Public Scrutiny Of Thames Water Executive Compensation

Table of Contents

The Scale of Thames Water Executive Compensation

Unveiling the Figures

Precise figures regarding individual Thames Water executive compensation packages are often difficult to obtain due to the complexities of disclosure requirements and the company's private ownership structure. However, reports and leaked information suggest that the CEO and other senior executives receive salaries and bonuses significantly exceeding industry averages for similarly sized companies. For example, while precise numbers vary depending on the year and reporting source, some estimates place the CEO's total compensation package in the millions of pounds annually. These figures should be compared against publicly available data from other major UK water companies and similar-sized businesses in different sectors, revealing a considerable disparity. Sources should include official company statements (where available), reports from investigative journalists, and analyses from financial news outlets.

- Comparison of CEO pay to average UK worker salary: A stark contrast needs highlighting to emphasize the scale of inequality.

- Breakdown of compensation packages (base salary, bonuses, stock options, benefits): Detailed information, if available, will show the structure of the pay.

- Historical trends in executive pay at Thames Water: Tracking changes over time can reveal patterns and potentially explain the escalation.

Analyzing the sheer magnitude of this compensation, especially considering Thames Water's performance record, highlights a significant disconnect between executive reward and public service delivery. The disparity raises fundamental questions about fairness, accountability, and the allocation of resources within the company.

Performance Metrics and Justifications for High Pay

Analyzing Thames Water's Performance

Thames Water's performance needs careful scrutiny to determine if the high executive pay is justified. Key performance indicators (KPIs) crucial to this evaluation include:

- Water quality and environmental performance: The number of sewage discharges into the River Thames is a crucial metric, as are indicators of overall water quality.

- Customer satisfaction ratings: Public perception and customer experience provide vital feedback on Thames Water's operational efficiency.

- Financial performance (profitability, debt levels): Profitability needs to be considered alongside the level of debt, particularly given the significant investment needs in upgrading aging infrastructure.

- Investment in infrastructure upgrades: Assessing the level of investment compared to the company's profits and the age of the infrastructure is crucial.

The question is whether these performance indicators support the level of executive compensation. The use of bonuses linked to financial performance, without adequately incorporating environmental performance and customer satisfaction, raises concerns about prioritizing short-term financial gains over long-term sustainability and public service. A critical evaluation of the metrics used to determine bonuses is needed to establish if they fairly reflect overall company performance.

Public Backlash and Regulatory Responses

Public Outrage and Media Coverage

The revelation of Thames Water executive salaries has caused widespread public outrage. Media coverage, including news articles, opinion pieces, and social media discussions, has amplified this sentiment.

- Social media sentiment analysis: Analyzing social media posts to gauge public opinion.

- Examples of news articles and opinion pieces: Quoting specific articles highlighting public anger.

- Public petitions and campaigns: Highlighting the scale of organized opposition.

This public reaction underscores the growing dissatisfaction with the perceived disconnect between executive rewards and company performance, particularly in relation to environmental responsibility.

Regulatory Scrutiny and Potential Reforms

Ofwat, the water regulator, plays a significant role in overseeing Thames Water and other water companies.

- Ofwat's stance on executive pay in the water industry: Determining the regulator's official position and actions.

- Potential for stricter regulations on executive compensation: Exploring possibilities for increased regulatory control.

- Government intervention and policy changes: Analyzing government responses and potential policy changes.

The public outcry and the potential for regulatory changes highlight the need for increased transparency and accountability in executive compensation within the water industry. This scrutiny could lead to stricter regulations, potentially limiting the scale of future executive pay packages.

Shareholder Activism and Corporate Governance

Role of Shareholders

Shareholders wield considerable power in influencing executive compensation.

- Shareholder voting on executive pay packages: Analyzing shareholder voting patterns on executive remuneration.

- Influence of institutional investors: Assessing the role of large institutional investors in shaping compensation policies.

- Activist shareholder campaigns: Identifying and highlighting instances of shareholder activism aimed at curbing excessive executive pay.

The effectiveness of current corporate governance structures in controlling executive compensation requires examination. Greater shareholder activism and more robust regulatory oversight are needed to ensure alignment between executive pay and company performance, and public expectations.

Conclusion

The public scrutiny of Thames Water executive compensation highlights significant discrepancies between executive pay and company performance, specifically concerning environmental responsibility and customer service. The public backlash, media coverage, and potential regulatory responses all underscore the urgent need for greater transparency and accountability in the water industry. The role of shareholder activism in influencing future executive pay packages is also crucial. Further investigation and regulatory reform are vital to ensure fairer compensation practices and prevent similar controversies from recurring. Continue to engage in the debate surrounding Thames Water executive compensation and demand greater transparency and accountability from the water industry.

