Wall Street's Palantir Prediction: Should You Invest Before May 5th?

Table of Contents

Analyzing Wall Street's Palantir Predictions

Wall Street analysts have offered varying opinions on Palantir's future, creating a fascinating debate for potential investors considering a Palantir investment.

Bullish Arguments for a Palantir Investment

Several factors point to a potentially bright future for Palantir stock. Positive analyst ratings and price targets suggest confidence in the company's growth trajectory. Key bullish arguments include:

- Increased Government Contracts: Palantir's strong presence in government contracting, particularly within defense and intelligence agencies, provides a stable revenue stream. Further contract wins could significantly boost revenue.

- Expanding Commercial Partnerships: Palantir is actively expanding its commercial partnerships, reaching new markets and diversifying its revenue streams away from its reliance on government contracts. This diversification is seen as a positive factor by many analysts.

- Advancements in AI: Palantir's continued investments in artificial intelligence and its integration into its platforms are expected to enhance its data analytics capabilities and attract more clients. This AI focus positions Palantir for growth in the rapidly expanding AI market.

- Expected Revenue Growth of 20% (Example): Many analysts predict significant revenue growth for Palantir in the coming years, contributing to a positive Palantir stock forecast. (Note: This is an example, replace with actual data.)

- Positive outlook on key partnerships with major corporations (Example): New partnerships with industry leaders could unlock significant growth opportunities, solidifying the positive PLTR buy rating from some analysts. (Note: This is an example, replace with actual data.)

These factors contribute to the optimistic Palantir stock price prediction held by some analysts, creating a compelling case for a Palantir investment. The keywords “Palantir stock forecast,” “Palantir stock price prediction,” and “PLTR buy rating” all relate to these bullish sentiments.

Bearish Concerns Regarding Palantir Stock

Despite the bullish sentiment, several factors warrant caution before jumping into a Palantir investment. Bearish concerns include:

- Reliance on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. Changes in government policy or budget cuts could negatively impact the company's financial performance.

- Competition in the Big Data Market: Palantir faces stiff competition from established players in the big data analytics market, which could limit its market share and growth potential.

- High Valuation: Palantir's current stock valuation is considered high by some analysts, potentially making the stock vulnerable to corrections if growth doesn't meet expectations.

- High debt-to-equity ratio (Example): Palantir's financial health should be carefully scrutinized. A high debt-to-equity ratio, for instance, could present a risk. (Note: This is an example, replace with actual data.)

- Potential for slower than expected growth (Example): Concerns exist about Palantir's ability to sustain the rapid growth predicted by some analysts. (Note: This is an example, replace with actual data.)

These concerns contribute to the negative Palantir stock risks highlighted by some analysts, leading to a PLTR sell rating from others. Keywords such as “Palantir stock risks,” “PLTR sell rating,” and “Palantir stock valuation” reflect these bearish perspectives.

Fundamental Analysis of Palantir's Financial Health

A thorough fundamental analysis of Palantir's financial health is essential before making a Palantir investment decision.

