Personal Loans: Today's Lowest Interest Rates (Under 6%)

Table of Contents

Understanding Personal Loan Interest Rates

Before diving into finding the lowest rates, let's understand what influences them. Your personal loan interest rate, often expressed as an Annual Percentage Rate (APR), reflects the cost of borrowing money. A lower APR means lower overall borrowing costs.

Factors Affecting Interest Rates

Several factors determine your personal loan interest rate:

-

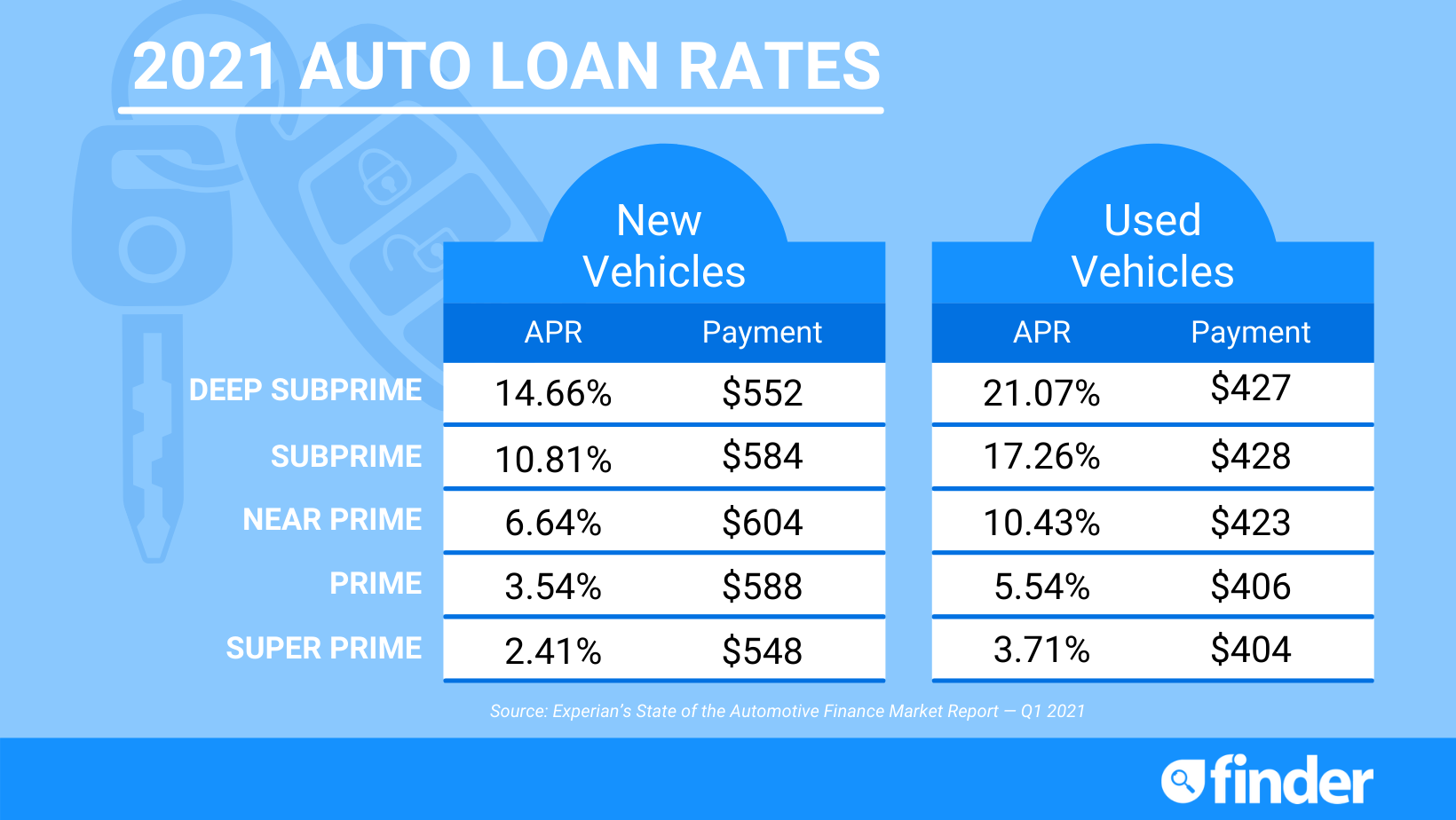

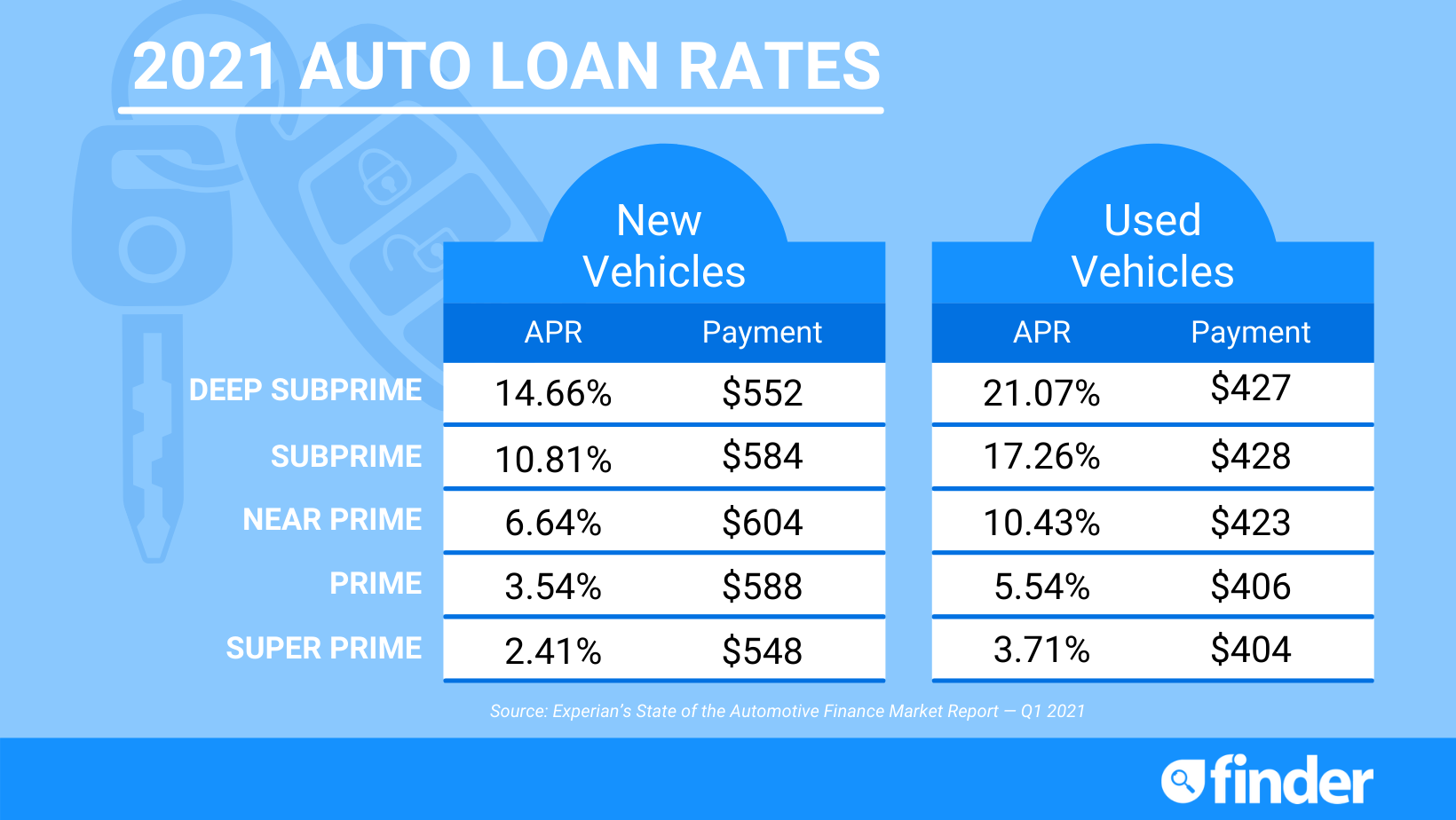

Credit Score: Your credit score is the most significant factor. Excellent credit (typically 750 or higher) qualifies you for the lowest personal loan interest rates, often under 6%. A fair credit score (around 670-739) will likely result in higher rates. A poor credit score will significantly increase your APR.

-

Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, shows lenders your ability to manage debt. A lower DTI generally leads to lower interest rates.

-

Loan Amount and Term Length: Larger loan amounts and longer loan terms often come with higher interest rates. Shorter loan terms typically result in higher monthly payments but lower overall interest paid. Understanding the interest rate calculation for different loan terms is crucial.

-

Type of Lender: Different lenders—banks, credit unions, and online lenders—have varying lending criteria and interest rate structures. Credit unions frequently offer more competitive rates for personal loans due to their member-focused approach.

Comparing Interest Rates from Different Lenders

Finding the best personal loan with low interest rates requires diligent rate shopping. Don't settle for the first offer you receive.

- Rate Shopping: Compare offers from multiple lenders – at least three to five – to ensure you're getting the most competitive rate.

- Online Comparison Tools: Use reputable online comparison tools that allow you to input your financial information and see offers from various lenders. This streamlines the process and saves you time.

