Norway's Sovereign Wealth Fund And The Trump Tariffs: Nicolai Tangen's Role

Table of Contents

The imposition of Trump-era tariffs presented a significant challenge to global investment strategies. This article examines how Norway's Sovereign Wealth Fund (often referred to as the Oil Fund, due to its origins in Norway's oil revenues), one of the world's largest, navigated this turbulent period under the leadership of Nicolai Tangen. We will explore the fund's investment decisions, risk mitigation strategies, and the overall impact of the tariffs on its massive portfolio. We will analyze how the fund's leadership successfully managed this complex situation and what lessons can be learned from its experience.

The Trump Tariffs and their Global Impact

Disruption to Global Trade

The Trump administration's tariffs, particularly those targeting steel and aluminum, significantly disrupted global trade flows. These actions created uncertainty and volatility across various markets.

- Aluminum and Steel Industries: The tariffs directly impacted aluminum and steel producers worldwide, leading to price increases and supply chain disruptions. Many downstream industries reliant on these materials faced increased costs and reduced competitiveness.

- Retaliatory Tariffs: The tariffs triggered retaliatory measures from other countries, further escalating trade tensions and creating a complex web of trade restrictions. This unpredictable environment made accurate forecasting extremely difficult.

- Economic Impact: Studies estimate that the Trump tariffs cost the US economy billions of dollars and negatively impacted global GDP growth. The World Trade Organization (WTO) and other international organizations documented significant disruptions to global trade patterns.

Increased Investment Risk

The unpredictable nature of the Trump tariffs dramatically increased investment risk for global investors, including sovereign wealth funds like Norway's. The uncertainty surrounding future trade policy made it challenging to predict market reactions and assess the long-term impact on investment returns.

- Market Volatility: The fluctuating trade environment led to significant market volatility, making it difficult to accurately value assets and manage investment portfolios effectively.

- Forecasting Challenges: Predicting the outcome of trade disputes and their impact on specific industries became exceptionally difficult, necessitating a more cautious and flexible investment approach.

- Geopolitical Uncertainty: The tariffs were just one element of a broader geopolitical landscape characterized by uncertainty, adding another layer of complexity to investment decision-making.

Nicolai Tangen's Approach to Managing Risk

Prioritizing Diversification

Nicolai Tangen, upon assuming leadership of the fund, prioritized diversification as a core strategy for mitigating risks associated with the trade wars. This involved diversifying across various geographies, asset classes, and sectors.

- Geographical Diversification: Reducing exposure to any single region or country helped minimize the impact of region-specific trade disputes. The fund increased investment in emerging markets and other regions less directly affected by the US-China trade war.

- Asset Class Diversification: The fund strategically allocated assets across a variety of asset classes, including equities, fixed income, real estate, and private equity, reducing the overall portfolio’s vulnerability to shocks in any single sector.

- Renewable Energy Investments: Investment in renewable energy sources acted as a potential hedge against trade disputes, as this sector is experiencing significant growth irrespective of trade policy changes.

Active vs. Passive Investment Strategies

Tangen employed a blend of active and passive investment strategies. While maintaining a significant portion of the portfolio in passively managed index funds, the fund also increased its active management capabilities to identify opportunities and mitigate risks arising from the fluctuating trade environment.

- Active Management for Opportunistic Investments: Active management allowed the fund to capitalize on undervalued assets in sectors affected by the tariffs, while also selectively exiting positions in sectors facing significant headwinds.

- Passive Management for Core Holdings: Passive investment strategies provided stability and diversification, forming the backbone of the portfolio and minimizing exposure to the potential negative impacts of the tariffs.

- Dynamic Strategy Adjustment: The fund's ability to adjust its strategy dynamically, shifting between active and passive management as needed, proved vital in navigating the uncertain market conditions.

Transparency and Communication

Maintaining transparency and clear communication with stakeholders was paramount to Tangen's approach. Open communication helped build confidence and manage expectations during a period of significant market uncertainty.

- Public Reporting: The fund maintained its commitment to regular and transparent reporting on its performance and investment strategies.

- Stakeholder Engagement: Tangen and the fund’s leadership engaged proactively with the Norwegian public and international investors, providing updates and explaining their investment decisions.

- Addressing Criticism: While the fund's approach was largely praised, it also faced some criticism. The fund's leadership addressed these concerns openly and transparently, demonstrating a commitment to accountability.

The Performance of Norway's Sovereign Wealth Fund During the Tariff Period

Analyzing Investment Returns

While the Trump tariffs negatively impacted global markets, Norway's Sovereign Wealth Fund demonstrated resilience. While specific figures related directly to tariff impact are difficult to isolate, the fund's overall performance during this period can be considered successful compared to benchmarks.

- Positive Returns Despite Volatility: The fund managed to generate positive returns despite the market volatility created by the tariffs, showcasing its effective risk management strategies. Detailed analysis of this performance should include comparisons to relevant benchmarks (e.g., other large sovereign wealth funds, major global indices).

- Sector-Specific Impacts: The fund's performance varied across different sectors. Sectors directly impacted by the tariffs (e.g., steel, aluminum) naturally experienced more volatility, but diversification mitigated these sector-specific impacts on overall fund performance.

- Benchmark Comparisons: Analyzing the fund's performance relative to other similar sovereign wealth funds can reveal the effectiveness of Tangen's approach in managing the specific risks presented by the trade wars.

Long-Term Implications

The experience of navigating the Trump tariffs had long-term implications for the fund's investment strategy. The fund’s approach demonstrated the crucial importance of diversification and flexibility.

- Enhanced Risk Management Frameworks: The experience reinforced the need for robust risk management frameworks capable of adapting to rapidly changing geopolitical and economic conditions.

