Palantir's 30% Decline: Should You Invest Now?

Table of Contents

Understanding Palantir's Recent Performance

Palantir's stock price (PLTR stock) has indeed seen a substantial fall. This decline, which occurred over [insert timeframe, e.g., the last quarter], needs to be understood within the context of the broader market volatility affecting technology stocks. Analyzing Palantir's recent financial reports is crucial. We need to examine key metrics such as:

- Revenue Growth: Has Palantir's revenue growth slowed significantly, signaling potential concerns? Analyzing the year-over-year and quarter-over-quarter growth rates provides valuable insights.

- Profitability: Is Palantir moving towards profitability, or are losses widening? Examining metrics like net income, operating margin, and free cash flow is essential.

- Key Metrics: Beyond the basics, examining key performance indicators (KPIs) specific to Palantir's business model (like customer acquisition costs or contract renewals) is crucial for a comprehensive understanding.

- Specific Events: Did any specific events contribute to the drop? Recent earnings reports, regulatory changes affecting the government contracting market (a significant part of Palantir's revenue), or increased competition could all have played a role. Understanding these events is vital in assessing the short and long-term implications for Palantir's stock price.

Factors Contributing to the Decline

Several factors likely contributed to Palantir's stock price decline. These include:

- Growth Slowdown: Concerns about slowing revenue growth are a major factor. Investors often react negatively to any perceived slowing of growth in high-growth technology companies.

- Valuation Concerns: Palantir's high valuation compared to its competitors and its current performance has raised concerns among some investors. A high price-to-earnings ratio (P/E ratio) or price-to-sales ratio (P/S ratio) might have contributed to the sell-off.

- Competition: The competitive landscape in the big data and analytics market is fierce. The emergence of new competitors or increased market share by existing rivals could be squeezing Palantir's growth potential.

- Market Sentiment: Overall negative sentiment towards the tech sector and the broader market can impact even fundamentally strong companies like Palantir.

- Investor Confidence: Declining investor confidence can lead to a stock price drop, creating a negative feedback loop. If investors perceive increased risk, they may sell their shares, further driving down the price. Understanding the reasons behind this erosion of confidence is vital.

- Business Model Concerns: Some investors may harbor doubts about the long-term sustainability or scalability of Palantir's business model. This often reflects a broader uncertainty regarding the future of the company’s revenue streams.

Assessing the Investment Potential

Investing in Palantir at this point requires a careful risk assessment. Let's weigh the potential rewards against the risks:

- Risks: Investing in Palantir, especially after a significant drop, involves substantial risk. Further price declines are always possible, and the company's high valuation remains a point of concern.

- Long-Term Growth: Despite the recent decline, Palantir's long-term growth prospects in both the government and commercial sectors remain relatively strong, particularly in the fields of data analytics and AI.

- Future Revenue Growth: Analyzing projections for future revenue growth and the company's plans for expansion is essential.

- Intrinsic Value: Comparing the current stock price to Palantir's intrinsic value (based on discounted cash flow analysis or other valuation methods) can help determine if the stock is undervalued.

- Investment Strategies: Different investment strategies can mitigate risks. Dollar-cost averaging (DCA), for instance, involves investing a fixed amount regularly, regardless of the stock price, to reduce the impact of volatility. A buy-and-hold strategy could be suitable for long-term investors with higher risk tolerance.

Alternative Investment Options

Diversification is key to managing risk. Instead of focusing solely on Palantir, consider other investment options within the tech sector or other sectors less correlated with Palantir's performance. This strategy can reduce overall portfolio volatility.

Conclusion

Palantir's 30% decline presents a complex investment scenario. While the significant drop might seem attractive to some, it's crucial to remember the inherent risks involved. Factors like slowing revenue growth, valuation concerns, and competition all contribute to the uncertainty surrounding Palantir's future stock performance. While the long-term potential within the government and commercial sectors remains, a thorough analysis of the company's financials and market position is crucial before making any investment decisions about Palantir stock. Weigh your risk tolerance, analyze the potential returns, and consider diversifying your portfolio before investing in Palantir or any other individual stock. Conduct thorough due diligence on Palantir's financial performance and future prospects to make an informed investment decision.

