The Impact Of Oil Supply Instability On Airline Operations And Finances

Table of Contents

Fuel Costs as a Major Expense for Airlines

Jet fuel is a dominant cost factor for airlines, significantly impacting their profitability and operational decisions. Understanding the magnitude of this expense is key to grasping the impact of oil supply instability.

The Proportion of Fuel Costs in Airline Budgets

Jet fuel typically accounts for a substantial portion (20-40%) of an airline's operating costs. This percentage varies depending on factors like aircraft type, route length, and load factor. Longer haul flights naturally consume more fuel, increasing the proportion of fuel costs in their budgets.

- Examples: A low-cost carrier operating short-haul routes might see fuel costs represent 25% of their operating expenses, while a full-service airline flying long-haul routes could see this figure reach 40% or even higher. Specific examples include Southwest Airlines, known for its fuel efficiency, versus a long-haul airline like Emirates.

- Fuel Hedging: Airlines often employ fuel hedging strategies – financial contracts to lock in future fuel prices at a predetermined rate. While this aims to mitigate risk associated with price volatility, it can also backfire if market prices fall unexpectedly below the hedged price.

Impact of Price Volatility on Profit Margins

Unpredictable oil prices directly affect airline profitability. Even small price fluctuations can significantly impact profit margins, potentially leading to reduced profits or substantial losses, especially for airlines with less financial resilience.

- Examples: A sudden 10% increase in oil prices can severely impact an airline's bottom line, potentially wiping out planned profits. Low-cost carriers, with their typically slimmer profit margins, are particularly vulnerable to such price shocks.

- Business Model Impact: Full-service airlines, with higher ticket prices and ancillary revenue streams, may have slightly more cushioning against fuel price increases compared to low-cost carriers, who heavily rely on low operational costs.

