Why Did Uber Stock Jump Double Digits In April?

Table of Contents

Strong First-Quarter Earnings Report

Uber's Q1 2023 earnings report played a pivotal role in the stock's surge. The company significantly exceeded analyst expectations, showcasing robust financial performance across various segments. This positive news instilled confidence among investors, leading to a considerable boost in the stock price.

-

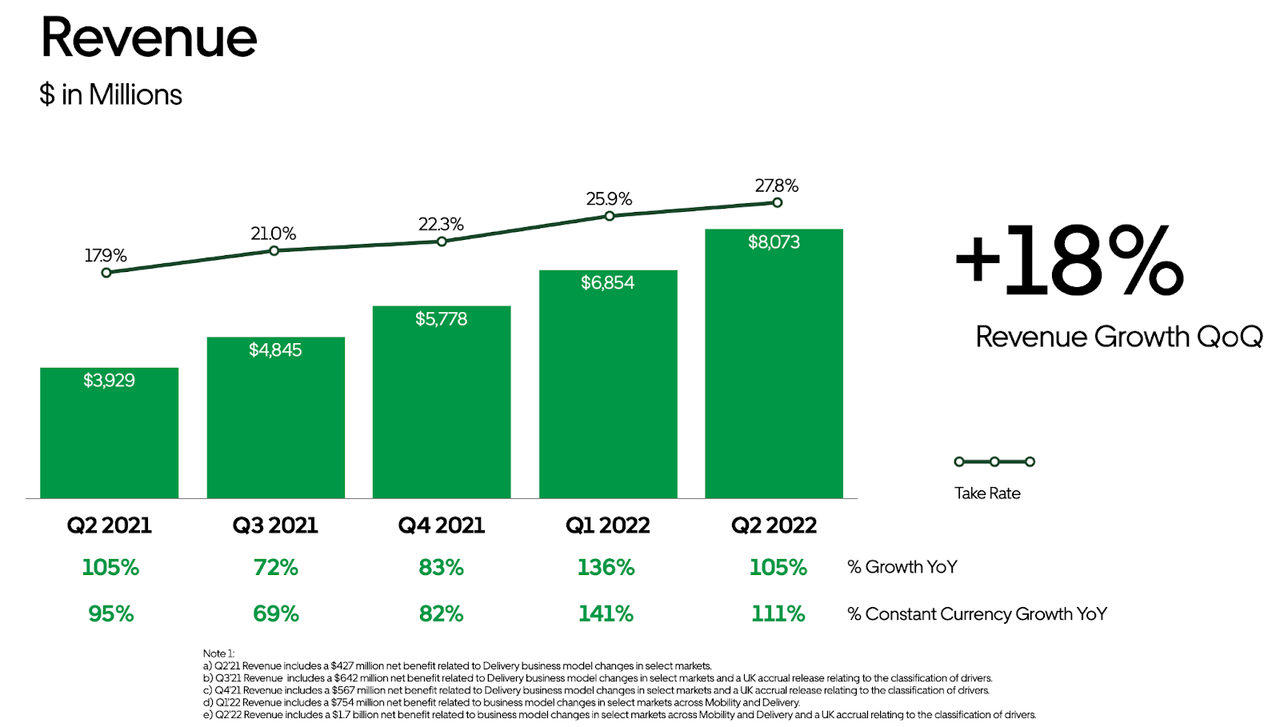

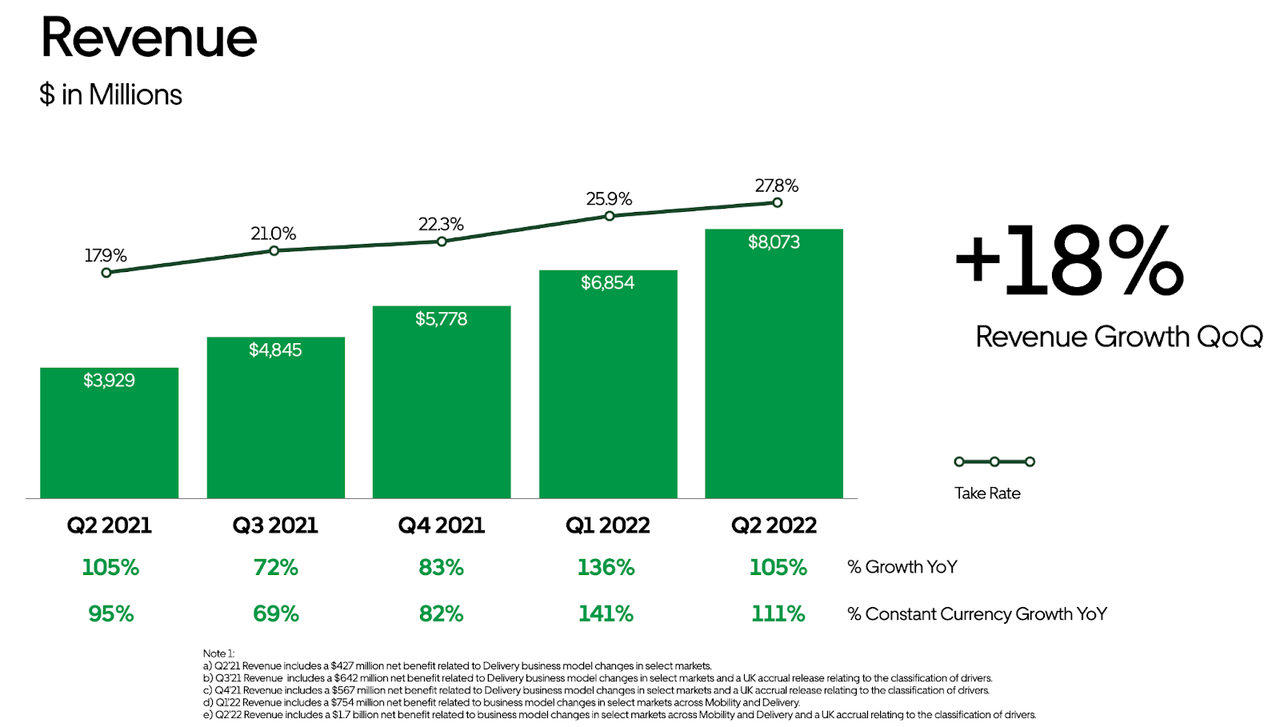

Revenue growth exceeding analyst predictions: Uber reported revenue growth significantly higher than what analysts had predicted, demonstrating strong demand for its services. This exceeded expectations by a considerable margin, signaling a healthy and expanding market share.

-

Increased profitability (or improved margins): The Q1 report highlighted improved profitability, or at least significantly improved margins, suggesting that Uber's cost-cutting measures were proving effective. This demonstrated a positive shift towards sustainable growth and financial stability.

-

Positive trends in key metrics like rides and deliveries: Key performance indicators (KPIs) such as the number of rides and food deliveries showed substantial growth, indicating a healthy recovery in the ride-sharing market and continued strong performance in the food delivery sector (Uber Eats). This underscored the resilience and adaptability of Uber's business model.

-

Details on specific segments performing well (e.g., Uber Eats, rideshare): Both the Uber Eats food delivery service and the core rideshare business showed impressive growth, indicating a diverse and robust revenue base. Uber Eats, in particular, continued its strong trajectory, solidifying its position in the competitive food delivery market. The recovery in rideshare demonstrated increasing consumer confidence and a return to pre-pandemic travel patterns.

