Refinancing Federal Student Loans: Is It Right For You?

Table of Contents

Understanding Federal Student Loan Refinancing

What is Federal Student Loan Refinancing?

Refinancing federal student loans involves replacing your existing federal loans with a new private loan from a lender. This is different from consolidation, which combines your federal loans into a single federal loan with the same terms, while refinancing replaces them entirely with a private loan. Key terms to understand include:

- Interest Rate: The percentage charged on the loan's outstanding balance. A lower interest rate translates to lower overall costs.

- Loan Term: The length of time you have to repay the loan. A longer term leads to lower monthly payments but higher total interest paid.

- Principal: The original amount borrowed.

Types of Refinancing Options

Refinancing options primarily come from private lenders. Unlike federal student loans, there aren't government programs dedicated to refinancing federal loans. This means you'll be dealing with private companies offering various terms and conditions.

- Private Lenders: These offer competitive interest rates based on your creditworthiness. However, they lack the federal protections associated with federal loans.

Bullet Points:

- Refinancing replaces your existing federal loans with a new private loan.

- Private lenders assess your creditworthiness to determine your interest rate and loan terms.

- Government-backed refinancing options for federal student loans are generally unavailable.

Benefits of Refinancing Federal Student Loans

Lower Monthly Payments

Refinancing can significantly reduce your monthly payment. This can be achieved through two main avenues: securing a lower interest rate or extending the loan term. A lower interest rate directly reduces the amount you pay each month, while a longer loan term spreads the payments out over a more extended period, lowering the monthly payment amount.

Lower Interest Rates

One of the primary attractions of refinancing is the potential to secure a lower interest rate than your current federal loans. This can result in substantial savings over the life of the loan. Current interest rate environments fluctuate, so it's essential to shop around and compare offers from multiple lenders.

Simplified Repayment

If you have multiple federal student loans, refinancing consolidates them into a single, manageable payment. This simplifies your repayment process and makes budgeting easier.

Bullet Points:

- Example: Refinancing a $50,000 loan from 7% to 5% can save thousands over the loan's life.

- Factors like your credit score and debt-to-income ratio significantly influence the interest rate offered.

- Consolidating multiple loans streamlines repayment and reduces administrative hassle.

Drawbacks of Refinancing Federal Student Loans

Loss of Federal Protections

This is a critical drawback. By refinancing, you forfeit crucial federal protections, including:

- Income-driven repayment plans (IDR): These plans tie your monthly payments to your income.

- Deferment: Allows temporary suspension of payments under specific circumstances.

- Forbearance: Allows temporary reduction in payments.

Credit Score Impact

The application process for refinancing involves a hard credit inquiry, which can temporarily lower your credit score. Check your credit report beforehand to ensure accuracy and address any negative items.

Potential for Higher Interest Rates (for borrowers with poor credit)

If you have a low credit score, you may not qualify for a lower interest rate through refinancing. In such cases, refinancing could actually increase your overall loan costs.

Bullet Points:

- Loss of federal protections can leave you vulnerable during financial hardship.

- A hard credit inquiry can temporarily impact your credit score, but this effect is usually temporary.

- Borrowers with poor credit may receive higher interest rates than their current federal loans.

Determining if Refinancing is Right for You

Assess Your Financial Situation

Before considering refinancing, thoroughly evaluate your current financial situation:

- Current interest rates on your federal loans

- Your credit score

- Your financial goals (e.g., homeownership, saving for retirement)

Compare Loan Offers

Obtain and compare offers from multiple private lenders. Don't settle for the first offer you receive; shop around for the best terms.

Consult a Financial Advisor

Seeking professional financial advice is crucial. A financial advisor can help you assess your financial situation, weigh the pros and cons of refinancing, and determine if it aligns with your overall financial goals.

Bullet Points:

- Consider factors like your income, expenses, and debt-to-income ratio.

- Compare interest rates, loan terms, and fees from different lenders.

- A financial advisor can provide unbiased guidance and help you make an informed decision.

Conclusion

Refinancing federal student loans can offer significant benefits, such as lower monthly payments and reduced interest rates. However, it's crucial to understand the drawbacks, primarily the loss of federal protections. Carefully weigh the advantages and disadvantages, compare offers from multiple lenders, and, most importantly, consult a financial advisor before making a decision. Explore federal student loan refinancing options today, but only after thorough research and consideration of your unique financial circumstances. Determine if refinancing your federal student loans is the right choice for you, and remember to learn more about refinancing your federal student loans and saving money responsibly.

