Banco Master Acquired By BRB: Reshaping Competition In Brazilian Finance

Table of Contents

Increased Market Share for BRB

The Aquisição Banco Master BRB represents a significant expansion strategy for BRB, bolstering its position as a major player in the Brazilian banking market. This acquisition translates into several key advantages:

- Increased branch network and geographic reach: The integration of Banco Master's branches expands BRB's physical presence, enabling it to reach a wider customer base across Brazil. This broadened geographical reach is a crucial element in achieving greater market dominance.

- Enhanced customer base and potential for cross-selling: Access to Banco Master's existing customer base provides BRB with a substantial opportunity for cross-selling its existing financial products and services. This increased customer base significantly strengthens BRB's market position.

- Strengthened capital position and financial stability: The acquisition enhances BRB's capital reserves and overall financial stability, providing a solid foundation for future growth and investment. This financial strength allows for a more aggressive expansion strategy and competitive advantage.

- Potential for synergies and cost optimization: Consolidating operations and streamlining processes between the two banks offers significant opportunities for cost optimization and operational efficiency. These synergies will likely translate into improved profitability and stronger market competitiveness.

While precise figures on market share changes immediately following the acquisition may not be readily available, the combination of Banco Master's existing customer base and BRB's established infrastructure is expected to result in a considerable increase in BRB's overall market share, solidifying its competitive advantage in the Brazilian banking sector.

Impact on Banco Master Customers

The successful integration of Banco Master's customer base into BRB's system is crucial for the long-term success of the Aquisição Banco Master BRB. The transition process will directly impact customers in several ways:

- Integration process and timeline: A clear and well-communicated integration process is essential to minimize disruption for Banco Master customers. The speed and efficiency of this transition will directly influence customer satisfaction.

- Potential changes to banking products and services: Customers should expect some changes to banking products and services as the two systems merge. Transparency regarding these changes is critical to maintain customer loyalty.

- Customer support and transition assistance: Providing comprehensive customer support and assistance throughout the integration process is paramount. This includes readily accessible channels for addressing customer queries and concerns.

- Impact on interest rates and loan terms: While the immediate impact on interest rates and loan terms may be minimal, longer-term adjustments are possible based on BRB's overall pricing strategy.

Effective customer transition management and clear communication are critical to ensure a smooth integration and maintain the confidence of Banco Master's existing clientele. The success of the Aquisição Banco Master BRB hinges on a positive customer experience during this transition period.

Competitive Dynamics in the Brazilian Banking Sector

The Aquisição Banco Master BRB significantly alters the competitive landscape of the Brazilian banking sector. Several key implications arise from this acquisition:

- Analysis of BRB's main competitors: The acquisition positions BRB for more direct competition with other large Brazilian banks, particularly those operating in similar market segments. This intensified competition will likely spur innovation and improved services across the sector.

- Potential for increased competition and innovation: The combined strength of BRB and Banco Master may force other banks to enhance their offerings and adopt more innovative strategies to maintain their market share. This competitive pressure should ultimately benefit consumers.

- Impact on smaller banks and financial institutions: Smaller banks and financial institutions may face increased pressure from the enlarged BRB, necessitating strategic adaptation to maintain competitiveness.

- Regulatory implications and potential antitrust concerns: Regulatory authorities will scrutinize the acquisition to ensure it does not lead to anti-competitive practices or hinder market fairness. Antitrust concerns will likely be a key focus for regulators.

The Aquisição Banco Master BRB is a game-changer for the Brazilian banking industry, increasing competition and potentially prompting a wave of innovation and strategic responses from other market players.

Long-Term Implications of the Aquisição Banco Master BRB

The long-term success of the Aquisição Banco Master BRB will depend on several factors including technological integration and broader economic conditions. Key long-term implications include:

- Potential for technological integration and digital banking expansion: The acquisition presents an opportunity to leverage technological synergies, potentially accelerating the expansion of digital banking services and enhancing customer experience through improved technology.

- Long-term impact on employment within both banks: While some redundancies may occur during the integration process, BRB's expansion plans might lead to new job opportunities in the long run. Effective workforce management will be critical.

- The role of this acquisition in the broader context of Brazilian economic development: The acquisition’s success contributes to the overall health and stability of the Brazilian financial system, impacting broader economic growth.

- Future strategies for BRB based on the acquisition: BRB's future strategic decisions will be shaped by the success of this acquisition. This will include deciding how to best integrate operations, leverage opportunities for growth, and respond to market trends and competitor activities.

