Private Credit Jobs: 5 Essential Do's And Don'ts

Table of Contents

Do's for Securing a Private Credit Job

Landing a coveted position in private credit requires a strategic approach. Here are some crucial "do's" to significantly enhance your chances:

Do: Network Strategically

Networking is paramount in the private credit industry. It's not just about submitting applications; it's about building relationships.

- Attend Industry Conferences: SuperReturn, IMN events, and other industry gatherings offer unparalleled networking opportunities. Connect with professionals, learn about new trends in private debt and alternative lending, and make lasting impressions.

- Master LinkedIn: Your LinkedIn profile should be a polished reflection of your skills and experience. Actively connect with recruiters specializing in private credit, investment banking, and private equity roles. Engage with industry thought leaders and participate in relevant discussions.

- Informational Interviews: Don't hesitate to reach out to people working in private credit for informational interviews. These conversations provide invaluable insights into the industry and can lead to unexpected opportunities.

- Join Professional Organizations: The CFA Institute, ACG (Association for Corporate Growth), and other similar organizations provide platforms for networking and professional development, helping you connect with individuals in private credit analyst and related positions.

Do: Master Financial Modeling

Proficiency in financial modeling is non-negotiable for private credit jobs. Your ability to build and analyze complex models will significantly influence your candidacy.

- Software Proficiency: Demonstrate expertise in Excel and financial modeling software like Argus and Bloomberg Terminal. Private debt analysis requires a deep understanding of these tools.

- Practical Experience: Practice creating financial models for leveraged buyouts (LBOs) and credit analysis. The more you practice, the more comfortable and proficient you’ll become.

- Highlight Achievements: Showcase your modeling skills in your resume and cover letter, quantifying your achievements whenever possible (e.g., "Developed a financial model that improved deal valuation accuracy by 15%").

- Interview Preparation: Be prepared to walk interviewers through your modeling process during interviews, explaining your assumptions and conclusions.

Do: Tailor Your Resume and Cover Letter

Generic applications rarely succeed. Each application should be meticulously tailored to the specific job description.

- Highlight Relevant Skills: Emphasize the skills and experience directly relevant to the job description, demonstrating a clear understanding of the role's requirements.

- Quantify Achievements: Whenever possible, quantify your accomplishments to showcase your impact (e.g., "Increased sales by 20%," "Reduced operational costs by 10%"). This demonstrates your value to potential employers.

- Keyword Optimization: Incorporate keywords from the job description into your resume and cover letter to improve your chances of getting noticed by applicant tracking systems (ATS).

- Proofreading is Crucial: Carefully proofread your documents to eliminate any errors. Typos and grammatical mistakes can create a negative impression.

Do: Prepare for Behavioral and Technical Interviews

Private credit interviews often involve both behavioral and technical questions. Thorough preparation is crucial.

- Behavioral Questions: Practice answering common behavioral interview questions like "Tell me about a time you failed," "Describe a challenging situation you overcame," and "How do you handle pressure?" Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Technical Proficiency: Review fundamental concepts of finance, accounting, and credit analysis. Be prepared to discuss your understanding of financial statements, credit ratios, and valuation methodologies.

- Case Studies: Practice case studies to demonstrate your analytical and problem-solving skills. Many private credit interviews include case study questions related to deal evaluation or credit risk assessment.

- Company Research: Thoroughly research the company and the interviewer before the interview. Demonstrate your knowledge and genuine interest.

Do: Showcase Your Passion for Private Credit

Genuine enthusiasm for the industry goes a long way.

- Demonstrate Interest: Express your passion for private credit and alternative lending during interviews. Show that you've researched the market and understand the current trends.

- Stay Updated: Stay current on industry news and market trends. This demonstrates your commitment and proactive nature.

- Highlight Relevant Experience: Highlight any relevant coursework, projects, or volunteer experiences that showcase your interest and skills.

- Show Initiative: Demonstrate initiative and a proactive approach to learning and problem-solving.

Don'ts for a Successful Private Credit Job Search

Avoiding these common pitfalls will significantly improve your chances of landing your dream job.

Don't: Neglect Networking

Networking is not optional; it's essential.

- Don't Underestimate Its Power: Don't rely solely on online applications. Actively reach out to individuals in the industry and attend networking events.

- Don't Be Passive: Don't just apply online; actively seek out opportunities and make connections.

Don't: Underestimate the Importance of Technical Skills

Financial modeling and analytical skills are critical.

- Don't Overlook Modeling: Don't underestimate the importance of strong financial modeling abilities. Practice relentlessly to master these skills.

- Don't Misrepresent Yourself: Don't claim expertise if you lack the necessary skills. Honesty and a willingness to learn are valued traits.

Don't: Submit Generic Applications

Each application should be tailored to the specific job and company.

- Don't Use Template Applications: Don't send the same resume and cover letter to every firm. Each application should be customized to reflect the specific requirements of the job and company.

- Don't Ignore Instructions: Carefully read and follow all application instructions and deadlines.

Don't: Underprepare for Interviews

Preparation is key to a successful interview.

