Understanding CoreWeave's (CRWV) Tuesday Stock Increase

Table of Contents

Potential Catalysts for the CRWV Stock Increase

Several factors could have contributed to CoreWeave's (CRWV) impressive stock price increase on Tuesday. Let's delve into the most likely possibilities:

Positive Financial News

Positive financial news often directly impacts a company's stock price. While specific figures may not be publicly available immediately following a market surge, we should look for:

- Strong Earnings Reports: A recent release of better-than-expected earnings reports, showcasing increased revenue and improved profit margins, could significantly boost investor confidence. Look for press releases and SEC filings for confirmation.

- Upbeat Revenue Projections: Forward-looking statements from CoreWeave regarding future revenue projections could also influence investor sentiment. Ambitious, yet realistic, predictions for growth can drive stock prices upward.

- Strategic Partnerships: Announcing a major partnership with a significant player in the cloud computing or AI industry could signal increased market share and future revenue streams. These collaborations often lead to positive stock market reactions. For example, a partnership with a large enterprise needing significant AI infrastructure could be a major catalyst.

We recommend checking reputable financial news sources for the latest financial reports and announcements related to CRWV.

Industry Trends: The Booming Cloud and AI Markets

The surge in CRWV's stock price may also reflect the broader positive trends in the cloud computing and artificial intelligence markets.

- Soaring Demand for AI Infrastructure: The growing demand for AI infrastructure is a major tailwind for companies like CoreWeave. The increasing adoption of AI across various sectors fuels the need for powerful and scalable cloud computing resources.

- Industry Reports and Developments: Positive industry reports highlighting the growth potential of cloud computing and AI infrastructure can bolster investor confidence in companies operating in this space. Major market research firms often publish reports that can provide valuable insights.

- Increased Adoption of GPUs: CoreWeave's specialization in GPU-powered cloud computing is particularly relevant in the context of AI's growing needs. The increased demand for GPUs for AI model training and inference directly benefits CoreWeave's business.

Analyst Upgrades and Price Target Adjustments

Positive assessments from financial analysts can significantly impact a company's stock price.

- Upgraded Ratings: If leading financial analysts upgraded their ratings for CRWV, it could indicate a more bullish outlook on the company's future performance. Look for analyst reports from reputable firms.

- Increased Price Targets: Higher price targets set by analysts signal their belief in the company's potential for future growth. This increased optimism often translates into increased investor demand.

It's crucial to review reports from multiple analysts to get a balanced perspective.

Market Sentiment and Speculation

Broader market trends and investor sentiment play a role in individual stock prices.

- Tech Stock Rally: A general positive sentiment towards technology stocks could lift the CRWV stock price, regardless of specific company-related news. Positive market sentiment often leads to increased investment in the tech sector.

- Macroeconomic Factors: Favorable macroeconomic conditions, such as lower interest rates or increased investor confidence, can create a more positive environment for tech stocks. Conversely, negative macroeconomic news could impact investor behavior.

- News Events: Positive news unrelated to CoreWeave but impacting the broader tech sector or AI development can trigger a ripple effect, boosting CRWV's stock price.

Analyzing CoreWeave's (CRWV) Competitive Advantage

CoreWeave's success isn't just a matter of market timing; it stems from its competitive advantages:

Technological Innovation

- GPU-optimized infrastructure: CoreWeave's focus on providing high-performance GPU-powered cloud computing services offers a distinct advantage in the rapidly growing AI market.

- Proprietary Technology: Any proprietary technology that enhances efficiency, scalability, or performance gives CoreWeave an edge over competitors.

- Competitive Benchmarking: Comparing CoreWeave's technology and services against its major competitors (e.g., AWS, Google Cloud, Azure) helps understand its unique strengths.

Strategic Partnerships

Strategic partnerships can accelerate growth and enhance a company's market position.

- Key Collaborations: Identifying CoreWeave's key partnerships and the benefits of these collaborations can shed light on its growth trajectory.

- Synergistic Relationships: Partnerships that lead to synergistic relationships, where the combined strengths of the partners create greater value, are especially beneficial.

Sustainable Growth Potential

CoreWeave's long-term prospects depend on its ability to adapt and grow within the dynamic cloud and AI markets.

- Market Share Estimates: Analyzing CoreWeave's potential market share in the growing cloud and AI markets is key to understanding its future growth potential.

