Private Credit Jobs: 5 Do's And Don'ts To Get Hired

Table of Contents

5 Do's to Land Your Dream Private Credit Job

Do 1: Network Strategically within the Private Credit Industry

Building a strong network is paramount in the private credit industry. It's not just about who you know, but about building genuine relationships.

- Attend Industry Events: Private credit conferences, workshops, and networking events provide invaluable opportunities to meet professionals and learn about emerging trends. Actively participate, engage in conversations, and exchange contact information. Keywords: Private Credit Networking, Private Credit Conferences.

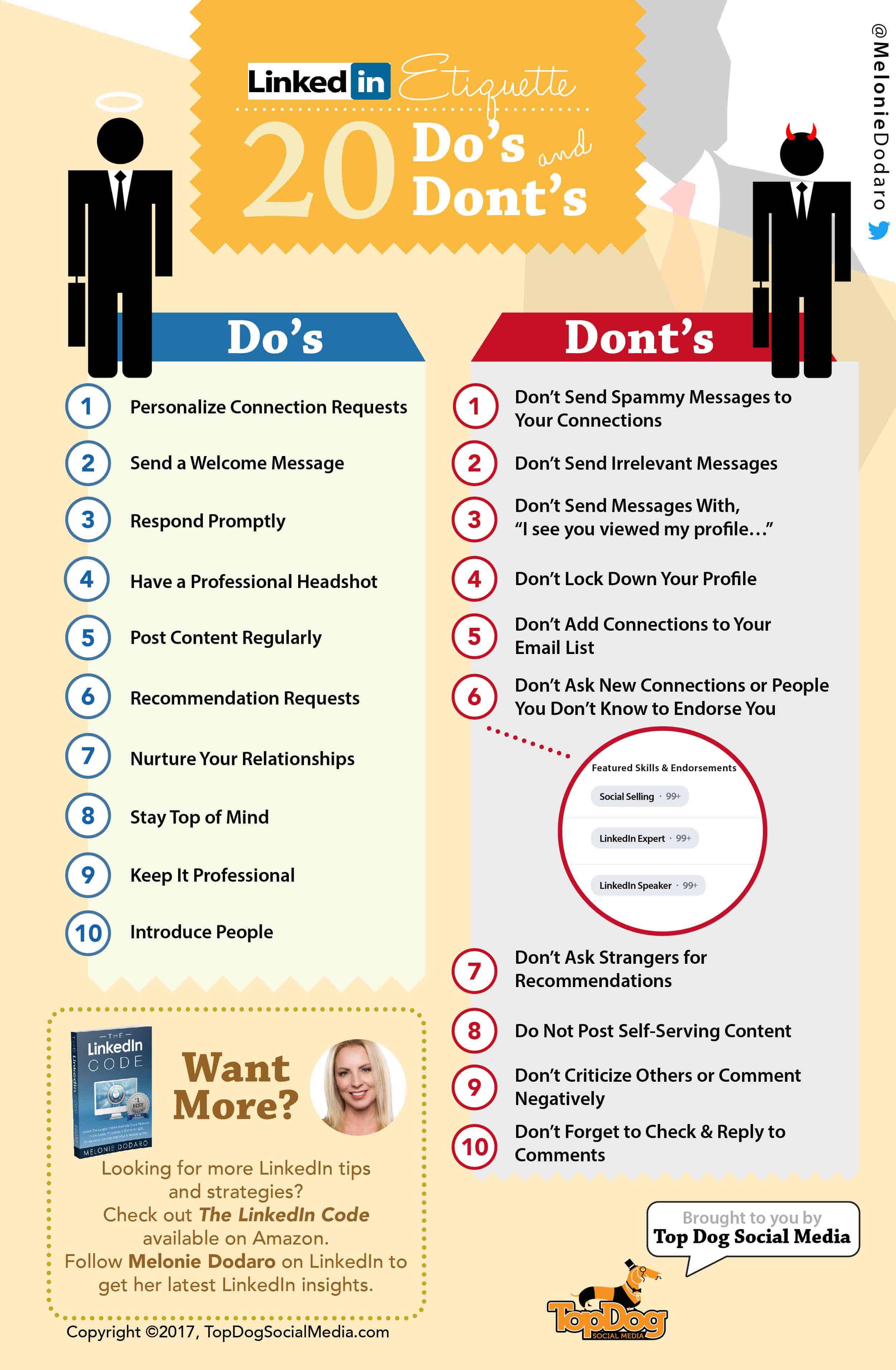

- Leverage LinkedIn: Optimize your LinkedIn profile with relevant keywords like "private credit," "credit analysis," "financial modeling," and "leveraged finance." Connect with recruiters specializing in private credit and engage with content shared by industry professionals. Keyword: LinkedIn Private Credit.

- Informational Interviews: Reach out to professionals in private credit for informational interviews. These conversations provide valuable insights into the industry, different career paths, and potential job openings. They also help you build relationships and demonstrate your genuine interest.

Do 2: Tailor Your Resume and Cover Letter to Each Private Credit Role

Generic applications rarely impress. Each application should be meticulously crafted to highlight your skills and experience relevant to the specific job description.

- Quantify Your Achievements: Instead of simply stating your responsibilities, quantify your achievements using metrics and numbers. For example, instead of saying "Managed client portfolios," say "Managed a portfolio of $50 million in assets, achieving a 15% return on investment." Keywords: Private Credit Resume, Private Credit Cover Letter.

