Recent Gold Price Trends: Two Weeks Of Losses In 2025

Table of Contents

Factors Contributing to the Recent Gold Price Dip

Several interconnected factors have contributed to the recent dip in gold prices. Understanding these dynamics is crucial for navigating the current gold market and making informed investment decisions.

Strengthening US Dollar

The US dollar and gold prices share an inverse relationship. A stronger dollar generally leads to lower gold prices. This is because gold is priced in US dollars, so when the dollar strengthens, gold becomes more expensive for buyers using other currencies, thus reducing demand.

- The recent strengthening of the US dollar is largely attributed to [cite specific economic policies or events impacting the dollar, e.g., aggressive monetary tightening by the Federal Reserve].

- The US Dollar Index (USDX) has risen to [insert hypothetical USDX figure, e.g., 105], indicating a strengthening dollar. (Source: [cite reputable financial news source, e.g., Bloomberg, Reuters])

- This makes gold less attractive to international investors, contributing to the price decline.

Increased Interest Rates

Rising interest rates also put downward pressure on gold prices. Higher interest rates make holding non-yielding assets like gold less attractive compared to interest-bearing investments like bonds or savings accounts. Investors may shift their funds towards higher-yielding options, reducing the demand for gold.

- The Federal Reserve's recent decision to raise interest rates by [insert hypothetical percentage, e.g., 0.25%] has increased the opportunity cost of holding gold. (Source: [cite Federal Reserve website or reputable financial news source])

- Higher interest rates generally boost the US dollar, further impacting gold prices negatively as described above.

- This shift in investor sentiment towards higher-yielding assets directly impacts the gold market.

Profit-Taking by Investors

After a period of gold price gains, it's not uncommon to see profit-taking by investors. Short-term market fluctuations can trigger investors to cash out their profits, leading to increased selling pressure and a price decline.

- Recent analysis suggests that some investors may be taking profits following the [insert hypothetical period, e.g., six-month] rally in gold prices. (Source: [cite a reputable financial analysis report])

- This short-term market behavior can exacerbate price declines, even in the absence of fundamental shifts in the market.

- Profit-taking is a common phenomenon in any asset class and should be considered a factor in the recent volatility.

Geopolitical Stability (or lack thereof)

Gold is often viewed as a safe-haven asset during times of geopolitical uncertainty. However, periods of relative stability can reduce investor demand for gold as a hedge against risk.

- While [mention any recent geopolitical events, e.g., a de-escalation of tensions], the overall geopolitical climate has been relatively stable, reducing the appeal of gold as a safe haven.

- This reduced demand for gold as a hedge contributes to downward price pressure.

- Investor confidence in other asset classes may be higher, leading them to move funds away from gold.

Analyzing the Impact on Gold Investors

The recent gold price drop presents both challenges and opportunities for gold investors. Understanding the short-term versus long-term perspectives, diversification strategies, and assessing future risks are critical.

Short-Term vs. Long-Term Perspectives

Investors may adopt different strategies depending on their investment timeline and risk tolerance.

- Short-term investors: May choose to sell their gold holdings to avoid further losses or to reallocate funds to higher-yielding assets.

- Long-term investors: May view the price dip as a buying opportunity, believing that gold's value will recover over time. Their strategy relies on the long-term outlook of gold as a precious metal.

Diversification Strategies

Diversification remains a key principle of successful investment strategies. Gold's recent price fluctuations highlight the importance of spreading risk across multiple asset classes.

- Including a variety of assets, such as stocks, bonds, and real estate, can help mitigate the impact of gold price volatility.

- Diversification reduces overall portfolio risk and protects against significant losses in any single asset class.

Risk Assessment and Future Predictions (Cautious)

Predicting future gold prices with certainty is impossible. However, several factors could influence future movements:

- Inflation: High inflation could increase the demand for gold as a hedge against inflation.

- Economic growth: Strong economic growth might reduce the demand for gold as investors move to riskier assets.

- Geopolitical events: Unexpected geopolitical events could significantly impact gold prices, potentially driving up demand.

Conclusion

The recent two-week decline in gold prices is attributable to a confluence of factors, including a strengthening US dollar, rising interest rates, profit-taking by investors, and relatively stable geopolitical conditions. This necessitates a careful assessment by investors regarding their short-term and long-term strategies within the gold market. The importance of diversification in mitigating risks associated with gold price volatility cannot be overstated. Stay informed about recent gold price trends to make well-informed decisions about your gold investments. Consult a financial advisor for personalized guidance concerning your precious metal investments and gold prices.