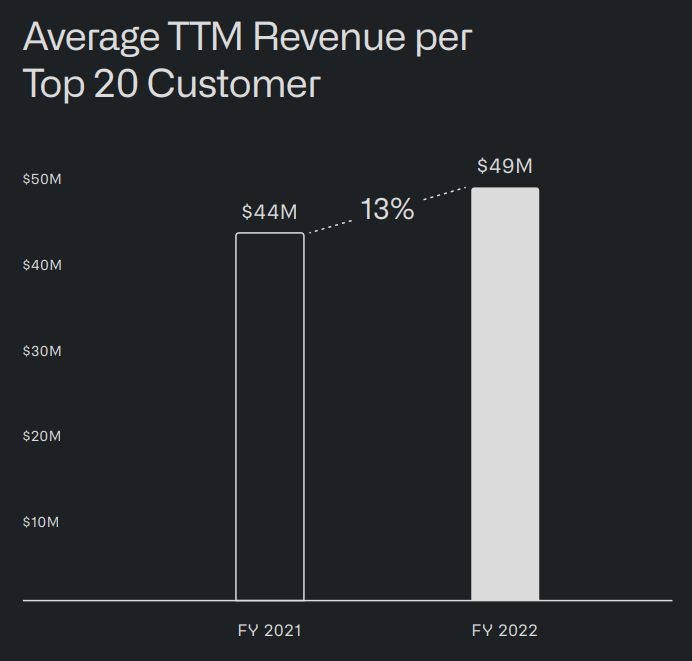

Examining Palantir's Revenue and Profitability

Analyzing Palantir's recent financial reports reveals trends in revenue growth, profitability, and operating margins. Visual representation through charts and graphs can clarify these trends. Examining the key figures related to Palantir revenue and profitability helps gauge the company's financial performance and its potential for future growth.

Assessing Palantir's Debt and Cash Flow

Understanding Palantir's debt levels and cash flow generation is crucial to assess its long-term financial strength. A robust cash flow is critical for a company's sustainability and ability to weather economic downturns. Key metrics relevant to the "Palantir financial statements," "PLTR revenue," "Palantir profitability," and "Palantir cash flow" need to be analyzed.

Technical Analysis and Chart Patterns

Technical analysis of Palantir's stock chart can provide insights into its price action and potential future movements.

Analyzing support and resistance levels, moving averages, RSI, and MACD can help predict potential price targets. Studying these patterns, including the Palantir stock chart, can offer clues about potential short-term and long-term price movements. Keywords like "Palantir stock chart," "PLTR technical analysis," and "Palantir support and resistance" are relevant to this section.

Alternative Investment Strategies for Palantir

There are various strategies for investing in Palantir, each carrying different levels of risk and reward.

- Buying Shares Outright: This is the simplest method, offering direct ownership of Palantir shares.

- Investing in Options Contracts: Options trading (calls or puts) offers leveraged exposure to price movements but involves higher risk.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, reducing the impact of market volatility.

The choice of strategy will depend on your risk tolerance and investment timeline, particularly regarding the May 5th deadline and overall Palantir investment outlook. Relevant keywords include "Palantir options trading," "PLTR investment strategies," and "dollar-cost averaging Palantir."

Conclusion

The decision of whether or not to invest in Palantir before May 5th is complex. While bullish arguments point to significant growth potential driven by government contracts, commercial partnerships, and AI advancements, bearish concerns regarding reliance on government contracts, competition, and high valuation warrant caution. A thorough fundamental and technical analysis is crucial before making any Palantir investment. Remember, this information is not financial advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own thorough research and consider consulting with a qualified financial advisor before making any investment decisions.

Call to Action: Before making an informed Palantir investment decision, conduct your own thorough research, assess your risk tolerance, and consider all the factors discussed in this article. Learn more about Palantir before May 5th and make a well-informed decision based on your individual circumstances. Remember to always practice due diligence before any Palantir investment.

Featured Posts

-

Nyt Strands Today April 12 2025 Clues Theme Hints And Pangram For Saturdays Game

May 10, 2025

Nyt Strands Today April 12 2025 Clues Theme Hints And Pangram For Saturdays Game

May 10, 2025 -

Palantir Stock Should You Invest Before May 5th Analysis And Prediction

May 10, 2025

Palantir Stock Should You Invest Before May 5th Analysis And Prediction

May 10, 2025 -

Us China Trade Talks The Unseen Influence Of The Fentanyl Crisis

May 10, 2025

Us China Trade Talks The Unseen Influence Of The Fentanyl Crisis

May 10, 2025 -

Us Debt Ceiling August Deadline Looms Warns Treasury Official

May 10, 2025

Us Debt Ceiling August Deadline Looms Warns Treasury Official

May 10, 2025 -

Is Palantir Stock A Buy Before May 5th Analyst Ratings And Future Outlook

May 10, 2025

Is Palantir Stock A Buy Before May 5th Analyst Ratings And Future Outlook

May 10, 2025