Point72's Departure: A Close Look At The Emerging Markets Fund's Closure

Table of Contents

Point72, the prominent hedge fund spearheaded by billionaire Steve Cohen, recently announced the closure of its emerging markets fund. This decision sends ripples through the investment world, impacting not only Point72's investors but also shaping perceptions of the emerging markets landscape. This article provides a comprehensive analysis of the reasons behind this significant move, its implications for Point72's overall strategy, and the broader ramifications for emerging market investments.

Reasons Behind the Closure of Point72's Emerging Markets Fund

Several factors likely contributed to Point72's decision to shutter its emerging markets fund. A combination of external market pressures and internal strategic shifts seems to have driven this significant change.

Underperformance and Market Volatility

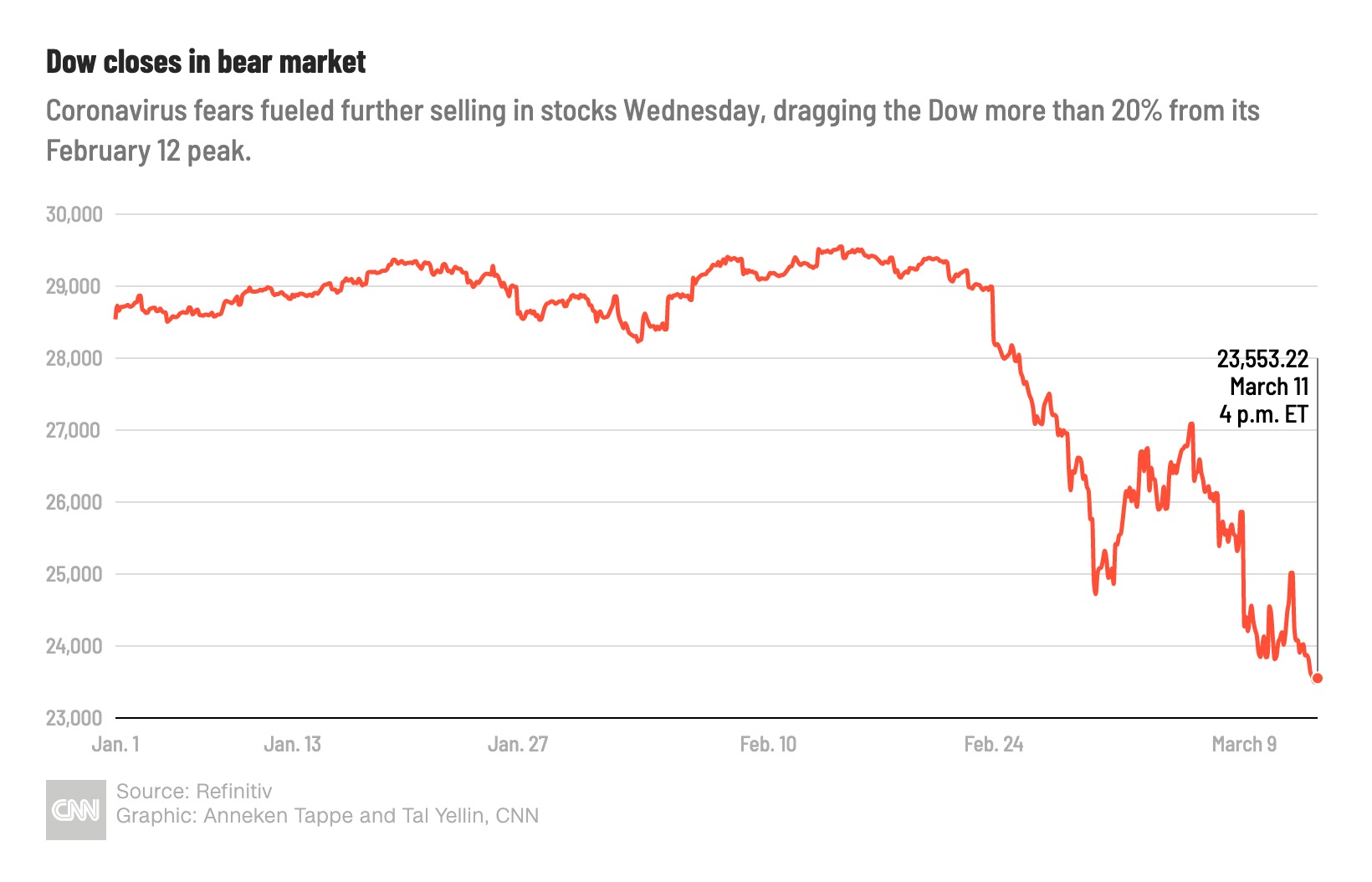

Point72's emerging markets fund faced considerable headwinds in recent years, experiencing underperformance relative to benchmark indices like the MSCI Emerging Markets Index and competing hedge funds specializing in the same sector. This underperformance can be largely attributed to increased market volatility.

