significantly enhance your investment strategy. Remember to utilize the resources mentioned above to access accurate and up-to-date NAV data. By regularly monitoring the Net Asset Value and understanding the factors influencing it, you can make informed investment decisions regarding the Amundi MSCI World Catholic Principles UCITS ETF Acc.

Featured Posts

-

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia Photos From The Event

May 25, 2025

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia Photos From The Event

May 25, 2025 -

Finding Community In Your Escape To The Country

May 25, 2025

Finding Community In Your Escape To The Country

May 25, 2025 -

Muezede Porsche 956 Nin Tavan Sergilemesi Teknik Aciklamalar

May 25, 2025

Muezede Porsche 956 Nin Tavan Sergilemesi Teknik Aciklamalar

May 25, 2025 -

The Annie Kilner Kyle Walker Controversy Examining The Allegations

May 25, 2025

The Annie Kilner Kyle Walker Controversy Examining The Allegations

May 25, 2025 -

Megeri Porsche 911 Es A 80 Millio Forintos Extrai

May 25, 2025

Megeri Porsche 911 Es A 80 Millio Forintos Extrai

May 25, 2025

Latest Posts

-

French Pms Public Dissent On Macrons Leadership

May 25, 2025

French Pms Public Dissent On Macrons Leadership

May 25, 2025 -

Re Evaluating News Corp Is It Undervalued By The Market

May 25, 2025

Re Evaluating News Corp Is It Undervalued By The Market

May 25, 2025 -

Frances 2027 Election Can Bardellas Rn Challenge Macron

May 25, 2025

Frances 2027 Election Can Bardellas Rn Challenge Macron

May 25, 2025 -

Bardellas Candidacy A Contender Or Long Shot In The French Presidential Race

May 25, 2025

Bardellas Candidacy A Contender Or Long Shot In The French Presidential Race

May 25, 2025 -

News Corp Hidden Value And Undervalued Potential In Its Portfolio

May 25, 2025

News Corp Hidden Value And Undervalued Potential In Its Portfolio

May 25, 2025