Palantir's Potential: Can It Achieve A Trillion-Dollar Market Cap By The End Of The Decade?

Table of Contents

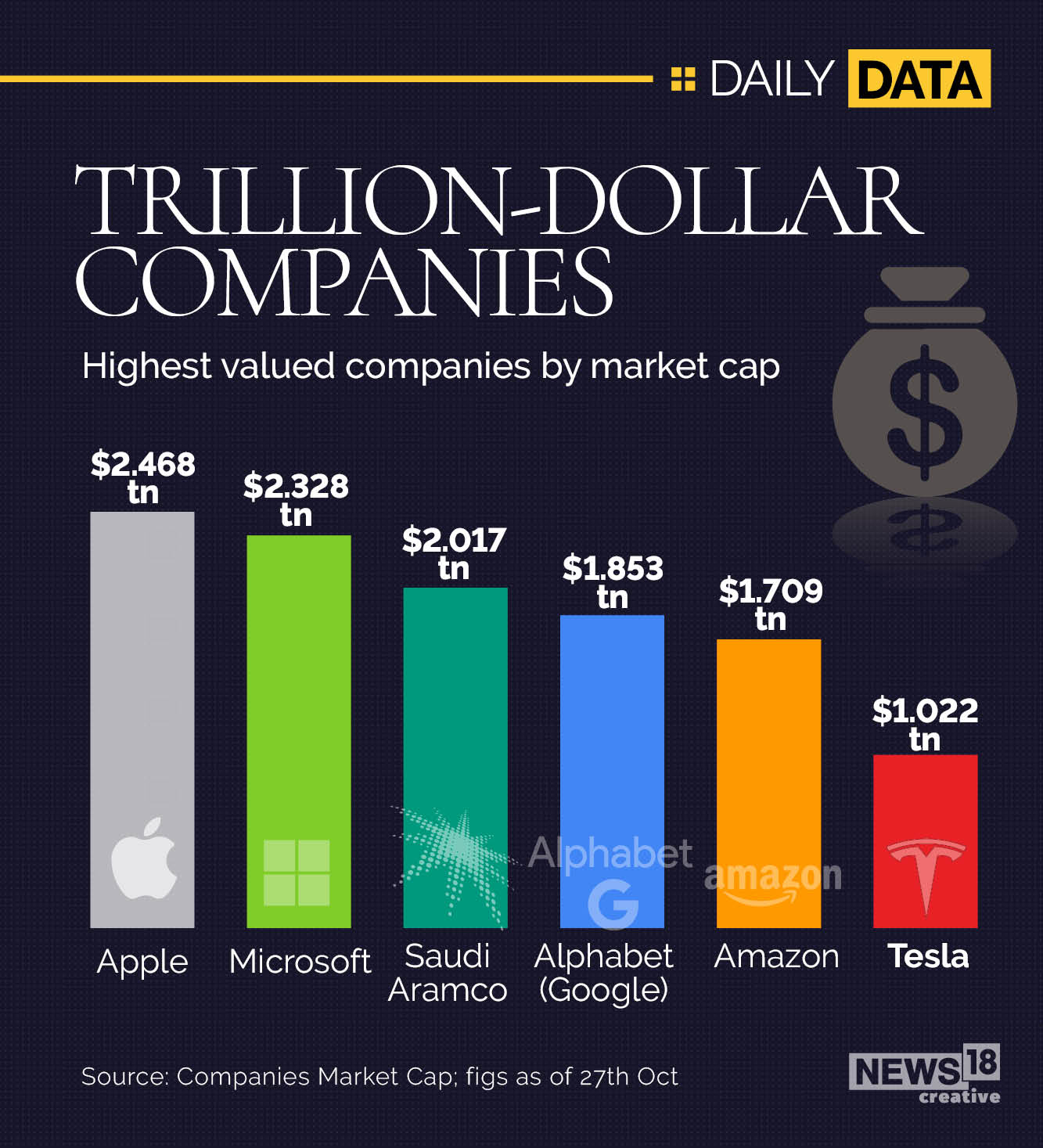

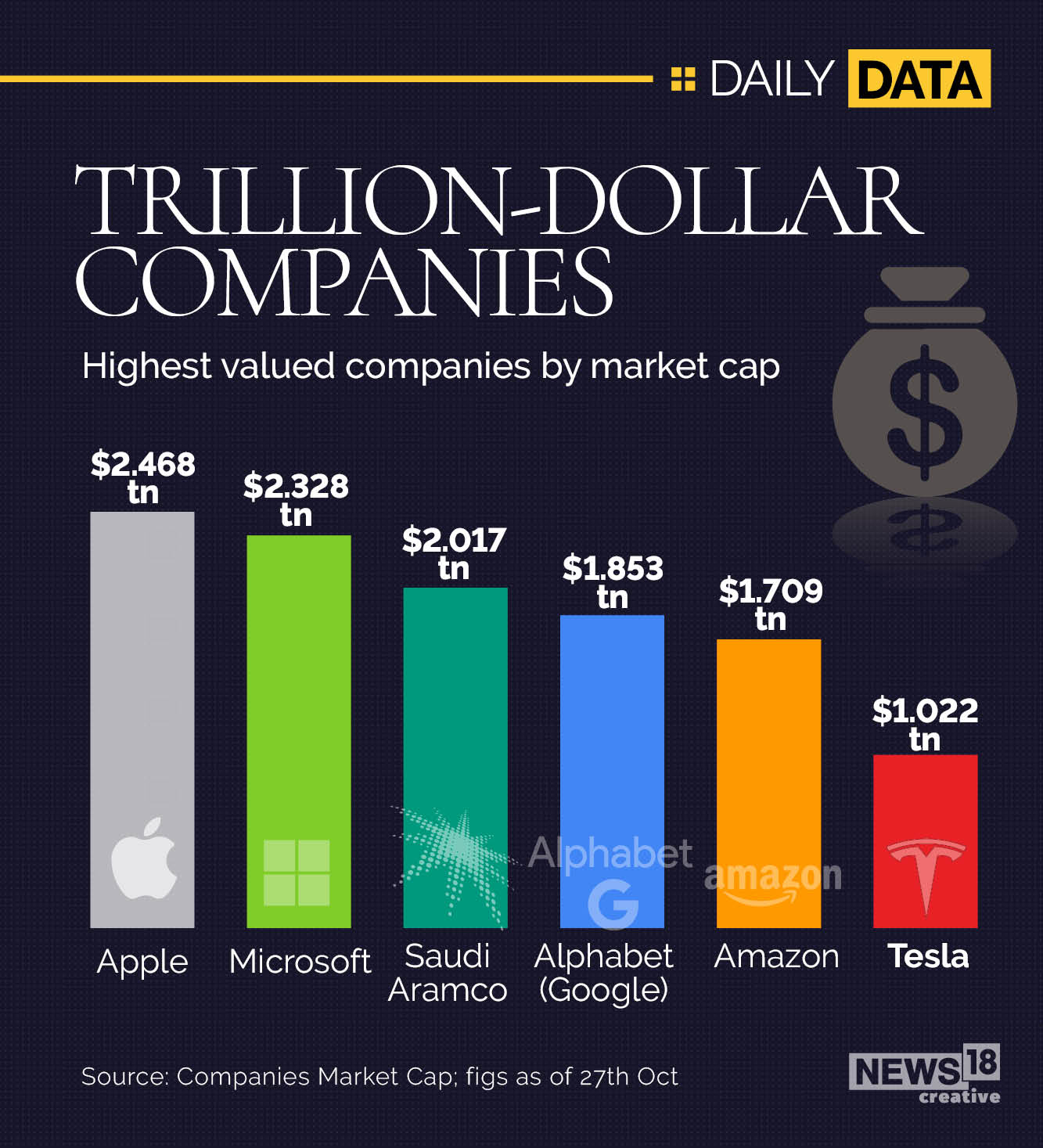

Palantir Technologies, the enigmatic data analytics firm, has experienced meteoric growth, leaving many wondering: can it realistically achieve a trillion-dollar market cap by the end of the decade? This ambitious goal necessitates a thorough examination of the company's strengths, weaknesses, and the overall market landscape. Palantir's trillion-dollar market cap potential is a question that demands careful consideration of its innovative technology, robust government contracts, and expanding commercial partnerships. Currently boasting a significant market capitalization, Palantir's trajectory is a subject of intense speculation among investors and analysts alike. This article will delve into the key factors that could contribute to – or hinder – Palantir's pursuit of this monumental milestone.

H2: Palantir's Strengths and Growth Drivers:

H3: Government Contracts and Expanding Partnerships:

Palantir's success is significantly anchored in its substantial portfolio of government contracts. These partnerships, both within the US and internationally, provide a stable revenue stream and access to critical data sets for refining its data analytics platforms. Expanding beyond its government stronghold, Palantir is actively forging partnerships within the commercial sector. This diversification strategy is vital for mitigating reliance on government spending fluctuations.

- Significant Government Contracts: Palantir has secured multi-year, multi-million-dollar contracts with key agencies like the US Department of Defense and various intelligence communities. These contracts demonstrate Palantir's proven ability to deliver high-value data analytics solutions for complex operational needs. The ongoing and future expansion of these contracts is central to Palantir’s growth.

- New Commercial Partnerships: Palantir has strategically partnered with major players in various industries, leveraging its data analytics platform to improve operational efficiency and decision-making. Specific examples include partnerships focused on enhancing supply chain optimization and fraud detection within the financial sector. These initiatives demonstrate a broadening of Palantir’s commercial footprint.

- Strategic Alliances: Collaboration with other technology firms, particularly in the AI and machine learning space, has further expanded Palantir's capabilities and market reach, solidifying its position in the rapidly growing data analytics market. These alliances provide both technological enhancements and broader distribution channels for its products and services.

H3: Technological Innovation and Product Development:

Palantir's continued investment in research and development is a crucial factor in its growth potential. The company's flagship product, Palantir Foundry, a comprehensive data integration and analytics platform, is constantly evolving. Advancements in AI and machine learning capabilities embedded within Foundry are providing clients with more powerful and insightful data analysis tools.

