Refinancing Federal Student Loans: Is A Private Lender Right For You?

Table of Contents

Understanding Federal Student Loan Benefits

Before considering private student loan refinancing, it's vital to understand the significant benefits associated with keeping your federal student loans. These benefits often outweigh the potential advantages of lower interest rates offered by private lenders. Federal student loans provide a safety net that private loans simply cannot match.

Keywords: Federal student loan benefits, federal student loan forgiveness, income-driven repayment plans, student loan repayment options

-

Access to Income-Driven Repayment Plans: Federal student loans offer various income-driven repayment (IDR) plans, such as the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR) plans. These plans adjust your monthly payments based on your income and family size, making them more manageable during periods of financial hardship. This flexibility is a key advantage not found with private loans.

-

Eligibility for Loan Forgiveness Programs: Certain federal student loan programs, like Public Service Loan Forgiveness (PSLF), offer the possibility of complete loan forgiveness after a set number of qualifying payments. This is a massive incentive for borrowers working in public service sectors like government, non-profits, and education. These forgiveness programs are generally unavailable with private student loan refinancing.

-

Deferment and Forbearance Options: Federal student loans provide deferment and forbearance options, allowing you to temporarily suspend or reduce your payments during periods of financial hardship, such as unemployment or illness. These options offer crucial breathing room that private lenders rarely provide.

-

Potential for Future Government Assistance Programs: The federal government periodically introduces new programs aimed at assisting student loan borrowers. Refinancing to a private lender can exclude you from future benefits or relief measures.

The Allure of Private Student Loan Refinancing

While federal student loans offer crucial protections, the allure of private student loan refinancing is undeniable for some borrowers. The potential benefits can be significant.

Keywords: Private student loan refinancing rates, private student loan refinance, lower interest rates student loans, student loan refinancing comparison

-

Potentially Lower Interest Rates: Private lenders often offer lower interest rates than federal loans, especially for borrowers with excellent credit scores. This can result in substantial savings over the life of the loan. However, it's crucial to compare rates carefully.

-

Fixed or Variable Interest Rate Options: Private lenders provide both fixed and variable interest rate options, allowing you to choose the option that best aligns with your risk tolerance and financial goals. Fixed rates offer predictability, while variable rates could potentially offer lower initial payments but come with the risk of increased payments later.

-

Shorter Repayment Terms: Refinancing can allow for shorter repayment terms, leading to faster payoff and significant long-term interest savings. However, shorter terms mean higher monthly payments.

-

Single Monthly Payment for Multiple Loans: Refinancing multiple federal student loans into a single private loan simplifies repayment, consolidating your various payments into one manageable monthly payment.

The Risks of Refinancing Federal Student Loans with a Private Lender

Refinancing federal student loans with a private lender comes with substantial risks. The loss of federal protections can have severe consequences.

Keywords: Student loan refinancing risks, losing federal loan benefits, private student loan drawbacks

-

Loss of Access to Income-Driven Repayment Plans: Once you refinance your federal loans into a private loan, you lose access to all income-driven repayment plans. This means you lose the flexibility to adjust your payments based on your income.

-

Ineligibility for Loan Forgiveness Programs: Refinancing eliminates your eligibility for federal loan forgiveness programs like PSLF. This can cost you tens of thousands of dollars over the life of your loan.

-

No Deferment or Forbearance Options: Private lenders generally do not offer deferment or forbearance options. If you experience financial hardship, you'll have no safety net to help you manage your payments.

-

Risk of Higher Interest Rates if Your Credit Score is Not Strong: Private lenders base their interest rates on your credit score. A low credit score can result in higher interest rates than your current federal loan rates, negating any potential savings.

Credit Score Impact on Refinancing Rates

Your credit score is a major factor determining the interest rate you'll receive when refinancing student loans with a private lender. A higher credit score typically translates to lower interest rates and more favorable loan terms. Borrowers with excellent credit scores will likely secure the best refinancing rates. Conversely, borrowers with poor credit scores might face higher interest rates, potentially making refinancing less advantageous than keeping their federal loans. Improving your credit score before applying for refinancing can significantly improve your chances of securing a better rate.

How to Choose the Right Private Lender

Choosing the right private lender is crucial to successfully refinancing your student loans. Don't rush this decision.

Keywords: Best student loan refinance lenders, compare student loan refinance lenders, student loan refinance interest rates comparison

-

Compare Interest Rates from Multiple Lenders: Obtain quotes from several lenders to compare interest rates, fees, and repayment terms. Don't just focus on the interest rate; consider the total cost of the loan.

-

Check for Origination Fees and Prepayment Penalties: Be aware of any origination fees or prepayment penalties. These fees can significantly impact the overall cost of your loan.

-

Review Customer Reviews and Ratings: Check online reviews and ratings from reputable sources to gauge the lender's customer service and reputation.

-

Understand the Lender's Eligibility Requirements: Carefully review the lender's eligibility requirements to ensure you meet their criteria before applying.

Conclusion

Refinancing federal student loans with a private lender can offer significant benefits, like lower interest rates and simpler repayment terms, but it also involves risks, mainly the loss of crucial federal loan protections. Carefully weigh the pros and cons based on your individual financial situation and long-term goals. Consider your credit score, financial stability, and the potential loss of government benefits before making a decision.

Before you make a decision about refinancing your federal student loans, thoroughly research your options and compare private lenders. Take the time to understand the implications of losing your federal student loan benefits. Make an informed choice about whether private student loan refinancing is the right path for your financial future.

