Recession-Proofing Your Portfolio: The Case For Uber Stock

Table of Contents

This article explores why Uber stock offers a unique opportunity for investors seeking to build a more resilient portfolio, even amidst its inherent volatility. We'll examine Uber's resilience during economic downturns, its long-term growth potential, and strategies for managing the associated risks.

Uber's Resilience in Economic Downturns

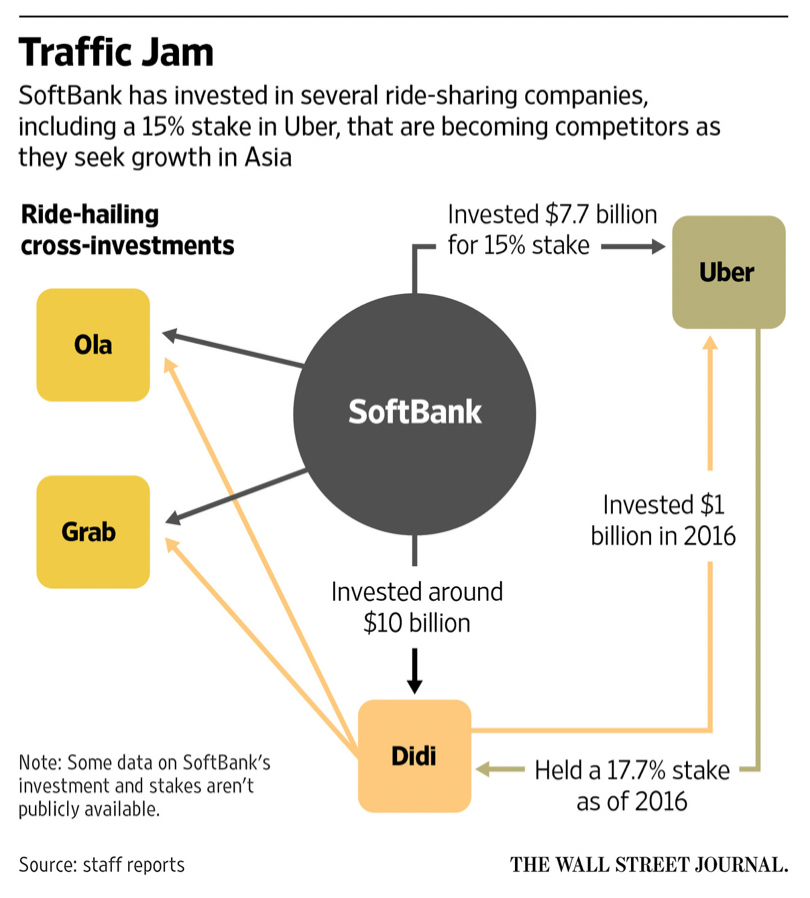

One of the most significant arguments for including Uber in a recession-proof strategy lies in its diverse revenue streams. Unlike companies reliant on a single product or service, Uber operates across multiple sectors, offering a degree of insulation against economic shocks. This diversification is a key factor in building a more resilient investment portfolio.

- Lower discretionary spending may impact rides, but essential services like food delivery remain robust. When budgets tighten, people may cut back on non-essential rides, but the demand for food delivery – especially through Uber Eats – often remains relatively strong. This is because food delivery is considered an essential service, unlike, say, luxury travel.

- Increased demand for gig work during economic hardship can benefit Uber drivers. During recessions, many people seek alternative income streams. The flexible nature of driving for Uber can provide a lifeline for individuals facing job losses, increasing the overall driver pool and potentially boosting Uber's revenue.

- Freight services offer a counter-cyclical element, as businesses often rely on cost-effective shipping during recessions. Uber Freight provides a crucial service for businesses seeking to optimize logistics and reduce costs during lean times. This counter-cyclical element further strengthens Uber's position during economic uncertainty.

While Uber's ride-sharing segment might experience some downturn during a recession, the combined strength of its other services helps mitigate the impact, making it a more resilient investment compared to many others. Past economic slowdowns have demonstrated Uber's ability to navigate such challenges, offering a glimpse into its potential for future resilience.

The Long-Term Growth Potential of Uber

Beyond its immediate resilience, Uber's long-term growth potential further strengthens its case as a recession-resistant investment. The company continues to expand its services and penetrate new markets globally, offering significant upside potential.

- Autonomous vehicle technology as a future growth driver. Uber's investments in self-driving technology represent a potential game-changer, promising increased efficiency and reduced operational costs in the long run. This technological innovation positions Uber for future growth, regardless of short-term economic fluctuations.

