PwC's Withdrawal From Nine African Countries: Implications And Analysis

Table of Contents

The Scope of PwC's Withdrawal: Which Countries and Why?

PwC's decision to exit nine African markets represents a major shift in its African strategy. While the exact reasons haven't been fully disclosed, several factors likely contributed to this unprecedented move. Understanding these reasons is crucial to assessing the broader implications for the affected nations.

The nine countries impacted by PwC's withdrawal are (Specific countries to be inserted here – this requires research to confirm the exact countries).

Several potential reasons underpin this strategic decision:

-

Regulatory Challenges and Compliance Burdens: Navigating diverse and sometimes complex regulatory environments across Africa presents significant challenges for multinational firms like PwC. Meeting international standards while adapting to local regulations can be costly and time-consuming. Stringent compliance requirements and the risk of non-compliance penalties may have influenced the decision. Keywords: PwC Africa, market exit, business strategy, regulatory environment.

-

Economic Instability in Specific Regions: Economic volatility in certain African regions, characterized by currency fluctuations, political uncertainty, and infrastructure limitations, can make operating in these markets less attractive and profitable. This instability poses significant financial and operational risks for businesses. Keywords: PwC Africa, economic instability, market risks.

-

Changes in PwC's Global Strategy and Resource Allocation: PwC, like other global firms, constantly reevaluates its global footprint to optimize resource allocation and focus on high-growth, high-return markets. The withdrawal could reflect a strategic shift towards other regions or a prioritization of specific service lines. Keywords: PwC global strategy, resource allocation, business restructuring.

-

Internal Restructuring or Reassessment of Market Viability: Internal restructuring, a reassessment of market profitability in certain African countries, and a focus on core business areas may have also led to the decision to withdraw. Keywords: PwC internal restructuring, market viability, profitability.

Economic and Business Implications for Affected African Nations

PwC's departure leaves a significant void in the auditing and accounting services landscape of the affected African nations. The consequences are far-reaching and impact various aspects of the business environment:

-

Foreign Direct Investment (FDI): The withdrawal could negatively impact foreign direct investment (FDI), as investors often rely on the presence of reputable international auditing firms to assess risk and ensure transparency. Reduced investor confidence could lead to a decline in FDI flows. Keywords: economic impact, FDI Africa, business disruption.

-

Job Losses within the Auditing and Accounting Sectors: The withdrawal will likely lead to job losses within PwC's offices in these countries, affecting both local and international staff. This has knock-on effects on the wider economy. Keywords: job losses, audit services Africa, financial reporting.

-

Access to Financial Services and Auditing Expertise: Businesses, particularly multinational corporations, rely on PwC's expertise for financial auditing, assurance services, and business consulting. Reduced access to these services could hinder their operations and growth. Keywords: access to finance, audit expertise, financial services Africa.

-

The Credibility of the Accounting and Financial Reporting Systems: The departure of a leading global firm might raise concerns about the credibility and robustness of the accounting and financial reporting systems within those countries, potentially impacting investor confidence. Keywords: financial reporting standards, accounting credibility, investor confidence.

The Role of Regulatory Frameworks and Governance in PwC's Decision

The varying regulatory frameworks and governance structures across Africa undoubtedly played a role in PwC's decision. Multinational firms face significant compliance challenges when operating in diverse environments with varying levels of regulatory sophistication.

-

Compliance Challenges: Meeting international accounting standards while adhering to local regulations can be exceptionally demanding, requiring substantial investment in compliance infrastructure and expertise. Keywords: regulatory compliance, governance Africa, business environment.

-

Importance of Strong Governance: Strong governance frameworks and predictable regulatory environments are crucial for attracting and retaining international businesses. Weak governance and inconsistent regulations increase the risks and costs of doing business. Keywords: corporate governance, regulatory framework, international standards.

-

Changes in Local Regulatory Environments: Changes within the local regulatory environments that simplify compliance procedures, enhance transparency, and reduce bureaucratic hurdles could attract future investments by similar multinational firms. Keywords: regulatory reform, business-friendly environment, regulatory simplification.

Alternative Solutions and Future Outlook for Auditing and Accounting Services in Africa

While PwC's withdrawal is a setback, it also presents opportunities for other players in the market:

-

Emergence of Alternative Audit Firms: The void left by PwC is likely to be filled by other international and local audit firms eager to expand their presence in Africa. Keywords: alternative audit firms, accounting firms Africa, competition.

-

Growth Opportunities for Smaller Accounting Firms: Smaller accounting firms in Africa can capitalize on the increased demand for auditing and accounting services. Keywords: small accounting firms, market expansion, growth opportunities.

-

Role of Technology and Digitalization: Technology and digitalization can play a significant role in providing more accessible and efficient audit and accounting services, particularly in remote areas. Keywords: digital accounting, technology in accounting, fintech Africa.

-

Long-Term Implications: In the long term, the consequences of PwC's withdrawal will depend on the ability of African countries to improve their regulatory environments, attract new investors, and nurture the growth of local accounting firms. Keywords: future of audit, long-term implications, African economic development.

