Post-US-China Trade Talks: Market Sentiment And The Path Forward

Table of Contents

Assessing the Immediate Market Reaction to the Trade Talks

The immediate aftermath of the US-China trade talks significantly impacted global markets. Analyzing this reaction is crucial for understanding the current sentiment and predicting future trends.

Stock Market Volatility and Investor Confidence

Post-talks market volatility was significant. The announcement triggered immediate fluctuations in major stock indices.

- Dow Jones Industrial Average: Experienced a [insert percentage]% swing [insert direction] following the announcement, reflecting investor uncertainty.

- S&P 500: Showed similar volatility, with analysts citing concerns about [mention specific concerns, e.g., future tariff implications, supply chain disruptions].

- Shanghai Composite: [Describe the impact on the Shanghai Composite, considering its unique relationship with US-China trade].

Investor sentiment analysis reveals a shift towards risk aversion in the short term, as evidenced by decreased trading volume in certain sectors and increased demand for safe-haven assets like gold. Post-talks market volatility underscores the interconnectedness of global financial markets and the sensitivity of investor confidence to US-China trade developments.

Currency Fluctuations and Exchange Rate Dynamics

The impact extended to currency markets. The US dollar's strength, typically seen as a safe haven during times of uncertainty, [describe whether it strengthened or weakened and why]. The Chinese Yuan experienced [describe Yuan fluctuation and reasons].

- US Dollar Index (DXY): [Insert data on DXY movement and analysis].

- USD/CNY Exchange Rate: [Insert data and analysis of the exchange rate between the US dollar and Chinese Yuan].

- Impact on International Trade: Fluctuations impacted international trade, making imports and exports more or less expensive depending on the currency pair.

Commodity Prices and Global Supply Chains

Commodity prices reacted to the news, reflecting concerns about global supply chain stability. For example, soybean prices, heavily impacted by US-China trade disputes, showed [describe price movement]. Oil prices, sensitive to global economic growth, experienced [describe price movement and rationale].

- Soybean Futures: [Insert data and analysis on soybean futures prices].

- Crude Oil Prices: [Insert data and analysis on crude oil prices].

- Supply Chain Disruptions: Concerns lingered about the potential for further disruptions to global supply chains, leading to increased uncertainty for businesses reliant on international trade. The impact on raw material costs remains a significant area of concern.

Understanding the Long-Term Implications for US-China Trade Relations

The long-term implications of the trade talks are far-reaching and complex, affecting various aspects of US-China relations and the global economy.

The Future of Tariffs and Trade Agreements

The likelihood of further tariff escalations or de-escalations remains a critical factor influencing market sentiment. The possibility of new trade agreements or revisions to existing ones is also under scrutiny.

- Existing Tariffs: [Analyze the status of current tariffs and potential future changes].

- New Trade Agreements: [Discuss potential areas for future negotiations and the likelihood of success].

- Expert Predictions: [Summarize the views of economists and experts on the long-term trajectory of US-China trade relations].

Geopolitical Risks and the Shifting Global Landscape

The US-China trade relationship is inextricably linked to broader geopolitical factors. Technological competition, differing political ideologies, and the overall balance of global power significantly influence the trajectory of their trade relations.

- Technological Rivalry: The competition for technological dominance between the US and China will likely continue to shape trade policies.

- Global Power Dynamics: The shifting global power balance impacts the negotiating leverage of both countries.

- Political Uncertainty: Domestic political factors in both countries also influence trade negotiations.

Opportunities for Businesses and Investment Strategies

Despite the uncertainties, opportunities exist for businesses willing to adapt and navigate the evolving landscape.

- Diversification Strategies: Businesses can mitigate risks through diversification of supply chains and markets.

- Investment Opportunities: Specific sectors may offer attractive investment opportunities despite the overall uncertainty.

- Risk Mitigation Techniques: Proactive risk management strategies are crucial for businesses operating in this environment.

Conclusion

The post-US-China trade talks landscape presents both challenges and opportunities. Understanding the current market sentiment and the long-term implications is crucial for making informed decisions. Careful analysis of market volatility, currency fluctuations, and geopolitical risks allows businesses and investors to develop effective strategies. By staying informed and adapting to the changing dynamics of US-China trade relations, stakeholders can mitigate risks and capitalize on emerging opportunities. Continue to monitor the developments regarding post-US-China trade talks for the latest updates and insights into navigating this evolving market landscape.

Featured Posts

-

Kya Tam Krwz Ne 36 Salh Adakarh Ke Sath Shady Ky He

May 12, 2025

Kya Tam Krwz Ne 36 Salh Adakarh Ke Sath Shady Ky He

May 12, 2025 -

Analyzing Rahal Letterman Lanigan Racings 2025 Indy Car Season

May 12, 2025

Analyzing Rahal Letterman Lanigan Racings 2025 Indy Car Season

May 12, 2025 -

Asylum Shelter Efficiency Advisory Councils Call For E1 Billion In Savings Through Improved Organization

May 12, 2025

Asylum Shelter Efficiency Advisory Councils Call For E1 Billion In Savings Through Improved Organization