The Aquisição Banco Master BRB represents a long-term investment with implications extending far beyond immediate market share gains; it holds a significant role in shaping the future of Brazilian finance.

Conclusion

The Aquisição Banco Master BRB is a watershed moment in Brazilian finance. This analysis highlights its significant impact on BRB's market position, the customer experience of Banco Master's clientele, and the competitive landscape of the Brazilian banking sector. The long-term effects will depend on successful integration, strategic decision-making, and adaptation to the ever-evolving technological and economic climate.

Stay informed about the evolving dynamics of the Brazilian banking sector following the Aquisição Banco Master BRB. Continue following our updates for more insightful analyses of the Brazilian financial market and the impact of major acquisitions like this one. For more information on the Aquisição Banco Master BRB and its implications, [link to further resources/future articles].

Featured Posts

-

She Still Waiting By The Phone My Experience

May 25, 2025

She Still Waiting By The Phone My Experience

May 25, 2025 -

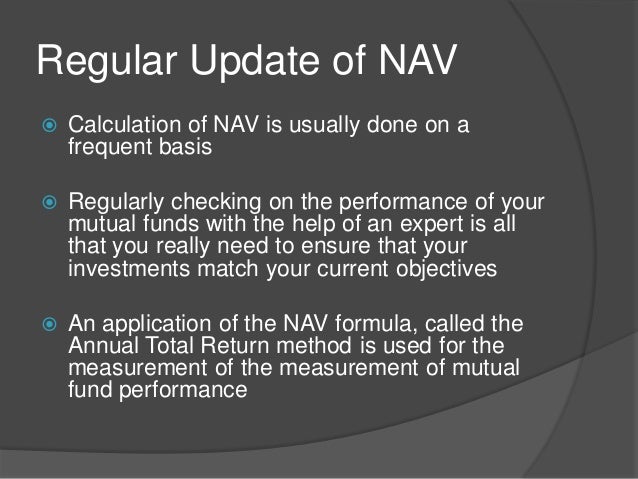

What Is Net Asset Value Nav A Focus On The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

What Is Net Asset Value Nav A Focus On The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Proposal To Ban Hijabs In Public For Under 15s Gains Traction In France

