Today's Stock Market: Dow Futures Reaction To China's Economic Measures

Table of Contents

China's Recent Economic Measures and Their Global Impact

China recently implemented a series of economic measures aimed at stimulating growth and addressing economic headwinds. These include:

- Interest Rate Cuts: Lowering borrowing costs to encourage investment and consumption.

- Stimulus Packages: Government spending initiatives focused on infrastructure projects and other key sectors.

- Regulatory Changes: Easing certain regulations to promote business activity and foreign investment.

These measures, while intended to boost the Chinese economy, have potential short-term and long-term effects:

- Short-Term: A potential surge in short-term economic activity due to increased spending and investment. However, there's also a risk of increased inflation if stimulus is not managed carefully.

- Long-Term: The long-term impact depends on the effectiveness of the measures in addressing underlying structural issues in the Chinese economy and fostering sustainable growth. Success could lead to robust economic expansion, while failure could exacerbate existing problems.

The global interconnectedness of modern economies means that China's actions don't stay within its borders. The Chinese economy is a major player in global trade and finance. Changes in its economic trajectory ripple outwards, impacting supply chains, commodity prices, and investor confidence worldwide. This interconnectedness is why the impact of China's economic stimulus is so keenly felt in markets like the Dow Futures. Related keywords: Chinese Economy, Global Market, Economic Stimulus, Interest Rate Cuts.

Analyzing the Dow Futures Reaction

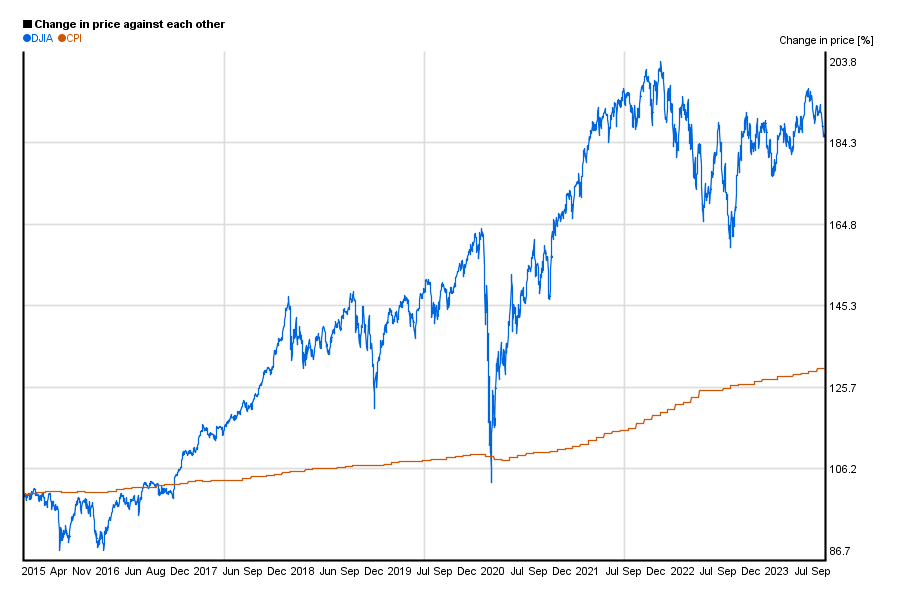

The immediate reaction of Dow Futures to the news of China's economic measures was a complex one. Initially, there was a period of increased volatility as investors digested the information and assessed its potential implications. (Insert chart or graph here visualizing Dow Futures movement post-announcement).

Several factors contributed to this reaction:

- Investor Sentiment: Optimism surrounding potential economic growth in China initially boosted investor confidence. However, concerns about the effectiveness of the stimulus and potential side effects led to some caution.

- Market Speculation: The market reacted to speculation about the long-term consequences of China's actions on global trade and the US economy.

- Risk Assessment: Investors reassessed their risk appetite, with some shifting investments based on their perception of the risk associated with the Chinese economy.

The initial volatility eventually subsided, but the overall impact on Dow Futures continues to unfold and be influenced by subsequent economic data releases. Related keywords: Dow Jones Industrial Average, Futures Trading, Market Volatility, Investor Sentiment.

Impact on Specific Sectors

Certain sectors of the US stock market are particularly vulnerable to shifts in the Chinese economy.

- Technology Stocks: Many US tech companies rely on China for manufacturing, sales, and supply chains. Changes in Chinese economic policy can directly influence their profits and valuations.

- Manufacturing Stocks: US manufacturers that export goods to China or source materials from China are susceptible to trade disputes or economic slowdowns in the Chinese market.

For example, (mention a specific technology company and its stock performance) experienced a dip following the announcement, reflecting concerns about its China-related revenue streams. Similarly, (mention a specific manufacturing company and its stock performance) reacted differently, perhaps due to its unique market position or diversified supply chain. Related keywords: Technology Stocks, Manufacturing Stocks, Supply Chain, Trade Relations.

Expert Opinions and Market Predictions

Financial analysts offer varied perspectives on the long-term implications of China's economic measures.

- Some analysts remain optimistic, predicting a positive impact on global growth, driven by increased Chinese demand and infrastructure spending.

- Others express caution, citing concerns about potential debt accumulation, inflationary pressures, and the long-term effectiveness of stimulus measures.

These varying perspectives underscore the inherent uncertainties in predicting market movements. Forecasts for Dow Futures vary widely, reflecting the complex interplay of factors impacting the global economy. (Include quotes from financial analysts to support the points mentioned above). Related keywords: Financial Analysts, Market Predictions, Economic Forecast, Investment Strategy.

Conclusion

China's recent economic measures have created significant ripples in the global markets, leading to considerable volatility in the Dow Futures. The market's reaction has been influenced by investor sentiment, market speculation, and a reassessment of risk. The long-term impact remains uncertain, with differing expert opinions highlighting the complexity of the situation. To effectively navigate this dynamic environment, it's crucial to monitor Dow Futures closely, analyze China's economic impact, and stay informed on stock market reactions. Continue to stay updated on market news and analysis through reputable financial sources to make informed investment decisions. Understanding the interplay between global events and the Dow Futures is key to successful investing.

Featured Posts

-

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025 -

Todays Stock Market Analyzing Dow Futures And Weeks Performance

Apr 26, 2025

Todays Stock Market Analyzing Dow Futures And Weeks Performance

Apr 26, 2025 -

7 Year Sentence Sought For George Santos By Justice Department

Apr 26, 2025

7 Year Sentence Sought For George Santos By Justice Department

Apr 26, 2025 -

Trump Envoy Witkoffs Moscow Arrival Interfax Report Details

Apr 26, 2025

Trump Envoy Witkoffs Moscow Arrival Interfax Report Details

Apr 26, 2025 -

Bof As View Why Current Stock Market Valuations Are Not A Cause For Alarm

Apr 26, 2025

Bof As View Why Current Stock Market Valuations Are Not A Cause For Alarm

Apr 26, 2025