- Checking Lender Reviews and Reputations: Always check the reviews and reputation of any lender before applying for a loan to ensure you're dealing with a trustworthy institution.

- Comparing Fees: Don't focus solely on the interest rate. Compare origination fees, late payment fees, and other charges to determine the total cost of the loan. A slightly higher interest rate with fewer fees might be a better deal overall.

Finding Personal Loans with Interest Rates Under 6%

Securing a personal loan with an interest rate under 6% requires preparation and strategic planning.

Qualifying for Low Interest Rates

-

High Credit Score: A high credit score is paramount. Aim for a credit score of 750 or higher to qualify for the most competitive interest rates. Improving your credit score takes time and effort, but the rewards are significant.

-

Strategies for Improving Credit Score: Pay all bills on time, keep your credit utilization low (ideally under 30% of your available credit), and maintain a diverse credit history without opening too many new accounts.

-

Building a Strong Financial History: Demonstrating a history of responsible financial behavior is essential. This includes consistent income, minimal late payments, and a low DTI.

Types of Lenders Offering Low Rates

-

Credit Unions: Often offer lower interest rates than banks, particularly for members. Their member-centric approach often translates to better terms.

-

Online Lenders: Provide convenience and sometimes offer competitive rates due to lower overhead costs. However, thoroughly research the reputation and legitimacy of any online lender.

-

Banks: Traditional banks offer personal loans, but their rates may be higher than those offered by credit unions or some online lenders.

Beyond the Interest Rate: Essential Considerations

While a low interest rate is crucial, it's not the only factor to consider.

Fees and Charges

- Origination Fees: These are upfront fees charged by lenders to process your loan application.

- Prepayment Penalties: Some lenders charge fees if you pay off your loan early.

- Late Payment Fees: These fees are charged if you miss a payment. Understanding these fees is crucial for determining the total cost of your loan.

Loan Terms and Repayment Schedule

-

Loan Term Length: A longer loan term results in lower monthly payments but higher total interest paid over the life of the loan. A shorter term means higher monthly payments, but less interest paid overall.

-

Repayment Schedule: Choose a repayment schedule that aligns with your budget and financial capabilities.

-

Amortization Schedules: Understand your amortization schedule, which outlines your monthly payments, interest paid, and principal reduction over the loan's life.

Secure Your Ideal Personal Loan with Today's Lowest Interest Rates (Under 6%)

Finding a personal loan with an interest rate under 6% involves understanding the factors influencing interest rates, comparing offers from multiple lenders, and carefully considering all fees and loan terms. Remember to prioritize a high credit score, manage your debt responsibly, and research various lenders to find the best option for your financial situation. Don't settle for high interest rates! Start your search for the lowest personal loan interest rates today by comparing offers from reputable lenders. You can utilize online comparison tools to simplify this process and find the best personal loan to fit your needs.

Featured Posts

-

Plummeting European Car Sales Reflect Economic Downturn

May 28, 2025

Plummeting European Car Sales Reflect Economic Downturn

May 28, 2025 -

The Student Loan Crisis Economic Ripple Effects And Consequences

May 28, 2025

The Student Loan Crisis Economic Ripple Effects And Consequences

May 28, 2025 -

Is Rayan Cherki Headed To Manchester United

May 28, 2025

Is Rayan Cherki Headed To Manchester United

May 28, 2025 -

Will Hugh Jackman Join Avengers Doomsday The Burning Question

May 28, 2025

Will Hugh Jackman Join Avengers Doomsday The Burning Question

May 28, 2025 -

Alcaraz Zverev And Sinner A Comparative Analysis Of Recent Performance

May 28, 2025

Alcaraz Zverev And Sinner A Comparative Analysis Of Recent Performance

May 28, 2025

Latest Posts

-

Inquietude A Bouton D Or Manque De Remplacants Et Surpopulation Des Classes

May 30, 2025

Inquietude A Bouton D Or Manque De Remplacants Et Surpopulation Des Classes

May 30, 2025 -

Engagement Politique De Laurent Jacobelli Depute De La Moselle

May 30, 2025

Engagement Politique De Laurent Jacobelli Depute De La Moselle

May 30, 2025 -

Elections 2027 Le Pen Face A Un Possible Empechement Selon Jacobelli

May 30, 2025

Elections 2027 Le Pen Face A Un Possible Empechement Selon Jacobelli

May 30, 2025 -

Le Depute Laurent Jacobelli Rn Un Portrait

May 30, 2025

Le Depute Laurent Jacobelli Rn Un Portrait

May 30, 2025 -

Marine Le Pen Et 2027 Jacobelli Alerte Sur Une Possible Exclusion De La Candidate

May 30, 2025

Marine Le Pen Et 2027 Jacobelli Alerte Sur Une Possible Exclusion De La Candidate

May 30, 2025