Palantir Stock Investment: Weighing The Risks And Rewards Before May 5th

Table of Contents

Palantir's Recent Performance and Financial Health

Understanding Palantir's financial health is crucial for any Palantir stock investment strategy. Let's examine key performance indicators (KPIs) to assess its recent performance.

Revenue Growth and Profitability

Analyzing Palantir's recent quarterly and annual reports reveals important trends in revenue growth and profitability. Key figures to consider include:

- Revenue Growth: While specific numbers fluctuate, Palantir has demonstrated consistent year-over-year revenue growth, showcasing a strong trajectory. However, investors should analyze the rate of growth to determine if it's sustainable.

- Net Income: Palantir's net income has shown improvement in recent periods, signaling increasing profitability. Investors should examine the factors contributing to this increase, as well as the company's guidance for future net income.

- Operating Margins: Improving operating margins indicate better cost management and efficiency. Tracking the trend in operating margins is crucial for evaluating the company's long-term profitability.

These figures, when considered together, paint a picture of Palantir's financial health and provide valuable insights for potential investors weighing a Palantir stock investment. Consistent growth across these KPIs suggests a healthy and potentially profitable investment opportunity.

Government Contracts vs. Commercial Sales

Palantir's revenue stream is derived from both government and commercial contracts. Understanding the balance between these two sectors is vital for assessing risk and future growth potential:

- Government Contracts: This sector provides a stable revenue stream but can be subject to budgetary constraints and shifts in government priorities. This reliance on government contracts poses a potential risk to the long-term stability of Palantir's revenue.

- Commercial Sales: This sector offers higher growth potential but also greater competition. Analyzing the success of Palantir's commercial sales strategy is crucial for determining future growth prospects.

A balanced portfolio of government and commercial contracts ideally mitigates some of the inherent risks associated with each sector, providing a more robust foundation for a Palantir stock investment.

Future Projections and Growth Potential

Analyzing Palantir's future projections is essential for assessing the potential rewards of a Palantir stock investment.

Market Expansion and New Product Launches

Palantir is actively pursuing market expansion and launching new products to drive future growth.

- New Markets: Palantir is targeting various sectors, including healthcare, finance, and manufacturing, to diversify its client base and reduce reliance on any single sector.

- New Products: The company continues to innovate, launching new products and services leveraging its expertise in data analytics and AI. These new offerings should be carefully evaluated for their market potential and competitive advantage.

The success of these expansion strategies and product launches will be a major factor in determining the future trajectory of Palantir's stock price.

Artificial Intelligence (AI) and Data Analytics Focus

Palantir's core strength lies in its AI and data analytics capabilities.

- AI-driven Products: Palantir leverages AI to enhance its data analysis platform, offering sophisticated solutions to clients across various industries.

- Revenue Impact: The increasing importance of AI and data analytics across various sectors presents substantial opportunities for Palantir to expand its market share and drive revenue growth.

Palantir's continued focus on AI innovation is a key factor supporting its long-term growth potential and making it an attractive option for investors considering a Palantir stock investment.

Risks Associated with Palantir Stock Investment

Before making a Palantir stock investment, carefully consider the inherent risks.

Market Volatility and Economic Uncertainty

Palantir's stock price is subject to market volatility and broader economic factors.

- Macroeconomic Risks: Factors like inflation, recession, and geopolitical instability can significantly impact Palantir's performance and stock price.

- Market Sentiment: Investor sentiment towards the tech sector and Palantir specifically can influence stock price fluctuations independent of the company's performance.

Understanding and managing these macroeconomic risks is essential for any Palantir stock investment strategy.

Competition and Technological Disruption

The data analytics and AI market is highly competitive, with established players and emerging startups vying for market share.

- Key Competitors: Identifying and analyzing the strategies of key competitors is critical to understanding the competitive landscape.

- Technological Disruption: The rapid pace of technological change poses a risk of disruption, rendering existing technologies obsolete.

Successfully navigating this competitive landscape and adapting to technological changes are crucial for Palantir's long-term success and should inform any Palantir stock investment decision.

Conclusion

A Palantir stock investment presents both significant potential rewards and considerable risks. This analysis has highlighted Palantir's recent performance, including revenue growth and profitability, the balance of its government and commercial contracts, and its future projections focused on market expansion, new product launches, and AI innovation. We also examined the risks associated with market volatility, economic uncertainty, and competition.

Before making any investment decisions regarding Palantir stock, conduct thorough research and consider seeking professional financial advice. Remember, this article is for informational purposes only and does not constitute financial advice. Carefully weigh the risks and rewards of a Palantir stock investment before May 5th, or any other date, to ensure it aligns with your personal investment strategy and risk tolerance. Do your own due diligence on Palantir stock investment and make informed decisions based on your own risk profile.

