Net Asset Value (NAV) Of The Amundi DJIA UCITS ETF: What You Need To Know

Table of Contents

What is the Amundi DJIA UCITS ETF?

The Amundi DJIA UCITS ETF is designed to track the performance of the Dow Jones Industrial Average (DJIA), one of the most widely followed stock market indices globally. This means the ETF aims to mirror the price movements of the 30 large, publicly-owned companies that make up the DJIA. Its structure as a UCITS (Undertakings for Collective Investment in Transferable Securities) ETF provides investors with regulatory protection and ensures compliance with European Union regulations. This makes it a popular choice for long-term investors seeking diversified exposure to a basket of blue-chip US companies. The typical investor profile includes those seeking broad market exposure with a focus on established, large-cap US companies.

Key features of the Amundi DJIA UCITS ETF include:

- Underlying Index: Dow Jones Industrial Average

- Expense Ratio: (Insert current expense ratio here – check Amundi's website for the most up-to-date information)

- Trading Currency: (Insert trading currency here – check Amundi's website for the most up-to-date information)

- Minimum Investment: (Insert minimum investment information here – check Amundi's website for the most up-to-date information)

How is the NAV of the Amundi DJIA UCITS ETF Calculated?

The Net Asset Value (NAV) of the Amundi DJIA UCITS ETF is calculated daily, typically at the close of the relevant market. This calculation represents the net asset value per share. The process involves determining the total market value of all the ETF's holdings (the 30 DJIA stocks) and subtracting any liabilities, such as management fees and other expenses. This net figure is then divided by the total number of outstanding ETF shares to arrive at the NAV per share. The ETF's custodian and independent pricing agents play a vital role in ensuring the accuracy and transparency of this valuation process.

Several factors influence the daily NAV fluctuations:

- Underlying Asset Prices: Changes in the prices of the 30 component stocks of the DJIA directly impact the ETF's NAV.

- Currency Fluctuations: If the ETF trades in a currency different from the base currency of the underlying assets, exchange rate movements will affect the NAV.

- Dividend Distributions: When the underlying companies pay dividends, the ETF receives these distributions, which, after deducting expenses, increase the NAV.

- Management Fees: The ETF's management fees are deducted from the assets, slightly reducing the NAV.

Why is Monitoring the NAV of the Amundi DJIA UCITS ETF Important?

Monitoring the NAV of the Amundi DJIA UCITS ETF is vital for several reasons. First, NAV changes directly reflect the ETF's performance. By tracking the NAV over time, you can assess the ETF's growth or decline. This is crucial for evaluating the success of your investment strategy. Second, understanding NAV fluctuations helps in making informed buy and sell decisions. Large discrepancies between the market price and the NAV can present potential arbitrage opportunities. Finally, comparing the NAV to the benchmark (the DJIA) allows you to evaluate the ETF's tracking effectiveness.

The benefits of monitoring NAV include:

- Performance Assessment: Track your investment's growth and compare it to benchmarks.

- Investment Decision-Making: Inform your buy and sell decisions based on NAV movements and market conditions.

- Risk Management: Identify potential risks and adjust your investment strategy accordingly.

- Understanding Market Trends: Gain insights into market behavior and anticipate potential shifts.

Where to Find the NAV of the Amundi DJIA UCITS ETF?

Reliable sources for accessing the NAV of the Amundi DJIA UCITS ETF include Amundi's official website, major financial data providers such as Bloomberg and Refinitiv, and your brokerage account. It's crucial to use official and reputable sources to ensure the accuracy of the NAV data.

Here are some places to find the NAV information:

- Amundi's Official Website: Check the ETF's dedicated page on Amundi's website.

- Major Financial Data Providers: Platforms like Bloomberg Terminal and Refinitiv Eikon provide real-time and historical NAV data.

- Your Brokerage Account: Most brokerage platforms display the NAV of your holdings.