Keywords: Uber Q1 earnings, Uber financial performance, revenue growth, profitability, Uber Eats growth, rideshare recovery

Successful Implementation of Cost-Cutting Measures

Uber's proactive approach to cost optimization significantly contributed to the positive market reaction. The company implemented several initiatives to enhance efficiency and reduce expenses, leading to improved profitability and a stronger financial position.

-

Layoffs or restructuring initiatives: While difficult, strategic layoffs and restructuring initiatives played a key role in streamlining operations and reducing overhead costs. This demonstrated a commitment to fiscal responsibility and long-term sustainability.

-

Technological advancements leading to cost savings: Investments in technology and automation resulted in significant cost savings across various departments. This showcased Uber's commitment to leveraging technology for operational efficiency and long-term growth.

-

Improved operational efficiency: Uber focused on optimizing its operational processes, leading to improved efficiency and reduced waste. This involved improvements in logistics, driver management, and order fulfillment, contributing significantly to cost reduction.

-

Focus on automation and streamlining processes: Uber’s ongoing commitment to automation and streamlining across all aspects of the business significantly impacted profitability. This showcased a forward-thinking approach to long-term cost management.

Keywords: Uber cost-cutting, operational efficiency, streamlining, profitability improvement, Uber expenses

Positive Market Sentiment and Investor Confidence

The overall market environment and investor sentiment played a crucial role in Uber's stock price increase. Positive industry trends and growing confidence in Uber's future prospects contributed to the surge.