- Expansion into new transportation modes (e.g., scooters, bikes). Uber's diversification beyond ride-sharing and food delivery into areas such as scooter and bike rentals broadens its market reach and revenue streams, adding another layer of resilience.

- Global market penetration. Uber's continued expansion into new international markets provides further growth opportunities, reducing reliance on any single geographic region and diversifying its risk profile.

Uber's Adaptability and Innovation

Uber's success is, in large part, due to its remarkable adaptability and commitment to innovation. The company has consistently shown the ability to pivot and adjust to changing market conditions and technological advancements.

- Examples of past adaptations and innovations (e.g., introducing Uber Eats during the pandemic). The rapid launch and success of Uber Eats during the pandemic is a prime example of Uber's ability to identify opportunities and adapt to unexpected circumstances. This demonstrates its capacity to innovate and capitalize on emerging needs.

- Discussion of Uber's technological investments and their role in future growth. Uber's ongoing investments in technology—from AI-powered algorithms to advanced mapping systems—are crucial to its long-term growth and competitiveness. These investments position it to navigate future challenges and capitalize on emerging opportunities. This commitment to innovation makes it a more appealing long-term investment, even for a recession-proof portfolio.

Managing Risk in Uber Stock

While Uber offers significant potential as a recession-resistant investment, it's crucial to acknowledge the inherent risks associated with investing in any stock, especially one as volatile as Uber.

- Competition in the ride-sharing and delivery markets. The ride-sharing and food delivery industries are fiercely competitive, with numerous established players and new entrants constantly emerging. This competitive landscape presents ongoing challenges.

- Regulatory hurdles and legal challenges. Uber operates in a heavily regulated industry and faces ongoing legal battles and regulatory scrutiny, which can impact its profitability and stock performance.

- Fluctuations in fuel prices and driver costs. Fluctuations in fuel prices and driver compensation directly affect Uber's operational costs and profitability.

To mitigate these risks, consider strategies such as diversification – spreading your investments across various asset classes – and dollar-cost averaging – investing a fixed amount regularly regardless of price fluctuations. These strategies can help smooth out volatility and reduce your overall portfolio risk.

Conclusion: Recession-Proofing Your Portfolio with Uber Stock

Uber stock presents a compelling case for inclusion in a diversified portfolio designed to withstand economic downturns. Its diverse revenue streams, long-term growth potential, and adaptability to changing market conditions offer a unique blend of resilience and upside potential. While inherent risks exist, implementing sound risk-management strategies, such as diversification, can significantly mitigate these concerns.

By understanding Uber's business model, its innovative spirit, and the potential for growth in various sectors, investors can confidently consider Uber stock as a valuable component in building a more resilient portfolio. Remember to research thoroughly and consider consulting a financial advisor before making any investment decisions. Building a truly resilient portfolio requires careful consideration of your risk tolerance and investment goals, but including recession-resistant investments like Uber can be a crucial step towards achieving long-term financial security.