- Don't Go Unprepared: Don't go into an interview without having thoroughly researched the company and the specific role.

- Don't Lack Detail: Don't be unprepared to discuss your experience and skills in detail, providing specific examples.

Don't: Appear Unenthusiastic or Uninformed

Show genuine interest and knowledge.

- Don't Show Disinterest: Don't show disinterest in the industry or the specific firm. Demonstrate your passion and eagerness to learn.

- Don't Lack Knowledge: Don't lack knowledge about current events or market trends in private debt, alternative lending, and the broader financial landscape.

Conclusion

Securing a private credit job requires a multifaceted approach. By diligently following these do's and avoiding the don'ts, you can significantly increase your chances of success. Remember, networking strategically, mastering financial modeling, tailoring your applications, preparing thoroughly for interviews, and showcasing your passion are crucial elements in your job search. Start your successful private credit job search today! Further resources on private credit and career development in the finance sector can help you build your expertise and expand your network.

Featured Posts

-

Gender Reveal Peppa Pigs Parents Announce The Sex Of Their Baby

May 22, 2025

Gender Reveal Peppa Pigs Parents Announce The Sex Of Their Baby

May 22, 2025 -

Open Ais Texas Data Center Secures 11 6 Billion In Exclusive Funding

May 22, 2025

Open Ais Texas Data Center Secures 11 6 Billion In Exclusive Funding

May 22, 2025 -

Explore Provence On Foot A Self Guided Itinerary From Mountains To Mediterranean

May 22, 2025

Explore Provence On Foot A Self Guided Itinerary From Mountains To Mediterranean

May 22, 2025 -

Restauration Du Patrimoine Breton Plouzane Et Clisson Beneficient De La Mission Patrimoine 2025

May 22, 2025

Restauration Du Patrimoine Breton Plouzane Et Clisson Beneficient De La Mission Patrimoine 2025

