Oil Market Update: Key Events And Analysis For May 16

Table of Contents

Geopolitical Tensions and their Impact on Oil Prices

Geopolitical risk remains a primary driver of oil price volatility. On May 16th, [insert specific geopolitical event relevant to the oil market on that date, e.g., escalating tensions in the Middle East, developments in the Russia-Ukraine conflict impacting oil exports]. These events created uncertainty within the market, leading to price fluctuations. The potential for supply disruptions due to these conflicts is a major concern for global oil markets. Sanctions imposed on certain oil-producing nations further exacerbate the situation, restricting supply and pushing prices higher.

- Analysis of specific geopolitical events and their immediate impact on oil futures: [Insert detailed analysis of the specific event's impact on futures contracts, referencing specific price changes if possible. Example: "The escalating tensions in the Middle East led to a sharp increase in Brent crude futures, jumping by X% within hours of the news."]

- Assessment of potential long-term effects on global oil supply chains: [Analyze potential disruptions to shipping routes, refining processes, or access to oil fields. Example: "Continued conflict in [region] could severely disrupt oil transport through the [strait/pipeline], potentially leading to prolonged supply shortages and higher prices."]

- Discussion on the role of major oil-producing nations in navigating the geopolitical landscape: [Discuss the responses of major oil-producing nations like Saudi Arabia, Russia, and the US to the geopolitical events, and how their actions influence oil prices. Example: "Saudi Arabia's role in maintaining stability within OPEC+ is crucial in moderating price spikes caused by geopolitical uncertainty."]

OPEC+ Decision and its Market Influence

Any OPEC+ meetings or announcements around May 16th significantly influenced oil prices. [Insert details of any OPEC+ meeting, production quota adjustments, or statements released. For example, if there was no meeting, state that clearly: "No OPEC+ meeting occurred on or around May 16th, leaving market participants to react to existing production levels and geopolitical events."] Understanding the OPEC+ strategy is vital for analyzing oil market dynamics. Production cuts typically result in higher oil prices, while increases can lead to price declines.

- Summary of the OPEC+ meeting's outcome (if applicable): [Summarize the key decisions and agreements made during the meeting.]

- Explanation of the rationale behind any production decisions: [Explain the reasons for any production adjustments, citing factors such as demand forecasts, geopolitical considerations, or member country needs.]

- Assessment of the market's reaction to the OPEC+ announcement: [Describe how the market reacted to the OPEC+ decision, including immediate price movements and investor sentiment.]

Economic Indicators and Oil Demand

Macroeconomic indicators strongly influence oil demand and, consequently, oil prices. On May 16th, [insert relevant economic data released, e.g., inflation figures, GDP growth projections, interest rate announcements]. These factors impact consumer and business spending, directly affecting energy consumption. Concerns about a global recession or economic slowdown can significantly lower oil demand forecasts.

- Review of key economic data released around May 16th relevant to oil demand: [Summarize the key economic data points and their potential implications for oil demand.]

- Analysis of how economic factors influenced investor sentiment towards oil: [Explain how economic indicators affected investor confidence in the oil market, leading to either buying or selling pressure.]

- Discussion on the potential impact of a recession or economic slowdown on oil demand: [Analyze how a potential recession would impact oil demand, considering reduced industrial activity and transportation needs.]

Refining Capacity and its Effect on Oil Prices

Refinery utilization rates and margins significantly influence oil prices. Global refining capacity and its efficiency in processing crude oil into various products (gasoline, diesel, jet fuel) directly impact supply and price. Changes in demand for these refined products – driven by factors such as seasonal changes in driving habits or petrochemical demand – also influence prices.

Future Outlook and Price Predictions (May 16th and beyond)

Based on the analysis of the key events discussed, the outlook for oil prices is [insert cautious outlook, e.g., uncertain, volatile, potentially upward trending]. [Insert short-term price prediction, if appropriate, with clear caveats. E.g., "While short-term price predictions are inherently unreliable, based on current trends, we anticipate a price range of X to Y dollars per barrel in the coming weeks."] Geopolitical risks and economic uncertainties remain significant factors that could influence future price volatility. Investing in the energy sector requires careful consideration of these factors.

Conclusion

This oil market update for May 16th highlighted the key factors influencing crude oil prices, including geopolitical tensions, OPEC+ decisions, and economic indicators. The interplay of these factors created volatility and uncertainty within the market. Understanding the nuances of these interlinked forces is essential for effective navigation of the energy markets.

Call to Action: Stay informed about daily fluctuations in the oil market by regularly checking our website for the latest oil market updates and analysis. Understanding the dynamics of the oil market is crucial for making informed investment decisions in the energy sector. Continue to follow our future oil market updates to remain ahead of the curve.

Featured Posts

-

Breaking News Seaweed Revolution Condo Damage And Corporate Crisis Update

May 17, 2025

Breaking News Seaweed Revolution Condo Damage And Corporate Crisis Update

May 17, 2025 -

Your Guide To Moto Racing Gncc Mx Sx Flat Track And Enduro News

May 17, 2025

Your Guide To Moto Racing Gncc Mx Sx Flat Track And Enduro News

May 17, 2025 -

Weekly Review Lessons From Our Failures

May 17, 2025

Weekly Review Lessons From Our Failures

May 17, 2025 -

Probe Into Bayesian Superyacht Disaster Links Mast Failure To Loss Of Life

May 17, 2025

Probe Into Bayesian Superyacht Disaster Links Mast Failure To Loss Of Life

May 17, 2025 -

14 0 Shutout Mariners First Inning Dominance Against Miami Marlins

May 17, 2025

14 0 Shutout Mariners First Inning Dominance Against Miami Marlins

May 17, 2025

Latest Posts

-

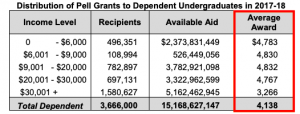

Understanding The Gops Proposed Student Loan Overhaul

May 17, 2025

Understanding The Gops Proposed Student Loan Overhaul

May 17, 2025 -

Game 4 Controversy Pistons Furious Over Missed Foul Call

May 17, 2025

Game 4 Controversy Pistons Furious Over Missed Foul Call

May 17, 2025 -

Gops Student Loan Plan Pell Grants Repayment And More Explained

May 17, 2025

Gops Student Loan Plan Pell Grants Repayment And More Explained

May 17, 2025 -

The Nbas No Call And Its Consequences The Pistons Game 4 Perspective

May 17, 2025

The Nbas No Call And Its Consequences The Pistons Game 4 Perspective

May 17, 2025 -

Nbas Admission A Costly No Call Affects Pistons Game 4 Outcome

May 17, 2025

Nbas Admission A Costly No Call Affects Pistons Game 4 Outcome

May 17, 2025