New X Financials: How Musk's Debt Sale Is Reshaping The Company

Table of Contents

The Mechanics of Musk's Debt Sale: Understanding the Deal

The specifics of Musk's debt acquisition remain somewhat opaque, yet crucial elements have emerged. Understanding these elements is vital to grasping the full impact on New X Financials.

Subheading: Types of Debt Involved

- High-Yield Bonds: These are typically higher-risk, higher-return bonds issued to investors willing to accept greater credit risk. The interest rates on these bonds are usually significantly higher than those of investment-grade bonds.

- Term Loans: These are loans with fixed repayment schedules, often provided by banks or other financial institutions. They generally come with specific covenants that X must adhere to.

Bullet Points:

- The exact sale amount remains undisclosed, but reports suggest billions of dollars were raised.

- A diverse group of lenders, including both traditional banks and alternative credit providers, are believed to be involved.

- Interest rates are speculated to be significantly high, reflecting the perceived risk associated with lending to X.

- Maturity dates for the debt vary, potentially creating different levels of risk in the coming years.

Explanation: The rationale behind this massive debt undertaking remains a subject of debate. While some suggest it was primarily used to refinance existing debt, others believe it was crucial for funding acquisitions, aggressive expansion plans, and navigating operational challenges. A thorough analysis of the deal's terms is necessary to determine whether the conditions are favorable for X's long-term financial health. High interest rates could significantly burden the company in the coming years.

The Impact on X's Debt Load and Creditworthiness

The debt sale has undoubtedly increased X's debt load, leading to significant changes in its financial profile.

Subheading: Analyzing X's Debt Before and After the Sale

- Debt-to-Equity Ratio: This crucial metric, which compares a company's total debt to its shareholders' equity, has likely risen substantially post-debt sale. A higher ratio indicates greater financial risk.

- Credit Ratings: Credit rating agencies, such as Moody's and S&P, are likely to reassess X's creditworthiness following the substantial increase in debt. Downgrades are a distinct possibility.

- Future Borrowing Costs: Increased debt levels usually result in higher borrowing costs in the future. This is because lenders perceive a higher risk associated with lending to highly leveraged companies.

Bullet Points:

- Pre-sale debt levels should be compared with post-sale figures to understand the magnitude of the increase.

- Any changes in credit ratings should be closely monitored, as they reflect the market's perception of X's financial health.

- The impact on future borrowing costs will directly affect X's ability to fund future investments and operations.

Explanation: The increased debt load introduces significant financial risk for X. The company’s ability to service its debt obligations, particularly in times of economic downturn, will heavily influence its financial stability and creditworthiness. High debt levels can lead to financial distress, ultimately jeopardizing the long-term viability of the company.

Implications for X's Future Investments and Operations

The new debt burden will significantly impact X's future strategic decisions.

Subheading: How the Debt Sale Might Affect X's Investment Strategy and Operational Efficiency

- Product Development: Funding for new product development and features might be constrained due to debt servicing obligations.

- Marketing Budgets: Marketing and advertising expenditures could face cuts to free up cash flow for debt repayments.

- Staffing Levels: To control costs, X might implement hiring freezes or even layoffs.

- Expansion Plans: Ambitious expansion plans could be scaled back or delayed, prioritizing debt reduction over growth.

Bullet Points:

- The impact on product development will be crucial for X's ability to remain competitive.

- Reduced marketing budgets may hinder user growth and revenue generation.

- Layoffs would negatively impact employee morale and productivity.

- Delays or cancellations of expansion plans may stifle growth opportunities.

Explanation: The trade-off between debt servicing and investments in future growth will be a critical challenge for X's management. Balancing the need to reduce debt with the need to continue innovating and expanding will determine the company's trajectory in the years to come. Careful strategic planning is essential to navigate this complex situation effectively.

The Broader Implications for X's Long-Term Financial Health

The long-term financial health of X depends heavily on its ability to manage its newly acquired debt.

Subheading: Assessing the Long-Term Sustainability of X's Financial Model

- Default Risk: The risk of defaulting on debt obligations is a considerable threat, especially if X fails to meet revenue projections.

- Financial Distress: Severe financial distress can result in restructuring, asset sales, or even bankruptcy.

- Increased Revenue: Increased revenue through enhanced user engagement and advertising sales could mitigate the impact of the debt.

- Improved Profitability: Cost-cutting measures and improved operational efficiency could boost profitability, helping X to service its debt.

Bullet Points:

- X's future financial performance will be closely scrutinized by investors and creditors.

- Effective debt management strategies are crucial to mitigating the risks associated with high debt levels.

- Transparency and clear communication with stakeholders will be essential to building confidence.

- Diversifying revenue streams can also enhance financial resilience.

Explanation: The long-term sustainability of X's financial model hinges on its ability to generate sufficient cash flow to service its debt obligations while simultaneously investing in growth initiatives. Successful navigation of this challenging situation requires skillful financial management, strategic decision-making, and a proactive approach to risk mitigation.

Conclusion: Navigating the New X Financials Landscape

Musk's debt sale has undeniably reshaped New X Financials, creating both opportunities and risks. While the immediate impact is an increased debt burden, the long-term implications depend significantly on X's ability to manage its debt, improve its operational efficiency, and increase its revenue. Close monitoring of its debt levels, credit rating, and operational efficiency is crucial. Staying informed about developments related to X's debt management and financial performance is essential for understanding the evolving landscape of New X Financials. Continue following reputable financial news sources for the latest updates and analyses. Understanding New X Financials is crucial for anyone interested in the future of this influential platform.

