Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF: A Comprehensive Guide

Table of Contents

1. Introduction: Understanding Net Asset Value (NAV) in Amundi Dow Jones Industrial Average UCITS ETF

The Net Asset Value (NAV) represents the total value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the NAV reflects the collective value of the holdings mirroring the Dow Jones Industrial Average, less any expenses. This ETF tracks the performance of the 30 major US companies in the Dow Jones Industrial Average, offering investors exposure to a well-established benchmark. This article provides a comprehensive guide to understanding the NAV of this popular ETF, enabling you to make more informed investment decisions.

2. Main Points:

2.1. Calculating the NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is calculated daily, typically at market close. The process involves:

- Determining the value of assets: This includes the market value of each of the 30 stocks comprising the Dow Jones Industrial Average held within the ETF.

- Subtracting liabilities: This includes expenses such as management fees, administrative costs, and any outstanding obligations.

- Dividing by the number of outstanding shares: This provides the NAV per share.

The fund manager, Amundi, is responsible for this calculation, ensuring accuracy and transparency. Currency fluctuations can impact the NAV if the underlying assets are denominated in different currencies. Understanding this Amundi Dow Jones Industrial Average UCITS ETF NAV calculation provides a clear picture of the ETF's true worth.

2.2. Factors Influencing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

Several factors directly influence the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

- Underlying Asset Performance: The performance of the Dow Jones Industrial Average components is the primary driver. Strong performance by the index's constituent companies will increase the NAV, while poor performance will decrease it.

- Dividends and Distributions: Dividends paid by the underlying companies are usually reinvested or distributed to ETF shareholders, impacting the NAV. Reinvested dividends increase the NAV, while distributions decrease it.

- Expenses: Management fees and other expenses reduce the overall value of the assets, thereby impacting the NAV negatively. These expenses are factored into the daily NAV calculation.

- Market Conditions: Bull markets generally result in higher NAVs, while bear markets lead to lower NAVs, reflecting the overall market sentiment and the performance of the underlying assets. Monitoring these factors helps predict potential Amundi Dow Jones Industrial Average UCITS ETF NAV fluctuations.

2.3. Accessing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

Investors can access the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF through several sources:

- Amundi's Website: The official Amundi website is the primary source for accurate and up-to-date NAV information.

- Financial News Sources: Reputable financial news websites and data providers often publish ETF NAV data, including that of the Amundi Dow Jones Industrial Average UCITS ETF.

- Online Brokerage Platforms: Most brokerage platforms display real-time or near real-time NAV data for ETFs held in investor accounts.

It's important to be aware that slight delays in NAV reporting can occur. Understanding how to find and interpret this Amundi Dow Jones Industrial Average UCITS ETF NAV data is essential.

2.4. NAV vs. Market Price of the Amundi Dow Jones Industrial Average UCITS ETF:

While the NAV represents the intrinsic value of the ETF, the market price reflects the price at which it's currently trading. Slight deviations between the two are common due to:

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

- Trading Volume: High trading volume generally leads to a smaller deviation, while low volume can result in larger discrepancies.

The market price can trade at a premium (above NAV) or a discount (below NAV) to the NAV. Understanding this relationship allows investors to assess potential buying or selling opportunities. Monitoring Amundi Dow Jones Industrial Average UCITS ETF NAV vs. market price is an important part of your investment strategy.

3. Conclusion: Making Informed Investment Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV

Understanding the Net Asset Value of the Amundi Dow Jones Industrial Average UCITS ETF is fundamental to making informed investment decisions. By regularly monitoring the NAV and its relation to the market price, investors can gain valuable insights into the ETF's performance and adjust their investment strategy accordingly. Remember to utilize the various resources available to access the daily NAV data. Consistent monitoring of the Amundi Dow Jones Industrial Average UCITS ETF NAV, coupled with further research into ETF investment strategies, will contribute to long-term investment success. Start monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV today to optimize your investment portfolio!