-

Positive industry trends affecting ride-sharing and delivery services: The overall growth of the ride-sharing and food delivery industries created a positive environment for Uber's growth. This favorable market backdrop provided a boost to investor confidence.

-

Increased investor confidence in Uber's long-term growth potential: Investors showed increased confidence in Uber's long-term growth strategy and its ability to adapt to the evolving market landscape. This was fueled by the strong Q1 performance and evidence of cost-cutting success.

-

Speculation about future innovations or partnerships: Market speculation surrounding potential future innovations and strategic partnerships also contributed to the positive sentiment surrounding Uber's stock. The anticipation of future growth opportunities fueled investor enthusiasm.

-

General market optimism influencing technology stocks: A general rise in optimism within the technology sector further boosted Uber's stock price. The overall positive market sentiment for tech companies created a favorable environment for Uber's growth.

Keywords: Investor confidence, market sentiment, Uber stock outlook, technology stock performance, industry trends

Strategic Initiatives and New Partnerships

Strategic initiatives and new partnerships played a supporting role in the April stock jump. These moves showcased Uber's commitment to innovation and expansion, further enhancing investor confidence.

-

New features or services launched by Uber: The launch of new features and services demonstrated Uber's commitment to innovation and its ability to meet evolving consumer demands. This showcased Uber's adaptability and its capacity for future growth.

-

Successful partnerships leading to expanded market reach or new revenue streams: Strategic partnerships broadened Uber's reach and opened up new revenue streams, enhancing the company's overall growth potential. These partnerships contributed to a more diversified revenue model.

-

Expansion into new markets or demographics: Expansion into new geographic markets and demographic segments showcased Uber's ambition and its potential for further growth. This diversification reduced reliance on existing markets and broadened the potential customer base.

-

Any significant technological advancements impacting the business model: Significant advancements in technology played a role in enhancing operational efficiency and improving the customer experience. This demonstrated a continued commitment to technological leadership.

Keywords: Uber partnerships, strategic initiatives, new features, market expansion, Uber technology, innovation

Conclusion

The double-digit jump in Uber stock price in April 2023 was a result of a confluence of factors. Strong Q1 earnings, successful cost-cutting measures, positive market sentiment, and strategic initiatives all contributed to this significant increase. These factors combined to demonstrate a renewed confidence in Uber's ability to achieve sustainable growth and profitability.

Call to Action: Understanding the reasons behind Uber's stock price surge is crucial for investors considering their investment strategy. Stay informed about Uber's performance and future announcements to make informed decisions regarding your Uber stock holdings. Keep an eye on Uber's financial reports and announcements to understand future fluctuations in the Uber stock price.

Featured Posts

-

Novak Djokovic In Miami Acik Final Yolu

May 17, 2025

Novak Djokovic In Miami Acik Final Yolu

May 17, 2025 -

Analyzing Piston And Knicks Success Key Differences This Season

May 17, 2025

Analyzing Piston And Knicks Success Key Differences This Season

May 17, 2025 -

Apple Tv Special Offer 3 Months Of Streaming For 3

May 17, 2025

Apple Tv Special Offer 3 Months Of Streaming For 3

May 17, 2025 -

Free Fortnite Cowboy Bebop Skins A Guide To The Limited Time Event

May 17, 2025

Free Fortnite Cowboy Bebop Skins A Guide To The Limited Time Event

May 17, 2025 -

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025

Latest Posts

-

6 1 Billion Celtics Sale Uncertainty And The Future Of The Franchise

May 17, 2025

6 1 Billion Celtics Sale Uncertainty And The Future Of The Franchise

May 17, 2025 -

Nba Prediction Celtics At Pistons Who Will Win

May 17, 2025

Nba Prediction Celtics At Pistons Who Will Win

May 17, 2025 -

Donald Trumps Family Tree Exploring The Generations Of The Trump Family

May 17, 2025

Donald Trumps Family Tree Exploring The Generations Of The Trump Family

May 17, 2025 -

Boston Celtics Sold For 6 1 B Fans React To Private Equity Ownership

May 17, 2025

Boston Celtics Sold For 6 1 B Fans React To Private Equity Ownership

May 17, 2025 -

Understanding The Trump Family A Detailed Look At The Presidents Lineage

May 17, 2025

Understanding The Trump Family A Detailed Look At The Presidents Lineage

May 17, 2025