Conclusion: Making Informed Decisions with the Net Asset Value (NAV)

Understanding and regularly monitoring the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF is crucial for successful investing. The NAV provides a clear picture of the ETF's performance, allowing for informed investment decisions, effective risk management, and a better understanding of market trends. Regularly check the Amundi DJIA UCITS ETF NAV, and consider tracking the NAV of your Amundi DJIA UCITS ETF holdings to optimize your investment strategy. Further research into the ETF's historical performance and its characteristics will further enhance your understanding and investment success. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025 -

Exploring The Proposed M62 Relief Route Through Bury

May 24, 2025

Exploring The Proposed M62 Relief Route Through Bury

May 24, 2025 -

Neden Porsche 956 Tavanindan Asili Duruyor

May 24, 2025

Neden Porsche 956 Tavanindan Asili Duruyor

May 24, 2025 -

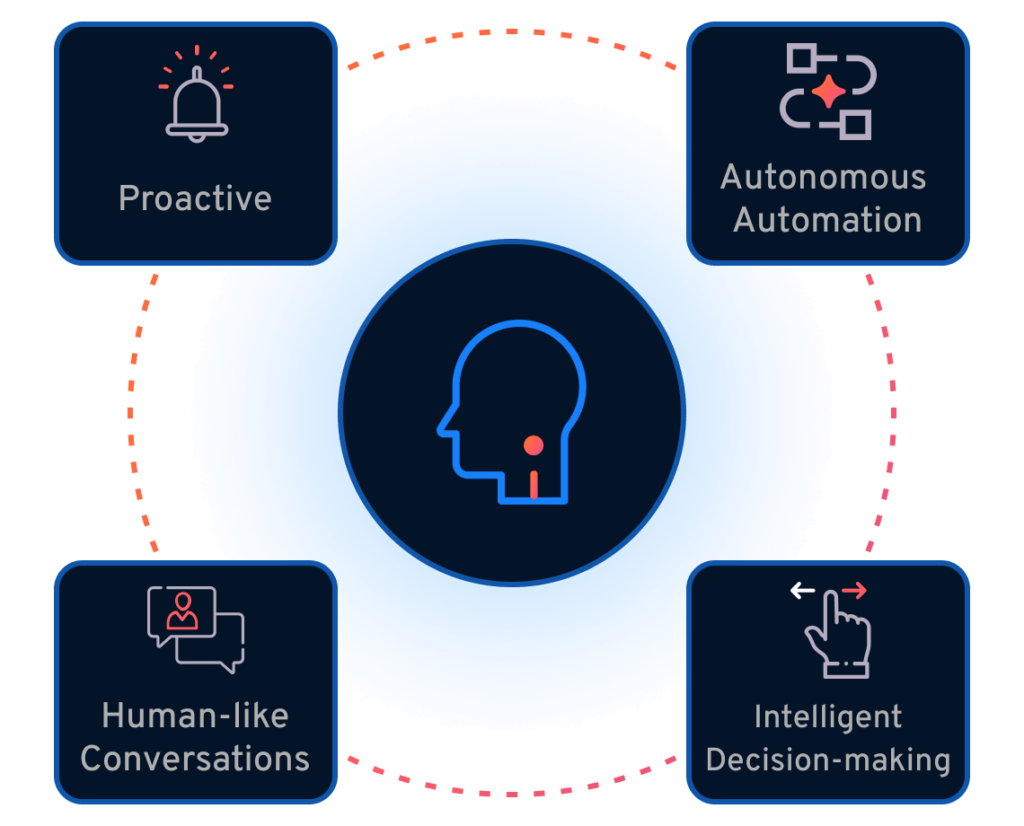

Camunda Con 2025 Unlocking The Potential Of Ai And Automation Through Orchestration In Amsterdam

May 24, 2025

Camunda Con 2025 Unlocking The Potential Of Ai And Automation Through Orchestration In Amsterdam

May 24, 2025 -

Nicki Chapmans 700 000 Country Home Investment Escape To The Country Success Story

May 24, 2025

Nicki Chapmans 700 000 Country Home Investment Escape To The Country Success Story

May 24, 2025

Latest Posts

-

Apple Stock Prediction Analyst Targets 254 Is It A Buy At 200

May 24, 2025

Apple Stock Prediction Analyst Targets 254 Is It A Buy At 200

May 24, 2025 -

Woody Allen Sexual Abuse Accusations Reignited Sean Penns Backing Sparks Debate

May 24, 2025

Woody Allen Sexual Abuse Accusations Reignited Sean Penns Backing Sparks Debate

May 24, 2025 -

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025 -

Sean Penns Recent Appearance And Controversial Statements Explained

May 24, 2025

Sean Penns Recent Appearance And Controversial Statements Explained

May 24, 2025 -

The Sean Penn Woody Allen Relationship A Me Too Controversy

May 24, 2025

The Sean Penn Woody Allen Relationship A Me Too Controversy

May 24, 2025