Featured Posts

-

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And The Top Artists

May 24, 2025

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And The Top Artists

May 24, 2025 -

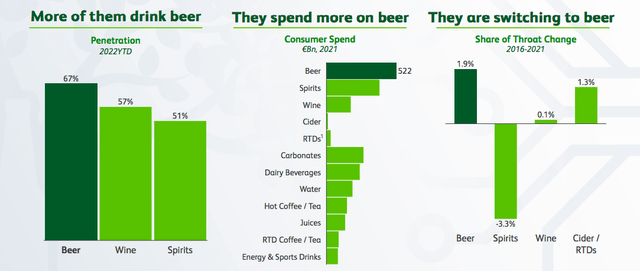

Heineken Exceeds Revenue Forecasts Maintains Positive Outlook Amidst Tariffs

May 24, 2025

Heineken Exceeds Revenue Forecasts Maintains Positive Outlook Amidst Tariffs

May 24, 2025 -

Trumps Tariff Relief Comments Boost European Stock Markets Lvmh Shares Fall

May 24, 2025

Trumps Tariff Relief Comments Boost European Stock Markets Lvmh Shares Fall

May 24, 2025 -

Ferrari Challenge South Florida Hosts Thrilling Racing Days

May 24, 2025

Ferrari Challenge South Florida Hosts Thrilling Racing Days

May 24, 2025 -

Artfae Qyasy Jdyd Ldaks 30 Tjawz Mstwa Mars

May 24, 2025

Artfae Qyasy Jdyd Ldaks 30 Tjawz Mstwa Mars

May 24, 2025

Latest Posts

-

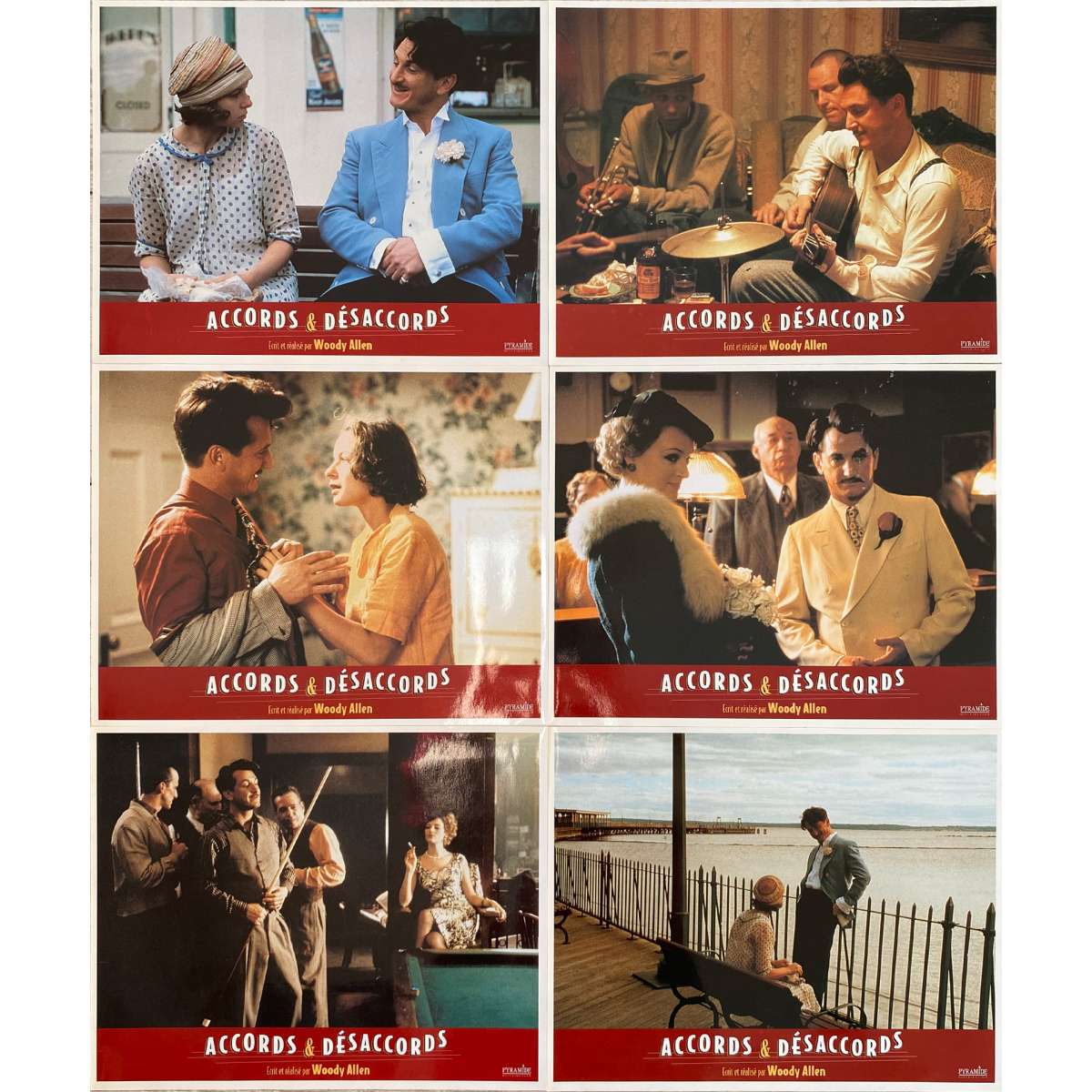

The Sean Penn Woody Allen Relationship A Me Too Controversy

May 24, 2025

The Sean Penn Woody Allen Relationship A Me Too Controversy

May 24, 2025 -

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025 -

Sean Penns Shocking Transformation Fans React To Bombshell Claims

May 24, 2025

Sean Penns Shocking Transformation Fans React To Bombshell Claims

May 24, 2025 -

Sean Penns Allegiance To Woody Allen A Persistent Me Too Issue

May 24, 2025

Sean Penns Allegiance To Woody Allen A Persistent Me Too Issue

May 24, 2025 -

Sean Penn And Woody Allen Examining A Continued Me Too Blind Spot

May 24, 2025

Sean Penn And Woody Allen Examining A Continued Me Too Blind Spot

May 24, 2025