Palantir Stock Investment: Weighing The Risks And Rewards Of A 40% 2025 Target

Table of Contents

Palantir's Business Model and Growth Potential

Palantir's success hinges on its unique business model and its potential for substantial growth. The company operates primarily in two key sectors: government and commercial. Understanding these revenue streams is crucial to evaluating the potential of a Palantir stock investment.

Government Contracts and Revenue Streams

Palantir's history is deeply intertwined with lucrative government contracts. Palantir Gotham, its platform for government clients, has secured significant deals with various intelligence and defense agencies worldwide. However, Palantir is actively diversifying its revenue streams, expanding aggressively into the commercial market with Palantir Foundry. This dual approach presents both opportunities and challenges.

- Successful Government Contracts: Palantir boasts a long list of high-profile government contracts, providing a stable base of revenue. These contracts demonstrate the platform's effectiveness in handling complex data analytics for national security and intelligence purposes.

- Recent Commercial Partnerships: Palantir's push into the commercial sector has yielded partnerships with major players in various industries, signaling its ambition and potential for explosive growth in this less-regulated market. These partnerships demonstrate the adaptability of its technology across different sectors.

- Projected Revenue Growth: Analyst forecasts suggest considerable revenue growth for Palantir in the coming years, fueled by both government and commercial contracts. However, realizing these projections hinges on successful execution of its strategic plans.

Technological Innovation and Competitive Advantage

Palantir's technological prowess is a significant factor in its growth potential. Its data analytics platforms, particularly Palantir Gotham and Palantir Foundry, are designed to integrate and analyze massive datasets, providing crucial insights for decision-making.

- Key Technological Differentiators: Palantir's platforms leverage advanced technologies like artificial intelligence (AI) and machine learning (ML) to provide unparalleled data analysis capabilities. This positions them at the forefront of the big data market.

- Patents and Intellectual Property: Palantir's strong intellectual property portfolio protects its technological innovations, providing a competitive moat in the rapidly evolving data analytics landscape.

- Competitive Landscape Analysis: While competition in the data analytics market is fierce, Palantir's unique platform and strong client relationships offer a considerable competitive advantage.

Assessing the Risks of Palantir Stock Investment

While the potential for Palantir stock appreciation is enticing, several risks warrant careful consideration before making any investment decisions. The inherent volatility of the stock market and Palantir's dependence on government contracts present significant challenges.

Market Volatility and Economic Uncertainty

Investing in the stock market, especially in a company like Palantir, exposes investors to significant risks. External factors such as economic downturns, inflation, and geopolitical instability can heavily impact stock prices.

- Impact of Interest Rate Hikes: Rising interest rates can dampen economic growth, impacting investor confidence and potentially reducing demand for Palantir's services.

- Inflationary Pressures: High inflation can erode purchasing power and impact the profitability of businesses, including Palantir.

- Geopolitical Risk: Global events can trigger market volatility, creating uncertainty and impacting stock prices.