May 22, 2025 -

Money For Streamers Confusion For Viewers Navigating The New Streaming Economy

May 22, 2025

Money For Streamers Confusion For Viewers Navigating The New Streaming Economy

May 22, 2025

Latest Posts

-

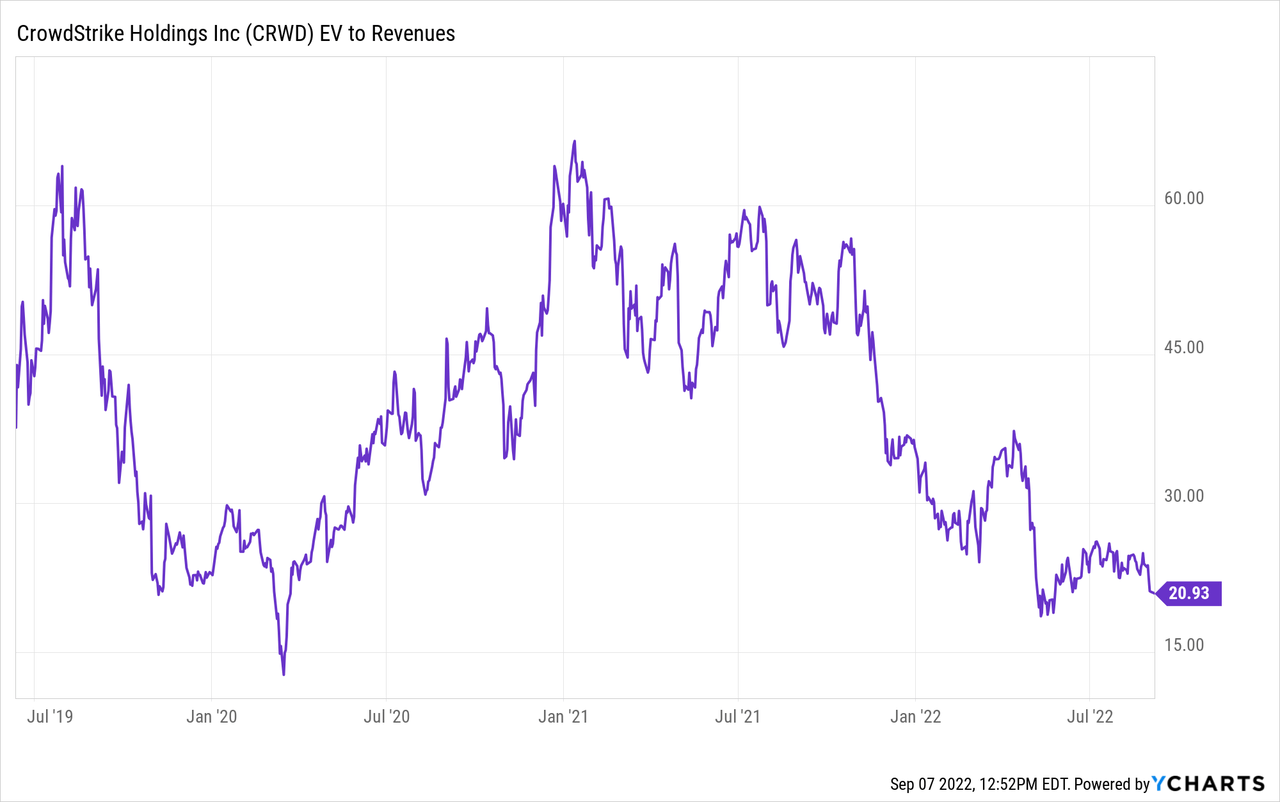

Core Weave Inc Crwv Tuesdays Stock Market Performance Explained

May 22, 2025

Core Weave Inc Crwv Tuesdays Stock Market Performance Explained

May 22, 2025 -

Why Did Core Weave Inc Crwv Stock Price Increase On Tuesday

May 22, 2025

Why Did Core Weave Inc Crwv Stock Price Increase On Tuesday

May 22, 2025 -

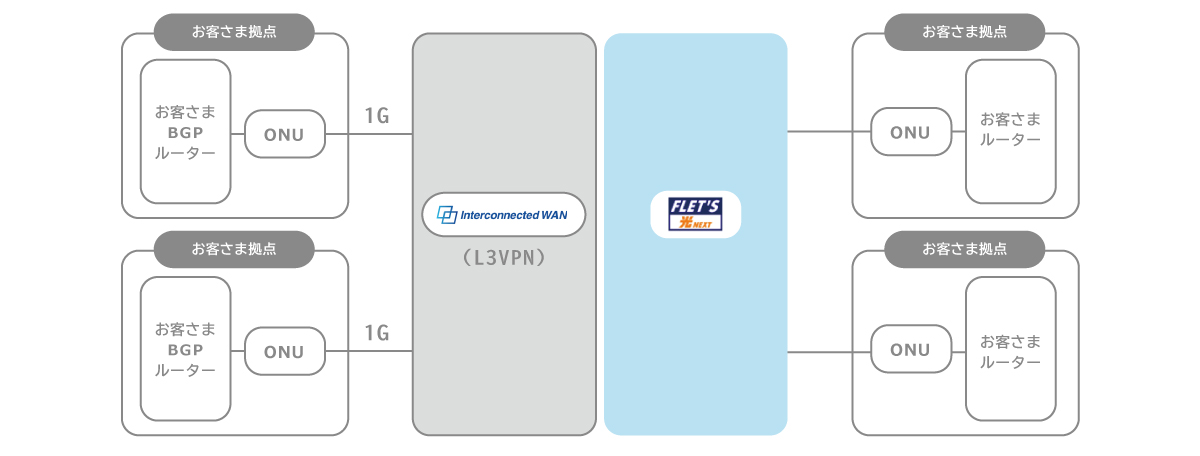

Ascii Jp Multi Interconnect Ntt At Be X

May 22, 2025

Ascii Jp Multi Interconnect Ntt At Be X

May 22, 2025 -

Understanding Core Weaves Crwv Tuesday Stock Increase

May 22, 2025

Understanding Core Weaves Crwv Tuesday Stock Increase

May 22, 2025 -

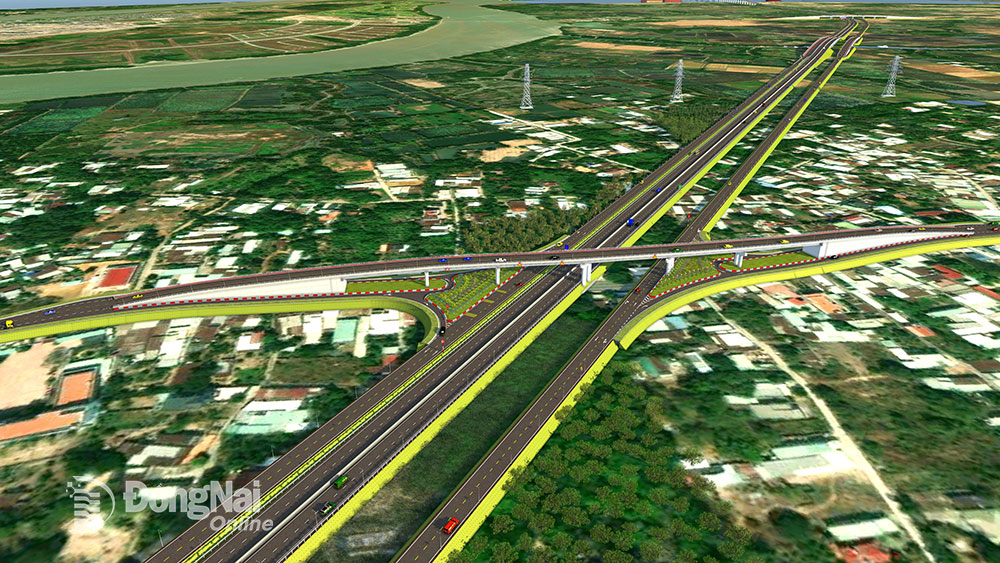

Thong Xe Cao Toc Dong Nai Vung Tau Chuan Bi Don Lan Song Du Lich Moi

May 22, 2025

Thong Xe Cao Toc Dong Nai Vung Tau Chuan Bi Don Lan Song Du Lich Moi

May 22, 2025