Norwegian Cruise Line (NCLH) Stock Jumps On Positive Earnings Report

Table of Contents

Exceeding Expectations: Key Highlights from NCLH's Earnings Report

The recently released NCLH earnings report showcased impressive financial performance, exceeding many analysts' projections and significantly impacting the NCLH stock price. Several key factors contributed to this positive outcome:

-

Robust Revenue Growth: NCLH reported a substantial increase in revenue, surpassing projected figures by a considerable margin. This strong revenue performance reflects the high demand for cruises and the company's effective strategies in attracting passengers. Detailed financial breakdowns will be available in the full earnings report, but early indications suggest significant growth across all revenue streams.

-

High Occupancy Rates: The report highlighted impressively high occupancy rates across NCLH's fleet. This indicates strong demand for cruises and the company's success in filling its ships, a critical factor in profitability for any cruise line. These high occupancy rates are a testament to the recovery of the travel industry and the continued allure of NCLH's offerings.

-

Positive Booking Trends: NCLH's future bookings demonstrate continued positive momentum for the cruise line. Strong booking numbers for upcoming voyages signal sustained demand and suggest robust future revenue growth potential for the NCLH stock. This provides investors with confidence in the company's long-term prospects.

-

Improved Profit Margins: The earnings report revealed an improvement in profit margins, showcasing NCLH's ability to manage costs effectively while maintaining high levels of service. This cost-cutting and efficiency improvement likely contributed significantly to the exceeding of profit expectations. The report detailed the specific measures implemented to improve margins, reinforcing the company's financial strength.

-

Positive Surprises: The report may have included unexpected positive surprises, such as advancements in new ship orders, successful cost-cutting initiatives beyond expectations, or stronger-than-anticipated performance in specific markets. These unexpected positives could have further contributed to the positive market reaction and the subsequent surge in NCLH stock price.

Factors Driving the NCLH Stock Price Increase

The significant increase in NCLH stock price is driven by a combination of factors, reflecting both the company's performance and broader market trends:

-

Boosted Investor Confidence: The positive earnings report significantly boosted investor confidence in NCLH. Exceeding expectations reassured investors about the company's financial health and its potential for future growth. This renewed faith translated into increased demand for NCLH stock, driving up its price.

-

Positive Market Sentiment: The positive NCLH earnings report also contributed to a generally positive market sentiment surrounding the cruise industry recovery. The successful performance of a major player like NCLH can lift the entire sector, attracting investors to other cruise line stocks as well.

-

Rising Travel Demand: The post-pandemic surge in travel demand is a crucial factor underpinning NCLH's success. Increased consumer spending on leisure activities, pent-up demand for travel, and a general return to normalcy fueled higher cruise bookings.

-

Macroeconomic Factors: Favorable macroeconomic conditions, such as a strengthening global economy and increased consumer spending, also played a role in the positive market response to NCLH's performance. A stable economic climate supports increased consumer confidence, leading to a surge in discretionary spending, including cruise travel.

-

Competitive Advantage: While the entire cruise sector is experiencing a recovery, NCLH's performance relative to its competitors can further amplify its stock price increase. Stronger-than-expected results compared to rivals can draw investors seeking a better performing cruise line stock.

Long-Term Outlook for NCLH Stock

The long-term outlook for NCLH stock is positive, but it’s essential to consider both potential upsides and downsides:

-

Future Projections: Based on current booking trends and the company's financial performance, future projections for NCLH suggest continued growth. However, it is important to note that these are projections and are subject to change based on various market factors.

-

Risk Assessment: Potential risks include unforeseen economic downturns, geopolitical instability, further pandemic-related disruptions, or increased competition within the cruise industry. Investors should thoroughly assess these risks before investing.

-

Growth Potential: NCLH's growth potential is significant, particularly considering the continued recovery of the travel industry and the company's strategic initiatives. New ship deployments, innovative offerings, and expansion into new markets contribute to its long-term growth potential.

-

Analyst Forecasts: Consult various financial analysts' reports and forecasts for a more comprehensive understanding of the projected trajectory of NCLH stock. Different analysts may hold varying opinions, leading to diverse predictions.

-

Competitive Landscape: Comparing NCLH's long-term prospects with those of its competitors in the cruise sector is crucial. Understanding the relative strengths and weaknesses of each company allows for a more informed investment decision.

Should You Invest in NCLH Stock?

