Reliance Shares Post 10-Month High On Positive Earnings

Table of Contents

Strong Q2 Earnings Results

Reliance Industries' Q2 (Second Quarter) earnings report significantly exceeded analyst expectations, providing a strong catalyst for the rise in Reliance shares. The financial performance showcased impressive revenue growth and a healthy profit margin, solidifying investor confidence in the company's financial strength.

- Revenue Growth: Reliance reported a substantial increase in revenue, exceeding projections by [insert percentage] compared to the same period last year. This growth was driven by strong performance across various segments.

- Net Profit: Net profit figures also demonstrated significant improvement, reaching [insert figures] – a [insert percentage] increase compared to Q2 of the previous year. This represents a substantial jump in profitability for the company.

- Key Sectors: The telecom sector, particularly Reliance Jio, and the retail sector, Reliance Retail, contributed significantly to the overall positive earnings. The energy sector also showed promising results, further diversifying Reliance's revenue streams.

- Surpassing Expectations: The impressive results clearly outperformed analysts' predictions, indicating a healthier financial state than previously anticipated. This positive surprise boosted investor sentiment.

- Comparison to Previous Quarters: Compared to the previous quarter, Q1, the Q2 earnings showed significant improvement, demonstrating a clear upward trend in Reliance's financial performance.

Positive Investor Sentiment and Market Outlook

The surge in Reliance shares isn't solely attributable to the Q2 earnings; positive investor sentiment and a bullish market outlook play a vital role. Several factors contributed to this enhanced confidence:

- Investment Upgrades: Several leading financial institutions have upgraded their ratings on Reliance shares, reflecting a positive outlook on the company's future prospects. These upgrades signal a growing belief in the long-term value of Reliance stock.

- Bullish Market Sentiment: The overall positive sentiment within the Indian stock market also played a role. A positive market generally creates a more favorable environment for individual stocks like Reliance to flourish.

- Global Market Trends: While global uncertainties exist, Reliance's strong domestic performance and diversified business model have mitigated the impact of these external factors on its share price.

- Future Projections: Analysts have issued positive predictions for Reliance's future performance, forecasting continued growth and profitability across its various business segments. This positive outlook further encourages investment.

Strategic Initiatives and Future Growth Prospects

Reliance Industries' ambitious strategic initiatives are key drivers of its future growth prospects and contribute significantly to the positive investor sentiment surrounding Reliance shares.

- Reliance Jio's Expansion: Reliance Jio's aggressive expansion into 5G services, coupled with continued subscriber growth, positions it for significant future growth within the Indian telecom sector.

- Reliance Retail's Growth: The continued expansion and innovation within Reliance Retail, including its foray into new markets and digitalization initiatives, are poised to drive further revenue and profitability.

- Investments in Renewable Energy: RIL's significant investments in renewable energy demonstrate a commitment to long-term sustainability and a potentially lucrative new revenue stream.

- New Partnerships and Acquisitions: Strategic partnerships and acquisitions further enhance Reliance's capabilities and market reach, contributing to its overall growth strategy.

The Role of Reliance Jio's Growth in the Share Price Rise

Reliance Jio's remarkable performance has been a significant contributor to the overall rise in Reliance shares. The rapid rollout of 5G services, coupled with impressive subscriber growth, has strengthened Jio's market position and significantly boosted Reliance's overall financial results. The expanding user base and the potential for increased revenue through 5G services have instilled significant confidence among investors. The impressive performance figures within the telecom sector clearly demonstrate its pivotal role in driving up the Reliance share price.

Conclusion

The recent 10-month high in Reliance shares is a result of several converging factors: exceptionally strong Q2 earnings, a positive market outlook fueled by investor confidence, and a promising future driven by strategic initiatives, particularly the continued success of Reliance Jio. This confluence of positive indicators has created a significant surge in demand for Reliance stock.

Call to Action: Stay informed about the latest developments in Reliance shares and the broader Indian stock market. Track Reliance stock performance closely, and consider consulting a financial advisor before making any investment decisions related to Reliance shares or any other investments. Understanding the factors influencing Reliance share prices is crucial for informed investment choices.

Featured Posts

-

Capital Summertime Ball 2025 Wembley Stadium Date Tickets And Info

Apr 29, 2025

Capital Summertime Ball 2025 Wembley Stadium Date Tickets And Info

Apr 29, 2025 -

Two Sides Of The Coin American Expats Experiences Living In Spain

Apr 29, 2025

Two Sides Of The Coin American Expats Experiences Living In Spain

Apr 29, 2025 -

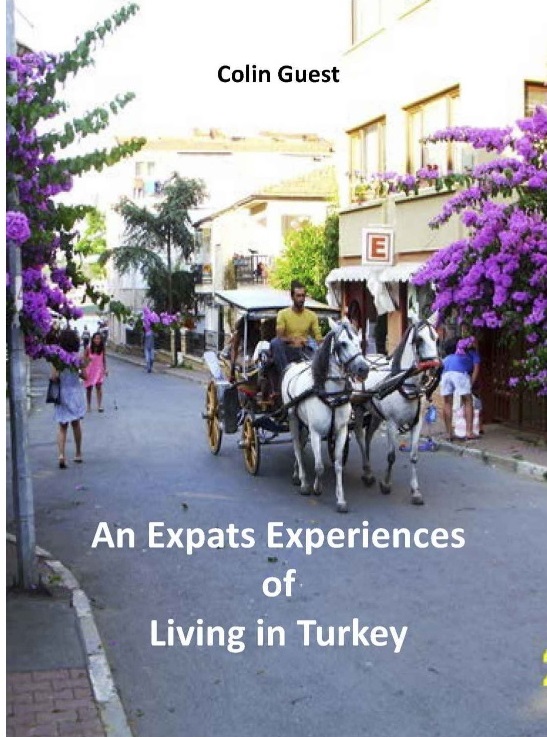

Nyt Spelling Bee February 10 2025 Solutions Answers And Pangram

Apr 29, 2025

Nyt Spelling Bee February 10 2025 Solutions Answers And Pangram

Apr 29, 2025 -

Securing Your Capital Summertime Ball 2025 Tickets Top Tips And Strategies

Apr 29, 2025

Securing Your Capital Summertime Ball 2025 Tickets Top Tips And Strategies

Apr 29, 2025 -

Analysis Of Pw Cs Pullout From Sub Saharan Africa Impact And Future Outlook

Apr 29, 2025

Analysis Of Pw Cs Pullout From Sub Saharan Africa Impact And Future Outlook

Apr 29, 2025

Latest Posts

-

Obrushenie Gorki V Tyumeni Postradavshie Otkazalis Ot Pomoschi Vlastey

Apr 30, 2025

Obrushenie Gorki V Tyumeni Postradavshie Otkazalis Ot Pomoschi Vlastey

Apr 30, 2025 -

The Family Farm Next Door Amanda Clive And Childrens Farming Journey

Apr 30, 2025

The Family Farm Next Door Amanda Clive And Childrens Farming Journey

Apr 30, 2025 -

Exploring Our Farm Next Door Amanda Clive And Their Childrens Adventures

Apr 30, 2025

Exploring Our Farm Next Door Amanda Clive And Their Childrens Adventures

Apr 30, 2025 -

A Day In The Life Our Farm Next Door With Amanda Clive And Family

Apr 30, 2025

A Day In The Life Our Farm Next Door With Amanda Clive And Family

Apr 30, 2025 -

Our Farm Next Door Following Amanda Clive And Family

Apr 30, 2025

Our Farm Next Door Following Amanda Clive And Family

Apr 30, 2025