Featured Posts

-

Student Loan Forgiveness Under Trump A Black Perspective

May 17, 2025

Student Loan Forgiveness Under Trump A Black Perspective

May 17, 2025 -

Giants Vs Mariners April 4 6 Series A Look At The Injured Players

May 17, 2025

Giants Vs Mariners April 4 6 Series A Look At The Injured Players

May 17, 2025 -

Megaloprepis Teleti Pos I Saoydiki Aravia Ypodextike Ton Proedro Tramp

May 17, 2025

Megaloprepis Teleti Pos I Saoydiki Aravia Ypodextike Ton Proedro Tramp

May 17, 2025 -

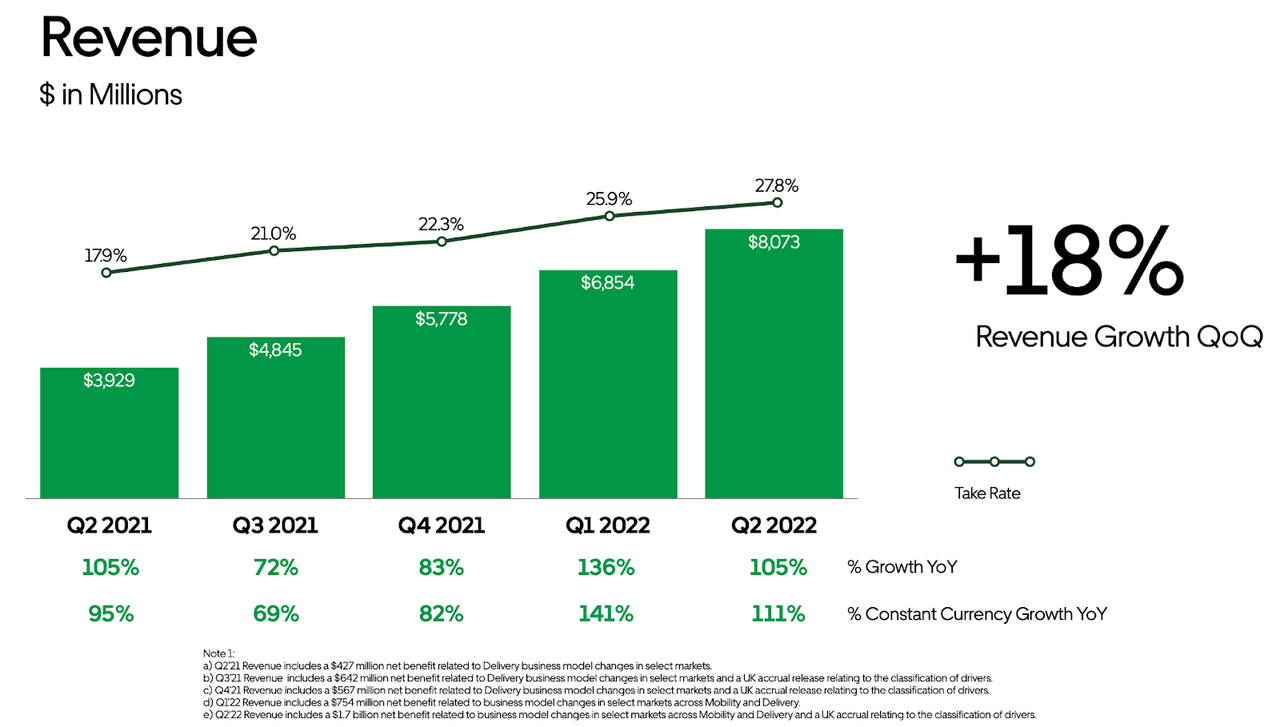

Why Did Uber Stock Jump Double Digits In April

May 17, 2025

Why Did Uber Stock Jump Double Digits In April

May 17, 2025 -

Angel Reese Dpoy Win Shadowed By Serious Injury

May 17, 2025

Angel Reese Dpoy Win Shadowed By Serious Injury

May 17, 2025

Latest Posts

-

Ali Marks Everything About Jalen Brunsons Better Half

May 17, 2025

Ali Marks Everything About Jalen Brunsons Better Half

May 17, 2025 -

Petition To Replace Lady Liberty With Jalen Brunson Gains Traction An Exclusive Update

May 17, 2025

Petition To Replace Lady Liberty With Jalen Brunson Gains Traction An Exclusive Update

May 17, 2025 -

Get To Know Jalen Brunsons Wife Ali Marks

May 17, 2025

Get To Know Jalen Brunsons Wife Ali Marks

May 17, 2025 -

Pistons Vs Knicks Playoff Race Jalen Brunsons Impact

May 17, 2025

Pistons Vs Knicks Playoff Race Jalen Brunsons Impact

May 17, 2025 -

Exclusive Knicks Fans Bold Petition To Replace Lady Liberty With Jalen Brunson

May 17, 2025

Exclusive Knicks Fans Bold Petition To Replace Lady Liberty With Jalen Brunson

May 17, 2025