QBTS Stock's Upcoming Earnings: What To Expect

Table of Contents

Analyzing QBTS's Recent Performance and Trends

Analyzing QBTS's recent performance is critical for predicting future earnings and potential stock price movements. This involves examining key performance indicators (KPIs) and comparing them to previous quarters and industry benchmarks. A thorough QBTS stock analysis needs to incorporate this data.

- Review of QBTS's performance in the previous quarter(s): Examining the previous quarter's revenue, earnings per share (EPS), and profit margins provides a baseline for understanding current trends. Look for any significant deviations from previous performance and identify contributing factors. A detailed review of QBTS financial results is crucial.

- Analysis of key performance indicators (KPIs) like revenue, EPS, and margins: Focus on the growth or decline in these KPIs. Are they exceeding expectations, meeting projections, or falling short? Understanding the underlying reasons for these changes is essential for a comprehensive QBTS stock forecast.

- Discussion of any significant changes in the company's market position: Has QBTS gained or lost market share? Are there any new competitors impacting its performance? This analysis provides insights into the competitive landscape influencing QBTS's revenue growth.

- Identification of factors contributing to positive or negative trends: Were positive trends driven by successful marketing campaigns, new product launches, or favorable market conditions? Conversely, were negative trends due to increased competition, economic downturns, or operational inefficiencies? Identifying these factors is vital for a realistic QBTS stock price prediction.

- Comparison to industry benchmarks and competitors: How does QBTS's performance stack up against its main competitors? Are its KPIs above or below the industry average? This comparative analysis provides valuable context for interpreting QBTS's financial trends.

Key Factors Influencing QBTS's Upcoming Earnings

Several factors can significantly influence QBTS's upcoming earnings. Understanding these factors is crucial for developing realistic expectations and making informed investment decisions regarding QBTS stock.

- Impact of macroeconomic conditions (e.g., inflation, interest rates): Economic factors like inflation and interest rates can greatly impact consumer spending and business investment, influencing QBTS's revenue and profitability. A rise in interest rates, for instance, might reduce investment in the company.

- Analysis of the competitive landscape and QBTS's strategic response: Is QBTS facing increased competition? How is the company responding to this competition through innovation, pricing strategies, or marketing initiatives? Analyzing competitive pressures is integral to a sound QBTS stock analysis.

- Discussion of any new product launches or initiatives: The introduction of new products or strategic initiatives can significantly impact QBTS's future earnings. Analyze the potential market reception and impact on revenue streams.

- Assessment of the impact of supply chain issues or other operational challenges: Supply chain disruptions, labor shortages, or other operational difficulties can negatively impact profitability. Assess the magnitude of these challenges and their potential effect on QBTS's upcoming results.

- Evaluation of the overall industry outlook and its influence on QBTS: The overall health and prospects of QBTS's industry significantly influence its performance. A positive industry outlook generally bodes well for QBTS, while a negative outlook might present challenges.

Predicting QBTS Stock Price Movement After Earnings

Predicting QBTS stock price movement after earnings is inherently uncertain, but analyzing various scenarios and considering past performance can provide insights.

- Discussion of potential scenarios based on different earnings outcomes (beat/meet/miss expectations): Consider how the market might react if QBTS surpasses, meets, or falls short of earnings expectations. A positive surprise typically leads to a stock price increase, while a negative surprise can trigger a decline. Understanding these QBTS stock price prediction scenarios is essential.

- Analysis of historical stock price reactions to previous earnings announcements: Examine how QBTS stock has reacted to previous earnings reports. This historical data offers valuable insights into potential market responses to the upcoming announcement.

- Assessment of investor sentiment and its potential influence on price movements: Investor sentiment, influenced by news, market trends, and analysts' opinions, plays a role in stock price volatility. Positive sentiment generally supports price increases, while negative sentiment can drive prices down. Analyzing this aspect provides valuable context in QBTS stock price prediction.

- Exploration of potential trading strategies based on anticipated volatility: Based on your analysis, you might consider different trading strategies, such as buying before the earnings announcement if you expect positive results or short-selling if you anticipate negative results. Remember this is speculative and involves risks. Always invest responsibly.

- Cautionary notes about the inherent uncertainties in stock market predictions: It's crucial to remember that stock market predictions are not guaranteed. Unexpected events can significantly impact stock prices, rendering even the most thorough analyses inaccurate.

