Financing Your Escape To The Country: Practical Financial Planning

Table of Contents

Assessing Your Finances for a Country Escape

Before even starting your search for that perfect country property, a thorough financial assessment is paramount. This isn't just about checking your bank balance; it's about understanding your entire financial picture and realistically projecting your future expenses. Budgeting for a country move differs significantly from urban living.

- Calculate your current net worth: This includes all assets (savings, investments, property) minus your liabilities (debts, loans). A clear picture of your net worth establishes your financial foundation.

- Create a detailed budget: Your current city budget won't suffice. Project your future expenses in the country, accounting for potential increases in various areas.

- Account for higher transportation costs: Rural living often means longer distances to amenities, resulting in increased fuel costs and potentially the need for a second vehicle.

- Factor in home maintenance: Rural properties often require more maintenance than city homes. Budget for repairs, renovations, and potential unexpected costs. Older properties will require higher maintenance budgets.

- Consider reduced access to services: Services like high-speed internet, healthcare, and shopping might be less readily available or more expensive in rural areas.

- Determine affordability: Based on your net worth, budget, and potential income in your new location, determine a realistic budget for property purchase and related costs. This includes not only the purchase price but also closing costs and ongoing expenses.

- Establish a savings plan: Aim to accumulate a substantial down payment to secure favorable mortgage terms and demonstrate financial stability to lenders. The larger your down payment, the better your loan options will be.

Exploring Financing Options for Rural Properties

Securing financing for a rural property can differ from financing a city home. Lenders often have stricter requirements or less experience with rural properties. Understanding the available options is vital.

- Conventional Mortgages: These are standard mortgages offered by banks and credit unions. However, securing a conventional mortgage for a rural property might present challenges due to appraisal complexities or perceived higher risks. Interest rates may also vary depending on the location and property type. Strong credit and a substantial down payment are usually crucial for approval.

- Rural Development Loans (USDA): The USDA offers various loan programs designed to assist individuals in purchasing rural properties. These programs often have more lenient eligibility requirements and lower down payment needs than conventional mortgages, making them an attractive option for many seeking a country escape. Understanding the eligibility criteria (income limits, property location) is vital.

- Farm Loans: If your rural property involves agricultural land or farming operations, farm loans might be an appropriate financing option. These loans are tailored to agricultural purposes and often have specific requirements regarding the use of the property.

- Seller Financing: In some cases, the seller might offer financing directly. This can be advantageous, especially in competitive rural markets, but carefully review the terms and interest rates before committing.

- Private Lending: Consider alternative lending options, like private lenders. These options might be more flexible but typically come with higher interest rates.

Understanding Closing Costs and Additional Expenses

Beyond the purchase price, several costs contribute to the overall expense of acquiring a rural property. Budgeting for these "hidden costs" is critical to avoid financial strain after moving.

- Appraisal fees: Professional appraisal to determine the property's market value.

- Inspection fees: Thorough property inspection to identify potential issues.

- Title insurance: Protects against title defects or claims against the property.

- Closing costs: Legal fees, transfer taxes, recording fees, etc. These can be substantial, so factoring them into your budget early is crucial.

- Property taxes: Property taxes in rural areas can vary significantly. Research the tax rates for your target location.

- Homeowners insurance: Insurance rates may be affected by factors like distance from fire stations or the property's age and condition.

- Moving expenses: Relocating to a rural area often involves higher moving costs due to increased distances and potentially specialized transportation needs.

Seeking Professional Financial Advice

Navigating the financial aspects of a country escape can be complex. Engaging financial and real estate professionals experienced with rural properties is invaluable.

- Financial advisor: A financial advisor can help create a personalized financial plan tailored to your specific circumstances, ensuring you're financially prepared for the transition.

- Mortgage broker: A mortgage broker specializing in rural properties can help you navigate the complexities of securing financing, comparing options, and finding the best rates.

