Today's Stock Market: Analyzing Dow Futures And Week's Performance

Table of Contents

Understanding Dow Futures Contracts

Dow Futures contracts represent an agreement to buy or sell the Dow Jones Industrial Average (DJIA) at a predetermined price on a future date. They're derivative instruments, meaning their value is derived from the underlying asset – the DJIA itself. The relationship between Dow Futures and the actual DJIA is inherently linked; fluctuations in the DJIA directly impact the price of Dow Futures contracts. This close correlation makes Dow Futures a powerful tool for speculating on the short-term direction of the market. Different types of contracts exist, including mini-Dow futures, which offer smaller contract sizes and are more accessible to smaller investors.

- Definition of Dow Futures: A contract obligating the buyer to purchase (or the seller to sell) a specific number of DJIA index points at a future date.

- Mechanism of trading Dow Futures: Traded on exchanges like the Chicago Mercantile Exchange (CME), allowing for leveraged trading and hedging strategies.

- Key factors influencing Dow Futures prices: Economic data releases (e.g., GDP, inflation), corporate earnings announcements, geopolitical events, and changes in interest rates.

- Risks and rewards associated with Dow Futures trading: High leverage magnifies both potential profits and losses. Careful risk management is crucial.

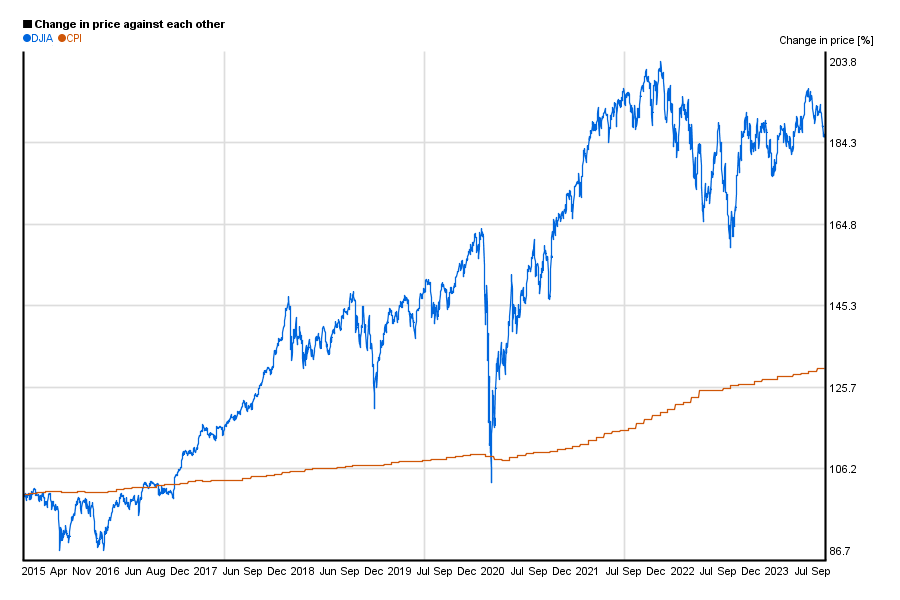

Analyzing the Week's Performance of the Dow Jones Industrial Average

Analyzing the week's performance of the Dow Jones Industrial Average requires a comprehensive approach. Several key factors contribute to the Dow's daily and weekly movements. Last week, for example, the Dow experienced a [Insert actual trend: e.g., moderate uptrend] largely driven by [Insert specific factors: e.g., positive economic data and strong earnings reports from tech companies]. Conversely, negative influences such as [Insert specific factors: e.g., rising interest rates and geopolitical uncertainty] exerted downward pressure. Visualizing this data with charts and graphs provides a clear picture of the overall trend.

- Economic indicators impacting the Dow: GDP growth, inflation rates, unemployment figures, consumer confidence indices.

- Significant corporate news affecting the Dow: Earnings reports, mergers and acquisitions, product launches, and regulatory changes.

- Geopolitical events with Dow implications: International conflicts, trade disputes, political instability in key regions.

- Technical analysis of the Dow's weekly chart: Identifying support and resistance levels, trend lines, and candlestick patterns to predict future price movements. (Insert relevant chart here)

Correlation Between Dow Futures and the Dow's Weekly Performance

The correlation between Dow Futures and the Dow's weekly performance is generally strong but not perfect. In many instances, Dow Futures accurately predict the direction of the DJIA. For example, [Insert example: e.g., a significant drop in Dow Futures contracts accurately predicted a market correction in the DJIA the following week]. However, discrepancies can occur due to various factors. Unexpected news events or market manipulation can cause temporary divergences. It's crucial to remember that Dow Futures are only one piece of the puzzle.

- Examples of accurate predictions by Dow Futures: [Provide specific examples with dates and brief explanations].