Deciding whether to invest in NCLH stock requires careful consideration of your personal investment strategy and risk tolerance.

-

Pros and Cons: Weigh the potential for high returns against the inherent risks associated with investing in the stock market, particularly in a sector as susceptible to external factors as the cruise industry.

-

Risk Tolerance: Investing in NCLH stock carries a moderate to high level of risk due to its susceptibility to economic fluctuations and external events. Only invest an amount that you are comfortable potentially losing.

-

Market Conditions: Consider current market conditions and future projections for the cruise industry before making an investment decision. Thoroughly research the current state of the market to inform your choices.

-

Balanced Perspective: Seek advice from qualified financial advisors before making any investment decisions. They can help you assess your personal risk tolerance and create an investment strategy aligned with your goals.

-

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Conclusion

The recent surge in Norwegian Cruise Line (NCLH) stock price is a strong indicator of the company's positive financial performance and the overall recovery of the cruise industry. The exceeding of expectations in their latest earnings report has boosted investor confidence and fueled significant growth in the NCLH stock price. While risks remain, the long-term outlook, based on current trends, appears promising.

Call to Action: Are you considering adding cruise line stocks to your portfolio? Learn more about NCLH stock and the current market trends to make informed investment decisions. Stay updated on the latest NCLH news and financial reports to effectively manage your investment in this dynamic sector. Remember to conduct thorough research and consult with a financial advisor before making any investment choices regarding NCLH stock or other cruise line stocks.