- Incorporate Keywords: Carefully review the job description and incorporate relevant keywords into your resume and cover letter. This helps applicant tracking systems (ATS) identify your application as a potential match. Keywords: Resume Keywords, Private Credit Analyst Skills.

- Showcase Relevant Knowledge: Demonstrate your understanding of various private credit strategies, such as leveraged buyouts, mezzanine financing, and direct lending. Highlight relevant projects and experiences.

Do 3: Master the Art of the Private Credit Interview

The interview is your opportunity to showcase your personality, skills, and knowledge. Preparation is key.

- The STAR Method: Use the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral questions. This ensures a clear and concise response that highlights your skills and accomplishments. Keyword: Private Credit Interview.

- Research the Firm: Thoroughly research the firm's investment strategy, recent transactions, and team members. Demonstrating your understanding shows genuine interest and initiative.

- Technical Proficiency: Practice answering technical questions related to financial modeling, credit analysis, and valuation techniques. Keyword: Financial Modeling Interview, Credit Analysis Interview.

- Ask Insightful Questions: Asking thoughtful questions shows your engagement and genuine interest in the role and the firm.

Do 4: Showcase Your Financial Modeling and Credit Analysis Skills

Proficiency in financial modeling and credit analysis is fundamental to success in private credit.

- Excel and Software Proficiency: Develop strong skills in Excel and other financial modeling software (e.g., Bloomberg Terminal, Argus). Be prepared to demonstrate your abilities during the interview process. Keyword: Financial Modeling Skills.

- Credit Analysis Expertise: Demonstrate a solid understanding of credit analysis principles, including ratio analysis, cash flow projections, and covenant compliance. Keyword: Credit Analysis Skills.

- Highlight Projects: Highlight past projects where you successfully applied these skills, quantifying your results whenever possible.

Do 5: Continuously Develop Your Knowledge of Private Credit Markets

The private credit landscape is constantly evolving. Continuous learning is crucial for staying ahead of the curve.

- Industry Publications: Stay updated on market trends by regularly reading industry publications such as PitchBook, Bloomberg, and other relevant financial news sources. Keyword: Private Credit Market Trends.

- Webinars and Courses: Attend webinars and online courses to enhance your understanding of private credit strategies and best practices. Keyword: Private Credit Training.

- Relevant Certifications: Consider pursuing relevant certifications, such as the Chartered Financial Analyst (CFA) charter or other finance-related qualifications, to demonstrate your commitment to the field. Keyword: Private Credit Certifications.

5 Don'ts When Applying for Private Credit Jobs

Don't 1: Submit Generic Applications

Sending the same resume and cover letter to multiple firms without tailoring them to each specific role is a significant mistake. It demonstrates a lack of effort and interest.

Don't 2: Underestimate the Importance of Networking

Don't rely solely on online job applications. Actively network to increase your visibility and build relationships within the industry.

Don't 3: Lack Preparation for the Interview

Thorough preparation is crucial. Practice your answers, research the firm extensively, and anticipate potential questions.

Don't 4: Fail to Showcase Your Quantitative Skills

Emphasize your analytical and quantitative capabilities throughout your application and interview process. Private credit roles demand strong analytical abilities.

Don't 5: Neglect Continuous Learning

The private credit industry is dynamic. Continuous learning is essential to staying competitive and informed about industry trends.

Conclusion

Securing a position in the competitive field of private credit jobs requires dedication and a strategic approach. By following these five "do's" and avoiding the five "don'ts," you can significantly increase your chances of success. Remember to network effectively, tailor your application materials, master the interview process, showcase your quantitative skills, and continuously expand your knowledge of private credit markets. Don't delay; start implementing these strategies today to accelerate your journey towards your dream private credit job.

Featured Posts

-

Canadians And 10 Year Mortgages A Look At The Low Uptake

May 06, 2025

Canadians And 10 Year Mortgages A Look At The Low Uptake

May 06, 2025 -

Shotgun Cop Man A Weird And Wild Platformer Experience

May 06, 2025

Shotgun Cop Man A Weird And Wild Platformer Experience

May 06, 2025 -

Falling Profits At Westpac Wbc The Impact Of Margin Pressure

May 06, 2025

Falling Profits At Westpac Wbc The Impact Of Margin Pressure

May 06, 2025 -

Rescue Of Crypto Entrepreneurs Father Finger Severed During Ordeal

May 06, 2025

Rescue Of Crypto Entrepreneurs Father Finger Severed During Ordeal

May 06, 2025 -

Crypto Entrepreneurs Father Freed Following Kidnapping Injury

May 06, 2025

Crypto Entrepreneurs Father Freed Following Kidnapping Injury

May 06, 2025

Latest Posts

-

Seeing Patrick Schwarzeneggers Bronco In Los Angeles

May 06, 2025

Seeing Patrick Schwarzeneggers Bronco In Los Angeles

May 06, 2025 -

Budget Friendly Buys Where To Find Quality Without Compromise

May 06, 2025

Budget Friendly Buys Where To Find Quality Without Compromise

May 06, 2025 -

Patrick Schwarzenegger Denies Nepotism Details White Lotus Role

May 06, 2025

Patrick Schwarzenegger Denies Nepotism Details White Lotus Role

May 06, 2025 -

Los Angeles Style Patrick Schwarzeneggers Bronco Ride

May 06, 2025

Los Angeles Style Patrick Schwarzeneggers Bronco Ride

May 06, 2025 -

Patrick Schwarzenegger On White Lotus Addressing Nepotism Claims

May 06, 2025

Patrick Schwarzenegger On White Lotus Addressing Nepotism Claims

May 06, 2025