Norway's Nicolai Tangen: Navigating Trump's Tariffs

Table of Contents

This article examines how Nicolai Tangen, the CEO of Norway's sovereign wealth fund, Norges Bank Investment Management (NBIM), successfully steered the massive fund through the turbulent waters of the Trump administration's trade wars and tariffs. We'll analyze his strategic decisions and their impact on Norway's economy, highlighting his adept risk management and investment strategies during a period of significant global economic uncertainty.

The Impact of Trump's Tariffs on the Global Economy

Trump's imposition of tariffs, particularly on Chinese goods, sent shockwaves through the global economy. This wasn't simply a bilateral issue; it created a complex web of interconnected consequences.

Disruption to Global Trade Flows

The tariffs significantly disrupted global trade flows, injecting considerable uncertainty into markets and leading to volatility across various asset classes.

- Increased costs for businesses: Tariffs directly increased the cost of imported goods, squeezing profit margins and impacting competitiveness.

- Supply chain disruptions: Businesses scrambled to adjust their supply chains, seeking alternative sources and incurring additional costs and delays.

- Retaliatory tariffs: China and other nations retaliated with their own tariffs, escalating the trade war and further hindering global trade.

- Negative impact on global growth: The overall effect was a dampening of global economic growth, as businesses delayed investment decisions and consumer confidence declined.

These global upheavals directly impacted NBIM's investment strategy, necessitating a reassessment of risk exposure and a recalibration of investment portfolios.

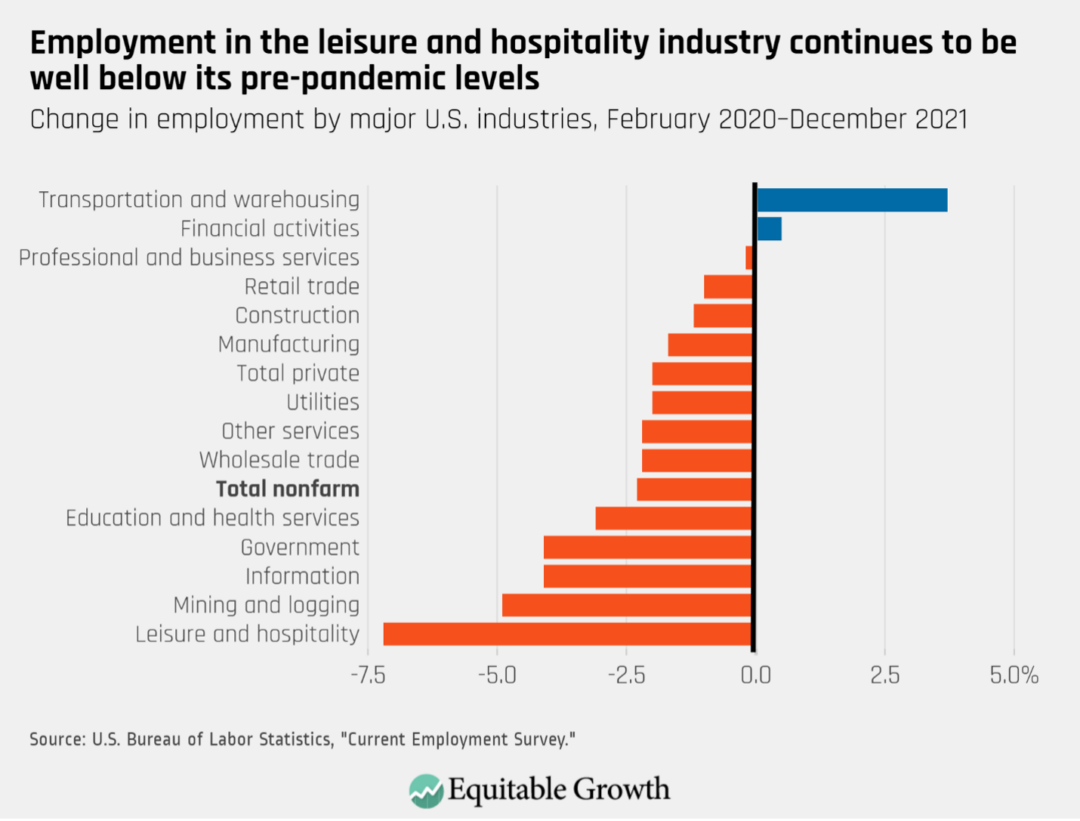

Specific Sectors Affected

Certain sectors felt the brunt of the tariffs more acutely than others. Manufacturing and agriculture, heavily reliant on international trade, faced considerable challenges.

- Manufacturing: Increased costs of imported components and raw materials squeezed profit margins and hampered production.

- Agriculture: Farmers experienced reduced demand for their products in export markets, leading to lower prices and financial hardship.

- NBIM's diversification strategies: NBIM's pre-existing diversification strategy across various sectors and geographies helped mitigate the impact. However, the fund had to actively manage its exposure to affected sectors, potentially reducing holdings in the most vulnerable areas.

Geopolitical Implications

Trump's trade policies had far-reaching geopolitical implications, influencing the global power dynamic and further complicating NBIM's investment decisions.

- Shifting global power dynamics: The trade war exacerbated existing tensions between the US and China, reshaping the global economic landscape.

- Increased trade tensions: Uncertainty surrounding trade policies made it harder for businesses to plan for the future and increased risk aversion among investors.

- Impact on investment choices: NBIM had to consider these geopolitical risks when making investment choices, seeking assets less vulnerable to trade disputes.

