Public Sector Pensions: A Costly Gamble For Taxpayers

Table of Contents

The Growing Burden of Public Sector Pension Liabilities

The sheer scale of unfunded liabilities in public sector pension schemes poses a considerable threat to fiscal stability worldwide. This section details the key factors driving the escalating costs.

Unfunded Liabilities: A Ticking Time Bomb

Unfunded liabilities represent the difference between the promised pension benefits and the assets available to pay them. This shortfall necessitates increased government contributions or benefit cuts in the future, ultimately impacting taxpayers. Several countries are facing enormous challenges:

- United States: Many states grapple with significant unfunded liabilities in their public employee retirement systems, leading to ongoing debates over pension reform.

- United Kingdom: The UK's public sector pension system faces substantial unfunded liabilities, requiring ongoing contributions from taxpayers to meet its obligations.

- Japan: Japan's aging population and generous public pension benefits contribute to a growing unfunded liability burden.

The projected growth of these liabilities is alarming, with many experts predicting substantial increases in the coming decades, placing immense pressure on national budgets and potentially crowding out essential public spending.

Increasing Life Expectancy: Living Longer, Costing More

Increased life expectancy significantly contributes to the escalating costs of public sector pensions. People are living longer, meaning they receive pension payments for an extended period.

- Global Trend: Life expectancy is rising globally, with significant implications for pension systems designed decades ago with lower life expectancy in mind.

- Impact on Payments: Longer lifespans translate directly into higher lifetime pension payouts, increasing the overall financial burden on taxpayers.

- Benefit Adjustments: Adjusting benefit structures to account for increased longevity is a complex challenge, requiring careful consideration of affordability and fairness.

Generous Benefit Packages: A Comparison

Many public sector pension schemes offer generous benefits compared to the private sector, further exacerbating the cost problem.

- Early Retirement: The availability of early retirement options in public sector schemes often leads to increased payout periods and higher overall costs.

- Final Salary Schemes: Defined benefit, or final salary, schemes guarantee a pension based on final salary, potentially leading to higher payouts than defined contribution schemes common in the private sector.

- Cost Implications: The combination of early retirement and final salary schemes creates a significant strain on public finances, making public sector pensions a costly proposition for taxpayers.

The Impact on Taxpayers

The burgeoning costs of public sector pensions have wide-ranging and serious implications for taxpayers.

Increased Tax Burden: Paying the Price

Public sector pension costs directly translate into higher taxes for citizens. This increased tax burden can affect various income groups and potentially hinder economic growth.

- Tax Increases: Many jurisdictions have witnessed tax increases directly attributable to the need to fund growing pension liabilities.

- Economic Effects: Higher taxes can stifle economic activity, reducing investment and potentially impacting job creation.

- Income Inequality: The impact of increased taxes can disproportionately affect lower and middle-income households.

Reduced Public Spending: Fewer Resources for Essential Services

The substantial resources allocated to public sector pensions often come at the expense of other essential public services.

- Healthcare Cuts: Funding for healthcare, education, and infrastructure may be reduced to accommodate rising pension costs.

- Social Impact: Cuts to essential services can negatively impact the quality of life for citizens and hinder social and economic progress.

- Long-Term Consequences: Chronic underfunding of public services can lead to long-term societal challenges and diminished economic competitiveness.

Economic Instability: A Looming Threat

The accumulation of large unfunded liabilities in public sector pension systems poses a significant risk to economic stability.

- Sovereign Debt Crises: Unsustainable pension obligations can contribute to sovereign debt crises, as seen in some European countries.

- Credit Rating Downgrades: High levels of public sector pension liabilities can lead to credit rating downgrades, making it more expensive for governments to borrow money.

- Investment Impacts: Concerns over public debt and pension liabilities can deter investment, hampering economic growth.

Potential Solutions and Reforms

Addressing the challenges posed by public sector pensions requires a multifaceted approach involving reform and greater transparency.

Pension Reform Strategies: Finding a Sustainable Path

Several strategies can help mitigate the escalating costs of public sector pensions.

- Raising Retirement Ages: Gradually increasing the retirement age can reduce the period for which pension payments are made.

- Reducing Benefit Levels: Adjusting benefit levels, potentially through a phased approach, can help control costs.

- Defined Contribution Schemes: Transitioning from defined benefit to defined contribution schemes can shift some of the risk from taxpayers to public sector employees.

- International Examples: Examining pension reforms implemented successfully in other countries can offer valuable insights and lessons learned.

Increased Transparency and Accountability: A Necessary Step

Greater transparency and accountability in managing public sector pensions are crucial for building public trust and ensuring responsible stewardship of public funds.

- Independent Audits: Regular independent audits can ensure the accuracy and reliability of pension accounting.

- Public Access to Data: Making pension data publicly available fosters greater transparency and allows for public scrutiny.

- Improved Governance: Strengthening governance structures and oversight mechanisms can help prevent mismanagement and ensure responsible resource allocation.