- Increased Focus on ESG Investing: The experience potentially increased the focus on ESG (environmental, social, and governance) factors in investment decisions, seeking companies with sustainable business models less susceptible to trade disputes.

- Strategic Adjustments: While the overall investment strategy remained largely consistent, certain adjustments were made to the fund's portfolio allocation and risk tolerance based on the lessons learned from navigating the tariff period.

Conclusion

This article explored how Norway's Sovereign Wealth Fund, under Nicolai Tangen's leadership, navigated the challenges posed by the Trump-era tariffs. Diversification, a blend of active and passive investment strategies, and transparent communication proved crucial in mitigating risks and maintaining a robust investment portfolio. The fund's experience offers valuable lessons for other global investors facing similar geopolitical and economic uncertainties. The successful management of Norway’s Sovereign Wealth Fund during this period serves as a case study in effective global investment management.

Call to Action: Learn more about the strategies employed by Norway's Sovereign Wealth Fund and how they successfully managed global investment risks during periods of trade uncertainty. Understanding Norway's Sovereign Wealth Fund's approach is crucial for any investor navigating a complex global landscape. Explore the fund's publicly available reports and analysis to gain further insights into their effective management of risk and investment returns.

Featured Posts

-

Hong Kong Restaurant Review Honjos Modern Take On Japanese Dining

May 04, 2025

Hong Kong Restaurant Review Honjos Modern Take On Japanese Dining

May 04, 2025 -

Nhl Playoff Standings Whats At Stake In Fridays Games

May 04, 2025

Nhl Playoff Standings Whats At Stake In Fridays Games

May 04, 2025 -

Farage Backs Snp Reforms Holyrood Election Strategy Revealed

May 04, 2025

Farage Backs Snp Reforms Holyrood Election Strategy Revealed

May 04, 2025 -

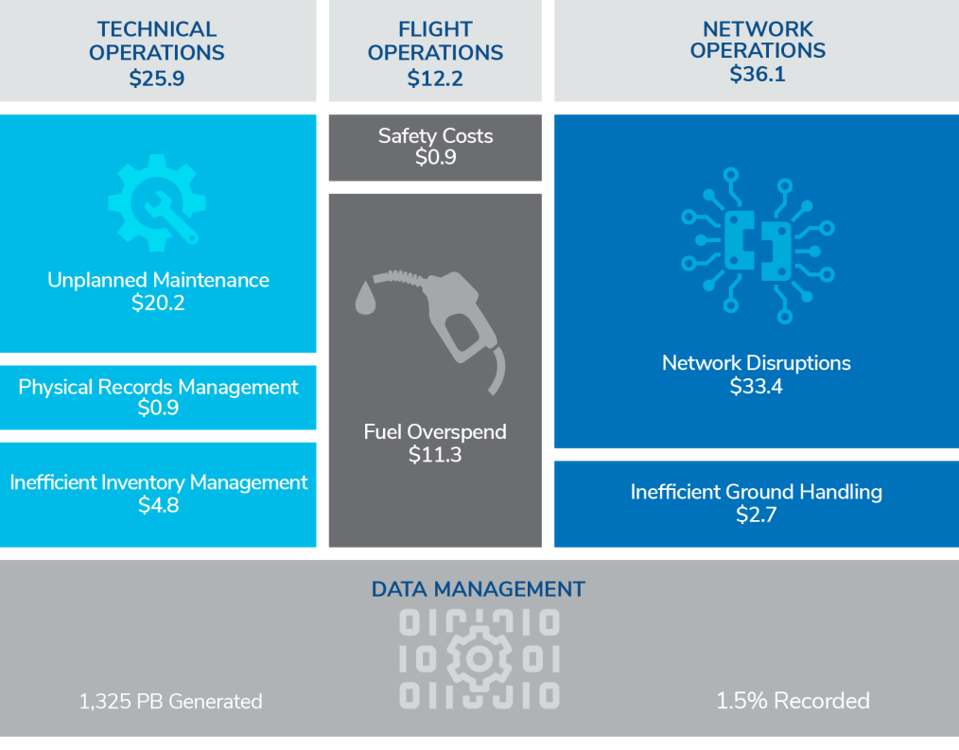

The Impact Of Oil Supply Instability On Airline Operations And Finances

May 04, 2025

The Impact Of Oil Supply Instability On Airline Operations And Finances

May 04, 2025 -

Daur Ulang Cangkang Telur Manfaatnya Untuk Pertumbuhan Tanaman Dan Kesehatan Hewan

May 04, 2025

Daur Ulang Cangkang Telur Manfaatnya Untuk Pertumbuhan Tanaman Dan Kesehatan Hewan

May 04, 2025

Latest Posts

-

West Bengal Holi Weather High Temperatures And Coastal Tide Alert

May 04, 2025

West Bengal Holi Weather High Temperatures And Coastal Tide Alert

May 04, 2025 -

Weather Alert Kolkata Temperatures To Rise Above 30 Degrees Celsius In March

May 04, 2025

Weather Alert Kolkata Temperatures To Rise Above 30 Degrees Celsius In March

May 04, 2025 -

Ufc 314 Full Bout Order Revealed For Main Card And Prelims

May 04, 2025

Ufc 314 Full Bout Order Revealed For Main Card And Prelims

May 04, 2025 -

Kolkata Temperature Forecast 30 C Expected In March

May 04, 2025

Kolkata Temperature Forecast 30 C Expected In March

May 04, 2025 -

Ufc 314 Fight Card Main Event Prelims And Bout Order Announced

May 04, 2025

Ufc 314 Fight Card Main Event Prelims And Bout Order Announced

May 04, 2025