Palantir Stock: Wall Street's Prediction Before May 5th - Should You Invest?

Table of Contents

Palantir Technologies (PLTR) has been a volatile stock, captivating investors with its powerful big data analytics platform but also leaving many uncertain about its investment potential. With May 5th approaching, analysts are issuing predictions, creating a buzz around the Palantir stock price. This article delves into Wall Street's sentiment and helps you decide if Palantir stock is a suitable addition to your portfolio.

Analyzing Wall Street's Predictions for Palantir Before May 5th

The sentiment surrounding Palantir stock before May 5th is mixed, with both bullish and bearish predictions emerging from Wall Street analysts. Understanding both perspectives is crucial before making any investment decisions.

The Bull Case for Palantir

The bullish case for Palantir rests on several key pillars. Analysts point to the company's significant growth potential, particularly in the government and commercial sectors. Recent contract wins and strategic partnerships fuel this optimism. Several analyst upgrades and increased price targets further bolster the bullish sentiment.

- Increased adoption of Palantir's Foundry platform: Foundry's integrated data analytics capabilities are attracting increasing interest from large enterprises seeking to improve operational efficiency and gain a competitive edge.

- Expansion into new markets and verticals: Palantir is actively diversifying its client base, moving beyond its traditional government focus and expanding its presence in the healthcare, finance, and other commercial sectors. This diversification reduces reliance on any single sector.

- Potential for significant revenue growth in the coming years: The combination of platform adoption and market expansion positions Palantir for substantial revenue growth over the next few years, driving potential stock price appreciation.

- Strong government contracts driving sustained revenue: Palantir maintains a strong foothold in the government sector, securing large contracts that provide a reliable revenue stream, reducing overall risk.

The Bear Case Against Palantir

Despite the positive aspects, the bear case highlights several concerns. Profitability and the high valuation of Palantir stock remain key issues for some analysts. Competition within the big data analytics market also presents a challenge.

- High operating expenses and potential for losses: Palantir's significant investments in research and development and sales & marketing contribute to high operating expenses, potentially impacting profitability in the short term.

- Competition from established players in the big data market: Companies like AWS, Microsoft, and Google pose stiff competition, offering established and integrated big data solutions.

- Dependence on government contracts for a substantial portion of revenue: While government contracts provide stability, over-reliance on this sector exposes Palantir to potential risks associated with government budget changes or regulatory shifts.

- Potential for stock price volatility: Palantir's stock price has historically been volatile, reflecting the inherent risks associated with high-growth technology companies.

Key Financial Indicators to Consider Before Investing in Palantir Stock

Before investing in Palantir stock, a thorough analysis of its key financial indicators is essential. This includes examining revenue growth, profitability, debt levels, and valuation metrics.

Revenue Growth and Profitability

Recent financial reports reveal Palantir's revenue growth trajectory. Analyzing profitability trends, including operating margins, provides insight into the company's financial health and its ability to translate revenue into profits. Comparing these figures to previous quarters and industry averages paints a clearer picture.

Debt and Cash Flow

Evaluating Palantir's debt levels, cash flow generation, and ability to fund future growth is crucial. A strong cash flow position allows the company to invest in innovation and expansion, supporting future growth and reducing financial risks.

Valuation Metrics

Understanding Palantir's valuation relative to its peers is vital. Examining metrics such as the Price-to-Sales ratio (P/S) and, if applicable, the Price-to-Earnings ratio (P/E), provides a comparative perspective on its valuation and helps assess whether the stock price reflects its fundamental value. Comparing these metrics against industry averages helps in making a sound investment decision.

- Include specific data points from recent financial reports: Integrate relevant financial data from Palantir's latest earnings reports and SEC filings.

- Provide charts or graphs visualizing key financial indicators: Visual representations of key data make complex financial information easily understandable.

- Compare Palantir's performance to competitors: Benchmarking against competitors like Salesforce, Snowflake, or Databricks allows for a more informed comparison.

- Offer interpretation of the financial data and its implications for investors: Clearly articulate the meaning of the financial data and its implications for potential investors.

Assessing the Risk Tolerance for Palantir Investment

Investing in a high-growth technology stock like Palantir inherently involves risk. Your risk tolerance plays a crucial role in your investment decision.

- High growth potential comes with higher risk: While the potential returns are substantial, the risk of significant losses is equally present.

- Consider diversification within your portfolio: Investing in Palantir shouldn't constitute your entire portfolio. Diversification reduces overall risk.

- Develop a long-term investment strategy: Palantir's long-term prospects are generally more promising than its short-term performance. A long-term view is recommended.

- Do your own due diligence before investing: This article provides information, but independent research is crucial before any investment decision. Consult reputable financial news sources and analyst reports.

Conclusion

This analysis of Wall Street's predictions and Palantir's financial performance offers a comprehensive overview to guide your investment decision before May 5th. While Palantir exhibits considerable promise, carefully consider both bullish and bearish perspectives, and importantly, your risk tolerance. The potential for high growth comes with significant volatility.