Conclusion

The substantial and growing cost of public sector pensions represents a significant challenge for taxpayers worldwide. The impact on national budgets, essential public services, and overall economic stability cannot be ignored. Reforms are urgently needed to ensure the long-term financial health of nations. We must demand greater accountability from our governments regarding the management of public sector retirement systems and advocate for necessary reforms, such as those outlined above, to ensure a sustainable future. Contact your elected officials, share this article, and help make your voice heard on this critical issue affecting government pensions and the financial well-being of our nations. Let's work together to address the unsustainable burden of pension liabilities before it's too late.

Featured Posts

-

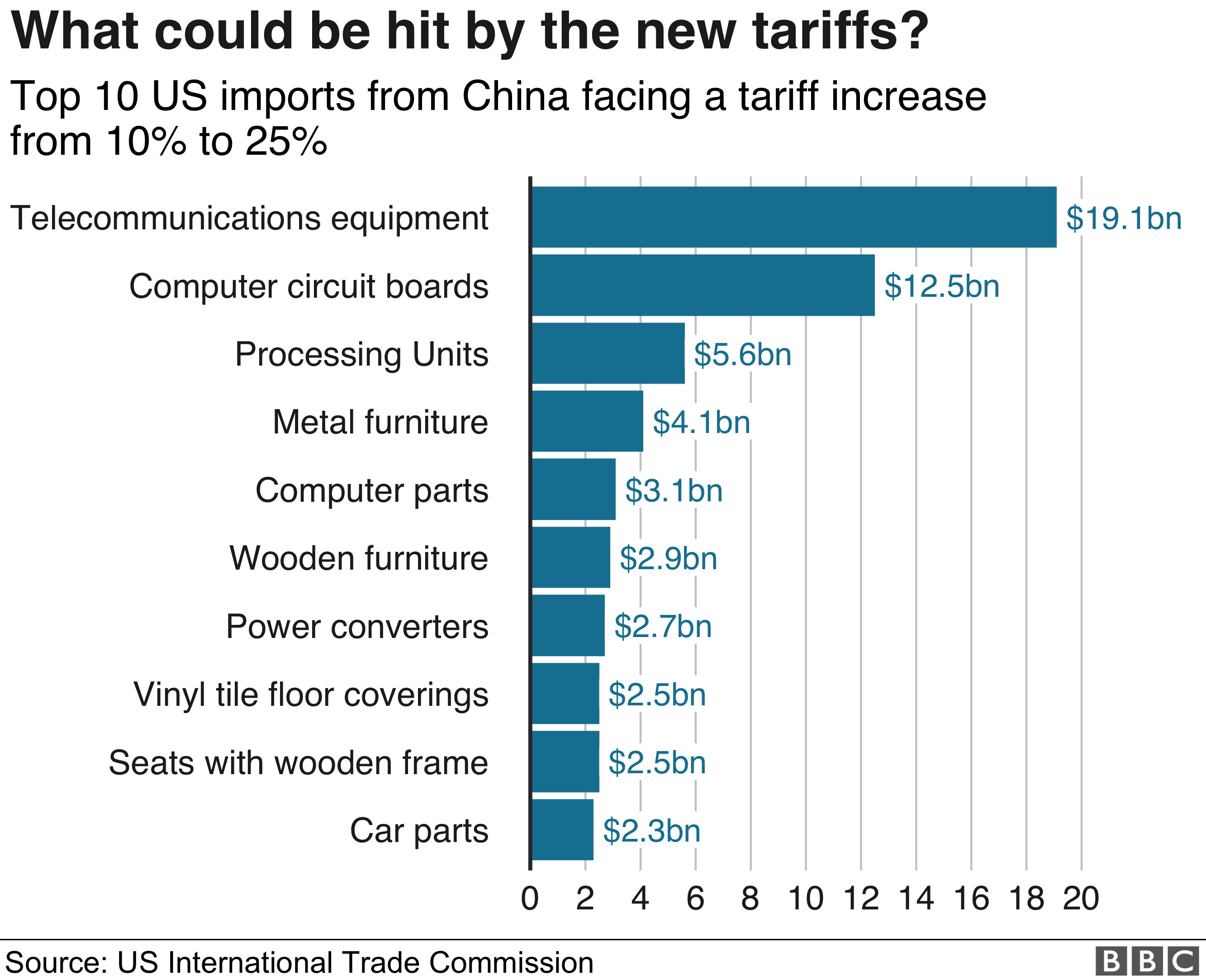

The Economic Impact Of Trumps China Tariffs A Deep Dive Into Inflation And Supply Chain Disruptions

Apr 29, 2025

The Economic Impact Of Trumps China Tariffs A Deep Dive Into Inflation And Supply Chain Disruptions