May 25, 2025

Proposal To Ban Hijabs In Public For Under 15s Gains Traction In France

May 25, 2025 -

Ferrari Hot Wheels New Releases Have Arrived Mamma Mia

May 25, 2025

Ferrari Hot Wheels New Releases Have Arrived Mamma Mia

May 25, 2025 -

Chine La Repression Des Dissidents Francais

May 25, 2025

Chine La Repression Des Dissidents Francais

May 25, 2025

Latest Posts

-

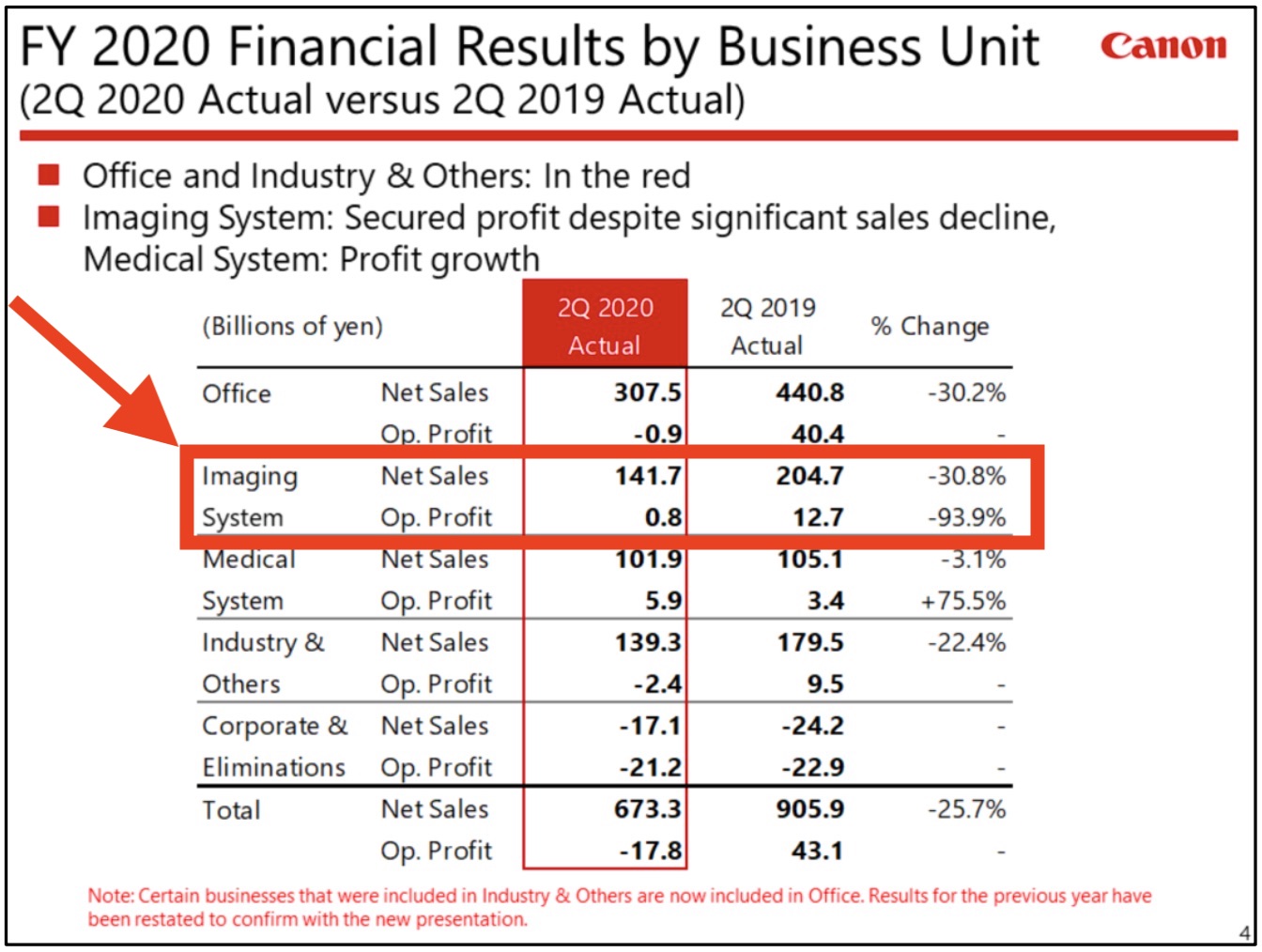

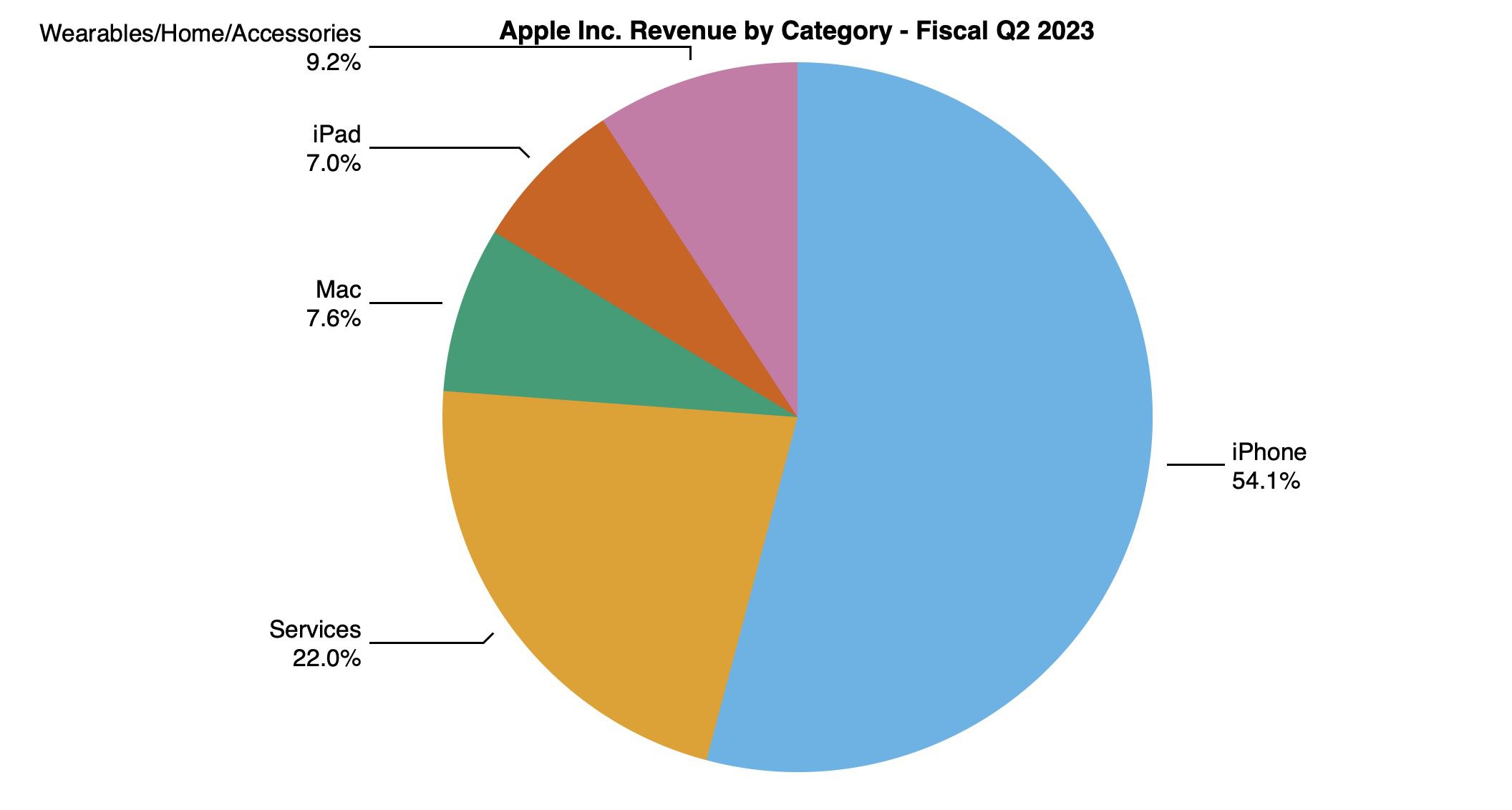

Apple Stock Analysis Of Q2 Financial Results And Future Outlook

May 25, 2025

Apple Stock Analysis Of Q2 Financial Results And Future Outlook

May 25, 2025 -

Tim Cooks Tariff Announcement Triggers Apple Stock Sell Off

