Palantir Stock: Is It A Smart Investment For Your Portfolio?

Table of Contents

Understanding Palantir's Business Model and Revenue Streams

Palantir operates primarily through two platforms: Gotham and Foundry. Gotham caters to government agencies, primarily focusing on defense and intelligence applications, while Foundry serves commercial clients across various sectors. This dual-pronged approach diversifies Palantir's revenue streams and mitigates risk associated with over-reliance on a single client base.

Palantir's revenue model centers around software licenses, services, and ongoing support. This recurring revenue stream provides predictability and stability, a significant advantage in the often volatile software market.

Key Clients and Industry Sectors:

- Government: Defense departments, intelligence agencies, law enforcement agencies.

- Financial Services: Banks, investment firms, insurance companies.

- Healthcare: Pharmaceutical companies, healthcare providers, research institutions.

- Energy: Oil and gas companies, renewable energy providers.

The success of Palantir Gotham within government contracts significantly impacts the overall Palantir investment outlook, showing the importance of securing these partnerships. Palantir Foundry’s success within the commercial market is equally crucial, providing growth opportunities beyond government contracts. This diversification minimizes the risk associated solely with government-dependent revenue streams in the broader Palantir stock analysis.

Analyzing Palantir's Financial Performance and Growth Prospects

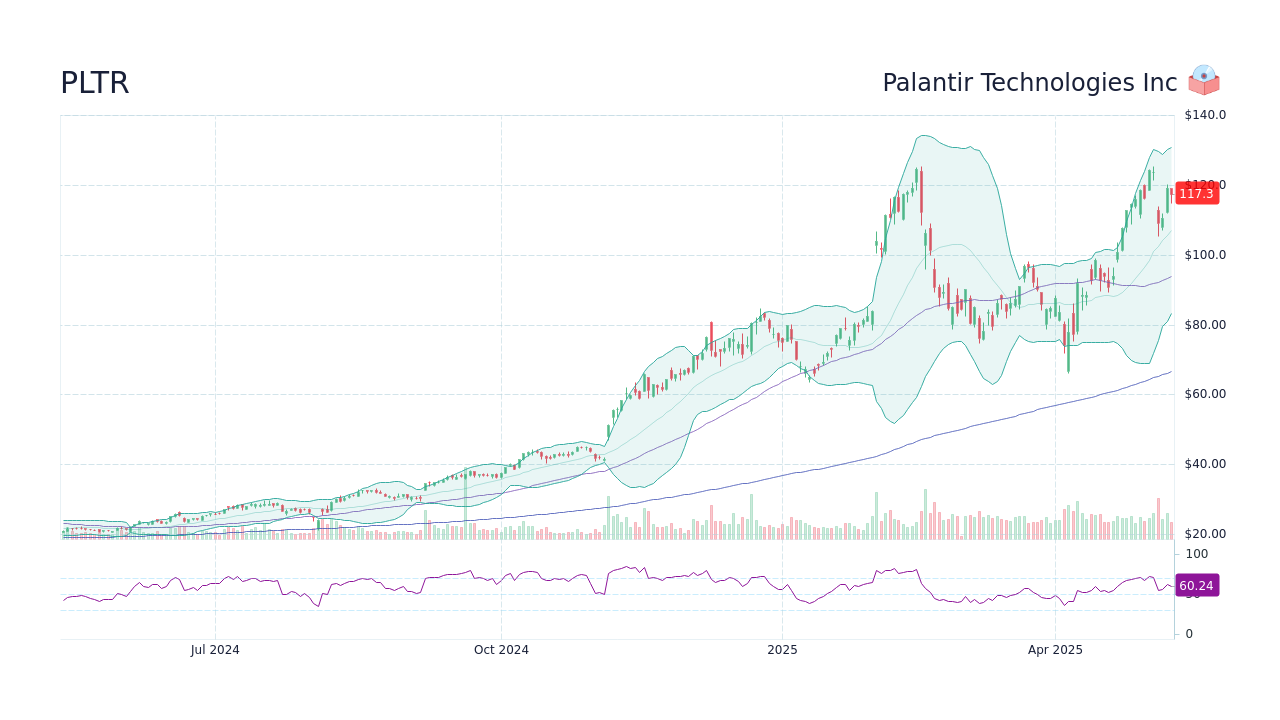

Palantir's financial performance has shown a mixed bag in recent years. While revenue has consistently grown, profit margins have fluctuated. Analyzing Palantir financials requires careful consideration of these factors:

-

Revenue Growth: Palantir has demonstrated strong revenue growth over the past few years, fueled by increased adoption of its platforms across both government and commercial sectors. [Insert chart or graph showing revenue growth].