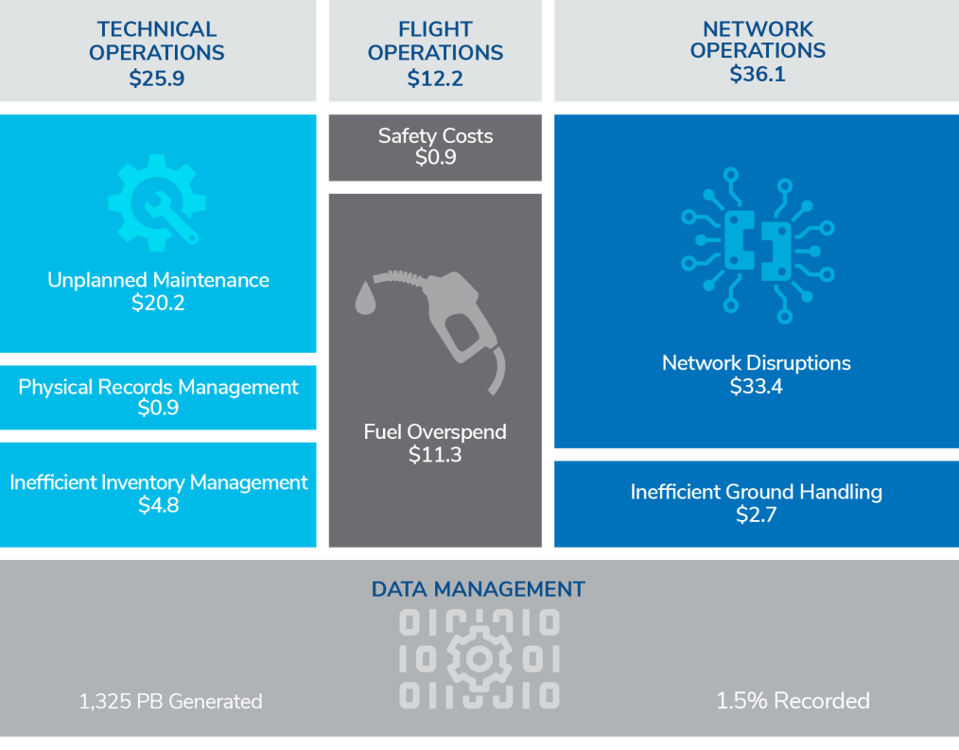

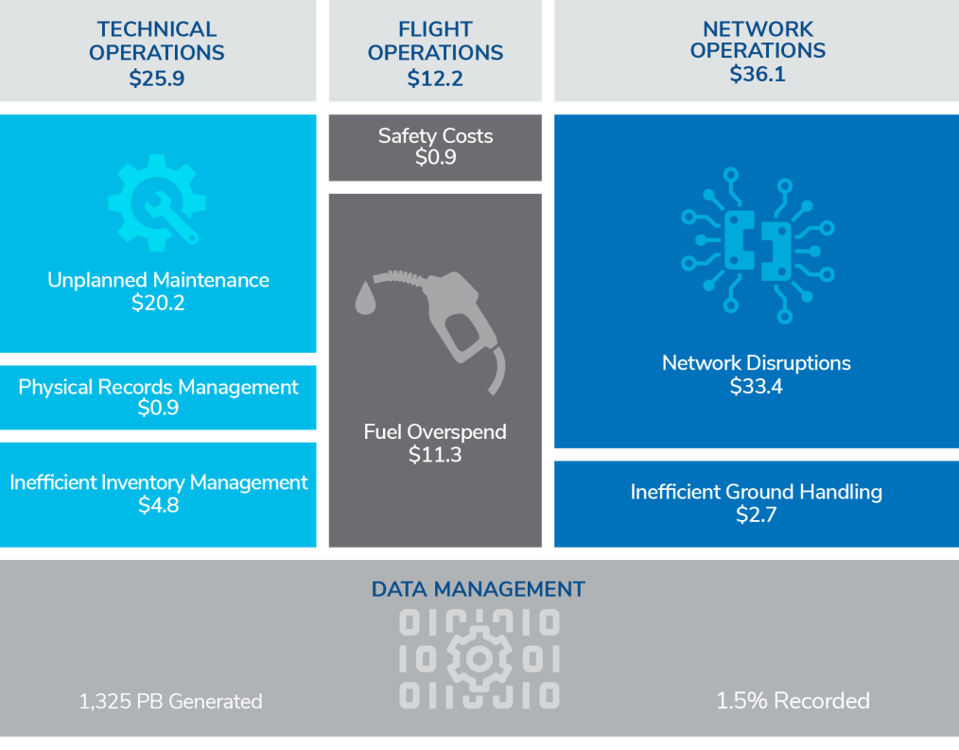

Operational Challenges Stemming from Oil Supply Disruptions

Oil supply disruptions extend beyond mere price fluctuations; they directly impact airline operations, leading to significant challenges.

Flight Cancellations and Schedule Disruptions

Oil shortages can cause significant disruptions to flight schedules. Airlines may be forced to cancel or delay flights due to a lack of fuel, creating considerable inconvenience for passengers and cascading effects throughout the aviation system.

- Real-world Examples: Past geopolitical events and natural disasters have demonstrably illustrated the impact of oil supply issues on flight operations, leading to widespread cancellations and delays.

- Knock-on Effects: Flight cancellations and delays create knock-on effects on air traffic control, ground handling operations (baggage handling, etc.), and crew scheduling, amplifying the initial disruption.

Increased Fuel Costs Leading to Route Adjustments

High fuel prices often force airlines to adjust their route networks. Airlines might reduce flight frequencies on less profitable routes or even cancel them entirely to reduce overall fuel consumption and costs.

- Vulnerable Routes: Routes with low passenger demand or high operating costs are particularly vulnerable to fuel price increases, potentially facing cuts or complete cessation.

- Regional Connectivity: The reduction or elimination of less profitable routes can significantly impact regional connectivity and accessibility, particularly in underserved areas.

