Nifty Hits 22,600, Sensex Up 200 Points: Key Market Movers

Table of Contents

Key Sectors Driving the Nifty and Sensex Rally

The robust performance of the Nifty and Sensex wasn't a monolithic event; specific sectors played pivotal roles. Analyzing sectoral performance reveals the key drivers behind today's impressive market rally. Understanding which stock market sectors led the charge is vital for informed investment decisions. The Nifty 50 and Sensex 30 indices both benefited from strong performances across various sectors.

-

IT Sector's Stellar Contribution: The Information Technology sector was a major contributor, experiencing a significant surge driven by positive global tech trends and strong quarterly earnings reports from several major players. This sector's growth injected considerable energy into the overall market indices. We saw an increase of approximately X% in this sector.

-

Financial Services Sector Strength: The financial services sector also demonstrated robust performance, reflecting positive investor sentiment and strong banking performance. The growth in this sector is a key indicator of overall economic health and market confidence. An increase of Y% was observed within this crucial sector.

-

FMCG Sector's Steady Growth: The Fast-Moving Consumer Goods (FMCG) sector displayed consistent growth, showing resilience amidst inflationary pressures. This sector's stability demonstrates strong consumer demand and brand loyalty. The FMCG sector contributed Z% to the overall market rally.

-

Energy and Materials Sectors' Positive Impact: The energy and materials sectors also contributed positively to the overall market performance, boosted by global commodity price fluctuations and increased industrial activity.

Top Performing Stocks: Individual Stock Analysis

Beyond sectoral analysis, understanding individual stock performance provides a more granular view of the market rally. Identifying the top gainers allows investors to assess market trends and potentially identify future investment opportunities. Analyzing best-performing stocks provides insights into what's driving the current market sentiment.

-

Top Performers: Three of the top performers today were (Data as of [Date]):

- Company A (Ticker: AXYZ): +P% gain. Strong Q[Quarter] earnings and a positive outlook drove this significant increase. [Link to relevant news article]

- Company B (Ticker: BCDE): +Q% gain. A successful new product launch and positive market sentiment fueled this stock's growth. [Link to relevant news article]

- Company C (Ticker: CDEF): +R% gain. Positive market speculation regarding an upcoming acquisition contributed to the substantial increase in share price. [Link to relevant news article]

Global Market Influences on the Indian Stock Market

The Indian stock market's performance isn't isolated; global market trends significantly influence its trajectory. Understanding these international market impacts is crucial for comprehensive stock market analysis. Global indices and geopolitical factors all play their part in shaping the landscape.

-

Positive US Market Performance: The positive performance in the US stock market had a ripple effect, impacting investor sentiment and leading to increased foreign investment in the Indian market.

-

Global Commodity Prices: Stable global commodity prices, particularly oil, reduced inflationary pressures, contributing to a more positive market outlook.

-

Geopolitical Factors: The absence of significant negative geopolitical events contributed to the overall positive market sentiment. Stable international relations allow for more confident investment strategies.

Analyzing the Future Trajectory: Potential Risks and Opportunities

While today's market rally is impressive, maintaining a cautious outlook is essential. Analyzing the market's future trajectory requires considering potential risks and opportunities. A balanced investment strategy acknowledges both growth potential and potential risks.

-

Short-Term Risks: Short-term risks could include global economic uncertainty or unforeseen geopolitical events. Market volatility should always be considered.

-

Long-Term Opportunities: The IT, financial services, and FMCG sectors appear poised for continued growth, presenting long-term investment opportunities for discerning investors.

-

Investment Suggestions: Investors should maintain a diversified portfolio, carefully assessing risk tolerance before making investment decisions. Regularly reviewing investment strategies is essential for navigating market fluctuations.

Conclusion

Today's market rally, with the Nifty hitting 22,600 and the Sensex gaining over 200 points, was driven by strong sectoral performance in IT, financial services, and FMCG, along with positive global market influences. While individual stocks like Company A, Company B, and Company C showed exceptional gains, maintaining a balanced perspective on potential risks and opportunities is crucial. Stay updated on the latest market movements and insightful analyses by regularly checking our site for more information on the Nifty and Sensex, and learn how to navigate the Indian stock market effectively. Follow us for daily updates on key market movers. Understand the interplay of Nifty, Sensex, and key market movers for informed investment decisions.

Featured Posts

-

Unexpected Daycare Costs After 3 000 Babysitting Bill A Real Life Example

May 09, 2025

Unexpected Daycare Costs After 3 000 Babysitting Bill A Real Life Example

May 09, 2025 -

Market Update Sensex Nifty Rally Adani Ports Eternal Top Movers

May 09, 2025

Market Update Sensex Nifty Rally Adani Ports Eternal Top Movers

May 09, 2025 -

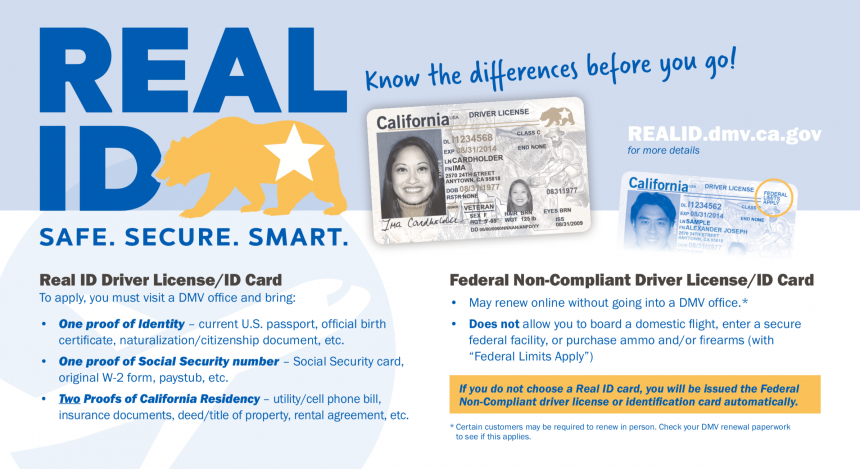

Avoid Travel Delays Check Your Real Id Status Before Your Summer Trip

May 09, 2025

Avoid Travel Delays Check Your Real Id Status Before Your Summer Trip

May 09, 2025 -

Where To Invest A Map Of The Countrys Rising Business Hotspots

May 09, 2025

Where To Invest A Map Of The Countrys Rising Business Hotspots

May 09, 2025 -

Uk Visa Policy Update Impacts And Implications For Applicants

May 09, 2025

Uk Visa Policy Update Impacts And Implications For Applicants

May 09, 2025