PwC's Exit Strategy: Operational Closure In Nine African Countries

Table of Contents

The Nine Affected African Countries: A Detailed Overview

PwC's decision to cease operations affects the following nine African nations: [Insert the list of nine countries here. For example: Burkina Faso, Burundi, Central African Republic, Djibouti, Eritrea, Guinea-Bissau, Lesotho, Liberia, and Mali]. This strategic withdrawal marks the end of an era for PwC in these markets, impacting its long-term engagement with numerous clients and partners.

- PwC Nigeria: [Insert details about PwC's history and operations in Nigeria. Include specific information like years of operation, key clients, and service offerings. Mention any specific projects or contributions to the Nigerian economy.]

- PwC Kenya: [Insert details about PwC's history and operations in Kenya, similar to the Nigeria example. Highlight key industry sectors served.]

- [Other Countries]: Repeat the above format for each of the remaining seven countries, providing tailored information for each. This allows for strong keyword optimization using country-specific keywords (e.g., "PwC Burundi," "PwC Lesotho").

These country-specific details will paint a clearer picture of PwC's footprint in these markets and the magnitude of its withdrawal. The information should focus on the scale of operations and its impact on the respective economies.

Reasons Behind PwC's Exit Strategy: Unpacking the Decision

PwC hasn't explicitly detailed all the reasons behind this strategic restructuring; however, several factors likely contributed to this significant decision:

- Economic Challenges: Some of the affected countries face significant economic instability, making sustained operations challenging and potentially unprofitable. [Elaborate on this, citing relevant economic indicators.]

- Regulatory Hurdles: Changes in regulatory environments, particularly regarding professional services, may have increased the operational complexities and costs in these regions. [Provide examples of specific regulatory changes.]

- PwC Restructuring: This exit could be part of a broader global restructuring initiative by PwC, focusing resources on higher-growth markets or core service areas. [Offer context on PwC's global strategy and any recent announcements related to restructuring.]

- Internal Reorganization: Consolidation of resources and a shift towards more efficient operational models might be driving this decision. [Discuss any evidence suggesting a broader shift in PwC's internal strategies.]

Impact on PwC's Clients and Employees: Assessing the Fallout

PwC's exit strategy will have a significant impact on its clients and employees in the affected countries.

- Client Transition: Existing clients will need to transition to new service providers. PwC should be providing support to ensure business continuity. [Discuss the importance of seamless transitions and potential challenges clients might face.]

- Employee Support: The immediate concern is the welfare of PwC employees facing job displacement. PwC's responsibility lies in ensuring adequate support, including outplacement services and job search assistance. [Highlight any publicly available information regarding PwC's employee support programs.]

- Business Continuity: The importance of minimizing disruptions for clients during this transition cannot be overstated. The success of PwC’s exit strategy will hinge on its ability to manage this transition smoothly.

This section emphasizes the human element of this strategic decision, stressing the importance of ethical and responsible corporate conduct.

Future Implications for PwC's African Operations: Looking Ahead

PwC's strategic withdrawal from these nine countries will undoubtedly shape its future presence and reputation in Africa.

- PwC Future Strategy: This move indicates a shift in PwC's focus within the African market. [Analyze whether this signifies a broader reassessment of its African strategy.]

- African Business Landscape: The impact on the accounting and consulting industry in Africa is substantial, creating opportunities for other firms to fill the void. [Discuss the competitive dynamics that are likely to emerge.]

- Potential Re-entry: While the immediate future involves withdrawal, there's a possibility of future re-entry into these markets depending on economic and political factors. [Offer a nuanced perspective on the potential for future involvement.]

This section provides a forward-looking perspective on the long-term implications of PwC's decision.

Conclusion: Understanding PwC's Exit Strategy and Its Implications

PwC's decision to cease operations in nine African countries marks a significant development in the African business landscape. This strategic withdrawal, driven by a combination of economic challenges, regulatory hurdles, and internal restructuring, presents both challenges and opportunities. The impact on clients necessitates a smooth transition, while employee support is paramount. The long-term implications for PwC's African operations, and the African consulting industry as a whole, remain to be seen. Understanding PwC's exit strategy and its ramifications is crucial for businesses operating in the affected regions and for anyone interested in the future of the African market. Stay informed about further developments regarding PwC’s exit strategy, analyze the implications for your own business, and research alternative accounting and consulting firms in the affected regions if necessary.