May 25, 2025

Tim Cooks Tariff Announcement Triggers Apple Stock Sell Off

May 25, 2025 -

Apple Stock Q2 Earnings I Phone Sales Boost Profits

May 25, 2025

Apple Stock Q2 Earnings I Phone Sales Boost Profits

May 25, 2025 -

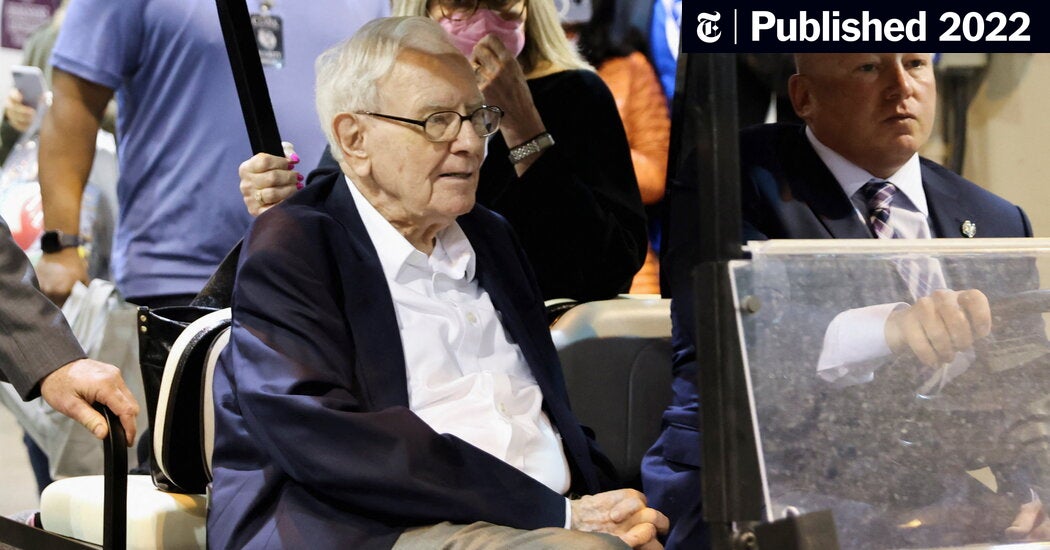

The Impact Of Buffetts Retirement On Berkshire Hathaways Apple Investment

May 25, 2025

The Impact Of Buffetts Retirement On Berkshire Hathaways Apple Investment

May 25, 2025 -

Boosting Regional And International Travel England Airpark And Alexandria International Airports New Campaign

May 25, 2025

Boosting Regional And International Travel England Airpark And Alexandria International Airports New Campaign

May 25, 2025