Palantir Stock: Analyzing Q1 2024 Government And Commercial Growth

Table of Contents

Palantir's Q1 2024 Government Sector Performance

Palantir's government sector remains a significant revenue contributor. Understanding its performance is crucial for assessing the overall health of Palantir stock.

Government Revenue Growth

Palantir's Q1 2024 government revenue growth (specific numbers would go here, replacing this placeholder. For example: "showed a 25% year-over-year increase, reaching $XXX million.") This surpasses the growth seen in previous quarters, indicating strong demand for Palantir's data analytics platforms within the government sector.

- Breakdown of revenue by specific government agencies: (Detailed breakdown of revenue contributions from different agencies like the Department of Defense, CIA etc., should be included here using real data if available). For example: "The Department of Defense accounted for the largest share of government revenue, followed by..."

- Significant contract wins or renewals: (Specific examples of large contract wins or renewals should be mentioned with financial values). For example: "The renewal of the crucial contract with [Agency Name] underscores the continued reliance on Palantir's solutions."

- Impact of geopolitical events: Geopolitical instability often increases demand for sophisticated data analytics tools, potentially benefiting Palantir's government revenue. (Discussion on how global events influenced growth should be included here.) For example: "The ongoing geopolitical tensions in [Region] have likely contributed to increased demand for Palantir's intelligence platforms."

Key Government Initiatives Driving Growth

Several key government initiatives are fueling Palantir's growth.

- Successful implementations: (Examples of successful implementations of Palantir's platforms within specific government agencies and their impact). For example: "Palantir's Gotham platform has proven instrumental in [Specific achievement within a government agency]."

- Long-term potential: The long-term prospects for government contracts appear positive, given the increasing reliance on data-driven decision-making within government agencies. (Analysis of long-term growth potential based on current trends and future government spending plans).

- Challenges and risks: (Potential challenges and risks, such as budget constraints, regulatory changes, or competition from other firms). For example: "Potential budget cuts could impact future contract awards, representing a risk factor for Palantir's government sector revenue."

Palantir's Q1 2024 Commercial Sector Performance

While the government sector is traditionally a major driver of revenue, Palantir's commercial growth is equally crucial for the long-term sustainability of Palantir stock.

Commercial Revenue Growth and Diversification

Palantir’s Q1 2024 commercial revenue growth (replace this with actual data from Q1 2024 earnings report. For example: "demonstrated a robust [percentage]% increase year-over-year, indicating diversification success.") This growth showcases Palantir's success in expanding beyond its traditional government client base.

- Commercial partnerships and successes: (Specific examples of successful commercial partnerships and their contributions to revenue growth). For example: "The partnership with [Company Name] in the [Industry] sector has yielded significant results."

- Strategy for expanding into new markets: (Discussion of Palantir's strategy for expanding into new commercial markets and its success rate). For example: "Palantir's focus on [Specific Industry] is paying off, as evidenced by the recent partnerships with..."

- Competition and competitive advantages: (Analysis of competition in the commercial sector and how Palantir is differentiating itself). For example: "Palantir's competitive advantage lies in its advanced AI capabilities and its ability to handle large, complex datasets."

Key Commercial Partnerships and Innovations

Innovation and strategic partnerships are driving Palantir's commercial success.

- Successful implementations: (Examples of successful implementations of Palantir's platforms in the commercial sector). For example: "Palantir's Foundry platform has been successfully deployed by [Company Name] to optimize its [Specific Business Process]."

- Long-term potential: (Analysis of the long-term growth potential of commercial partnerships and the overall commercial sector for Palantir). For example: "The expanding use of AI and big data across various industries presents a significant opportunity for Palantir's continued commercial growth."

- Challenges and risks: (Potential challenges and risks within the commercial sector such as economic slowdowns or increased competition). For example: "A potential economic downturn could negatively affect commercial spending on data analytics solutions."

Overall Financial Performance and Future Outlook for Palantir Stock

Analyzing Palantir's overall financial health provides a clearer picture of its potential.

Key Financial Metrics

(This section should include specific numerical data from the Q1 2024 earnings report. Replace the placeholders below with the actual figures.)

- Revenue: (Total revenue for Q1 2024 and a comparison to previous quarters). For example: "Total revenue for Q1 2024 reached $XXX million, representing a [percentage]% increase compared to Q1 2023."