-

Earnings Per Share (EPS): Palantir's EPS has shown volatility, reflecting the company's investment in growth and expansion. [Insert chart or graph showing EPS].

-

Profit Margins: Palantir's profit margins have improved, although they remain subject to fluctuations depending on the mix of government and commercial contracts.

-

Debt Levels: Palantir's debt levels are relatively manageable, indicating a sound financial position for its growth strategy.

The future growth prospects of Palantir depend heavily on continued expansion into the commercial market and successful execution of its product roadmap. These factors significantly influence any Palantir investment strategy. Analyzing Palantir financials carefully and monitoring these key performance indicators (KPIs) is crucial for any potential investor.

Evaluating the Risks and Challenges Faced by Palantir

Investing in Palantir stock involves inherent risks. A comprehensive Palantir risk assessment should consider these key factors:

-

Market Competition: The big data analytics market is highly competitive, with established players and emerging startups vying for market share. This presents a significant challenge to Palantir's growth ambitions.

-

Dependence on Government Contracts: A considerable portion of Palantir's revenue comes from government contracts. Changes in government priorities or budget cuts could negatively impact its financial performance.

-

High Valuation: Palantir's stock valuation has been high relative to its earnings, making it susceptible to market corrections.

-

Regulatory Risk: The nature of Palantir's work with government agencies and sensitive data exposes it to potential regulatory scrutiny and changes. Understanding these regulatory risks is crucial for any Palantir stock investment.

-

Stock Volatility: Palantir stock is known for its volatility, influenced by various factors including earnings reports, market sentiment, and news related to its contracts.

Comparing Palantir Stock to Competitors in the Big Data Market

Palantir faces stiff competition from other big data analytics companies such as Snowflake and Databricks. While Palantir boasts unique strengths in its highly specialized platforms and focus on mission-critical applications, competitors offer broader platforms and potentially wider market appeal.

-

Competitive Advantages: Palantir's strength lies in its deep expertise in data integration and its strong relationships with government agencies.

-

Competitive Disadvantages: Palantir's high prices and specialized approach may limit its market penetration compared to more widely accessible solutions offered by its competitors.

Determining a Fair Valuation for Palantir Stock

Determining a fair valuation for Palantir stock requires a multifaceted approach. Methods such as Discounted Cash Flow (DCF) analysis and Price-to-Sales (P/S) ratio can provide insights into Palantir's intrinsic value. However, the inherent uncertainties associated with its future growth and the competitive landscape make precise valuation challenging. Comparing Palantir valuation to its competitors is a useful tool in this assessment.

-

DCF Analysis: Projects future cash flows and discounts them to their present value to estimate the company's intrinsic value.

-

P/S Ratio: Compares the company's market capitalization to its revenue, providing a relative valuation metric.

Comparing the results of these analyses to the current market price helps determine whether the stock is overvalued, undervalued, or fairly priced.

Conclusion: Is Palantir Stock Right for Your Portfolio?

Palantir presents a compelling investment proposition with considerable potential for growth, particularly in the expanding big data analytics market. However, its high valuation, dependence on government contracts, and competitive landscape introduce significant risks. While its innovative technology and strong government relationships are undeniable assets, investors should carefully weigh these risks against the potential rewards before making any investment decisions.

Therefore, while Palantir stock offers intriguing potential, it's crucial to remember that this is a high-growth, high-risk investment. Before adding Palantir stock to your portfolio, conduct thorough due diligence, consider your risk tolerance, and consult with a qualified financial advisor. This comprehensive Palantir stock analysis should assist you in making an informed decision about a potential Palantir stock investment. Remember to diversify your portfolio to mitigate risk and conduct further research into Palantir stock analysis before making any investment decisions.

Featured Posts

-

India En Brekelmans Een Analyse Van De Huidige Samenwerking

May 09, 2025

India En Brekelmans Een Analyse Van De Huidige Samenwerking

May 09, 2025 -

Dakota Johnsons Role Choices The Chris Martin Factor

May 09, 2025

Dakota Johnsons Role Choices The Chris Martin Factor

May 09, 2025 -

New Report Reveals Potential Uk Visa Restrictions By Nationality

May 09, 2025

New Report Reveals Potential Uk Visa Restrictions By Nationality

May 09, 2025 -

Harry Styles Addresses The Controversial Snl Impression

May 09, 2025

Harry Styles Addresses The Controversial Snl Impression

May 09, 2025 -

Investing In Palantir Technologies A Practical Guide For 2024

May 09, 2025

Investing In Palantir Technologies A Practical Guide For 2024

May 09, 2025