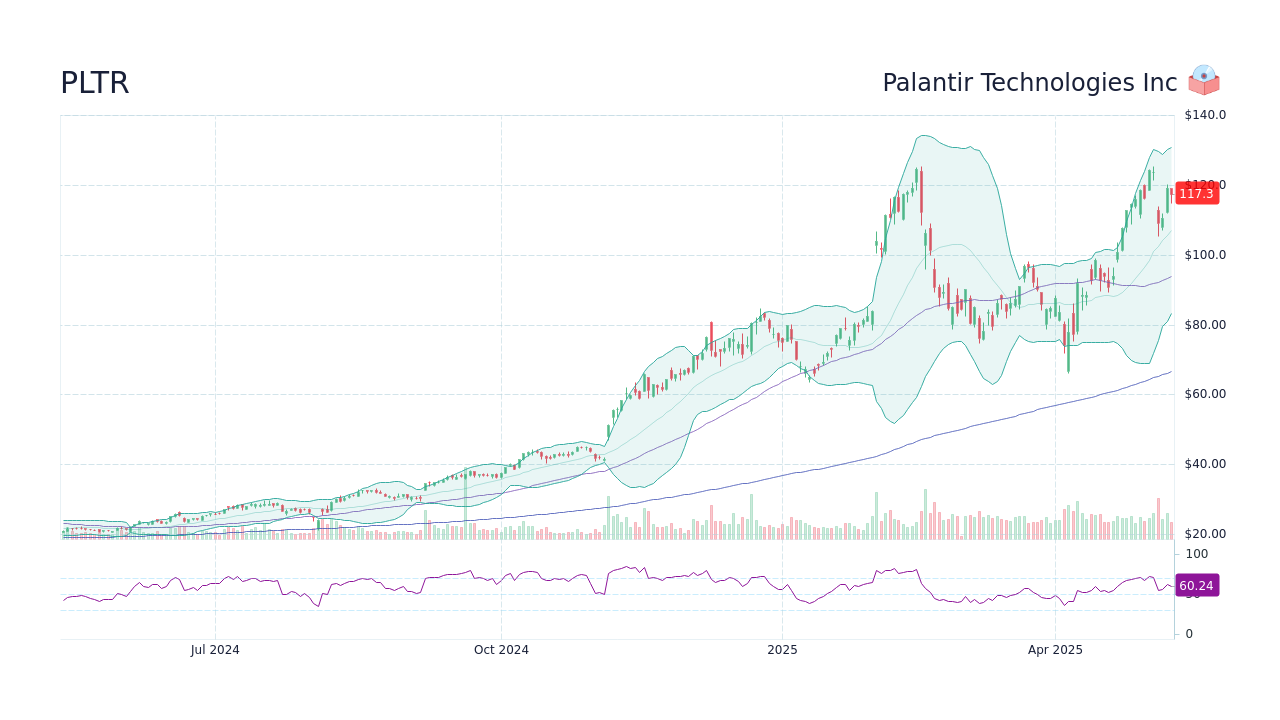

- Historical Volatility: Palantir's stock has historically shown significant volatility, reflecting the inherent risks associated with this growth-stage company.

Dependence on Government Contracts

Palantir's significant reliance on government contracts exposes it to the risks associated with government spending cycles and potential changes in procurement policies.

- Potential Changes in Government Spending: Shifts in government priorities or budget cuts could negatively impact Palantir's revenue streams.

- Competition for Government Contracts: Palantir faces competition from other technology companies vying for government contracts.

- Risks Associated with Contract Renegotiation: The renegotiation of existing contracts carries the risk of reduced revenue or even contract cancellation.

Valuation and Price Targets

Evaluating Palantir's current valuation is critical for assessing the plausibility of the 40% 2025 target. Analyzing key metrics such as the price-to-earnings ratio (P/E) and price-to-sales ratio (P/S) provides valuable insights.

- Price-to-Earnings Ratio (P/E): Comparing Palantir's P/E ratio to its competitors and industry benchmarks helps determine whether it is overvalued or undervalued.

- Price-to-Sales Ratio (P/S): The P/S ratio offers another perspective on Palantir's valuation, particularly valuable for companies that are not yet profitable.

- Analyst Ratings and Price Targets: Examining analyst ratings and price targets can provide a sense of market sentiment and expectations for future price movements.

- Potential Catalysts for Stock Price Appreciation: Factors such as securing large new contracts, significant technological breakthroughs, or successful expansion into new markets can act as catalysts for stock price appreciation.

Conclusion: Making Informed Decisions About Palantir Stock Investment

Investing in Palantir stock presents a compelling opportunity for growth, driven by its innovative technology and expanding market reach. However, significant risks exist, including market volatility and reliance on government contracts. The projected 40% target by 2025 is ambitious and its realization hinges on favorable market conditions and successful execution of Palantir's strategic initiatives.

Remember to conduct thorough due diligence before making any investment decisions. Assess your risk tolerance, diversify your portfolio, and consider your investment goals carefully. Consult with a financial advisor to gain personalized guidance tailored to your financial situation. Ultimately, the decision to invest in Palantir stock, aiming for that 40% 2025 target, rests on your own thorough assessment of the risks and rewards. Remember to perform your own research and consider consulting a financial professional before making any investment decisions.

Featured Posts

-

Kucherovs Performance Propels Lightning To 4 1 Win Over Oilers

May 09, 2025

Kucherovs Performance Propels Lightning To 4 1 Win Over Oilers

May 09, 2025 -

R3

May 09, 2025

R3

May 09, 2025 -

Investing In Palantir Technologies A Practical Guide For 2024

May 09, 2025

Investing In Palantir Technologies A Practical Guide For 2024

May 09, 2025 -

Jeanine Pirros Comments On Due Process For Americans In El Salvadorian Prisons A Controversial Statement

May 09, 2025

Jeanine Pirros Comments On Due Process For Americans In El Salvadorian Prisons A Controversial Statement

May 09, 2025 -

Operation Sindoor Pakistan Stock Market Plunges Over 6 Trading Halted

May 09, 2025

Operation Sindoor Pakistan Stock Market Plunges Over 6 Trading Halted

May 09, 2025