Private Credit Jobs: 5 Crucial Do's And Don'ts To Remember

Table of Contents

Do's for Securing Private Credit Jobs

1. Master Essential Skills

The private credit world demands a strong foundation in financial analysis and related fields. To stand out, focus on:

- Financial Modeling & Valuation: Become highly proficient in building complex financial models, performing discounted cash flow (DCF) analysis, and conducting thorough valuations of companies and assets. This is critical for due diligence in private debt investments.

- Credit Analysis: Develop a deep understanding of credit risk assessment, including analyzing financial statements, calculating key credit ratios, and understanding various credit scoring models.

- Debt Structuring & Legal Documentation: Familiarize yourself with different debt structures (e.g., senior secured, subordinated debt) and the legal agreements involved. Understanding legal documentation is paramount in this field.

- Regulatory Compliance: Private credit is subject to regulations. Stay updated on relevant laws and compliance requirements.

- Software Proficiency: Master financial software such as Excel (including advanced functions like VBA), Bloomberg Terminal, and Argus. These are essential tools for any private credit professional.

- Certifications: Consider pursuing relevant certifications, such as the Chartered Financial Analyst (CFA) charter or the Chartered Alternative Investment Analyst (CAIA) designation, to enhance your credentials. These demonstrate your commitment to the field.

Highlight these skills prominently in your resume and cover letter, using keywords like "financial modeling," "credit analysis," and "debt structuring" to catch the attention of recruiters.

2. Network Strategically

Networking is crucial in the private credit industry. Don't underestimate its power:

- Industry Events: Attend conferences and networking events focused on private credit, alternative lending, and private equity. These are excellent opportunities to meet potential employers and learn about new opportunities.

- LinkedIn: Leverage LinkedIn to connect with professionals in the field. Engage with their posts, participate in relevant groups, and reach out for informational interviews.

- Informational Interviews: Schedule informational interviews with individuals working in private credit roles. These conversations provide invaluable insights and can lead to unexpected opportunities.

- Recruiters: Build relationships with recruiters specializing in private credit placements. They often have access to unadvertised roles.

- Alumni Networks: Tap into your university's alumni network to connect with graduates working in the private credit industry.

3. Tailor Your Resume and Cover Letter

Generic applications rarely succeed in a competitive market like private credit.

- Customization: Tailor your resume and cover letter to each specific job description, highlighting the skills and experiences most relevant to the role.

- Keyword Optimization: Use keywords from the job posting in your application materials to ensure your application gets noticed by Applicant Tracking Systems (ATS).

- Quantifiable Achievements: Quantify your achievements whenever possible using data and metrics to demonstrate the impact of your work.

- Market Understanding: Showcase your understanding of private debt markets, investment strategies, and current market trends.

- Proofreading: Meticulously proofread your application materials for any grammatical errors or typos. A polished application demonstrates professionalism.

Don'ts for Seeking Private Credit Jobs

1. Neglect Industry Knowledge

Staying informed about the private credit market is non-negotiable.

- Market Trends: Don't underestimate the importance of understanding current market trends and economic conditions impacting the private debt sector.

- Regulatory Changes: Stay updated on private credit news and regulatory changes that could affect investment strategies and compliance.

- Industry Publications: Read industry publications and follow key influencers on social media to stay abreast of the latest developments.

- Interview Preparation: Demonstrate your knowledge during interviews by discussing relevant market events and their potential impact on the industry. A lack of awareness shows a lack of commitment.

2. Underestimate the Importance of Networking

Networking isn't just beneficial; it's essential for finding private credit jobs.

- Proactive Approach: Don't rely solely on online job applications. Actively network to uncover hidden opportunities.

- Hidden Opportunities: Many private credit jobs aren't advertised publicly. Networking significantly increases your chances of finding these roles.

- Maintain Relationships: Don't burn bridges; maintain professional relationships with everyone you meet.

- Active Participation: Avoid appearing passive; actively pursue networking opportunities.

3. Overlook the Importance of Soft Skills

Technical skills are crucial, but soft skills are equally important.

- Communication Skills: Don't underestimate the value of strong communication and interpersonal skills. Private credit requires collaboration.

- Teamwork: Demonstrate your ability to work effectively in a team environment.

- Presentation & Negotiation: Develop strong presentation and negotiation skills, as these are essential for successful deal-making.

- Time Management & Pressure: Show your ability to work effectively under pressure and manage time efficiently. This is critical in a fast-paced environment.

- Problem-Solving: Highlight your initiative and problem-solving abilities during interviews.

Conclusion

Securing a rewarding career in private credit jobs requires a combination of hard skills, strategic networking, and a meticulous approach to the job search process. By following the "do's" and avoiding the "don'ts" outlined above, you can significantly improve your chances of success. Remember to continuously hone your financial modeling skills, build your network, and tailor your applications to each opportunity. Start your journey towards a successful career in private credit today! Don't delay, begin your search for fulfilling private credit jobs now!