- Scalability and Adaptability: The company's ability to scale its infrastructure and adapt to evolving market demands is a critical factor in determining its long-term sustainability.

Conclusion: Understanding and Investing in CoreWeave's (CRWV) Future

CoreWeave's (CRWV) Tuesday stock increase likely resulted from a confluence of factors: positive financial news, favorable industry trends, analyst upgrades, and broader market sentiment. Understanding these dynamics is crucial for any investor considering a position in CRWV. While the potential for growth is significant, it's essential to acknowledge inherent risks in the stock market. Remember to conduct thorough due diligence and research before making any investment decisions. Stay informed about CoreWeave's stock, monitor the CRWV price, and learn more about CoreWeave's future growth potential through reputable financial sources and analyst reports to make informed investment choices.

Featured Posts

-

Arunas Unexpected Loss At Wtt Chennai Open

May 22, 2025

Arunas Unexpected Loss At Wtt Chennai Open

May 22, 2025 -

Exclusive Examining Taylor Swift And Blake Livelys Stance On The It Ends With Us Legal Battle

May 22, 2025

Exclusive Examining Taylor Swift And Blake Livelys Stance On The It Ends With Us Legal Battle

May 22, 2025 -

Record Breaking 19 Indian Paddlers Compete In Wtt Star Contender Chennai

May 22, 2025

Record Breaking 19 Indian Paddlers Compete In Wtt Star Contender Chennai

May 22, 2025 -

Shooting Investigation In Lancaster County Pa Details Emerge

May 22, 2025

Shooting Investigation In Lancaster County Pa Details Emerge

May 22, 2025 -

Yevrokomisar Pro Golovnu Pereshkodu Dlya Vstupu Ukrayini Do Nato

May 22, 2025

Yevrokomisar Pro Golovnu Pereshkodu Dlya Vstupu Ukrayini Do Nato

May 22, 2025

Latest Posts

-

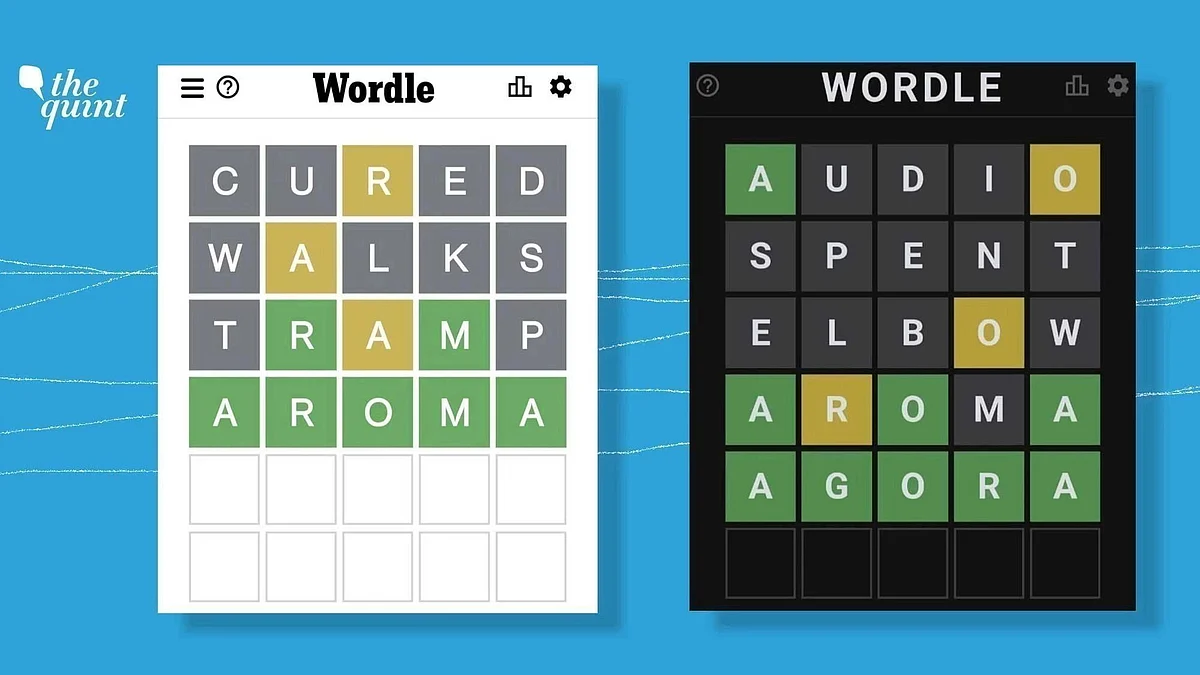

Nyt Wordle Help And Hints For March 18th Puzzle 1368

May 22, 2025

Nyt Wordle Help And Hints For March 18th Puzzle 1368

May 22, 2025 -

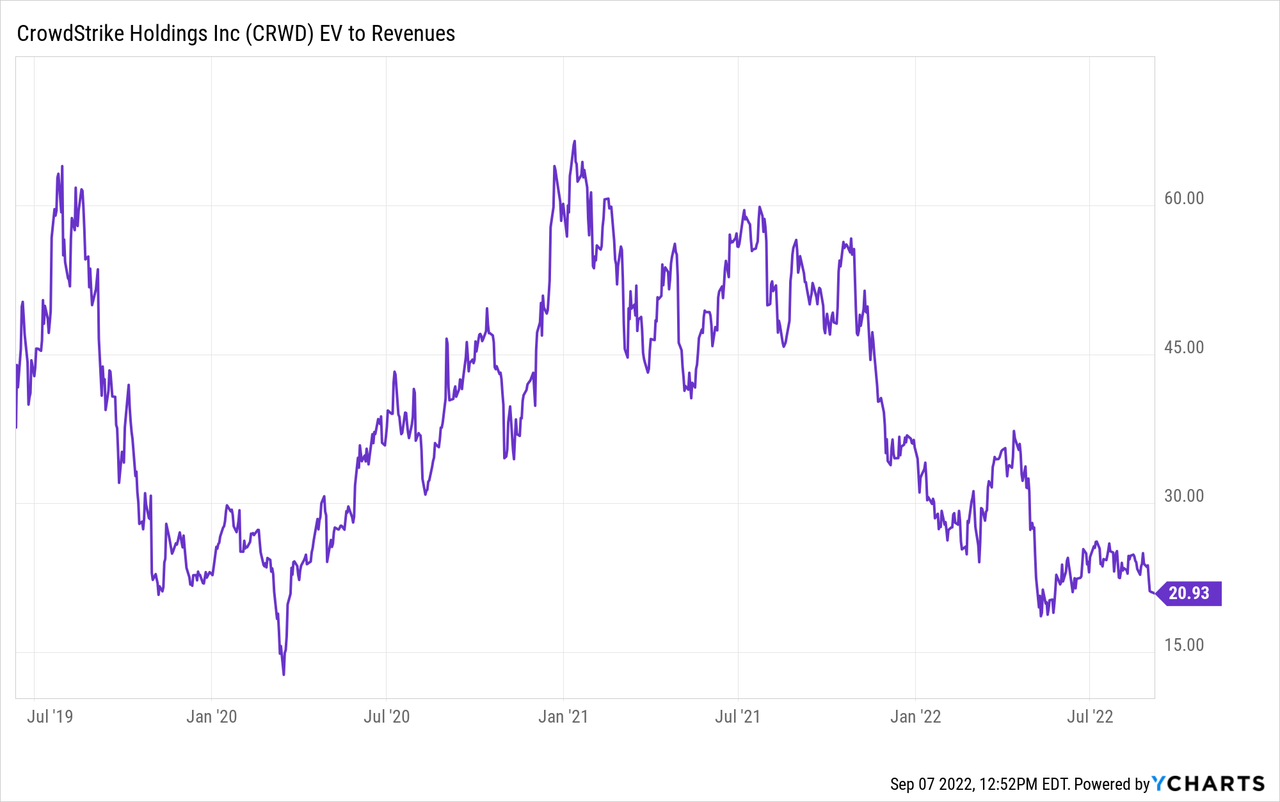

Nearly 20 Cents Higher The Current State Of Gas Prices

May 22, 2025

Nearly 20 Cents Higher The Current State Of Gas Prices

May 22, 2025 -

Understanding The 20 Cent Increase In Average Gas Prices

May 22, 2025

Understanding The 20 Cent Increase In Average Gas Prices

May 22, 2025 -

Wordle 367 Solution Hints And Clues For Monday March 17

May 22, 2025

Wordle 367 Solution Hints And Clues For Monday March 17

May 22, 2025 -

Recent Gas Price Jump A 20 Cent Increase Nationwide

May 22, 2025

Recent Gas Price Jump A 20 Cent Increase Nationwide

May 22, 2025