PMI Strength Boosts Dow Jones's Gradual Climb

Table of Contents

Understanding the Purchasing Managers' Index (PMI) and its Significance

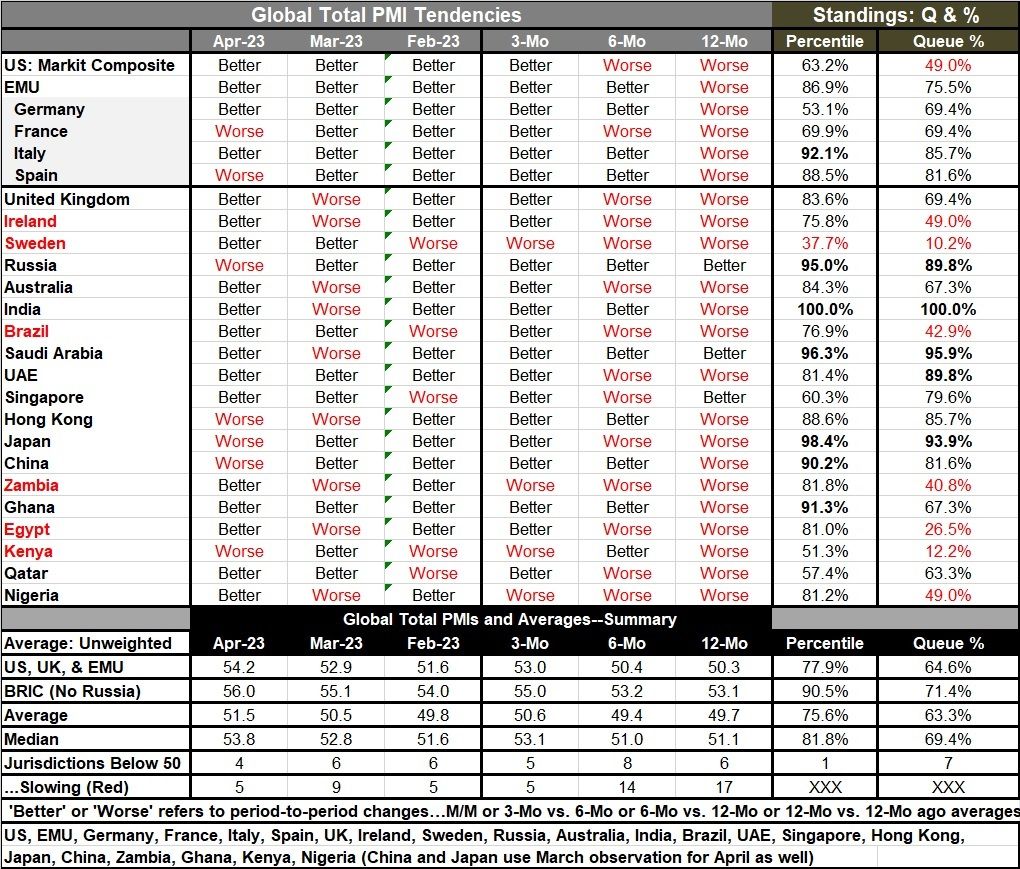

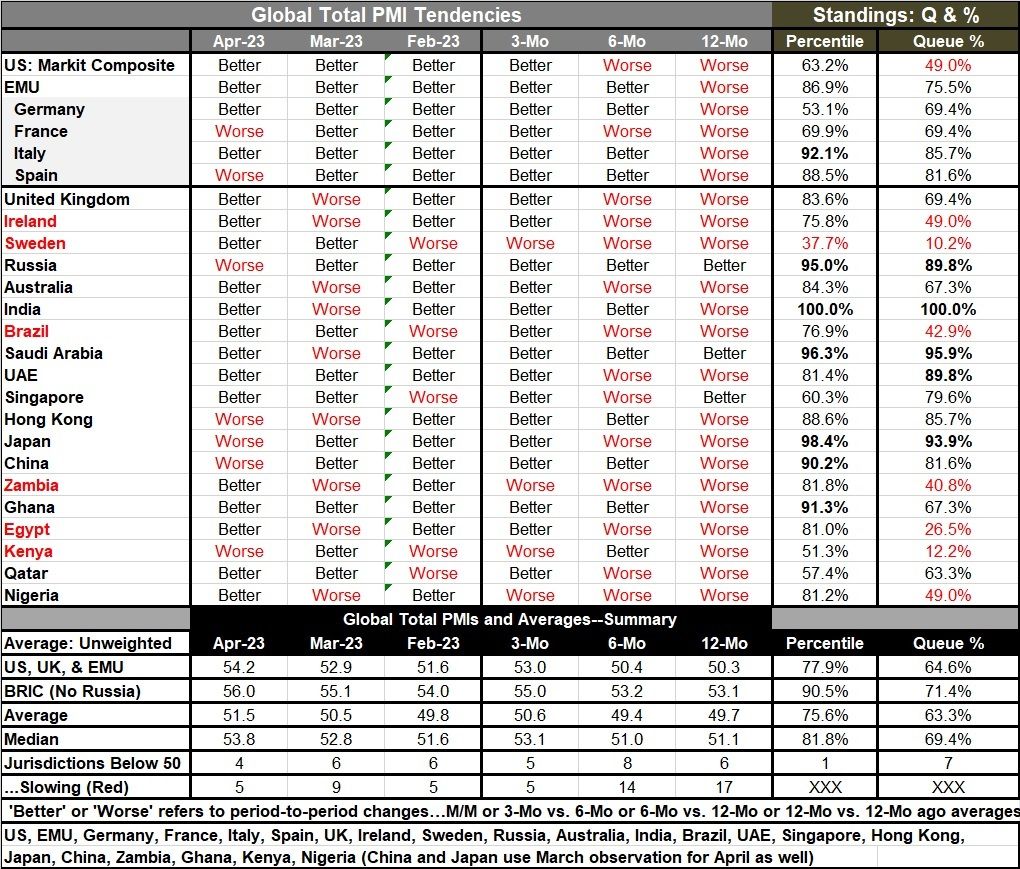

The Purchasing Managers' Index (PMI) is a crucial economic indicator that tracks the activity levels of purchasing managers in the manufacturing and services sectors. Calculated using surveys of purchasing managers, it reflects the health of the economy by assessing factors such as production, new orders, employment, and supplier deliveries. A PMI reading above 50 generally indicates expansion, while a reading below 50 suggests contraction.

Why is PMI so important for investors? Because it serves as a leading indicator of economic growth. Changes in PMI often precede broader economic shifts, giving investors a valuable heads-up about potential market movements. This makes PMI data a key component of any comprehensive market analysis.

- PMI as a leading indicator of economic growth: Changes in PMI often anticipate changes in GDP growth.

- How different PMI components (new orders, employment, etc.) influence market sentiment: Strong new orders suggest future growth, boosting investor confidence. Conversely, declining employment levels might signal economic slowdown, leading to market corrections.

- The impact of global PMI data on US markets: Global interconnectedness means that international PMI data influences US markets. A strong global PMI generally reflects positive global economic health, positively impacting US stock markets.

Recent PMI Data and its Impact on the Dow Jones

The latest PMI data released showed a significant improvement. For instance, the August Manufacturing PMI registered 52.8, exceeding expectations and marking a clear uptick from the previous month's figure of 49.1. Similarly, the Services PMI showed robust growth, reaching 54.5. This positive PMI strength boosts Dow Jones, causing a noticeable market reaction.

The market reacted positively to this unexpectedly strong PMI data. The Dow Jones Industrial Average saw a significant increase in the days following the release, demonstrating a clear correlation between positive economic news and stock market gains.

- Specific sectors within the Dow Jones particularly affected by the PMI data: Industrials and consumer discretionary sectors, which are directly impacted by manufacturing and service sector activity, saw some of the most substantial gains.

- Correlation between the PMI increase and investor confidence: The positive PMI figures reinforced investor confidence, leading to increased buying activity and pushing the Dow Jones higher.

- Conflicting economic data tempering the positive effects of the PMI: While the PMI was strong, concerns about persistent inflation could potentially limit the extent of the Dow Jones’s rally.

Other Contributing Factors to the Dow Jones's Rise

While the strong PMI data played a significant role, it's crucial to acknowledge that the Dow Jones's recent rise is not solely attributable to this factor. Other factors are at play.