Featured Posts

-

Nyt Spelling Bee Answers For April 3rd 2025 Complete Solutions

Apr 29, 2025

Nyt Spelling Bee Answers For April 3rd 2025 Complete Solutions

Apr 29, 2025 -

Why Making An All American Product Is So Difficult

Apr 29, 2025

Why Making An All American Product Is So Difficult

Apr 29, 2025 -

Willie Nelson And Rodney Crowell Duet On New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelson And Rodney Crowell Duet On New Album Oh What A Beautiful World

Apr 29, 2025 -

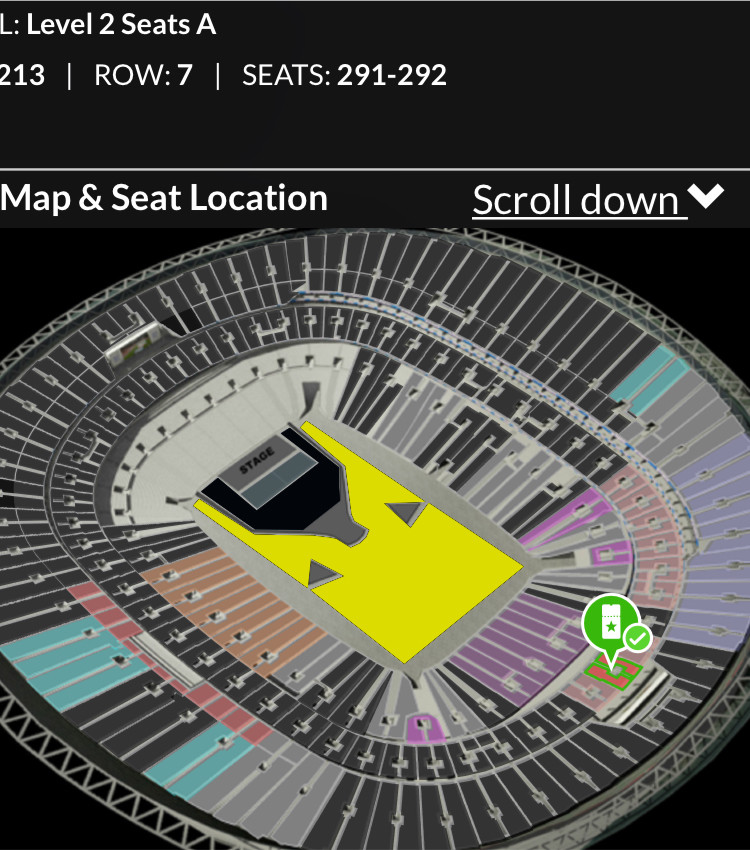

How To Buy Capital Summertime Ball 2025 Tickets Now

Apr 29, 2025

How To Buy Capital Summertime Ball 2025 Tickets Now

Apr 29, 2025 -

A Geographic Analysis Of The Countrys Top Emerging Business Markets

Apr 29, 2025

A Geographic Analysis Of The Countrys Top Emerging Business Markets

Apr 29, 2025

Latest Posts

-

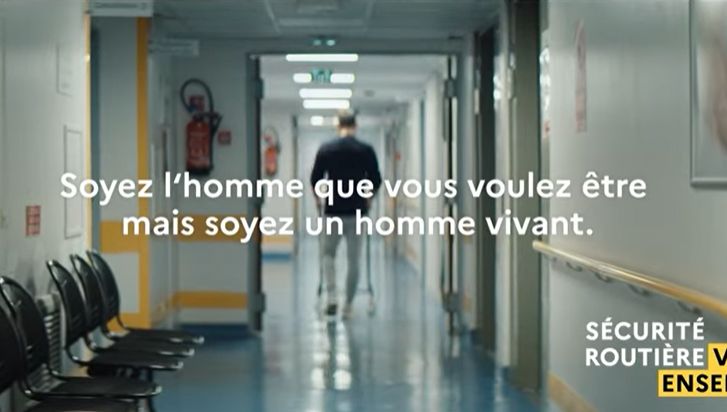

Reduire La Mortalite Routiere L Efficacite Des Glissieres De Securite Sur Les Routes Francaises Or Adapt The Country As Needed

Apr 30, 2025

Reduire La Mortalite Routiere L Efficacite Des Glissieres De Securite Sur Les Routes Francaises Or Adapt The Country As Needed

Apr 30, 2025 -

Air Ambulance Called To Incident Near Yate Recycling Centre

Apr 30, 2025

Air Ambulance Called To Incident Near Yate Recycling Centre

Apr 30, 2025 -

Ameliorer La Securite Routiere L Installation De Glissieres Un Investissement Pour Sauver Des Vies

Apr 30, 2025

Ameliorer La Securite Routiere L Installation De Glissieres Un Investissement Pour Sauver Des Vies

Apr 30, 2025 -

Get Google Slides Free Android I Os Web App Download

Apr 30, 2025

Get Google Slides Free Android I Os Web App Download

Apr 30, 2025 -

2025

Apr 30, 2025

2025

Apr 30, 2025