Net Asset Value (NAV) Analysis: Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

Factors Influencing the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

The daily Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is a dynamic figure, influenced by several key factors. Understanding these factors is crucial for interpreting NAV changes and making informed investment decisions.

-

Underlying asset performance (MSCI World Index): The ETF tracks the MSCI World Index, a benchmark for global large and mid-cap equities. Positive performance in the index directly increases the ETF's NAV, while negative performance decreases it. For example, a strong performance by US tech companies within the MSCI World Index would likely lead to a higher NAV for the Amundi ETF.

-

Currency exchange rate fluctuations (USD Hedged implications): The "USD Hedged" designation means the ETF employs strategies to minimize the impact of currency fluctuations between the underlying assets' currencies and the US dollar. However, these hedging strategies aren't perfect and can still lead to minor fluctuations in the NAV. A strengthening US dollar against other currencies in the index might slightly lower the NAV, despite positive underlying asset performance, as the hedging strategy might not completely offset the effects.

-

Management fees and expenses: The ETF's operating expenses, including management fees, are deducted from the asset pool, impacting the NAV. These fees are typically small but have a cumulative effect over time. Understanding these expense ratios is critical to accurately assessing the overall return.

-

Dividend distributions and reinvestment: Dividend payments from the underlying companies in the MSCI World Index are typically reinvested into the ETF, thereby affecting the NAV. The NAV will decrease on the ex-dividend date, reflecting the payout, but should subsequently increase as the reinvested dividends generate returns.

-

Impact of inflows and outflows of ETF shares: High demand for the ETF (inflows) can increase the NAV slightly, while increased selling (outflows) may have the opposite effect. This is because the ETF provider needs to buy or sell the underlying assets to meet investor demand.

How to Interpret the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Interpreting NAV data accurately requires understanding where to find it and how to contextualize it.

-

Locating NAV data: You can typically find the daily NAV on the Amundi ETF website, major financial news websites (like Bloomberg or Yahoo Finance), and through your brokerage account.

-

NAV vs. Market Price: The NAV represents the theoretical value of the ETF's assets, while the market price reflects the actual price at which the ETF trades on the exchange. Small discrepancies between the NAV and market price are normal due to trading volume and liquidity.

-

Analyzing NAV charts and trends: Tracking NAV changes over time provides valuable insights into the ETF's performance. A consistently upward trending NAV suggests positive performance, while a downward trend indicates the opposite. Comparing NAV to the benchmark (MSCI World Index) helps assess how well the ETF is tracking its reference index.

Using NAV Analysis for Investment Decisions in Amundi MSCI World II UCITS ETF USD Hedged Dist

While NAV is a crucial metric, it shouldn't be the sole factor driving your investment decisions.

-

Holistic approach: Consider NAV alongside other vital metrics like the expense ratio, trading volume, and the ETF's overall investment strategy.

-

Risk assessment: NAV analysis can aid in assessing diversification and risk. A stable, slowly rising NAV might indicate a well-diversified portfolio with lower risk.

-

Buy/Sell signals (with caution): While dramatic changes in NAV can signal potential buy or sell opportunities, it's crucial to consider the broader market context and other relevant factors. Don't solely rely on NAV for timing market entry and exit points.

-

Investment timeframe: Long-term investors might focus on long-term NAV trends, while short-term investors will monitor more frequent fluctuations.

Understanding the "USD Hedged" aspect and its impact on NAV

The "USD Hedged" feature in the ETF's name is a significant consideration.

-

Currency risk reduction: Hedging reduces the impact of currency fluctuations on the returns for USD-based investors. If the Euro strengthens against the dollar, for instance, the value of Euro-denominated assets within the index might increase. However, the hedging strategy aims to mitigate this impact on the NAV for US dollar investors.

-

Hedging's impact on NAV: While hedging reduces currency risk, the hedging strategies themselves can slightly affect the NAV, sometimes positively, sometimes negatively, depending on market conditions and the effectiveness of the hedging approach. It's not a perfect shield against currency movements.