Call to Action: Before making any investment decisions regarding Palantir stock, conduct thorough research and consider consulting a financial advisor. This article serves informational purposes only and does not constitute financial advice. Are you ready to assess your investment strategy regarding Palantir stock?

Featured Posts

-

Cryptocurrencys Future Despite Geopolitical Uncertainty

May 09, 2025

Cryptocurrencys Future Despite Geopolitical Uncertainty

May 09, 2025 -

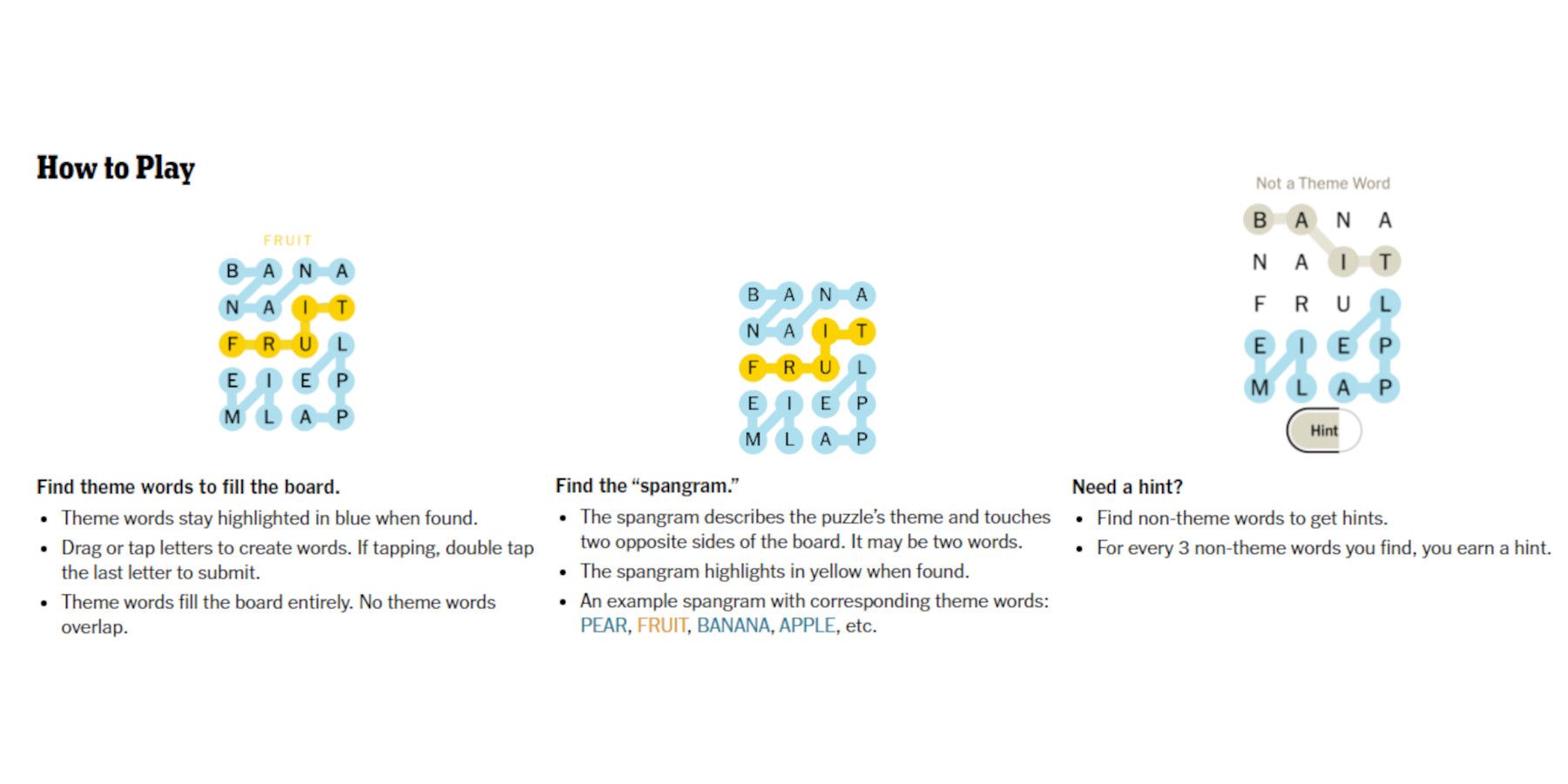

Nyt Strands Hints And Answers Wednesday April 9 Game 402

May 09, 2025

Nyt Strands Hints And Answers Wednesday April 9 Game 402

May 09, 2025 -

India En Brekelmans De Toekomst Van Een Partnerschap

May 09, 2025

India En Brekelmans De Toekomst Van Een Partnerschap

May 09, 2025 -

Comparing Styles An Examination Of Benson Boone And Harry Styles Music

May 09, 2025

Comparing Styles An Examination Of Benson Boone And Harry Styles Music

May 09, 2025 -

Edmonton Oilers Draisaitl Sidelined Game Against Jets In Doubt

May 09, 2025

Edmonton Oilers Draisaitl Sidelined Game Against Jets In Doubt

May 09, 2025