Potential US Debt Crisis: August Deadline Heightens Concerns

Table of Contents

Understanding the US Debt Ceiling

What is the debt ceiling?

The US debt ceiling, also known as the debt limit, is a legal limit on the total amount of money the US government can borrow to meet its existing obligations. This limit doesn't restrict the government's ability to spend money; rather, it restricts its ability to finance that spending. The debt ceiling has been raised or suspended numerous times throughout history, reflecting the continuous growth of the federal debt. Think of it as a credit limit on a national credit card.

- Definition: The debt ceiling is a statutory limit on the total amount of outstanding debt the US Treasury can hold.

- Role: It controls the government's borrowing to meet spending obligations already authorized by Congress.

- Historical Context: The debt ceiling has been in place since 1917 and has been raised or suspended many times, often leading to political debate and negotiations.

Why is it a crisis now?

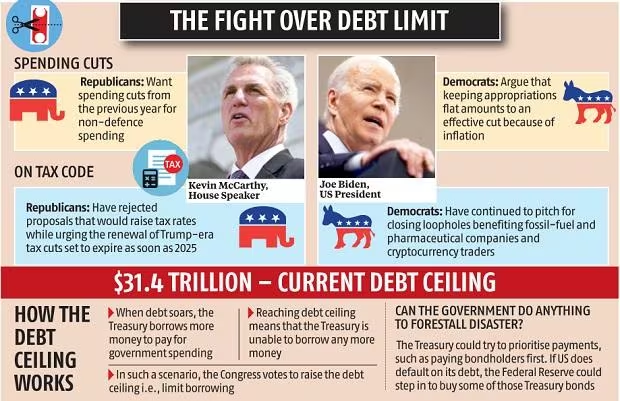

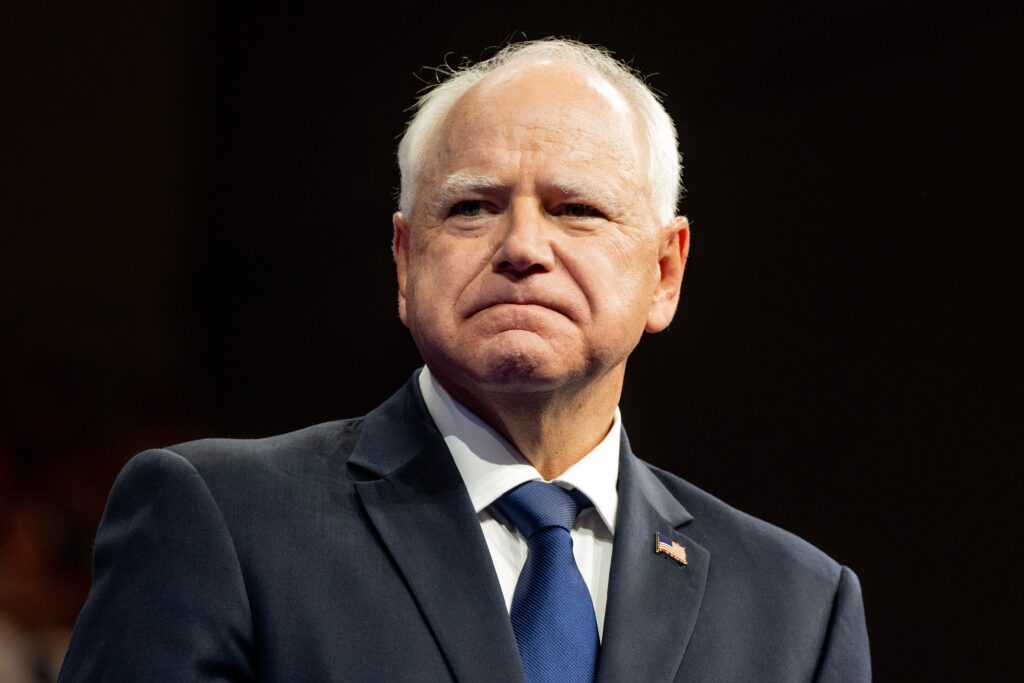

The current situation presents a particularly acute crisis due to a political deadlock between the Republican-controlled House and the Democrat-led Senate and White House. Disagreements over government spending and fiscal responsibility have stalled negotiations, raising the specter of a potential default. The urgency stems from the approaching deadline, after which the Treasury Department might lack the authority to borrow more funds to pay its bills.

