Regulatory Scrutiny Of Bond Forwards: The Indian Insurer Perspective

Table of Contents

The Indian insurance sector is facing increasing Regulatory Scrutiny of Bond Forwards in India. This article delves into the key aspects of this scrutiny, examining the implications for Indian insurers and exploring the evolving regulatory landscape surrounding these complex financial instruments. Understanding the nuances of this regulatory environment is crucial for insurers to navigate the complexities of bond forward trading and maintain compliance. The use of bond forwards, while offering potential for enhanced returns, introduces significant risks that necessitate a robust regulatory framework and proactive risk management strategies by Indian insurance companies.

H2: IRDAI's Stance on Bond Forwards and Investment Strategies

The Insurance Regulatory and Development Authority of India (IRDAI) plays a pivotal role in shaping the regulatory landscape for bond forwards within the Indian insurance industry. IRDAI guidelines pertaining to bond forward investments aim to balance the potential benefits of these instruments with the need to maintain the financial stability and solvency of insurance companies. The IRDAI's primary concerns revolve around effective risk management and ensuring that insurers' exposure to bond forwards doesn't jeopardize their ability to meet policyholder obligations.

- Capital adequacy requirements for bond forward positions: IRDAI mandates specific capital adequacy ratios (CAR) that account for the risk associated with bond forward contracts. These requirements vary depending on the maturity, credit rating, and other characteristics of the underlying bonds. Insurers must maintain sufficient capital to absorb potential losses stemming from adverse movements in interest rates or credit defaults.

- Limitations on exposure to bond forwards: To limit systemic risk, IRDAI imposes restrictions on the overall proportion of an insurer's investment portfolio that can be allocated to bond forwards. These limits vary depending on the insurer's risk profile and solvency position.

- Reporting requirements and transparency stipulations: Insurers are required to maintain detailed records of their bond forward transactions and report regularly to IRDAI on their exposure. This transparency is crucial for effective regulatory oversight and monitoring of systemic risks.

- Auditing and compliance procedures for bond forward investments: Independent audits are crucial to ensure that insurers are adhering to IRDAI guidelines and maintaining proper risk management practices in relation to their bond forward investments. Non-compliance can lead to significant penalties.

H2: Risk Management and Mitigation Strategies for Bond Forwards

Bond forward contracts, while offering diversification potential, inherently involve several risks that insurers must actively manage.

- Interest rate risk: Fluctuations in interest rates can significantly impact the value of bond forwards, leading to potential losses.

- Credit risk: The risk of default by the counterparty to the bond forward contract is a substantial concern.

- Liquidity risk: The ability to easily exit a bond forward position at a fair price might be constrained, especially during periods of market stress.

Effective risk management is paramount for mitigating these risks:

- Hedging techniques and their efficacy: Insurers can employ various hedging strategies, such as using interest rate swaps or options, to offset potential losses from interest rate fluctuations. The effectiveness of these techniques depends on the accuracy of the risk assessment and the chosen hedging instruments.

- Stress testing and scenario analysis: Proactive risk assessment involves simulating various adverse scenarios, including significant interest rate movements or credit events, to evaluate the potential impact on the insurer’s bond forward portfolio.

- Diversification of bond forward portfolio: Spreading investments across a range of bonds with different maturities, credit ratings, and issuers helps to reduce overall risk.

- Use of independent valuation services: Regular independent valuation of bond forward positions ensures accurate assessment of the market value and assists in risk monitoring.

H2: Impact of Regulatory Changes on Insurer Investment Decisions

Recent and anticipated regulatory changes significantly influence investment strategies related to bond forwards.

- Changes in permitted investment limits: Adjustments to IRDAI's guidelines on permitted investment limits in bond forwards directly impact insurers’ investment allocation decisions. Increased limits might lead to greater participation, while stricter limits necessitate portfolio adjustments.

- Effects on asset-liability management (ALM): Regulatory changes influence insurers’ ability to effectively manage the matching of their assets and liabilities. This includes consideration of the duration and interest rate sensitivity of their bond forward positions.

- Impact on profitability and return on investment: Regulatory changes can indirectly influence profitability by impacting the risk-return profile of bond forward investments. Stricter regulations might reduce potential returns, while relaxed regulations might increase risks.