Featured Posts

-

Trump Appoints Jeanine Pirro As Dc Top Prosecutor Fox News Role And Implications

May 09, 2025

Trump Appoints Jeanine Pirro As Dc Top Prosecutor Fox News Role And Implications

May 09, 2025 -

Fox News Hosts Sharp Rebuttal To Colleagues Trump Tariff Stance

May 09, 2025

Fox News Hosts Sharp Rebuttal To Colleagues Trump Tariff Stance

May 09, 2025 -

Indian Stock Market Sensex Nifty And Key Stock Updates Date

May 09, 2025

Indian Stock Market Sensex Nifty And Key Stock Updates Date

May 09, 2025 -

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 09, 2025

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 09, 2025 -

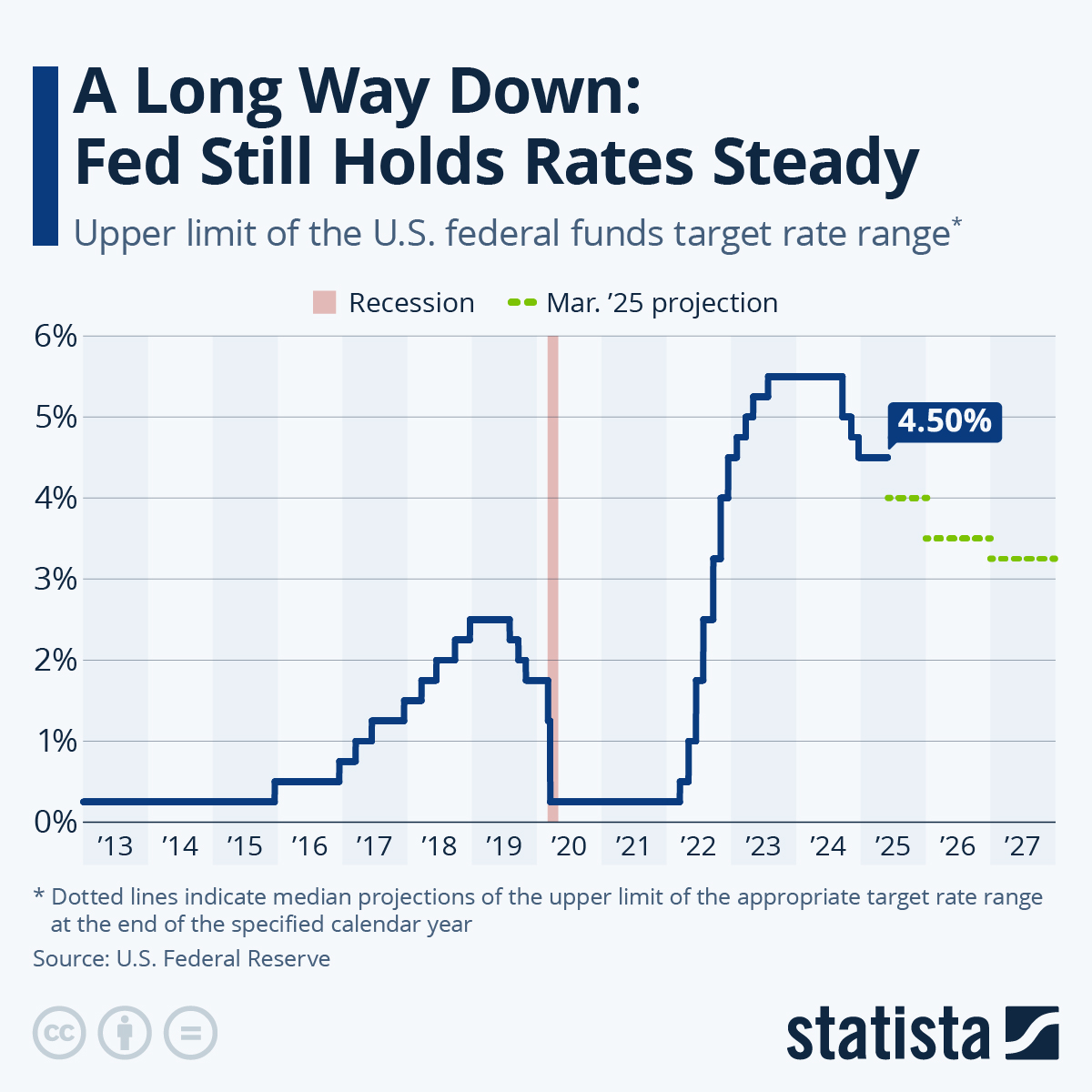

U S Federal Reserve Holds Steady Inflation And Economic Pressures

May 09, 2025

U S Federal Reserve Holds Steady Inflation And Economic Pressures

May 09, 2025