Philips Convenes Annual General Meeting: Results And Future Outlook

Table of Contents

Financial Performance Review at the Philips Annual General Meeting

Financial Highlights

The Philips Annual General Meeting presented a comprehensive review of the company's financial performance. Key financial results included:

- Revenue: €[Insert Revenue Figure] for the fiscal year, representing a [percentage]% increase/[decrease] compared to the previous year. This growth/decline was primarily driven by [mention key factors, e.g., strong performance in specific segments, market challenges, etc.].

- Net Profit: €[Insert Net Profit Figure], showing a [percentage]% increase/[decrease] year-on-year. Profitability was impacted by [mention factors like increased costs, investments in R&D, etc.].

- Operating Margins: [Insert Margin Percentage]%, reflecting [explain the trend and reasons behind it, e.g., improved efficiency, increased competition, etc.].

- Earnings Per Share (EPS): [Insert EPS Figure], indicating [explain the trend and factors influencing it].

The company faced headwinds during the reporting period, including [mention specific challenges, e.g., supply chain disruptions, geopolitical instability, etc.], which impacted financial results. Despite these challenges, Philips demonstrated resilience and a commitment to long-term growth. Analyzing these financial results offers a clear picture of the company's financial health and its progress in achieving its strategic objectives.

Dividends and Shareholder Returns

Philips announced a dividend payout of [Insert Dividend Amount] per share, payable on [Insert Payment Date]. This reflects the company's commitment to returning value to shareholders. The decision to maintain/increase/decrease the dividend was based on [explain the rationale, e.g., confidence in future performance, need for reinvestment, etc.]. The company also discussed [mention any share buyback programs or other shareholder return initiatives]. The overall shareholder return strategy aims to [explain the strategy's goals and how it supports long-term value creation]. This demonstrates Philips’ dedication to balancing growth investments with rewarding its investors. Understanding the dividend payout and shareholder return strategy is vital for assessing the investment attractiveness of Philips' stock.

Strategic Initiatives and Key Developments at the Philips AGM

Innovation and New Product Launches

The Philips AGM highlighted several key innovations and new product launches, demonstrating the company's commitment to technological advancement. These include: [List new products and technologies, briefly explaining their functionalities and target markets]. These launches are strategic because they [explain the strategic rationale, e.g., address unmet market needs, expand into new market segments, improve existing product lines, etc.]. The anticipated market impact is [mention potential impact on revenue, market share, etc.]. Innovation and new product launches are key drivers of Philips' long-term growth strategy.

Sustainability and Corporate Social Responsibility (CSR)

Philips reaffirmed its commitment to sustainability and corporate social responsibility (CSR) at the AGM. The company highlighted its progress toward achieving specific ESG (Environmental, Social, and Governance) targets, including:

- Reduction in carbon emissions by [percentage]% by [year].

- Increased use of recycled materials in its products.

- Improved ethical sourcing practices within its supply chain.

These sustainability initiatives are not only vital for environmental protection but also contribute to the company's long-term value creation and brand reputation. These commitments are becoming increasingly important for investors and consumers alike, highlighting Philips’ dedication to sustainable and responsible business practices. Understanding Philips' ESG performance is crucial for evaluating the company's overall sustainability profile.

Restructuring and Operational Efficiency

Philips outlined its plans for restructuring and enhancing operational efficiency. This includes [mention specific initiatives such as streamlining operations, cost-cutting measures, etc.]. The main reasons behind these initiatives are [explain the drivers, e.g., adapting to changing market conditions, improving profitability, etc.]. These changes are expected to result in [mention the anticipated positive impacts, e.g., cost savings, increased efficiency, improved margins, etc.]. Restructuring and operational efficiency are essential for maintaining a competitive advantage and ensuring long-term profitability.

Future Outlook and Guidance from the Philips Annual General Meeting

Management's Expectations

Management provided guidance for the upcoming fiscal year, projecting [Insert revenue growth projections, profitability targets, and other KPIs]. They anticipate that [mention anticipated challenges or uncertainties, such as economic slowdown, competition, etc.] may impact performance. The overall outlook remains [positive/cautiously optimistic/etc.], reflecting management's confidence in the company's ability to navigate challenges and achieve its strategic objectives. Understanding the management's expectations is crucial for investors to assess the potential risks and rewards associated with investing in Philips.

Long-Term Strategic Vision

Philips reiterated its long-term strategic vision, which centers on [mention key strategic priorities, e.g., focusing on specific market segments, developing innovative technologies, etc.]. These priorities align with broader market trends of [mention relevant market trends, e.g., aging population, increasing demand for healthcare solutions, etc.]. The company is well-positioned to capitalize on these trends through its continued investments in R&D, strategic partnerships, and operational excellence. The long-term vision provides a framework for understanding Philips' direction and its commitment to sustainable long-term growth.