-

Limitations of hedging: In some market situations, hedging might prove less effective. For instance, sudden, unexpected shifts in exchange rates could still lead to minor NAV impacts.

Mastering Net Asset Value (NAV) Analysis for Amundi MSCI World II UCITS ETF USD Hedged Dist

In conclusion, understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for effective investment management. Several factors influence the NAV, including underlying asset performance, currency fluctuations (mitigated by the USD hedging), fees, dividends, and investor flows. Analyzing NAV trends alongside other key metrics allows for a more informed approach to investing. Remember, while NAV is a valuable tool, it's not a standalone predictor of future performance. Actively monitor the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist and continue to expand your knowledge of NAV and its applications to other ETFs for successful long-term investment strategies.

Featured Posts

-

Nemecke Firmy A Hromadne Prepustanie Aktualny Prehlad A Dosledky

May 24, 2025

Nemecke Firmy A Hromadne Prepustanie Aktualny Prehlad A Dosledky

May 24, 2025 -

Dax Rally Potential Threats From A Us Market Rebound

May 24, 2025

Dax Rally Potential Threats From A Us Market Rebound

May 24, 2025 -

Joy Crookes Releases New Song I Know You D Kill Details And Listen

May 24, 2025

Joy Crookes Releases New Song I Know You D Kill Details And Listen

May 24, 2025 -

Lauryn Goodman Explains Italian Relocation After Kyle Walker Transfer Rumours

May 24, 2025

Lauryn Goodman Explains Italian Relocation After Kyle Walker Transfer Rumours

May 24, 2025 -

When To Fly Around Memorial Day 2025 Avoid Crowds

May 24, 2025

When To Fly Around Memorial Day 2025 Avoid Crowds

May 24, 2025

Latest Posts

-

Dramatic Refueling During 90mph Police Chase Astonishing Footage

May 24, 2025

Dramatic Refueling During 90mph Police Chase Astonishing Footage

May 24, 2025 -

90mph Refuel The Extraordinary Escape During A Police Helicopter Pursuit

May 24, 2025

90mph Refuel The Extraordinary Escape During A Police Helicopter Pursuit

May 24, 2025 -

High Speed Police Chase Astonishing Refueling Moment At 90mph

May 24, 2025

High Speed Police Chase Astonishing Refueling Moment At 90mph

May 24, 2025 -

M56 Motorway Incident Car Accident Results In Casualty Paramedic Treatment

May 24, 2025

M56 Motorway Incident Car Accident Results In Casualty Paramedic Treatment

May 24, 2025 -

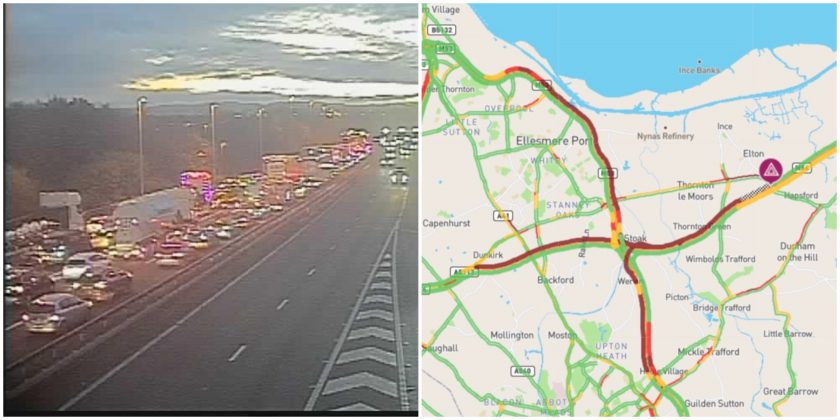

Severe Delays On M56 Following Collision Cheshire Deeside Area

May 24, 2025

Severe Delays On M56 Following Collision Cheshire Deeside Area

May 24, 2025