News Corp: Undervalued Business Units And Investment Opportunities

Table of Contents

The Undervalued Powerhouse: Dow Jones & The Wall Street Journal

The Wall Street Journal, a flagship asset of News Corp's Dow Jones division, enjoys unparalleled brand recognition and remains a critical source of financial news and information for professionals worldwide. Despite the rise of numerous digital competitors in the financial news landscape, its robust subscription model provides a remarkably stable and predictable revenue stream. This is a key factor in the News Corp stock analysis for many investors.

- Strong brand recognition and established readership: The WSJ's reputation for high-quality, in-depth reporting ensures a loyal and substantial subscriber base, providing a strong foundation for future growth.

- Successful transition to a digital subscription model: Dow Jones has effectively transitioned its business model to incorporate digital subscriptions, securing a crucial revenue stream in the evolving media environment. This successful adaptation makes it a compelling component of any News Corp stock analysis.

- Continued dominance in financial news reporting: The Wall Street Journal maintains its position as a leading source of financial news, offering unparalleled coverage and analysis. This market leadership translates to significant pricing power and competitive advantage.

- Potential for further digital product diversification and expansion: Opportunities exist for Dow Jones to expand its digital offerings, perhaps through targeted content, new platforms, or strategic partnerships. This expansion potential significantly bolsters the overall News Corp investment opportunities.

Realtor.com: A Growing Force in Real Estate

Realtor.com's significant market share in the online real estate sector positions it for continued growth and expansion, particularly in the ever-evolving digital landscape. The platform provides robust advertising opportunities and delivers essential services for both buyers and sellers of real estate, making it a significant contributor to News Corp's overall investment appeal.

- High market share in the online real estate market: Realtor.com holds a substantial share of the online real estate market, providing a solid base for revenue generation and future growth.

- Growing revenue from digital advertising and premium services: Realtor.com benefits from a rising revenue stream derived from digital advertising and premium services offered to real estate professionals and consumers alike. This is a crucial element in the News Corp stock analysis.

- Potential for expansion into related real estate technologies: Opportunities exist for Realtor.com to broaden its service offerings into related real estate technologies, such as property management software or mortgage tools. This expansion represents significant News Corp investment opportunities.

- Strong strategic partnerships within the industry: Realtor.com enjoys strong partnerships with key players in the real estate industry, strengthening its position and offering potential for synergistic growth.

News Corp's Diversified Portfolio: Hidden Gems Beyond the Headlines

Beyond its major brands like the Wall Street Journal and realtor.com, News Corp's diversified portfolio encompasses several smaller, yet potentially high-growth, business units. These divisions contribute to a robust and stable revenue stream, mitigating overall company risk and offering further upside potential for investors interested in the News Corp stock.

- Strong presence in book publishing and other media sectors: News Corp maintains a strong presence in book publishing and other media sectors, offering diversified revenue streams and reduced overall company risk.

- Diversified revenue streams reduce overall company risk: The diversity of News Corp's revenue streams acts as a hedge against economic downturns or sector-specific challenges, making it a more stable investment.

- Potential for acquisitions and expansion in related industries: Opportunities exist for News Corp to acquire complementary businesses or expand into related industries, further enhancing its portfolio and potential for growth.

- Undervalued assets within the broader News Corp portfolio: Many analysts believe that the market undervalues certain assets within the broader News Corp portfolio, creating attractive opportunities for long-term investors.

Conclusion

News Corp's current market valuation may not fully capture the intrinsic value of its diverse and powerful business units. The Wall Street Journal, realtor.com, and other components of its portfolio present compelling investment opportunities for those seeking exposure to established brands with significant growth potential. A thorough News Corp stock analysis, considering its financial statements and future prospects, suggests that the company is potentially undervalued, offering substantial returns for long-term investors. Consider adding News Corp to your investment portfolio and capitalize on these potentially lucrative News Corp investment opportunities. Begin your research on News Corp's undervalued business units today.

Featured Posts

-

Pertimbangan Investasi Di Mtel Dan Mbma Implikasi Pencatatan Msci Small Cap

May 24, 2025

Pertimbangan Investasi Di Mtel Dan Mbma Implikasi Pencatatan Msci Small Cap

May 24, 2025 -

Iam Expat Fair Your One Stop Shop For Housing Finance Family Fun

May 24, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance Family Fun

May 24, 2025 -

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025 -

Celebrating Keiki Creativity A Memorial Day Lei Poster Contest In Hawaii

May 24, 2025

Celebrating Keiki Creativity A Memorial Day Lei Poster Contest In Hawaii

May 24, 2025 -

8 Stock Market Gain On Euronext Amsterdam After Trumps Tariff Announcement

May 24, 2025

8 Stock Market Gain On Euronext Amsterdam After Trumps Tariff Announcement

May 24, 2025

Latest Posts

-

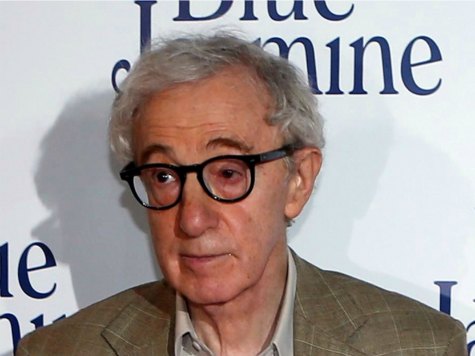

Dispute Over Dylan Farrows Accusations Sean Penns Perspective

May 24, 2025

Dispute Over Dylan Farrows Accusations Sean Penns Perspective

May 24, 2025 -

Dylan Farrow And Woody Allen Sean Penn Weighs In

May 24, 2025

Dylan Farrow And Woody Allen Sean Penn Weighs In

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Case

May 24, 2025 -

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025 -

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 24, 2025

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 24, 2025