Featured Posts

-

Drake Bells Controversial Comparison Amanda Bynes And Friends Rachel

May 18, 2025

Drake Bells Controversial Comparison Amanda Bynes And Friends Rachel

May 18, 2025 -

Netflix Documentary Captures 9 11 Survivors Fight For Survival

May 18, 2025

Netflix Documentary Captures 9 11 Survivors Fight For Survival

May 18, 2025 -

Los Angeles Dodgers Left Handed Bats Facing A Slump Can They Bounce Back

May 18, 2025

Los Angeles Dodgers Left Handed Bats Facing A Slump Can They Bounce Back

May 18, 2025 -

1 May 2025 Daily Lotto Winning Numbers Announced

May 18, 2025

1 May 2025 Daily Lotto Winning Numbers Announced

May 18, 2025 -

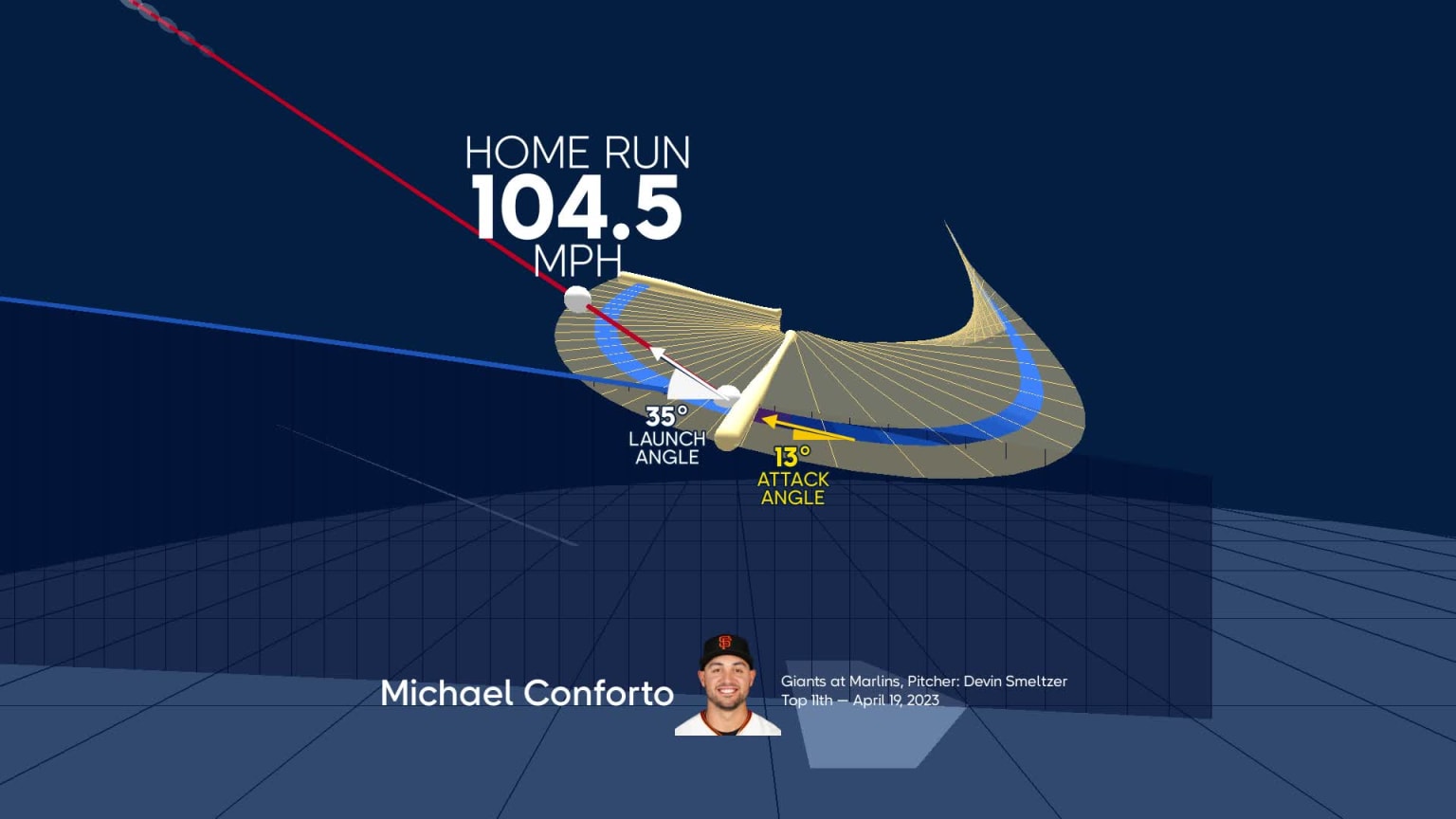

Analyzing Confortos Chances Of Replicating Hernandezs Dodger Success

May 18, 2025

Analyzing Confortos Chances Of Replicating Hernandezs Dodger Success

May 18, 2025

Latest Posts

-

Ubers Double Digit April Rally Reasons Behind The Surge

May 19, 2025

Ubers Double Digit April Rally Reasons Behind The Surge

May 19, 2025 -

Autonomous Ride Hailing Expands Waymo And Uber Launch In Austin

May 19, 2025

Autonomous Ride Hailing Expands Waymo And Uber Launch In Austin

May 19, 2025 -

Evaluating Uber Technologies Uber As An Investment

May 19, 2025

Evaluating Uber Technologies Uber As An Investment

May 19, 2025 -

Robotaxi Revolution Uber And Waymo Launch Autonomous Ride Hailing In Austin

May 19, 2025

Robotaxi Revolution Uber And Waymo Launch Autonomous Ride Hailing In Austin

May 19, 2025 -

Uber Technologies Uber Investment Potential And Risks

May 19, 2025

Uber Technologies Uber Investment Potential And Risks

May 19, 2025