-

Interest rate decisions: The Federal Reserve's monetary policy decisions, specifically regarding interest rate hikes, play a substantial role in shaping market sentiment. If interest rates are rising slowly, it may signal less aggressive tightening and can benefit the stock market.

-

Geopolitical events: Global political stability and geopolitical risks significantly influence investor confidence. Reduced geopolitical tensions can boost market performance.

-

Corporate earnings: Strong corporate earnings reports from major companies listed on the Dow Jones can drive up the index.

-

Interplay between PMI and other factors: The positive impact of the PMI is amplified when combined with positive corporate earnings and a stable geopolitical landscape. However, rising interest rates could offset some of the positive impact.

Future Outlook and Potential Risks

The current PMI strength suggests a continuing positive trend for the Dow Jones, but sustainability is not guaranteed. While the strong PMI indicates a robust economic outlook, several potential risks could reverse the current upward trend.

-

Inflation: Persistent high inflation could lead to further interest rate hikes by the Federal Reserve, potentially dampening economic growth and negatively impacting the stock market.

-

Recession fears: Although the PMI is positive, concerns about a potential recession linger, which can cause market volatility.

-

Geopolitical instability: Unexpected geopolitical events can quickly shift market sentiment, causing significant downward pressure on the Dow Jones.

-

Upcoming economic events impacting the Dow Jones: The next Federal Reserve meeting and any significant announcements regarding inflation data will be key events to monitor.

-

Uncertainties and risks associated with interpreting the PMI data: PMI data is not a perfect predictor of future performance and should be considered alongside other economic indicators.

-

Balanced perspective: While the current PMI data is positive, investors should remain aware of potential risks and maintain a balanced approach to their investment strategies.

Conclusion: PMI Strength and the Future Trajectory of the Dow Jones

In summary, the recent strong PMI data has significantly contributed to the Dow Jones's upward trajectory. However, it's crucial to remember that this is only one piece of a larger economic puzzle. While positive PMI strength boosts Dow Jones performance, other factors, such as inflation, interest rates, and geopolitical events, also play a vital role in shaping the market's future. Understanding the interplay of these factors is critical for informed investment decisions. Stay ahead of the market by consistently monitoring PMI strength and its impact on the Dow Jones. Understanding these critical economic indicators is key to making informed investment decisions and navigating the complexities of the stock market effectively.

Featured Posts

-

Jack Draper Triumphs Indian Wells Masters 1000 Champion

May 25, 2025

Jack Draper Triumphs Indian Wells Masters 1000 Champion

May 25, 2025 -

M56 Road Closure Live Updates On Traffic Disruptions

May 25, 2025

M56 Road Closure Live Updates On Traffic Disruptions

May 25, 2025 -

Escape To The Country Nicki Chapmans Profitable Property Investment

May 25, 2025

Escape To The Country Nicki Chapmans Profitable Property Investment

May 25, 2025 -

Porsche Koezuti Autok F1 Motorok Ereje Az Utakon

May 25, 2025

Porsche Koezuti Autok F1 Motorok Ereje Az Utakon

May 25, 2025 -

Amsterdam Stock Market Opens Down 7 On Intensifying Trade War Concerns

May 25, 2025

Amsterdam Stock Market Opens Down 7 On Intensifying Trade War Concerns

May 25, 2025

Latest Posts

-

Global Healthcare Transformation Insights From The Philips Future Health Index 2025 On Ai

May 25, 2025

Global Healthcare Transformation Insights From The Philips Future Health Index 2025 On Ai

May 25, 2025 -

The Future Of Healthcare Analysis Of The Philips Future Health Index 2025 On Ai

May 25, 2025

The Future Of Healthcare Analysis Of The Philips Future Health Index 2025 On Ai

May 25, 2025 -

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 25, 2025

Philips Future Health Index 2025 Urgent Call To Action On Ai In Healthcare

May 25, 2025 -

Waarom Stijgt De Aex Terwijl De Amerikaanse Beurs Daalt

May 25, 2025

Waarom Stijgt De Aex Terwijl De Amerikaanse Beurs Daalt

May 25, 2025 -

Dazi E Borse L Ue Pronta A Reazioni Drastiche

May 25, 2025

Dazi E Borse L Ue Pronta A Reazioni Drastiche

May 25, 2025