Strong April Jobs Report: U.S. Employment Growth Continues

Table of Contents

Job Creation Across Sectors: A Detailed Breakdown

The April jobs report showcased robust job creation across various sectors, indicating a broad-based economic expansion.

Significant Gains in Key Industries:

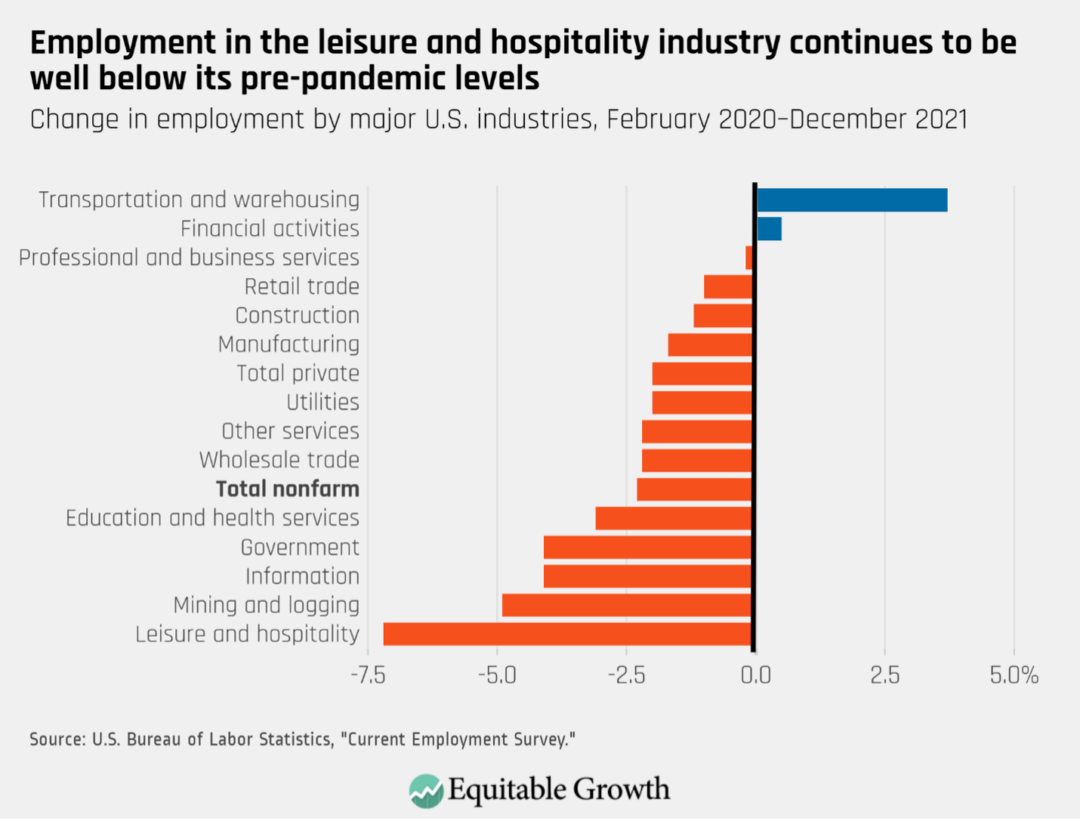

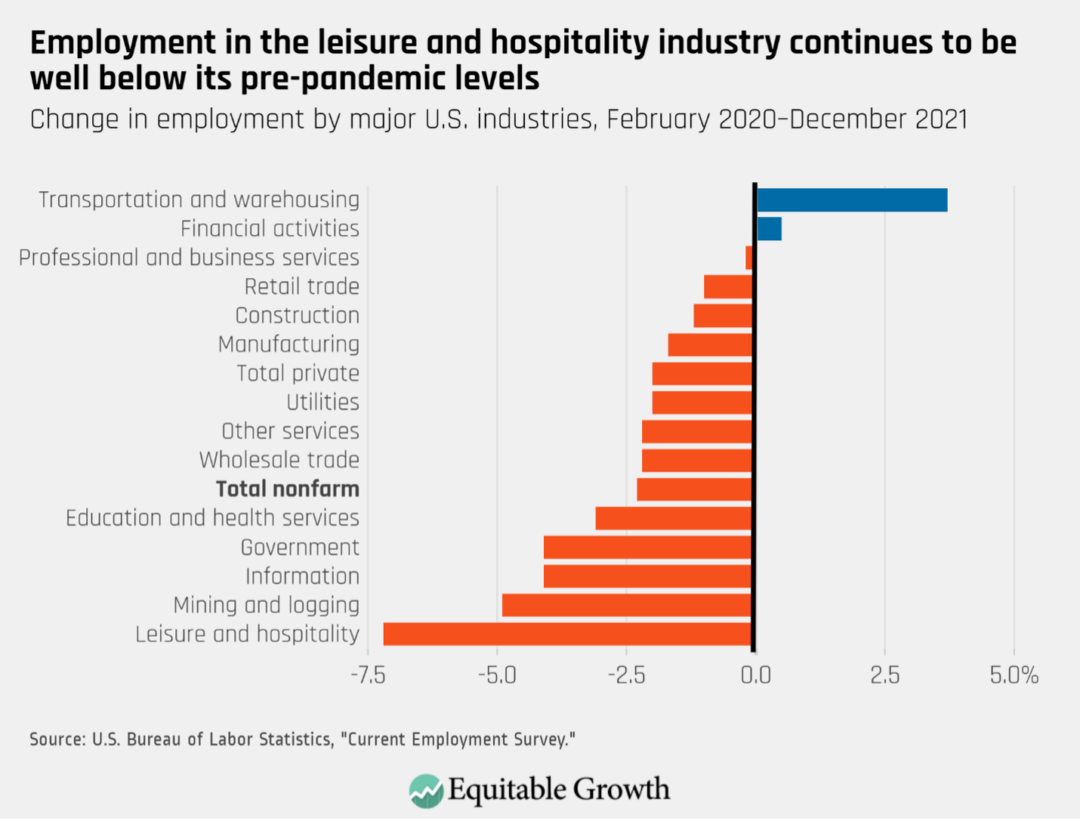

- Leisure and Hospitality: This sector added 146,000 jobs, continuing its recovery from pandemic-related losses. This growth is likely fueled by increased consumer spending on travel, dining, and entertainment.

- Professional and Business Services: This sector saw a substantial increase of 125,000 jobs, reflecting strong demand for professional services across various industries. This growth demonstrates the continued expansion of businesses and increased investment.

- Healthcare: The healthcare sector added 38,000 jobs, representing steady growth in a crucial sector of the U.S. economy. This includes roles in hospitals, nursing homes, and other healthcare facilities.

- Construction: The construction industry added 28,000 jobs, driven by ongoing infrastructure projects and housing demand. However, this sector still faces challenges related to material costs and labor shortages.

Unexpectedly, the manufacturing sector experienced a slight decline, losing 14,000 jobs, potentially due to softening global demand and ongoing supply chain issues. Further analysis is required to determine the long-term implications of this decline.

Impact of the Strong Labor Market on Wages:

The strong job market led to a modest increase in average hourly earnings, rising 0.5% for the month and 4.4% year-over-year. While this wage growth indicates improved worker compensation, it also contributes to inflationary pressures. The relationship between job growth and wage increases remains complex, with ongoing debates about the extent to which wage growth outpaces inflation. Furthermore, disparities in wage growth continue to exist across demographic groups, with some workers experiencing faster increases than others. Analyzing these discrepancies is crucial for understanding the overall impact of the labor market on income inequality.

Unemployment Rate Remains Low: Analyzing the Data

The April Unemployment Rate:

The unemployment rate for April remained low at 3.4%, unchanged from March and representing a historically low rate. This figure is lower than many economists' predictions and continues a trend of low unemployment that has persisted for several months. A low unemployment rate usually signals a healthy economy, but it can also contribute to increased wage pressures and inflation.