Conclusion: Key Takeaways from the Philips Annual General Meeting

The Philips Annual General Meeting provided valuable insights into the company's financial performance, strategic direction, and future outlook. Key takeaways include strong financial results despite market headwinds, a continued commitment to shareholder returns, significant investments in innovation and sustainability, and a positive outlook for the future. These announcements are significant for investors and stakeholders, demonstrating Philips' resilience and its commitment to long-term growth and value creation. Stay updated on Philips' progress by visiting their investor relations website. Follow future Philips Annual General Meetings for continued insights into the company's performance and strategic direction.

Featured Posts

-

Trumps Tariff Decision Sends Euronext Amsterdam Stocks Soaring 8

May 25, 2025

Trumps Tariff Decision Sends Euronext Amsterdam Stocks Soaring 8

May 25, 2025 -

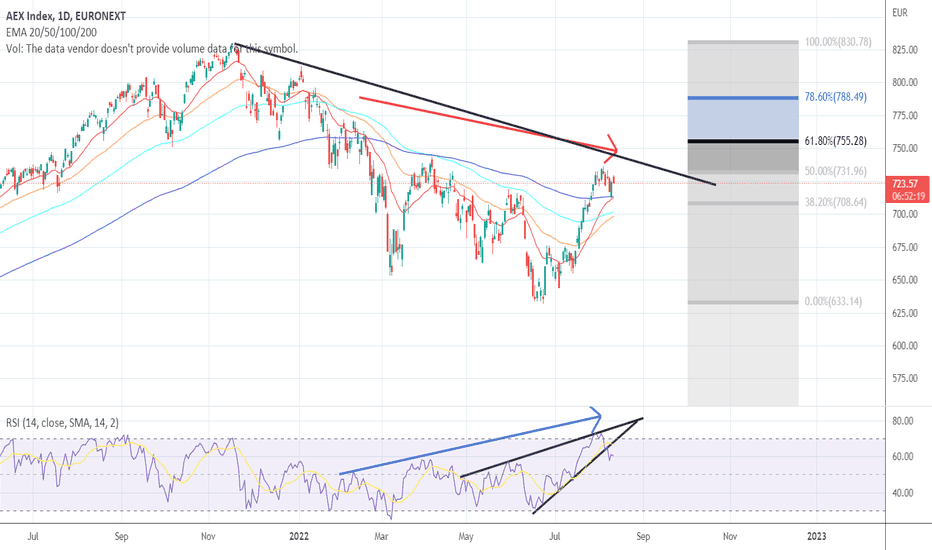

Aex Index Falls Below Key Support Level Market In Decline

May 25, 2025

Aex Index Falls Below Key Support Level Market In Decline

May 25, 2025 -

Banco Master Acquired By Brb Reshaping Competition In Brazilian Finance

May 25, 2025

Banco Master Acquired By Brb Reshaping Competition In Brazilian Finance

May 25, 2025 -

Lego Master Manny Garcia Visits Veterans Memorial Elementary School Photo Highlights

May 25, 2025

Lego Master Manny Garcia Visits Veterans Memorial Elementary School Photo Highlights

May 25, 2025 -

Konchita Vurst O Evrovidenii 2025 Ee Predskazanie Chetyrekh Pobediteley

May 25, 2025

Konchita Vurst O Evrovidenii 2025 Ee Predskazanie Chetyrekh Pobediteley

May 25, 2025

Latest Posts

-

The La Wildfires A Case Study In Disaster And The Rise Of Speculative Betting

May 25, 2025

The La Wildfires A Case Study In Disaster And The Rise Of Speculative Betting

May 25, 2025 -

Accentures 50 000 Employee Promotions A Six Month Delay Explained

May 25, 2025

Accentures 50 000 Employee Promotions A Six Month Delay Explained

May 25, 2025 -

La Fire Victims Face Price Gouging Reality Tv Star Sounds Alarm

May 25, 2025

La Fire Victims Face Price Gouging Reality Tv Star Sounds Alarm

May 25, 2025 -

Angry Elon Is Back Good News For Tesla

May 25, 2025

Angry Elon Is Back Good News For Tesla

May 25, 2025 -

G 7 De Minimis Tariff Talks On Chinese Goods What To Expect

May 25, 2025

G 7 De Minimis Tariff Talks On Chinese Goods What To Expect

May 25, 2025