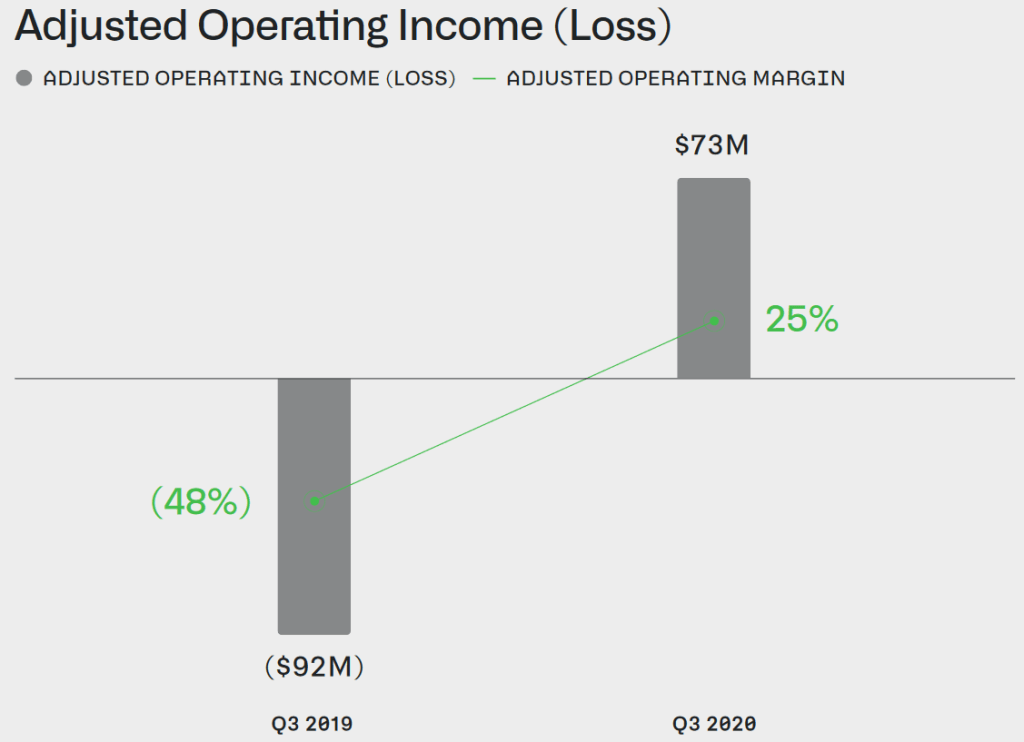

- Operating Income/Net Income/EPS: (Operating income, net income, and earnings per share (EPS) for Q1 2024 and a comparison to previous quarters).

- Profit margins: (Analysis of profit margins and their trajectory, indicating profitability trends).

- Cash flow: (Discussion of cash flow and its implications for future investments and growth).

- Company guidance: (Mention any guidance provided by the company for future quarters).

Investor Sentiment and Stock Valuation

Investor sentiment towards Palantir stock is complex.

- Analyst ratings and price targets: (Mention any analyst ratings and price targets for Palantir stock).

- Potential risks and opportunities: (Discussion of potential risks and opportunities for Palantir stock, considering both internal and external factors).

- Comparison to competitors: (Comparison of Palantir's performance to its competitors in the data analytics market).

Conclusion: Investing in Palantir Stock: A Q1 2024 Perspective

Palantir's Q1 2024 performance shows a mixed bag. While strong growth in both the government and commercial sectors is encouraging, investors must carefully weigh the potential risks and opportunities. The continued success in securing government contracts and expanding its commercial reach is vital for future growth of Palantir stock. Understanding the intricacies of Palantir's government and commercial growth is crucial for any investor considering Palantir stock. Conduct your own thorough due diligence before making any investment decisions. Remember to consult with a financial advisor before making any investment choices.

Featured Posts

-

Evaluating Palantir After A Significant 30 Price Correction

May 09, 2025

Evaluating Palantir After A Significant 30 Price Correction

May 09, 2025 -

Is This Black Rock Etf The Next Big Thing Billionaire Investments Suggest So

May 09, 2025

Is This Black Rock Etf The Next Big Thing Billionaire Investments Suggest So

May 09, 2025 -

Wynne And Joanna All At Sea Character Study And Plot Analysis

May 09, 2025

Wynne And Joanna All At Sea Character Study And Plot Analysis

May 09, 2025 -

Uk To Tighten Student Visas Pakistan And Potential Asylum Increases

May 09, 2025

Uk To Tighten Student Visas Pakistan And Potential Asylum Increases

May 09, 2025 -

Nottingham Attacks Inquiry Retired Judge Appointed

May 09, 2025

Nottingham Attacks Inquiry Retired Judge Appointed

May 09, 2025