Featured Posts

-

2 Fall On Amsterdam Stock Exchange Following Trumps Latest Tariffs

May 24, 2025

2 Fall On Amsterdam Stock Exchange Following Trumps Latest Tariffs

May 24, 2025 -

Memorial Day 2025 Flights Finding The Best Deals And Avoiding Crowds

May 24, 2025

Memorial Day 2025 Flights Finding The Best Deals And Avoiding Crowds

May 24, 2025 -

Anchor Brewing Companys Closure What Happens Next

May 24, 2025

Anchor Brewing Companys Closure What Happens Next

May 24, 2025 -

Pamyati Sergeya Yurskogo Trogatelniy Vecher V Teatre Mossoveta

May 24, 2025

Pamyati Sergeya Yurskogo Trogatelniy Vecher V Teatre Mossoveta

May 24, 2025 -

Sharp Decline In Amsterdam Stock Exchange Aex Index Down Over 4

May 24, 2025

Sharp Decline In Amsterdam Stock Exchange Aex Index Down Over 4

May 24, 2025

Latest Posts

-

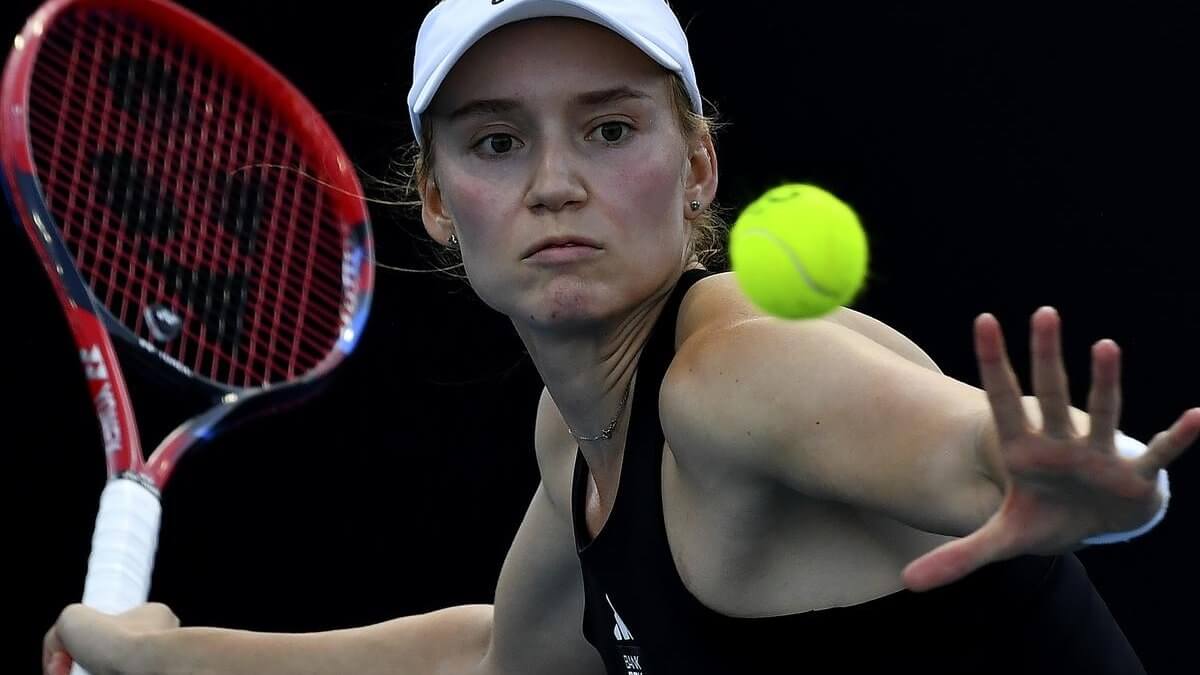

Elena Rybakina Proshla Vo Vtoroy Krug V Rime

May 24, 2025

Elena Rybakina Proshla Vo Vtoroy Krug V Rime

May 24, 2025 -

Rybakina V Tretem Kruge Turnira V Rime

May 24, 2025

Rybakina V Tretem Kruge Turnira V Rime

May 24, 2025 -

Programma Podderzhki Eleny Rybakinoy Dlya Molodykh Tennisistok Kazakhstana

May 24, 2025

Programma Podderzhki Eleny Rybakinoy Dlya Molodykh Tennisistok Kazakhstana

May 24, 2025 -

Goroskopy I Predskazaniya Razvernutiy Analiz Vashey Sudby

May 24, 2025

Goroskopy I Predskazaniya Razvernutiy Analiz Vashey Sudby

May 24, 2025 -

Vklad Eleny Rybakinoy V Razvitie Zhenskogo Tennisa V Kazakhstane

May 24, 2025

Vklad Eleny Rybakinoy V Razvitie Zhenskogo Tennisa V Kazakhstane

May 24, 2025