- Recent Product Updates: Regular updates to Palantir Foundry incorporate new features, enhanced usability, and improved performance, keeping the platform at the forefront of data analytics innovation. These updates help maintain a competitive advantage.

- Advancements in AI and Machine Learning: Palantir’s integration of cutting-edge AI and machine learning techniques into its platform provides a competitive advantage, allowing clients to extract more meaningful insights from their data. This enhances the value proposition for clients and increases revenue potential.

- Competitive Advantages: Palantir's focus on data security and its unique approach to data integration provide significant competitive advantages in a market increasingly concerned with data privacy and regulatory compliance.

H3: Strong Financial Performance and Future Projections:

Palantir’s consistent revenue growth and improving profitability indicate a healthy financial foundation for future expansion. While profitability has been a focus, analyzing revenue growth projections and the overall trajectory of its financial performance is key to understanding Palantir's potential.

- Key Financial Metrics: Analyzing metrics like revenue growth, operating margins, and customer acquisition costs provides crucial insights into Palantir’s financial health and its ability to sustain its growth trajectory.

- Analyst Predictions: Several financial analysts have offered optimistic projections for Palantir's future revenue, suggesting strong growth potential in the coming years. These predictions, however, should be considered with caution and a degree of healthy skepticism.

- Revenue Growth Projections: Positive projections, coupled with successful implementation of its strategic growth initiatives, suggest a significant pathway towards a higher market capitalization. These projections, however, are based on several assumptions about market demand and competitive landscape.

H2: Challenges and Risks Facing Palantir:

H3: Intense Competition in the Data Analytics Market:

Palantir operates within a highly competitive landscape, facing established players like Databricks, Snowflake, and Amazon Web Services (AWS). Maintaining market share requires continuous innovation and a strong focus on delivering superior value to clients.

- Competitive Landscape Analysis: A comprehensive understanding of the competitive landscape is crucial to assess the challenges ahead. This includes the capabilities and strategies of key competitors.

- Comparison of Palantir’s Offerings: Direct comparison of Palantir’s product features and capabilities with its competitors helps to pinpoint its relative strengths and weaknesses.

- Potential Threats: Emerging technologies and new entrants into the data analytics space present constant threats that require ongoing vigilance and adaptation.

H3: Dependence on Government Contracts and Geopolitical Risks:

Palantir's reliance on government contracts exposes it to geopolitical risks. Changes in government policy, budget cuts, or international conflicts can significantly impact its revenue stream.

- Potential Disruptions to Contracts: Unexpected disruptions to existing contracts, whether due to political changes or budget constraints, can significantly affect Palantir’s revenue.

- Impact of Political Changes: Shifts in political priorities and government spending can directly influence the demand for Palantir’s services. Diversification beyond government contracts is vital to mitigate this risk.

- Market Diversification Strategy: Palantir's push into the commercial sector is a critical step in reducing its dependence on government contracts and improving overall resilience.

H3: Valuation and Market Sentiment:

Palantir's current valuation and the overall market sentiment towards the company significantly influence its potential to achieve a trillion-dollar market cap. Market volatility and macroeconomic factors can have a substantial impact on its stock price.

- Price-to-Sales Ratio: Analyzing Palantir's price-to-sales ratio in relation to its competitors provides context for its current valuation.

- Investor Sentiment: Positive investor sentiment is essential for maintaining a high stock price, while negative sentiment can lead to market corrections.

- Impact of Macroeconomic Factors: Broader economic conditions, such as interest rate changes and inflation, can influence investor behavior and impact Palantir's valuation.

3. Conclusion:

Palantir's journey towards a trillion-dollar market cap is fraught with both significant opportunities and considerable challenges. While its strong technology, government contracts, and expanding commercial partnerships represent substantial strengths, intense competition, dependence on government contracts, and market volatility present significant hurdles. Whether Palantir can overcome these challenges and achieve this ambitious goal by 2033 remains uncertain. A reasoned assessment suggests that while the potential exists, it’s far from guaranteed. The company’s continued innovation, successful execution of its diversification strategy, and favorable market conditions will be crucial determinants of its ultimate success.

What do you think? Can Palantir achieve a trillion-dollar market cap? Share your thoughts on Palantir's future and its potential to reach this ambitious target in the comments below!

Featured Posts

-

2025 1078

May 10, 2025

2025 1078

May 10, 2025 -

Wall Streets Palantir Prediction Should You Invest Before May 5th

May 10, 2025

Wall Streets Palantir Prediction Should You Invest Before May 5th

May 10, 2025 -

Transgender Girls Banned From Ihsaa Sports Following Trump Order

May 10, 2025

Transgender Girls Banned From Ihsaa Sports Following Trump Order

May 10, 2025 -

The Snl Impression That Left Harry Styles Heartbroken

May 10, 2025

The Snl Impression That Left Harry Styles Heartbroken

May 10, 2025 -

Benson Boone Addresses Harry Styles Comparison Claims

May 10, 2025

Benson Boone Addresses Harry Styles Comparison Claims

May 10, 2025