Featured Posts

-

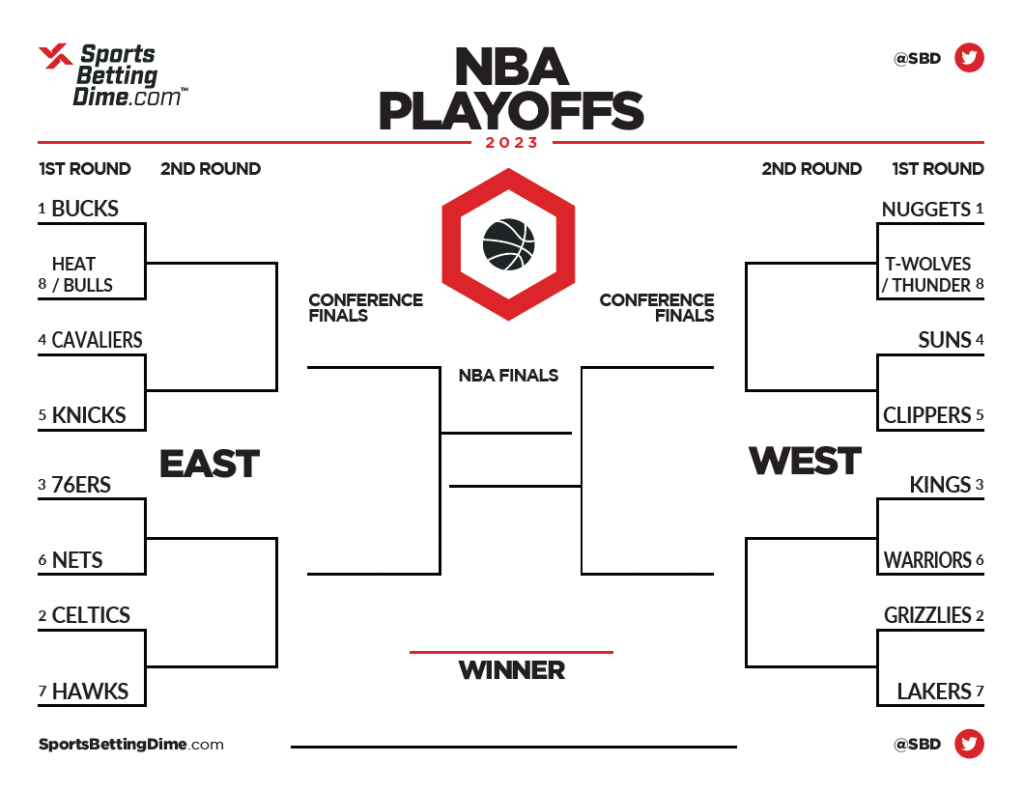

Nba Round 1 Playoffs 2025 Your Guide To The Games And Tv Schedule

May 06, 2025

Nba Round 1 Playoffs 2025 Your Guide To The Games And Tv Schedule

May 06, 2025 -

Trumps Trade Deal Cuts Dismissing Economic Concerns

May 06, 2025

Trumps Trade Deal Cuts Dismissing Economic Concerns

May 06, 2025 -

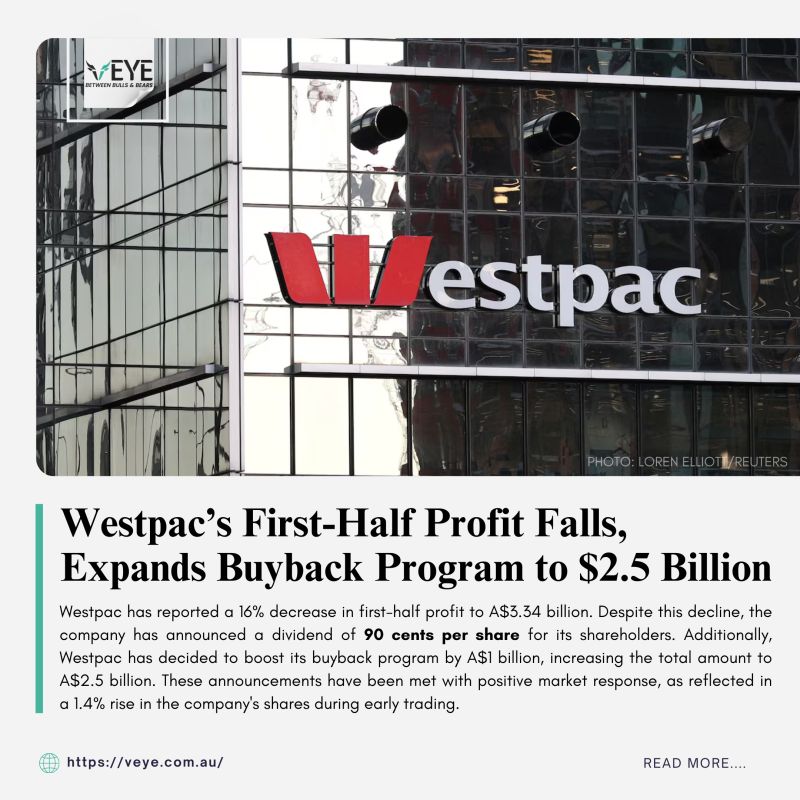

Westpac Wbc Profit Decline Margin Pressure Impacts Earnings

May 06, 2025

Westpac Wbc Profit Decline Margin Pressure Impacts Earnings

May 06, 2025 -

Trumps Response On Upholding The Constitution I Dont Know

May 06, 2025

Trumps Response On Upholding The Constitution I Dont Know

May 06, 2025 -

Saving Venice A High Tech Solution To Rising Tides

May 06, 2025

Saving Venice A High Tech Solution To Rising Tides

May 06, 2025

Latest Posts

-

Sabrina Carpenters Unexpected Snl Collaboration A Fun Size Flashback

May 06, 2025

Sabrina Carpenters Unexpected Snl Collaboration A Fun Size Flashback

May 06, 2025 -

Sabrina Carpenters Fun Size Friend Joins Her For Snl Performance

May 06, 2025

Sabrina Carpenters Fun Size Friend Joins Her For Snl Performance

May 06, 2025 -

Snl Sabrina Carpenter Teams Up With Fun Size Castmate

May 06, 2025

Snl Sabrina Carpenter Teams Up With Fun Size Castmate

May 06, 2025 -

Sabrina Carpenter Headline Gig A 6 99 Festival Ticket Breakdown

May 06, 2025

Sabrina Carpenter Headline Gig A 6 99 Festival Ticket Breakdown

May 06, 2025 -

6 99 Festival Featuring Sabrina Carpenter What You Need To Know

May 06, 2025

6 99 Festival Featuring Sabrina Carpenter What You Need To Know

May 06, 2025