Featured Posts

-

Pet Friendly Uber Rides Now Available In Delhi And Mumbai A Partnership With Heads Up For Tails

May 17, 2025

Pet Friendly Uber Rides Now Available In Delhi And Mumbai A Partnership With Heads Up For Tails

May 17, 2025 -

Principal Financial Group Pfg 13 Analysts Weigh In

May 17, 2025

Principal Financial Group Pfg 13 Analysts Weigh In

May 17, 2025 -

Federal Vs Private Student Loan Refinancing A Comparison Guide

May 17, 2025

Federal Vs Private Student Loan Refinancing A Comparison Guide

May 17, 2025 -

High School Confidential Week 26 In 2024 25

May 17, 2025

High School Confidential Week 26 In 2024 25

May 17, 2025 -

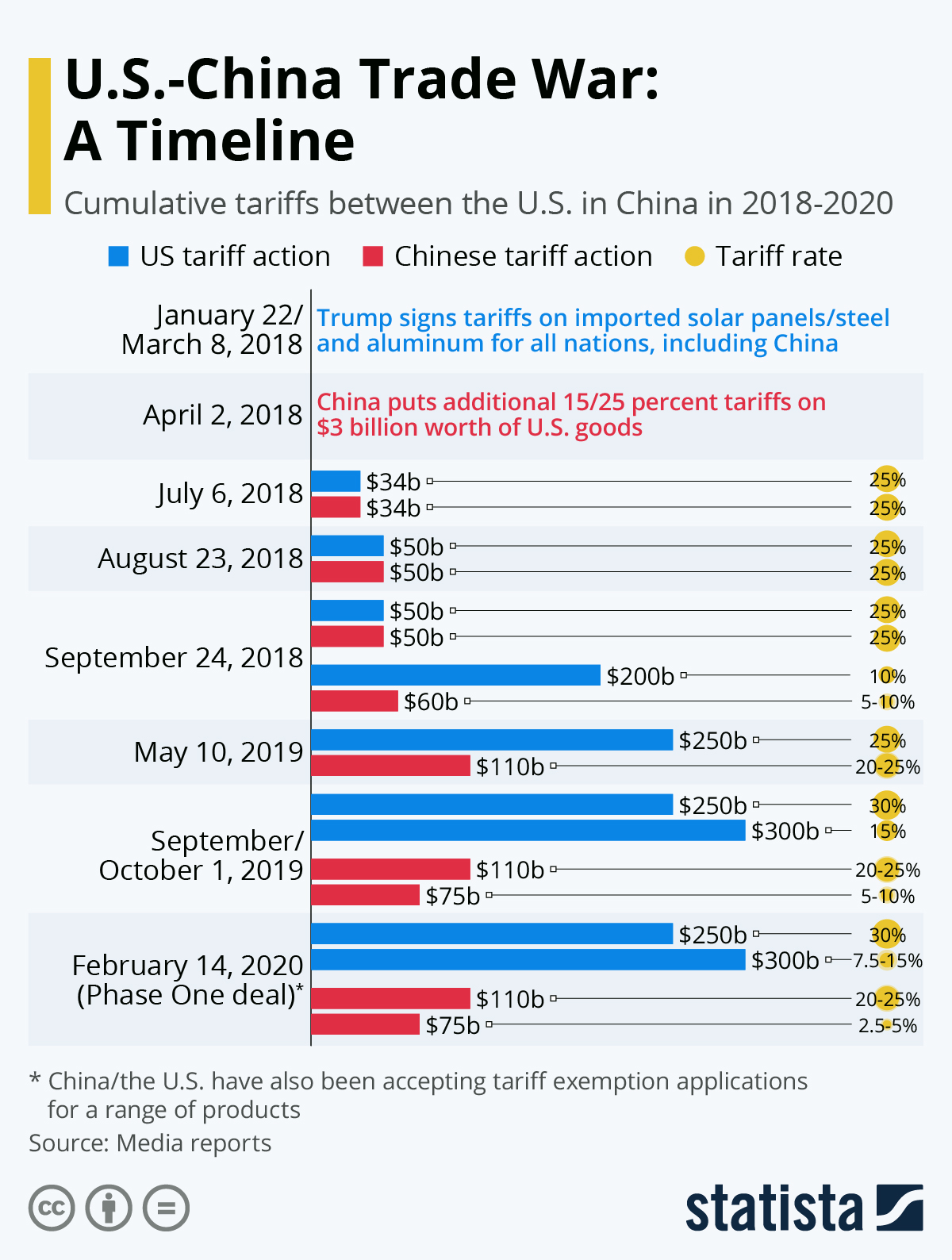

Trumps 30 Tariffs On China An Extended Forecast Through 2025

May 17, 2025

Trumps 30 Tariffs On China An Extended Forecast Through 2025

May 17, 2025

Latest Posts

-

Playing At The Best Online Casinos A New Zealand Players Guide 7 Bit Casino Featured

May 17, 2025

Playing At The Best Online Casinos A New Zealand Players Guide 7 Bit Casino Featured

May 17, 2025 -

Recession Proof Stocks Is Uber One Of Them

May 17, 2025

Recession Proof Stocks Is Uber One Of Them

May 17, 2025 -

Discover The Best Online Casinos In New Zealand 7 Bit Casino Review Included

May 17, 2025

Discover The Best Online Casinos In New Zealand 7 Bit Casino Review Included

May 17, 2025 -

Why Uber Stock Might Weather An Economic Downturn

May 17, 2025

Why Uber Stock Might Weather An Economic Downturn

May 17, 2025 -

Real Money Online Casinos In New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025

Real Money Online Casinos In New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025