- Real estate agent: An experienced real estate agent familiar with the rural market can provide guidance on property selection and negotiations, enhancing your chances of finding the perfect property within your budget.

Conclusion

Financing your escape to the country requires careful planning and a thorough understanding of the associated costs and financing options. By meticulously assessing your finances, exploring suitable financing options like USDA loans or conventional mortgages, budgeting for all associated expenses including closing costs and ongoing maintenance, and seeking professional guidance, you can pave the way for a successful and stress-free transition to your dream rural lifestyle. Start planning your financing your escape to the country today! Don't let your dreams of rural living remain a fantasy. Take the first step towards securing your future in the countryside by thoroughly researching financing options and seeking professional guidance. Start your journey to country living financial planning now!

Featured Posts

-

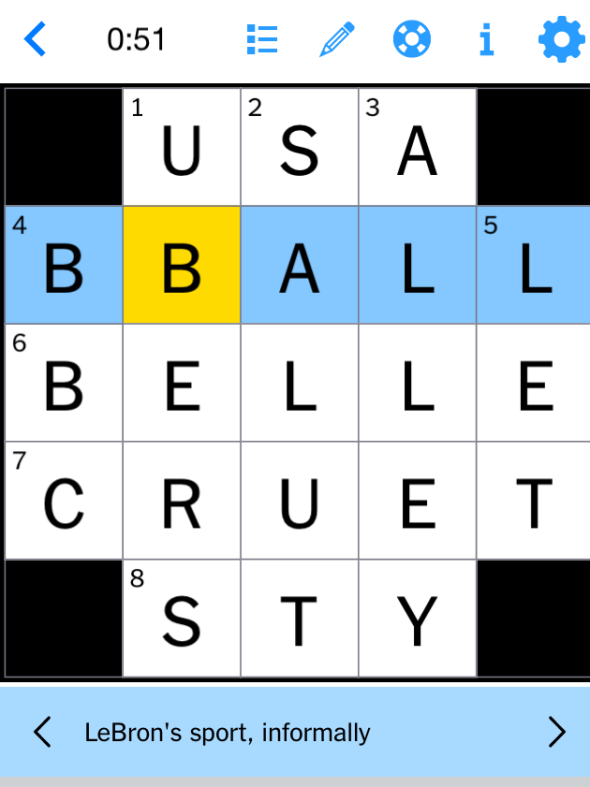

Nyt Mini Crossword March 26 2025 Hints To Help You Solve

May 24, 2025

Nyt Mini Crossword March 26 2025 Hints To Help You Solve

May 24, 2025 -

Amsterdam Exchange Index Down Over 4 Reaching 1 Year Low

May 24, 2025

Amsterdam Exchange Index Down Over 4 Reaching 1 Year Low

May 24, 2025 -

Essen Aktuelles Und Beruehrendes Rund Um Das Uniklinikum

May 24, 2025

Essen Aktuelles Und Beruehrendes Rund Um Das Uniklinikum

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 24, 2025 -

The Demna Gvasalia Effect Reshaping Guccis Brand Identity

May 24, 2025

The Demna Gvasalia Effect Reshaping Guccis Brand Identity

May 24, 2025

Latest Posts

-

Analysts Bold Prediction Apple Stock To Reach 254 Investment Advice

May 24, 2025

Analysts Bold Prediction Apple Stock To Reach 254 Investment Advice

May 24, 2025 -

Actress Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation Policy

May 24, 2025

Actress Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation Policy

May 24, 2025 -

Apple Stock Price Prediction Reaching 254 A Realistic Outlook

May 24, 2025

Apple Stock Price Prediction Reaching 254 A Realistic Outlook

May 24, 2025 -

Reputation Ruin 17 Celebrity Implosions

May 24, 2025

Reputation Ruin 17 Celebrity Implosions

May 24, 2025 -

The Downfall 17 Celebrities Who Lost Everything Instantly

May 24, 2025

The Downfall 17 Celebrities Who Lost Everything Instantly

May 24, 2025