May 12, 2025 -

Automated Visual Inspection Of Lyophilized Vials Challenges And Solutions

May 12, 2025

Automated Visual Inspection Of Lyophilized Vials Challenges And Solutions

May 12, 2025 -

Brewers Yankees Series Examining The Injured Lists March 27 30

May 12, 2025

Brewers Yankees Series Examining The Injured Lists March 27 30

May 12, 2025

Latest Posts

-

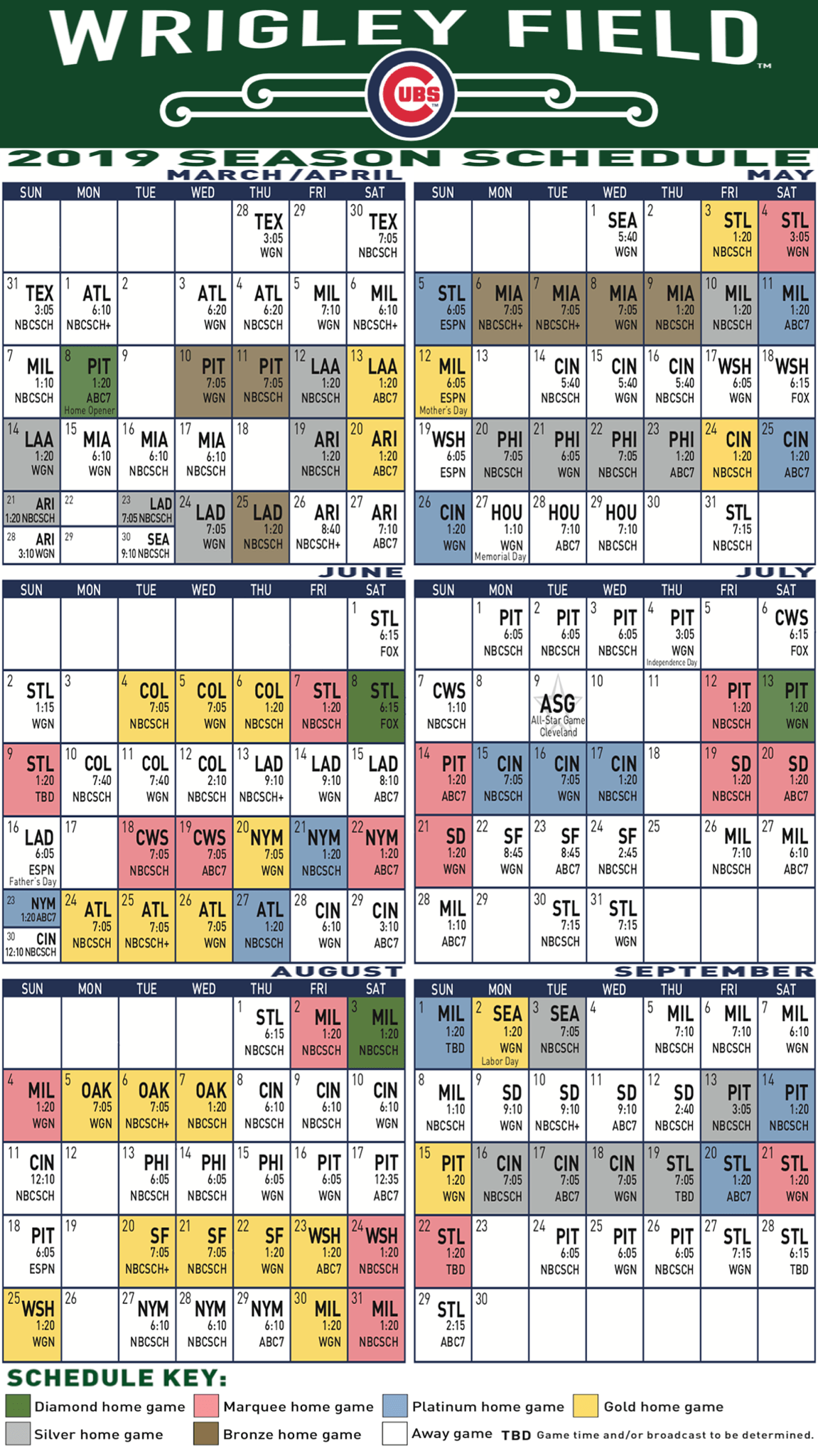

Dodgers Defeat Cubs 3 0 Yamamotos 6 Inning Masterpiece And Edmans 3 Run Homer

May 13, 2025

Dodgers Defeat Cubs 3 0 Yamamotos 6 Inning Masterpiece And Edmans 3 Run Homer

May 13, 2025 -

2025 Chicago Cubs Deconstructing Game 16s Wins And Losses

May 13, 2025

2025 Chicago Cubs Deconstructing Game 16s Wins And Losses

May 13, 2025 -

Edmans Homer Yamamotos Shutout Pitching Power Dodgers Past Cubs

May 13, 2025

Edmans Homer Yamamotos Shutout Pitching Power Dodgers Past Cubs

May 13, 2025 -

3 0 Dodgers Win Yamamotos Pitching And Edmans Home Run Secure Victory Against Cubs

May 13, 2025

3 0 Dodgers Win Yamamotos Pitching And Edmans Home Run Secure Victory Against Cubs

May 13, 2025 -

Cubs Game 16 2025 Heroes Goats And Key Moments

May 13, 2025

Cubs Game 16 2025 Heroes Goats And Key Moments

May 13, 2025