Featured Posts

-

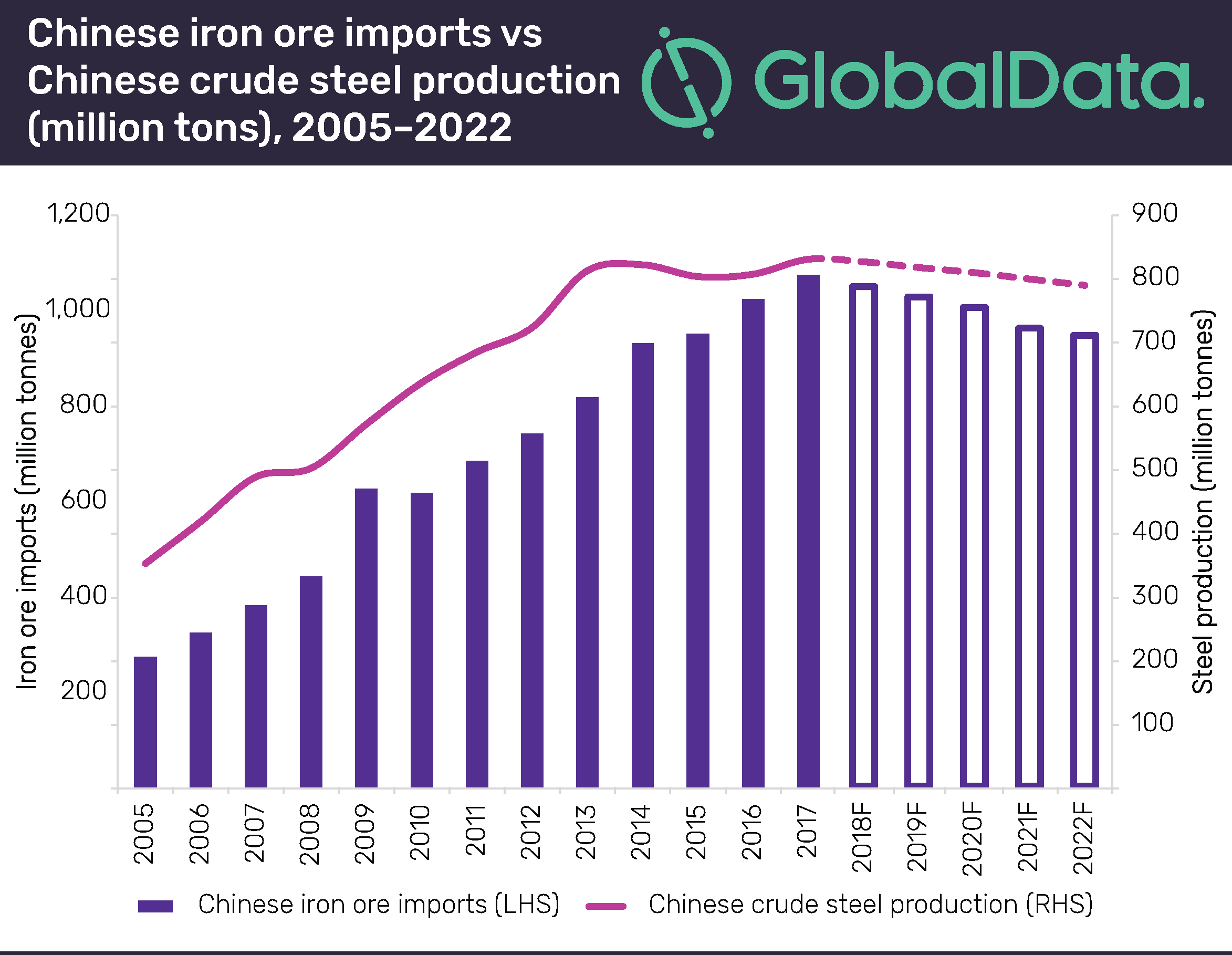

Falling Iron Ore Prices The Effect Of Chinas Steel Production Reduction

May 10, 2025

Falling Iron Ore Prices The Effect Of Chinas Steel Production Reduction

May 10, 2025 -

Mother Daughter Duo Dakota Johnson And Melanie Griffith Show Off Spring Style

May 10, 2025

Mother Daughter Duo Dakota Johnson And Melanie Griffith Show Off Spring Style

May 10, 2025 -

Resultat National 2 Dijon 0 1 Concarneau 28e Journee

May 10, 2025

Resultat National 2 Dijon 0 1 Concarneau 28e Journee

May 10, 2025 -

La Fires Selling Sunset Star Highlights Landlord Price Gouging Concerns

May 10, 2025

La Fires Selling Sunset Star Highlights Landlord Price Gouging Concerns

May 10, 2025 -

10 Gripping Film Noir Movies To Watch Right Now

May 10, 2025

10 Gripping Film Noir Movies To Watch Right Now

May 10, 2025