- Examples of inaccurate predictions by Dow Futures: [Provide specific examples with dates and brief explanations, emphasizing reasons for discrepancies].

- Factors influencing the correlation between Dow Futures and Dow performance: Unexpected news, market sentiment, speculative trading, and algorithmic trading activities.

- Importance of considering other market indicators alongside Dow Futures: Fundamental analysis, technical indicators, and global economic conditions should be incorporated into your analysis.

Predicting Future Dow Performance Based on Current Futures

Current Dow Futures prices can provide valuable insights into the potential short-term direction of the DJIA. A consistently rising Futures price suggests bullish sentiment and potential upward movement in the underlying index. However, relying solely on Dow Futures for prediction is inherently risky. The market is influenced by many factors beyond just future contracts.

- Interpreting current Dow Futures prices: Analyzing the price movements, open interest, and volume of Dow Futures contracts provides insight into market sentiment.

- Limitations of using Dow Futures for prediction: Dow Futures reflect short-term expectations, not long-term trends. External events can significantly impact the market regardless of Futures prices.

- Combining Dow Futures with other analysis techniques: Integrating technical and fundamental analysis enhances prediction accuracy.

- Importance of risk management: Employing appropriate stop-loss orders and position sizing is crucial to mitigate potential losses in leveraged trading.

Conclusion: Key Takeaways and Call to Action

Analyzing today's stock market requires a multifaceted approach. Dow Futures offer valuable insights into short-term market trends, but they are most effective when used in conjunction with other analytical tools. Understanding the correlation between Dow Futures and the Dow's weekly performance, while recognizing its limitations, is crucial for making informed investment decisions. Don't solely rely on Dow Futures; incorporate fundamental and technical analysis for a more comprehensive perspective.

Stay informed on "Today's Stock Market: Analyzing Dow Futures and Week's Performance" by regularly checking reputable financial news sources like [Link to reputable financial news source 1] and [Link to reputable financial news source 2] and conducting your own thorough analysis. Understanding Dow Futures is a crucial step in navigating the complexities of the stock market. Remember to always practice responsible risk management.

Featured Posts

-

Cnn Anchors Top Pick Why He Loves Florida

Apr 26, 2025

Cnn Anchors Top Pick Why He Loves Florida

Apr 26, 2025 -

Newsoms Transgender Athlete Policy Unfair And Divisive

Apr 26, 2025

Newsoms Transgender Athlete Policy Unfair And Divisive

Apr 26, 2025 -

Congresss Most Aromatic Member Unmasked

Apr 26, 2025

Congresss Most Aromatic Member Unmasked

Apr 26, 2025 -

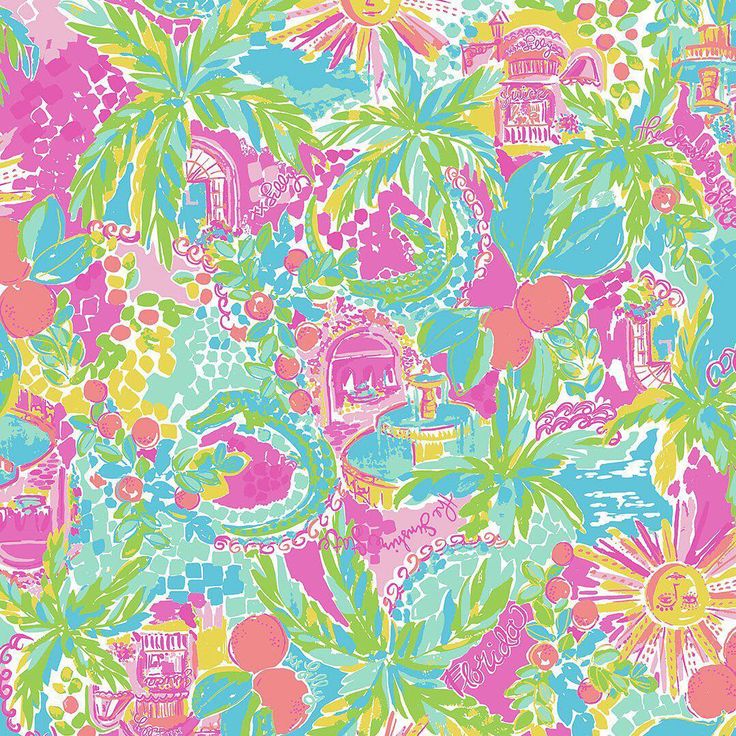

Trade Wars And Gold Why Bullion Prices Are Surging

Apr 26, 2025

Trade Wars And Gold Why Bullion Prices Are Surging

Apr 26, 2025 -

China Economic Stimulus And Its Effect On The Stock Market And Dow Futures

Apr 26, 2025

China Economic Stimulus And Its Effect On The Stock Market And Dow Futures

Apr 26, 2025