Nicolai Tangen's Leadership and Strategic Responses

Nicolai Tangen's response to the turbulent market conditions demonstrated strong leadership and a clear understanding of risk management.

Risk Management and Diversification Strategies

Tangen's approach centered on a robust risk management framework and a diversified investment portfolio.

- Diversification across asset classes: NBIM’s already diversified portfolio, including equities, fixed income, real estate, and private equity, cushioned the impact of the tariffs.

- Geographical diversification: Investing across various regions reduced dependence on any single market vulnerable to trade disruptions.

- Active vs. passive management: NBIM likely employed a blend of active and passive management strategies, allowing for both tactical adjustments and long-term strategic positioning.

Adapting the Investment Portfolio

NBIM adapted its investment portfolio to reflect the changing economic landscape.

- Shifting investment allocations: This might involve reducing exposure to sectors heavily impacted by tariffs and reallocating capital to more resilient sectors.

- Focusing on specific sectors: NBIM likely increased investment in sectors less exposed to trade tensions, such as technology or healthcare.

- Timing of changes: The timing of these adjustments was crucial, balancing the need to respond quickly to market volatility with avoiding rash, potentially costly decisions.

Communication and Transparency

Tangen’s emphasis on clear and transparent communication was vital in maintaining stakeholder confidence during uncertain times.

- Transparency regarding investment decisions: Open communication about NBIM's investment strategy helped address concerns and build trust.

- Engagement with stakeholders: Engaging with the Norwegian government, media, and other stakeholders ensured a unified approach to navigating the economic challenges.

- Maintaining investor confidence: Transparency and consistent communication helped maintain confidence among both domestic and international investors.

Long-Term Implications for Norway and NBIM

The Trump-era tariffs presented both challenges and opportunities for Norway and NBIM.

The Norwegian Economy's Resilience

Norway's economy demonstrated resilience during this period, largely due to the strength of its sovereign wealth fund.

- Economic indicators: While the global slowdown impacted Norway, the oil fund provided a buffer against severe economic shocks.

- Impact of the oil fund: The fund's robust performance and ability to withstand market volatility helped stabilize the Norwegian economy.

Lessons Learned in Investment Strategy

The experience provided valuable lessons for NBIM and global investors alike.

- The importance of diversification: The crisis underscored the importance of diversification across geographies and asset classes.

- Robust risk management: Effective risk management is essential for navigating periods of economic uncertainty.

- Adaptability: The ability to adapt to changing market conditions is crucial for long-term success.

- Strategic long-term thinking: Focusing on long-term goals, rather than short-term market fluctuations, proved crucial.

The Future of NBIM Under Tangen's Leadership

NBIM's future trajectory under Tangen's leadership is promising, built on lessons learned during the Trump tariff era.

- Future investment strategies: NBIM will likely continue to emphasize diversification, sustainable investing, and active management.

- Potential challenges and opportunities: The fund will face new challenges, such as climate change and geopolitical instability, but will also benefit from emerging opportunities in developing markets.

- Tangen’s vision: Tangen's vision for NBIM involves a responsible and sustainable approach to investing, aligning the fund's activities with broader societal goals.

Conclusion

Nicolai Tangen's leadership of NBIM during the era of Trump's tariffs provides a compelling case study in navigating global economic uncertainty. His focus on diversification, proactive risk management, and transparent communication ensured that Norway's sovereign wealth fund not only survived but thrived. The experience underscores the vital role of agile investment strategies in a volatile global landscape. Understanding how Tangen managed the impact of Trump’s tariffs offers valuable insights into effective risk management for sovereign wealth funds and global investors alike. Further research into Nicolai Tangen's strategies and the broader impact of Trump’s tariffs on global finance will reveal even more about his masterful navigation of these complex economic challenges.

Featured Posts

-

The Wests Importance To Canadas Future Gary Mars Call To Action For Mark Carney

May 05, 2025

The Wests Importance To Canadas Future Gary Mars Call To Action For Mark Carney

May 05, 2025 -

Analyzing Australias Vote A Global Indicator Against Trumpism

May 05, 2025

Analyzing Australias Vote A Global Indicator Against Trumpism

May 05, 2025 -

Kentucky Derby 2024 Final Preparations At Churchill Downs

May 05, 2025

Kentucky Derby 2024 Final Preparations At Churchill Downs

May 05, 2025 -

Strong April Jobs Report U S Employment Growth Continues

May 05, 2025

Strong April Jobs Report U S Employment Growth Continues

May 05, 2025 -

Even Marvel Knows Improving Its Movies And Shows

May 05, 2025

Even Marvel Knows Improving Its Movies And Shows

May 05, 2025

Latest Posts

-

Get The Look Anna Kendricks Sparkling Shell Crop Top

May 05, 2025

Get The Look Anna Kendricks Sparkling Shell Crop Top

May 05, 2025 -

Anna Kendricks Shell Crop Top The Perfect Summer Look

May 05, 2025

Anna Kendricks Shell Crop Top The Perfect Summer Look

May 05, 2025 -

Celebrity Style Inspiration Anna Kendricks Must Have Shell Top

May 05, 2025

Celebrity Style Inspiration Anna Kendricks Must Have Shell Top

May 05, 2025 -

Dispelling Rumors Another Simple Favor Director On Lively And Kendricks Relationship

May 05, 2025

Dispelling Rumors Another Simple Favor Director On Lively And Kendricks Relationship

May 05, 2025 -

Blake Lively And Anna Kendricks Another Simple Favor Director Sets The Record Straight

May 05, 2025

Blake Lively And Anna Kendricks Another Simple Favor Director Sets The Record Straight

May 05, 2025