Apr 29, 2025 -

Wga And Sag Aftra Strike The Complete Guide To Hollywoods Production Shutdown

Apr 29, 2025

Wga And Sag Aftra Strike The Complete Guide To Hollywoods Production Shutdown

Apr 29, 2025 -

50 000 Fine For Anthony Edwards Following Vulgar Exchange With Fan

Apr 29, 2025

50 000 Fine For Anthony Edwards Following Vulgar Exchange With Fan

Apr 29, 2025 -

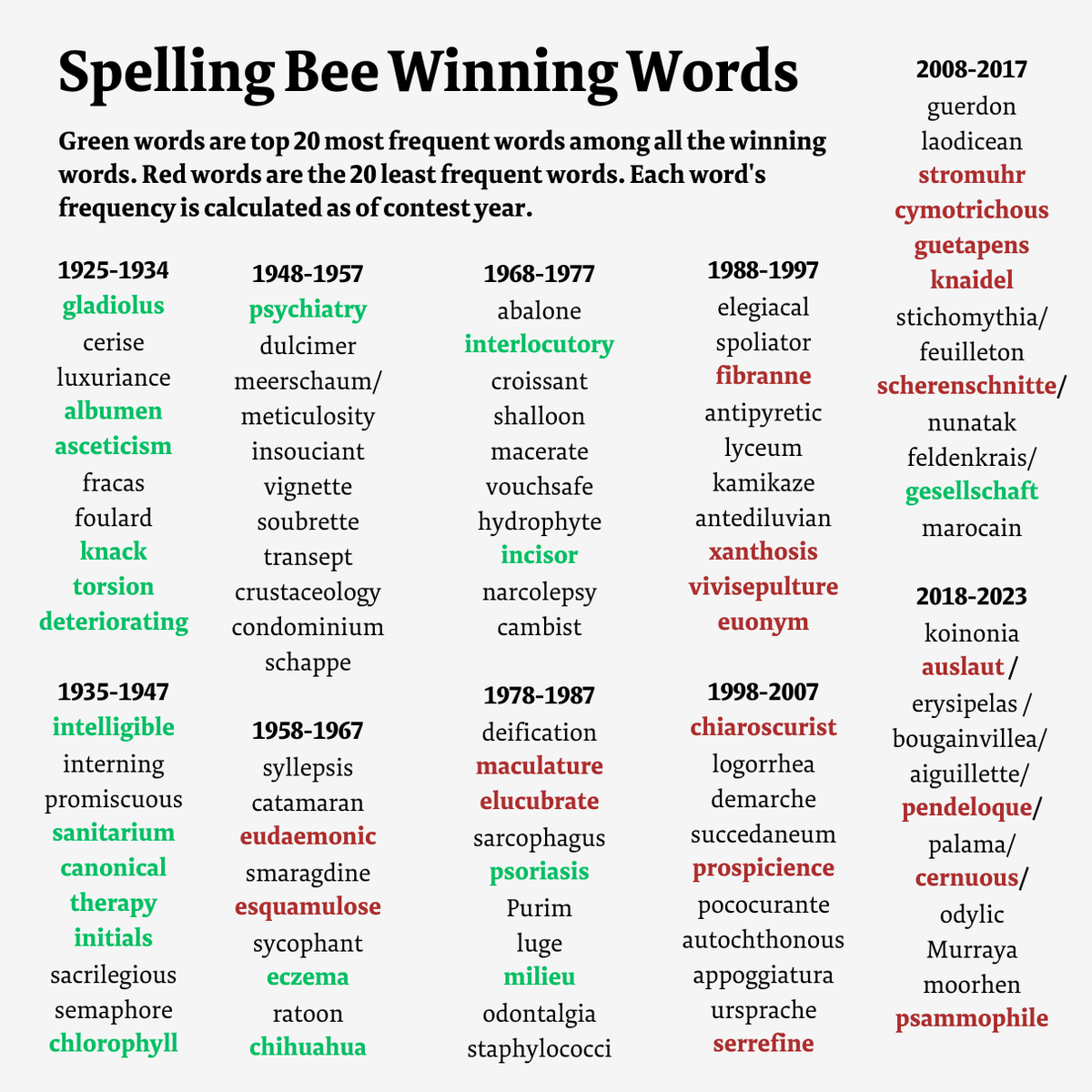

Nyt Spelling Bee February 25 2025 Clues Answers And Pangram

Apr 29, 2025

Nyt Spelling Bee February 25 2025 Clues Answers And Pangram

Apr 29, 2025 -

Long Lasting Power Evaluating Kuxius Solid State Power Bank Technology

Apr 29, 2025

Long Lasting Power Evaluating Kuxius Solid State Power Bank Technology

Apr 29, 2025

Latest Posts

-

Amanda Owen Addresses Recent Conflict With Ex Husband Clive

Apr 30, 2025

Amanda Owen Addresses Recent Conflict With Ex Husband Clive

Apr 30, 2025 -

Raw And Real Amanda Owen Shares Photos Of Her 9 Childrens Lives

Apr 30, 2025

Raw And Real Amanda Owen Shares Photos Of Her 9 Childrens Lives

Apr 30, 2025 -

Amanda Owens Tearful Response To Clive Owens Latest Move

Apr 30, 2025

Amanda Owens Tearful Response To Clive Owens Latest Move

Apr 30, 2025 -

Amanda Owen Unfiltered Photos Of Her 9 Childrens Busy Lives

Apr 30, 2025

Amanda Owen Unfiltered Photos Of Her 9 Childrens Busy Lives

Apr 30, 2025 -

9 Kids 9 Times The Chaos Amanda Owens Family Album

Apr 30, 2025

9 Kids 9 Times The Chaos Amanda Owens Family Album

Apr 30, 2025