Conclusion: Assessing the Long-Term Impact of PwC's Withdrawal from Nine African Countries

PwC's withdrawal from nine African countries marks a significant development with far-reaching implications for the affected nations and the continent as a whole. The decision highlights the challenges faced by multinational firms operating in diverse African markets, particularly regarding regulatory compliance and economic stability. The economic and business consequences are substantial, impacting FDI, job creation, and access to crucial financial services.

The future of auditing and accounting services in Africa hinges on strengthening regulatory frameworks, fostering a stable business environment, and leveraging technological advancements. The potential for growth exists for both local and international firms ready to embrace these opportunities.

We encourage you to share your thoughts and insights on PwC's withdrawal from nine African countries and its lasting consequences. The ongoing developments surrounding this significant event warrant close monitoring and analysis.

Featured Posts

-

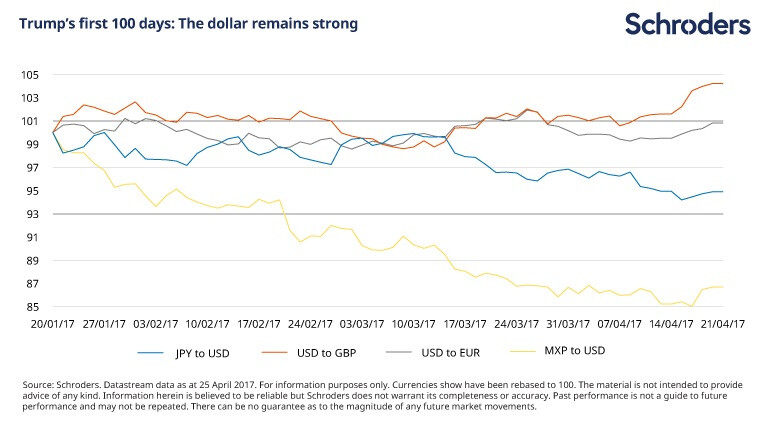

U S Dollars First 100 Days Under Scrutiny A Comparison To The Nixon Era

Apr 29, 2025

U S Dollars First 100 Days Under Scrutiny A Comparison To The Nixon Era

Apr 29, 2025 -

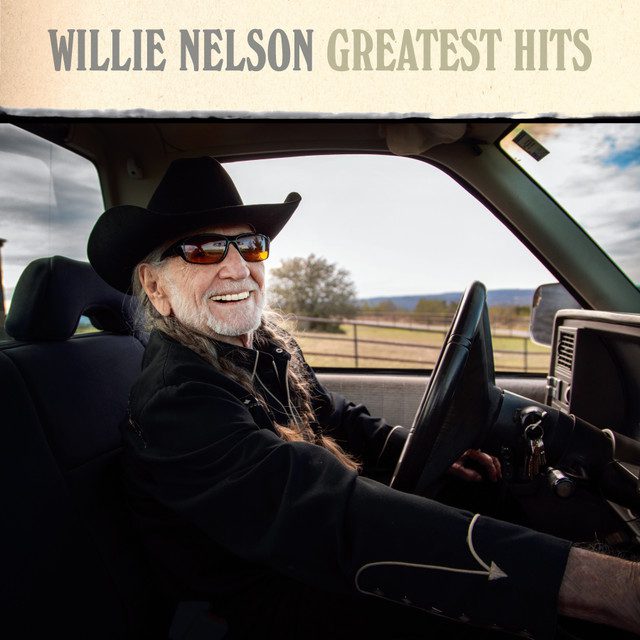

Willie Nelson And Rodney Crowell Duet On New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelson And Rodney Crowell Duet On New Album Oh What A Beautiful World

Apr 29, 2025 -

Nyt Spelling Bee February 12 2025 Pangram And Word List

Apr 29, 2025

Nyt Spelling Bee February 12 2025 Pangram And Word List

Apr 29, 2025 -

Shedeur Sanders Prank Call Son Of Falcons Defensive Coordinator Offers Apology

Apr 29, 2025

Shedeur Sanders Prank Call Son Of Falcons Defensive Coordinator Offers Apology

Apr 29, 2025 -

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025

Latest Posts

-

Recognizing Adult Adhd 8 Subtle Symptoms To Watch For

Apr 29, 2025

Recognizing Adult Adhd 8 Subtle Symptoms To Watch For

Apr 29, 2025 -

Adult Adhd 8 Subtle Signs You Might Be Overlooking

Apr 29, 2025

Adult Adhd 8 Subtle Signs You Might Be Overlooking

Apr 29, 2025 -

Rethinking Adhd Diagnosis The Role Of Tik Tok

Apr 29, 2025

Rethinking Adhd Diagnosis The Role Of Tik Tok

Apr 29, 2025 -

The Impact Of Social Media On Adhd Perceptions

Apr 29, 2025

The Impact Of Social Media On Adhd Perceptions

Apr 29, 2025 -

Tik Tok Adhd And The Dangers Of Self Diagnosis

Apr 29, 2025

Tik Tok Adhd And The Dangers Of Self Diagnosis

Apr 29, 2025