Featured Posts

-

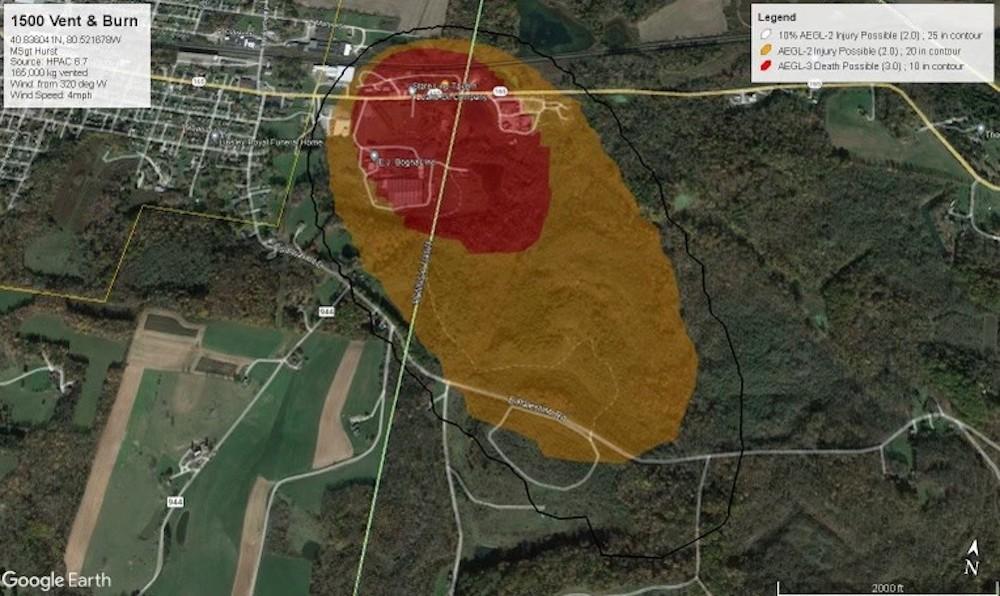

Toxic Chemical Fallout The Long Term Impact Of The Ohio Train Derailment

May 01, 2025

Toxic Chemical Fallout The Long Term Impact Of The Ohio Train Derailment

May 01, 2025 -

England Vs France Six Nations Dalys Late Show Delivers Victory

May 01, 2025

England Vs France Six Nations Dalys Late Show Delivers Victory

May 01, 2025 -

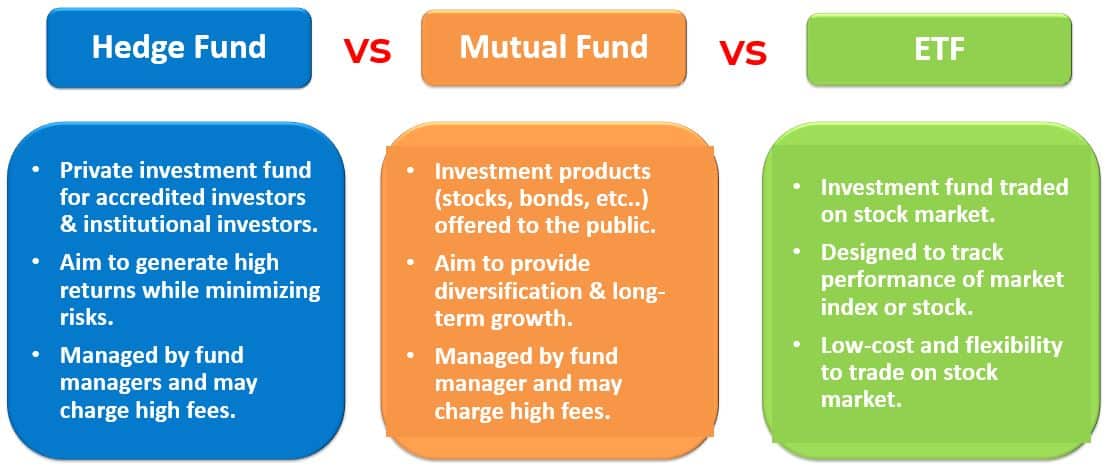

Analyzing Nclh What Do Hedge Fund Holdings Suggest

May 01, 2025

Analyzing Nclh What Do Hedge Fund Holdings Suggest

May 01, 2025 -

Merck To Build 1 Billion Factory For Us Supply Of Blockbuster Drug

May 01, 2025

Merck To Build 1 Billion Factory For Us Supply Of Blockbuster Drug

May 01, 2025 -

Obituary Priscilla Pointer Celebrated Dalla Star Dies At 100

May 01, 2025

Obituary Priscilla Pointer Celebrated Dalla Star Dies At 100

May 01, 2025

Latest Posts

-

Appello Processo Becciu Inizio 22 Settembre L Assoluta Innocenza Proclammata

May 01, 2025

Appello Processo Becciu Inizio 22 Settembre L Assoluta Innocenza Proclammata

May 01, 2025 -

Scandalo Vaticano Le Chat Segrete Di Becciu E Le Accuse Di Processo Falsato

May 01, 2025

Scandalo Vaticano Le Chat Segrete Di Becciu E Le Accuse Di Processo Falsato

May 01, 2025 -

Becciu E Il Vaticano Nuove Rivelazioni Sulle Chat Segrete E Il Processo

May 01, 2025

Becciu E Il Vaticano Nuove Rivelazioni Sulle Chat Segrete E Il Processo

May 01, 2025 -

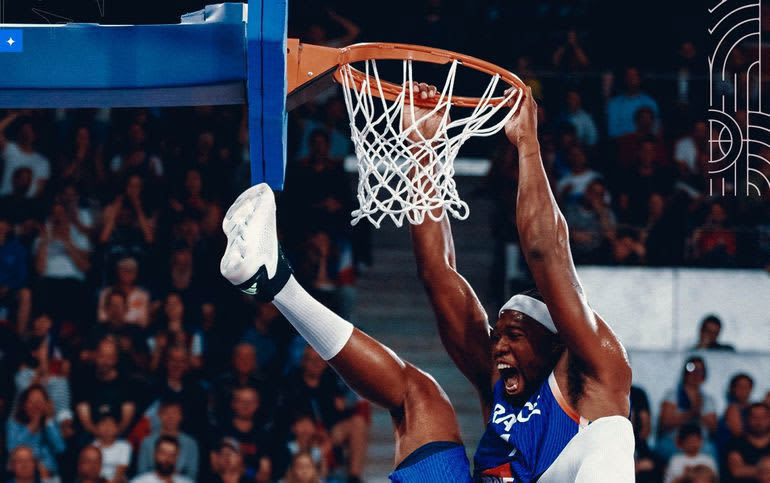

I Odysseia Ton 50 000 Ponton I Istoria Toy Lempron Tzeims

May 01, 2025

I Odysseia Ton 50 000 Ponton I Istoria Toy Lempron Tzeims

May 01, 2025 -

Lempron Tzeims 50 000 Pontoi Kai I Kyriarxia Toy Sto Nba

May 01, 2025

Lempron Tzeims 50 000 Pontoi Kai I Kyriarxia Toy Sto Nba

May 01, 2025