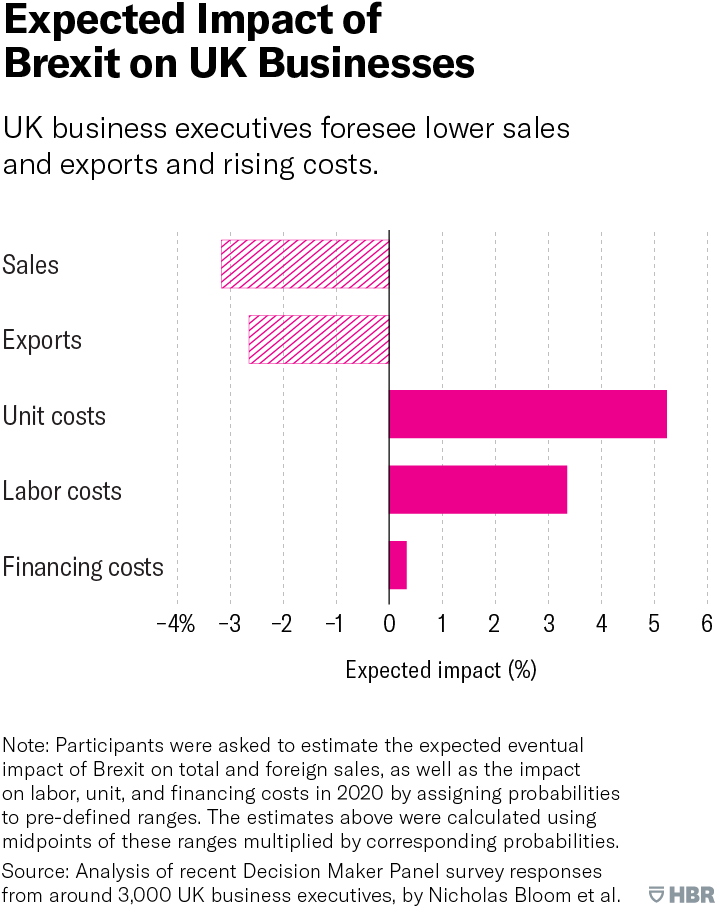

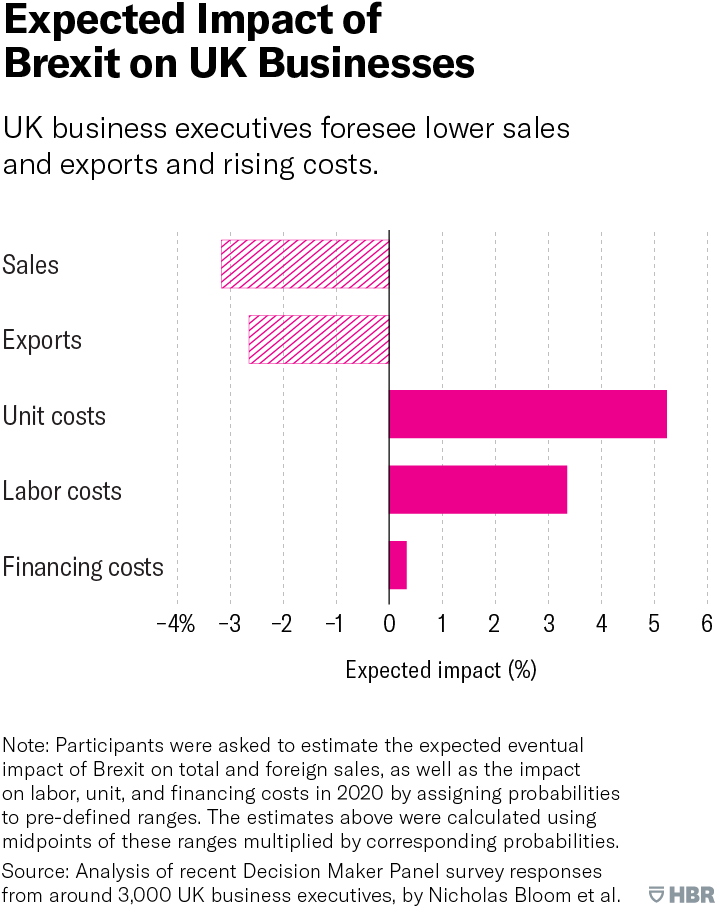

UK Luxury Sector: Brexit's Lingering Export Challenges

Table of Contents

Increased Bureaucracy and Administrative Burden

Post-Brexit, exporting luxury goods from the UK to the EU has become significantly more complex. New customs procedures, stringent documentation requirements, and a dramatic increase in paperwork place a considerable burden on businesses, particularly smaller enterprises. This added administrative layer directly translates into higher costs and operational inefficiencies.

- Increased shipping costs: Customs delays and increased inspections lead to longer transit times and higher freight charges, impacting profitability. Luxury goods, often time-sensitive or perishable, are especially vulnerable to these delays.

- Complex certification requirements: Meeting diverse EU regulations and obtaining the necessary certifications for each product and destination is a time-consuming and costly process. This complexity can be especially daunting for businesses exporting a wide range of luxury products.

- Time-consuming documentation: The sheer volume of paperwork involved in exporting goods, including customs declarations, certificates of origin, and other supporting documentation, consumes valuable time and resources. This administrative burden can divert attention from core business activities, such as design and marketing.

- Risk of delays and loss: Delays at customs can lead to significant losses, particularly for perishable luxury goods like high-end food products or certain types of flowers. This risk adds to the overall cost and uncertainty associated with exporting.

Tariff and Non-Tariff Barriers

Beyond increased bureaucracy, the UK luxury sector faces significant tariff and non-tariff barriers when exporting to the EU. Tariffs, imposed on certain goods, directly increase the price, affecting competitiveness. Non-tariff barriers, such as sanitary and phytosanitary (SPS) regulations, further complicate the export process.