- Adaptation strategies for insurers: Insurers must develop robust adaptation strategies to comply with evolving regulatory frameworks. This involves reviewing investment policies, strengthening risk management processes, and enhancing internal controls.

H2: Comparison with Global Regulatory Frameworks for Bond Forwards

While the Indian regulatory framework for bond forwards shares similarities with those in other major insurance markets like the US and UK, some key differences exist.

- Differences in capital requirements: Capital requirements for bond forward exposures can vary significantly across jurisdictions, reflecting differences in risk tolerance and regulatory philosophies.

- Variations in reporting standards: Reporting requirements and the level of transparency demanded by regulators differ across countries.

- Contrasting risk management approaches: Different regulatory bodies might advocate different risk management approaches for bond forwards, emphasizing various aspects such as diversification, hedging, or stress testing.

- Impact on international insurance operations: Variations in regulatory frameworks across countries create complexities for insurers with international operations, necessitating a nuanced understanding of diverse regulations.

Conclusion:

The Regulatory Scrutiny of Bond Forwards in India is creating a dynamic environment for insurers. Navigating this requires a robust understanding of IRDAI guidelines, proactive risk management, and a flexible investment strategy. Staying informed about regulatory developments and adapting to changing rules is crucial for maintaining compliance and ensuring financial stability. By adhering to best practices and proactively addressing regulatory concerns, Indian insurers can leverage the potential benefits of bond forwards while effectively managing the associated risks. Further research into the specific implications of Regulatory Scrutiny of Bond Forwards in India for different insurer segments is recommended to optimize investment strategies and comply fully with IRDAI regulations.

Featured Posts

-

Palantir Stock Weighing The Risks And Rewards Before May 5th

May 10, 2025

Palantir Stock Weighing The Risks And Rewards Before May 5th

May 10, 2025 -

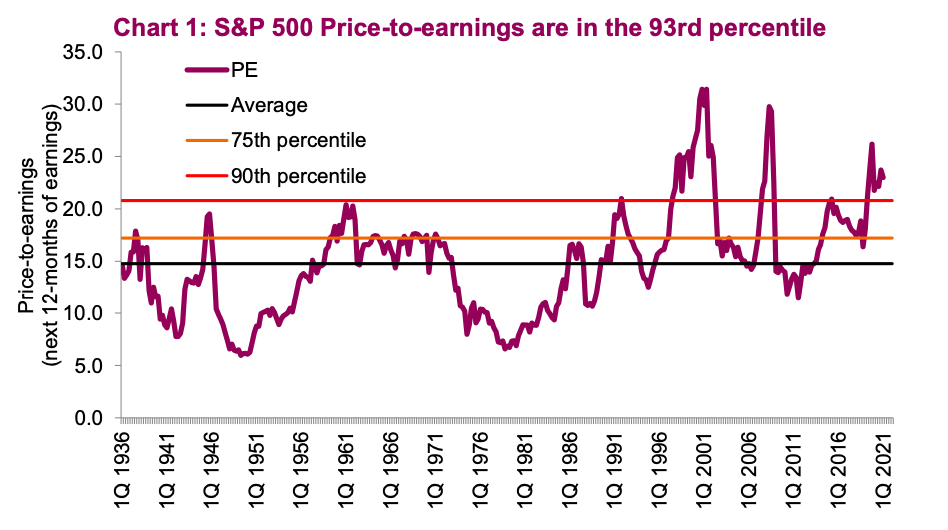

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 10, 2025

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 10, 2025 -

Jobs A Dijon Restaurants Et Rooftop Dauphine Postes A Pourvoir

May 10, 2025

Jobs A Dijon Restaurants Et Rooftop Dauphine Postes A Pourvoir

May 10, 2025 -

Nyt Strands Saturday March 15 Complete Answers For Game 377

May 10, 2025

Nyt Strands Saturday March 15 Complete Answers For Game 377

May 10, 2025 -

James Comers Epstein Files Rant Pam Bondis Reaction Sparks Controversy

May 10, 2025

James Comers Epstein Files Rant Pam Bondis Reaction Sparks Controversy

May 10, 2025