- Specific examples of underperforming investments: While specific details remain undisclosed, it's plausible that investments in certain emerging market economies heavily impacted by geopolitical instability or experiencing significant currency devaluation underperformed expectations.

- Data on fund performance compared to relevant indices: Publicly available data (if any) comparing the fund's returns against relevant benchmarks would offer a clearer picture of its underperformance. A lack of such information underscores the opaque nature of hedge fund reporting.

- Mention of specific geopolitical events impacting emerging markets: The war in Ukraine, escalating inflation globally, and rising interest rates in developed economies significantly impacted emerging markets, creating an environment of increased uncertainty and risk for investors. These events likely played a major role in the fund's struggles.

Strategic Portfolio Restructuring

The closure of the emerging markets fund is likely part of a broader strategic portfolio restructuring within Point72. The firm may be reallocating capital from less profitable areas to sectors deemed more promising and aligned with its overall risk tolerance.

- Mention of other successful Point72 funds or investment areas: Point72 has a diverse portfolio. Identifying any particularly successful areas within their holdings could indicate a shift in investment focus, away from emerging markets and towards higher-performing sectors.

- Analysis of Point72's overall risk tolerance and investment philosophy: Understanding Point72's investment philosophy is critical. The closure could reflect a decision to reduce exposure to higher-risk emerging markets in favor of more stable investments.

- Potential shifts in investment focus for the firm: The closure could signify a shift towards other investment strategies, perhaps focusing more on developed markets or specific technological sectors.

Internal Factors and Management Decisions

While external factors played a significant role, internal issues within Point72's emerging markets team might also have contributed to the closure.

- Discussion of any relevant personnel changes within Point72: Changes in key personnel managing the fund, particularly the departure of experienced portfolio managers, could have weakened the team's capacity and contributed to the decision.

- Analysis of the challenges of managing emerging market investments: Navigating the complexities of emerging markets requires specialized expertise and a deep understanding of local political and economic conditions. Difficulties in attracting or retaining top talent in this area might have played a role.

- Mention of potential internal reviews or assessments: Following periods of underperformance, internal reviews and assessments are common practice. These reviews could have led to the decision to close the fund rather than attempt a turnaround.

Implications for Investors and the Broader Market

The closure of Point72's emerging markets fund has significant implications for both investors and the broader investment landscape.

Impact on Investors in the Closed Fund

Investors in the now-closed fund face the immediate consequence of their investment being liquidated.

- Details on the fund's liquidation process: Understanding the specific process for returning capital to investors is crucial. Transparency in this process is paramount to mitigate potential investor concerns.

- Discussion of any investor compensation or support: Depending on the terms of the investment agreement, investors may be entitled to certain compensation or support during the liquidation process.

- Mention of potential legal ramifications: In some cases, significant underperformance or mismanagement could lead to legal challenges from investors.

Market Sentiment and Emerging Market Investment

Point72's decision might influence market sentiment towards emerging market investments.

- Analysis of investor confidence in emerging markets: The closure could cause some investors to re-evaluate their exposure to emerging markets, potentially leading to decreased investment in this sector.

- Mention of other hedge funds' strategies in emerging markets: Examining the strategies of other prominent hedge funds operating in emerging markets will provide insights into how this decision impacts the broader industry.

- Discussion of potential future trends in emerging market investment: The closure might accelerate a trend towards more cautious and selective investment in emerging markets, with a greater emphasis on risk management and diversification.

Conclusion

Point72's decision to close its emerging markets fund underscores the inherent risks and volatility associated with this asset class. While the precise reasons remain partly undisclosed, a combination of underperformance, market volatility, and strategic portfolio adjustments likely contributed to this significant move. This closure impacts not only Point72's investors but also shapes the perception of emerging market investment opportunities. To stay informed about this evolving situation and other developments in the hedge fund industry and emerging markets, continue monitoring reputable financial news sources for further updates on Point72 and similar strategic decisions. Understanding the intricacies of Point72's emerging markets fund closure is crucial for effectively navigating the complexities of the global investment market.

Featured Posts

-

Paris Nice 2024 Jorgenson Secures Back To Back Wins

Apr 26, 2025

Paris Nice 2024 Jorgenson Secures Back To Back Wins

Apr 26, 2025 -

Todays Nyt Spelling Bee March 25th 387 Hints Answers And Tips

Apr 26, 2025

Todays Nyt Spelling Bee March 25th 387 Hints Answers And Tips

Apr 26, 2025 -

Stock Market Update Positive Dow Futures Signal Strong Week Close

Apr 26, 2025

Stock Market Update Positive Dow Futures Signal Strong Week Close

Apr 26, 2025 -

Todays Stock Market Dow Futures Reaction To Chinas Economic Measures

Apr 26, 2025

Todays Stock Market Dow Futures Reaction To Chinas Economic Measures

Apr 26, 2025 -

Pierre Terrasson Exposition Photographique A La Galerie Le Labo Du 8

Apr 26, 2025

Pierre Terrasson Exposition Photographique A La Galerie Le Labo Du 8

Apr 26, 2025