- Tariff impacts: Certain luxury goods, such as high-end spirits or specific types of textiles, now face tariffs when exported to the EU, making them less price-competitive compared to goods originating within the EU. This directly affects profitability and market share.

- Pricing and competitiveness: The added cost of tariffs inevitably impacts pricing strategies, potentially reducing the attractiveness of UK luxury goods in the EU market. This challenges the UK's ability to maintain its position as a premium provider of luxury products.

- Logistical complexities: Non-tariff barriers, including complex SPS regulations for food and agricultural products, introduce further logistical hurdles, adding to the cost and time involved in exporting. This makes exporting more challenging for businesses with limited resources.

- Disproportionate impact on SMEs: Smaller luxury businesses often lack the resources and expertise to navigate these complex trade barriers, placing them at a significant disadvantage compared to larger competitors.

Supply Chain Disruptions

Brexit has also created significant disruptions to the supply chains for raw materials and components used in the production of many UK luxury goods. The reliance on EU-based suppliers, combined with labor shortages and transportation issues, has further hampered the sector's ability to meet demand.

- Increased transportation costs and lead times: The increased complexity of cross-border transportation has led to significantly higher costs and longer lead times for raw materials and components. This impacts production schedules and overall efficiency.

- Sourcing difficulties: Access to specific raw materials or components sourced from the EU has become more challenging and costly, affecting production capabilities and potentially impacting product quality.

- Production schedule disruptions: The delays and uncertainties associated with supply chains have led to disruptions in production schedules, affecting the ability of luxury businesses to meet orders and maintain timely delivery.

- Supply chain diversification: Many UK luxury businesses are now actively seeking to diversify their supply chains, reducing reliance on EU-based suppliers and mitigating future risks.

Impact on Brand Reputation and Consumer Confidence

The delays, disruptions, and increased costs associated with Brexit can significantly impact the perceived value and prestige of UK luxury brands. Delayed deliveries or product shortages can damage a brand's reputation, affecting consumer confidence and demand.

- Brand image damage: Late deliveries or stock shortages can directly impact a brand's image, potentially diminishing its perceived value and exclusivity. This is particularly damaging in the luxury sector where reputation is paramount.

- Loss of market share: Competitors from other regions that have not experienced similar export challenges may gain market share at the expense of UK luxury brands.

- Transparent communication: Maintaining open and transparent communication with customers is vital to mitigating potential negative impacts on brand reputation. Proactive communication about delays or changes can help manage customer expectations.

- Maintaining customer loyalty: Implementing strategies to maintain customer loyalty, such as personalized service and exclusive offers, are crucial in navigating these challenging times and preserving brand value.

Conclusion

The UK luxury sector continues to face significant challenges in exporting goods post-Brexit. Increased bureaucracy, tariff and non-tariff barriers, supply chain disruptions, and the potential damage to brand reputation all contribute to a complex and evolving landscape. These challenges have a substantial impact on the UK economy and the future of this vital sector. Addressing these lingering UK Luxury Sector Brexit Export Challenges requires collaborative efforts from the government, businesses, and industry bodies. Strategic investment in streamlining customs processes, negotiating favorable trade deals, and providing support to businesses adapting to the new environment is crucial to securing the continued success and global competitiveness of the UK's luxury sector. Let's work together to overcome these hurdles and ensure a prosperous future for this important industry.

Featured Posts

-

Ai 82

May 20, 2025

Ai 82

May 20, 2025 -

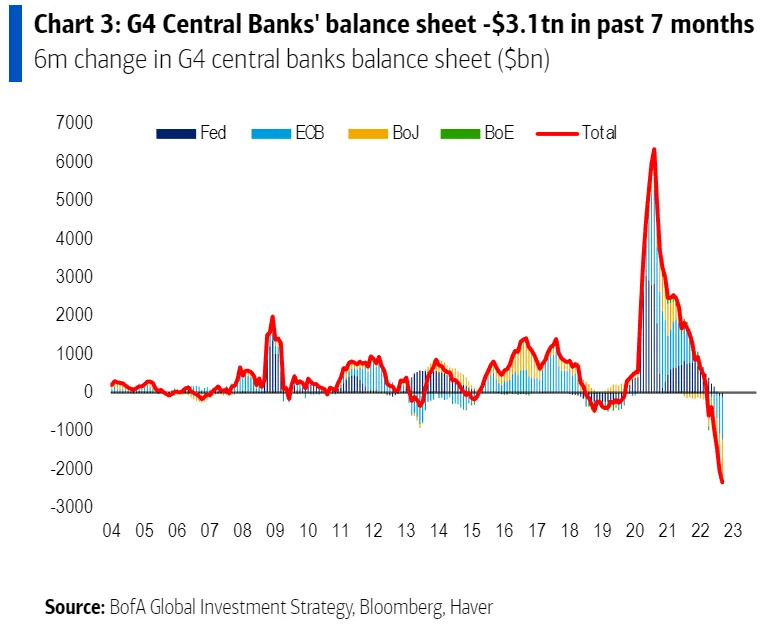

Ignoring High Stock Market Valuations The Bof A Rationale

May 20, 2025

Ignoring High Stock Market Valuations The Bof A Rationale

May 20, 2025 -

Rain Timing The Most Up To Date Predictions

May 20, 2025

Rain Timing The Most Up To Date Predictions

May 20, 2025 -

Jalkapallo Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuransa

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuransa

May 20, 2025 -

Dusan Tadic Fenerbahce Tarihine Gececek Bir Ilk

May 20, 2025

Dusan Tadic Fenerbahce Tarihine Gececek Bir Ilk

May 20, 2025