Featured Posts

-

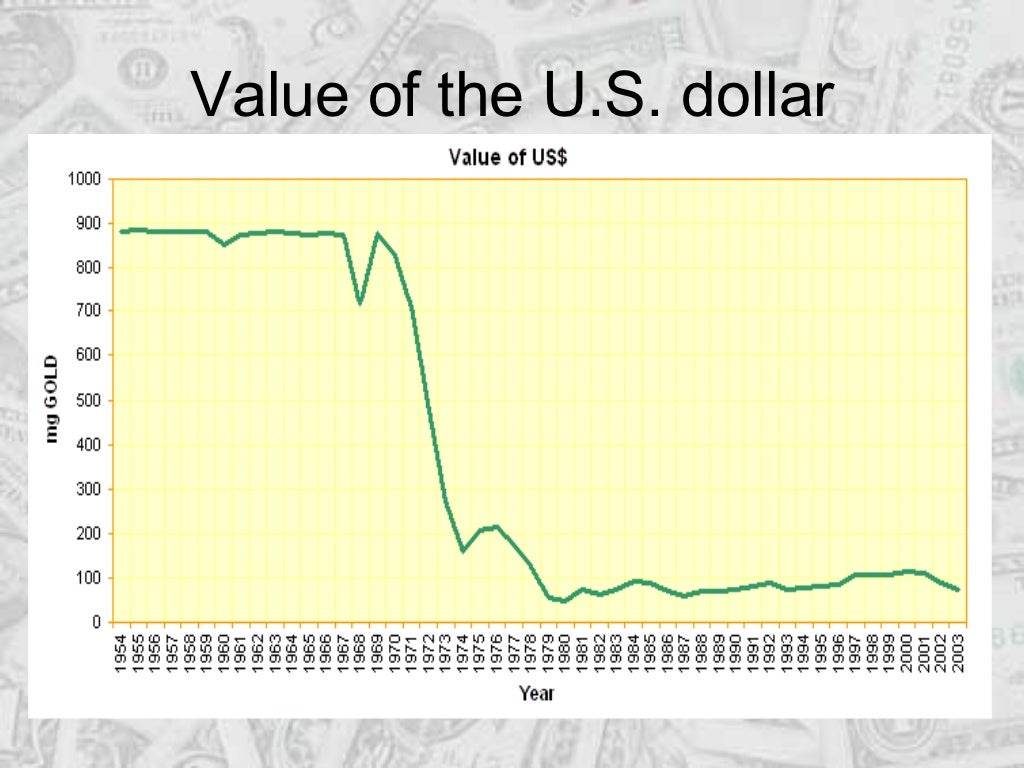

The U S Dollars Uncertain Future A Historical Perspective

Apr 28, 2025

The U S Dollars Uncertain Future A Historical Perspective

Apr 28, 2025 -

Efficient Podcast Production Using Ai To Process Repetitive Scatological Documents

Apr 28, 2025

Efficient Podcast Production Using Ai To Process Repetitive Scatological Documents

Apr 28, 2025 -

Starbucks Workers Reject Companys Guaranteed Raise Offer

Apr 28, 2025

Starbucks Workers Reject Companys Guaranteed Raise Offer

Apr 28, 2025 -

Dows Alberta Investment Delayed Examining The Tariff Impact

Apr 28, 2025

Dows Alberta Investment Delayed Examining The Tariff Impact

Apr 28, 2025 -

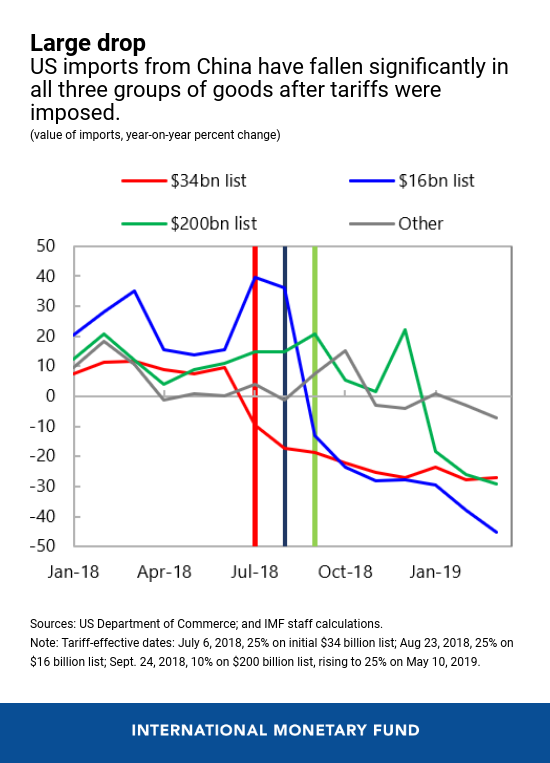

Recent Developments In Us China Trade Relations Tariff Changes

Apr 28, 2025

Recent Developments In Us China Trade Relations Tariff Changes

Apr 28, 2025

Latest Posts

-

Red Sox Roster Update Outfielders Return Impacts Lineup Casas Moves Down

Apr 28, 2025

Red Sox Roster Update Outfielders Return Impacts Lineup Casas Moves Down

Apr 28, 2025 -

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Back In Action

Apr 28, 2025

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Back In Action

Apr 28, 2025 -

Red Sox Lineup Changes Triston Casas Slide And Outfield Return

Apr 28, 2025

Red Sox Lineup Changes Triston Casas Slide And Outfield Return

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Red Sox Outfielder Breakout Could This Player Be The Next Jarren Duran

Apr 28, 2025

Red Sox Outfielder Breakout Could This Player Be The Next Jarren Duran

Apr 28, 2025