Featured Posts

-

Canada Posts Last Minute Offer Before Potential Strike

May 24, 2025

Canada Posts Last Minute Offer Before Potential Strike

May 24, 2025 -

En Zeki Burclar Dahilik Genleri Ve Akil Yetenekleri

May 24, 2025

En Zeki Burclar Dahilik Genleri Ve Akil Yetenekleri

May 24, 2025 -

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 24, 2025

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 24, 2025 -

130 Years After Dreyfus Affair French Parliament Debates Posthumous Promotion

May 24, 2025

130 Years After Dreyfus Affair French Parliament Debates Posthumous Promotion

May 24, 2025 -

Financing Your Escape To The Country Practical Financial Planning

May 24, 2025

Financing Your Escape To The Country Practical Financial Planning

May 24, 2025

Latest Posts

-

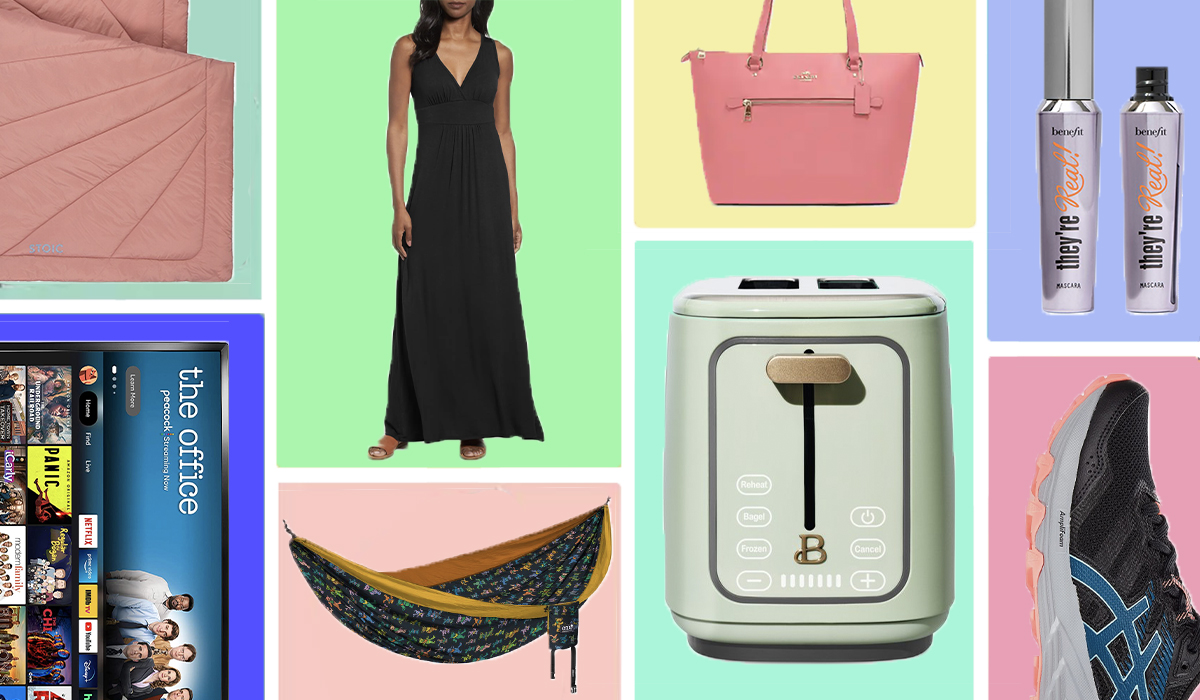

Your Guide To The Top Memorial Day Sales And Deals In 2025

May 24, 2025

Your Guide To The Top Memorial Day Sales And Deals In 2025

May 24, 2025 -

Where To Find The Best Memorial Day Sales And Deals In 2025

May 24, 2025

Where To Find The Best Memorial Day Sales And Deals In 2025

May 24, 2025 -

2025 Memorial Day Find The Best Sales And Deals Here

May 24, 2025

2025 Memorial Day Find The Best Sales And Deals Here

May 24, 2025 -

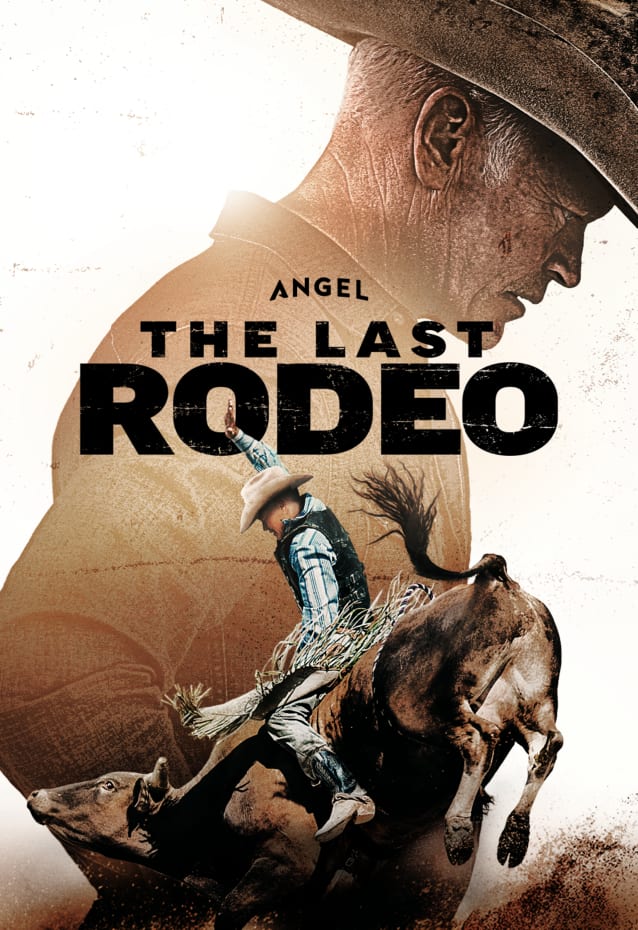

Neal Mc Donough And The Last Rodeo A Western Showdown

May 24, 2025

Neal Mc Donough And The Last Rodeo A Western Showdown

May 24, 2025 -

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025