- Political Deadlock: Significant disagreements exist between political parties regarding spending levels and fiscal policy.

- Potential Default: Failure to raise the debt ceiling could result in the US government defaulting on its debt obligations for the first time in history.

- Urgency: The short timeframe before the deadline adds immense pressure to find a solution, preventing a catastrophic economic fallout.

Potential Consequences of a US Debt Crisis

Economic Fallout

A US debt default would trigger a severe economic crisis, both domestically and globally. The consequences could include a recession, significant inflation, a stock market crash, and a downgrade in the US credit rating. This could lead to higher interest rates, making borrowing more expensive for businesses and consumers.

- Recession: A significant contraction of the US economy, leading to widespread job losses and reduced economic activity.

- Inflation: A rapid increase in the price of goods and services, eroding purchasing power.

- Stock Market Crash: A dramatic decline in stock market values, impacting retirement savings and investment portfolios.

- Credit Rating Downgrade: A reduction in the US's credit rating, increasing borrowing costs for the government and the private sector.

Social Impact

The impact of a US debt crisis would extend beyond the economy, profoundly affecting social programs and the general population. Essential government services, including Social Security and Medicare payments, could be disrupted or delayed.

- Social Security and Medicare Cuts: Potential cuts or delays in payments to retirees and those eligible for healthcare benefits.

- Government Service Disruptions: Delays or interruptions in various government services, impacting citizens' access to essential programs.

- Increased Uncertainty: Widespread uncertainty and anxiety among the population, impacting consumer confidence and overall well-being.

Possible Solutions and Negotiations

Negotiating a solution

Negotiations between the White House and Congress are crucial to finding a solution. Potential compromises might involve spending cuts in certain areas, adjustments to tax policies, or a combination of both. However, reaching an agreement presents significant challenges due to deeply entrenched political differences.

- Bipartisan Negotiations: Finding common ground between the Republican and Democratic parties is paramount for a successful resolution.

- Fiscal Policy Adjustments: Changes to government spending and revenue collection are likely part of any agreement.

- Obstacles to Compromise: Deeply divided political ideologies and partisan gridlock pose significant obstacles.

Short-term vs. long-term solutions

While a short-term solution might simply raise the debt ceiling temporarily, this only postpones the underlying problem. Long-term strategies are needed to address the nation's growing national debt. This might involve implementing comprehensive budget reforms, promoting economic growth to increase tax revenue, and exploring further spending adjustments.

- Debt Reduction Strategies: Implementation of long-term plans to decrease the national debt sustainably.

- Budget Reforms: Structural changes to the federal budget to improve efficiency and control spending.

- Economic Growth Initiatives: Policies aimed at stimulating economic growth and increasing tax revenue.

Conclusion

The looming US debt crisis presents a significant challenge with potentially devastating consequences if the August deadline passes without a resolution. Understanding the complexities of the debt ceiling, the potential consequences of inaction, and the ongoing negotiations are crucial for every citizen. Staying informed about the developments regarding the US debt crisis is essential, so continue to monitor credible news sources and engage in informed discussions to promote responsible fiscal policy. We must demand action from our elected officials to prevent a potential catastrophe. Learn more about the current state of the US debt crisis and urge your representatives to find a solution.

Featured Posts

-

Does The Us Government Fund Transgender Mouse Research Separating Fact From Fiction

May 10, 2025

Does The Us Government Fund Transgender Mouse Research Separating Fact From Fiction

May 10, 2025 -

Incredibly Dangerous Internal Warnings Ignored Before Newark Atc Failure

May 10, 2025

Incredibly Dangerous Internal Warnings Ignored Before Newark Atc Failure

May 10, 2025 -

The Aoc Pirro Fact Check Debate What You Need To Know

May 10, 2025

The Aoc Pirro Fact Check Debate What You Need To Know

May 10, 2025 -

Transgender Mouse Research And Us Government Funding Separating Fact From Fiction

May 10, 2025

Transgender Mouse Research And Us Government Funding Separating Fact From Fiction

May 10, 2025 -

Analyzing Palantir Stock Before May 5th Is It A Good Investment

May 10, 2025

Analyzing Palantir Stock Before May 5th Is It A Good Investment

May 10, 2025