Financial Implications and Strategic Responses

The impact of oil supply instability extends to the broader financial landscape of the airline industry.

Impact on Airline Stock Prices and Investor Confidence

Oil price instability is strongly correlated with airline stock performance. Sudden price spikes often lead to decreased investor confidence and a decline in airline stock prices, reflecting the industry's vulnerability.

- Stock Price Reactions: News of oil supply disruptions or significant price increases often triggers immediate reactions in the stock market, with airline stocks frequently experiencing volatility.

- Mergers and Acquisitions: Periods of oil price instability can influence merger and acquisition activity within the industry as airlines seek to consolidate to achieve greater economies of scale and enhance their resilience to fuel price shocks.

Strategies for Mitigating the Impact of Oil Supply Instability

Airlines employ various strategies to mitigate the impact of oil supply instability:

- Fuel Hedging: As mentioned earlier, this involves securing future fuel purchases at a predetermined price to protect against price spikes.

- Route Optimization: Careful planning of flight routes to minimize fuel consumption and optimize load factors.

- Fleet Modernization: Investing in more fuel-efficient aircraft significantly reduces fuel costs over the long term.

- Diversification of Fuel Sources: Exploring alternative fuels such as biofuels and sustainable aviation fuels (SAFs) reduces reliance on traditional fossil fuels.

- Government Policies & International Cooperation: Government regulations and international collaboration play a vital role in ensuring stable fuel supplies and promoting sustainable aviation practices.

Conclusion

The impact of oil supply instability and airline operations is profound and multifaceted. From directly affecting fuel costs and profit margins to disrupting flight schedules and impacting investor confidence, the challenges are significant. Airlines must adopt proactive strategies such as fuel hedging, fleet modernization, and efficient route planning to mitigate these risks. Understanding the complex relationship between oil supply instability and airline performance is crucial for industry stakeholders, policymakers, and passengers alike. Staying informed about oil supply instability and airline operations is essential for navigating the future of air travel.

Featured Posts

-

Unexpected Spring Snow Nyc Suburbs To See 1 2 Inches Tomorrow

May 04, 2025

Unexpected Spring Snow Nyc Suburbs To See 1 2 Inches Tomorrow

May 04, 2025 -

Thunderbolts Will This Team Save The Mcu

May 04, 2025

Thunderbolts Will This Team Save The Mcu

May 04, 2025 -

Murder And Torture Indictment Against Stepfather In Teens Case

May 04, 2025

Murder And Torture Indictment Against Stepfather In Teens Case

May 04, 2025 -

Rethinking The 10 Year Mortgage A Canadian Perspective

May 04, 2025

Rethinking The 10 Year Mortgage A Canadian Perspective

May 04, 2025 -

Anna Kendricks Real Age A Closer Look At The Actresss Longevity

May 04, 2025

Anna Kendricks Real Age A Closer Look At The Actresss Longevity

May 04, 2025

Latest Posts

-

No Trump Tariff Support From Buffett Reports Untrue

May 04, 2025

No Trump Tariff Support From Buffett Reports Untrue

May 04, 2025 -

Deutschland Praesentiert Chefsache Esc 2025 Sonderedition

May 04, 2025

Deutschland Praesentiert Chefsache Esc 2025 Sonderedition

May 04, 2025 -

Neue Chefsache Esc 2025 Sonderedition Fuer Deutschland

May 04, 2025

Neue Chefsache Esc 2025 Sonderedition Fuer Deutschland

May 04, 2025 -

Buffett Rejects Trump Tariff Rumors Reports Fabricated

May 04, 2025

Buffett Rejects Trump Tariff Rumors Reports Fabricated

May 04, 2025 -

Start Der Chefsache Esc 2025 Sonderedition In Deutschland

May 04, 2025

Start Der Chefsache Esc 2025 Sonderedition In Deutschland

May 04, 2025