Labor Force Participation Rate:

The labor force participation rate saw a slight increase in April. This indicates more people are entering or re-entering the workforce, which is a positive sign for the economy. Factors contributing to this increase may include improving childcare access, improved economic prospects, and a continued shift in work-life balance. However, continued monitoring is crucial to understand long-term trends and identify any factors that may hinder further increases in labor force participation.

Implications for the Federal Reserve and Monetary Policy

Federal Reserve Response to Strong Employment Growth:

The strong April jobs report reinforces the Federal Reserve's concerns about inflation. The persistently low unemployment rate and moderate wage growth increase the likelihood of further interest rate hikes. The Federal Reserve's primary goal is to manage inflation and maintain price stability. The strong employment numbers may lead the Fed to continue its monetary tightening policy to cool down the economy and bring inflation closer to its 2% target.

Long-Term Economic Outlook:

While the April jobs report paints a positive picture of the short-term outlook, several challenges remain. Geopolitical risks, high inflation, and potential global economic slowdowns could impact future employment numbers. Technological advancements also pose both opportunities and challenges, as automation and artificial intelligence may displace some jobs while creating others in new sectors. Continued monitoring of global economic trends and technological developments is essential for predicting the long-term health of the U.S. job market.

Sustained Growth in the U.S. Job Market: A Positive Outlook

The strong April jobs report highlights sustained growth in the U.S. job market, characterized by robust job creation across multiple sectors and a consistently low unemployment rate. This positive trend has significant implications for the overall economy, although potential risks and challenges remain. The report also indicates increased wage pressures, impacting inflation and Federal Reserve monetary policy.

To stay informed about the evolving job market and its influence on the economy, stay tuned for our analysis of the next jobs report. Understanding these key economic indicators is crucial for navigating the dynamic landscape of the U.S. employment market. Subscribe to our newsletter for in-depth analysis and insights into the latest employment data and economic trends.

Featured Posts

-

Kentucky Derby 2025 Factors Influencing The Race Pace

May 05, 2025

Kentucky Derby 2025 Factors Influencing The Race Pace

May 05, 2025 -

Nhl Playoffs First Round Predictions Analysis And What To Expect

May 05, 2025

Nhl Playoffs First Round Predictions Analysis And What To Expect

May 05, 2025 -

The Low Uptake Of 10 Year Mortgages In Canada An Analysis

May 05, 2025

The Low Uptake Of 10 Year Mortgages In Canada An Analysis

May 05, 2025 -

Myke Wright Lizzos Partner His Career Wealth And Their Relationship

May 05, 2025

Myke Wright Lizzos Partner His Career Wealth And Their Relationship

May 05, 2025 -

The Internets Reaction To Lizzos Recent Weight Change

May 05, 2025

The Internets Reaction To Lizzos Recent Weight Change

May 05, 2025

Latest Posts

-

Emma Stones Popcorn Butt Lift Dress Snl Red Carpet Look Goes Viral

May 05, 2025

Emma Stones Popcorn Butt Lift Dress Snl Red Carpet Look Goes Viral

May 05, 2025 -

Exploring A Fox 2 Simulcast Red Wings And Tigers Games

May 05, 2025

Exploring A Fox 2 Simulcast Red Wings And Tigers Games

May 05, 2025 -

Indy Cars 2024 Season A New Era With Fox

May 05, 2025

Indy Cars 2024 Season A New Era With Fox

May 05, 2025 -

Indy Car Series A Look Ahead At Foxs Coverage

May 05, 2025

Indy Car Series A Look Ahead At Foxs Coverage

May 05, 2025 -

Analyst Chris Fallica Slams Trumps Putin Policy

May 05, 2025

Analyst Chris Fallica Slams Trumps Putin Policy

May 05, 2025