Risk Assessment for QBTS Stock

Investing in QBTS stock, like any investment, carries risks. A thorough risk assessment is crucial before making any investment decisions.

- Identify potential risks associated with investing in QBTS: These could include competition, economic downturns, regulatory changes, or operational challenges. A comprehensive understanding of QBTS investment risks is paramount.

- Analyze the likelihood and impact of these risks: Assess the probability of each risk occurring and the potential impact on QBTS's stock price and your investment.

- Suggest strategies for mitigating these risks: Diversification, setting stop-loss orders, and thorough due diligence are essential for managing investment risks.

Conclusion

This analysis of QBTS's upcoming earnings has highlighted key factors to consider, including recent performance trends, influential market forces, and potential price reactions. Understanding these aspects is vital for informed investment decisions. Remember that any investment carries risk.

Call to Action: Stay informed about QBTS stock and its upcoming earnings announcement. Continue researching QBTS stock analysis and consider developing a robust investment strategy based on your risk tolerance and financial goals. Learn more about how to effectively manage your QBTS stock investments. Remember to conduct thorough due diligence before making any investment in QBTS or any other stock.

Featured Posts

-

Japanese Manga Predicts Disaster Impact On Tourism

May 20, 2025

Japanese Manga Predicts Disaster Impact On Tourism

May 20, 2025 -

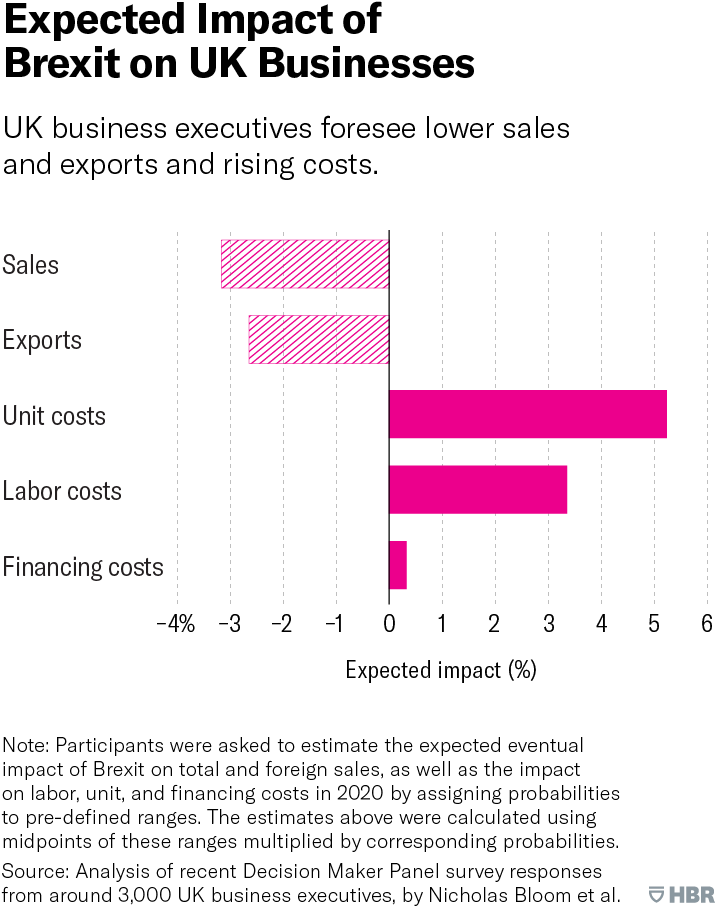

Uk Luxury Sector Brexits Lingering Export Challenges

May 20, 2025

Uk Luxury Sector Brexits Lingering Export Challenges

May 20, 2025 -

Monte Carlo Rain Impacts Sinners First Training Session

May 20, 2025

Monte Carlo Rain Impacts Sinners First Training Session

May 20, 2025 -

Min Xasete Tampoy Epistrefei Sto Mega

May 20, 2025

Min Xasete Tampoy Epistrefei Sto Mega

May 20, 2025 -

Jennifer Lawrence Silencio Apos Rumores De Nascimento E Nova Aparencia

May 20, 2025

Jennifer Lawrence Silencio Apos Rumores De Nascimento E Nova Aparencia

May 20, 2025